Dogecoin (DOGE) News Today

Latest crypto news and price forecasts for DOGE: Gate News brings together the latest updates, market analysis, and in-depth insights.

Whale Dogecoin steps back, retail investors join the fray – Where will the market head?

Dogecoin (DOGE) starts the first week of December with a correction, falling 6.3% in 24 hours and trading around the mark of 0.14 USD. The market capitalization of this memecoin currently stands at 21 billion USD at the time of writing, while recent on-chain activities seem to be strongly impacting the trend.

DOGE-9.58%

TapChiBitcoin·11h ago

Dogecoin Price Shows Signs of Recovery, Eyes $0.30 by December 2025

Key Insights:

Dogecoin benefits from the broader crypto market recovery, as altcoins tend to rise with major cryptocurrencies like Bitcoin.

The popularity of other meme coins, including Shiba Inu and Bonk, is expected to fuel Dogecoin&39;s potential price surge.

New ETFs like Grayscale and

CryptoFrontNews·12h ago

Dogecoin Holds $0.1495 As Whale Activity Hits Two-Month Low and Price Trades Between $0.1476 and ...

The number of dogecoin whale transactions has declined to its lowest point in two months and this has made the network less profitable at the high-value level.

DOGE has a narrow band and its support is at $0.1476 but it is floating just below resistance at $0.1499.

The price is currently at $0.149

DOGE-9.58%

CryptoNewsLand·19h ago

XRP and DOGE Whales Are Moving to Digitap Presale As Discount Reaches 60% for a Limited Time

November’s 60% discount for new investors has driven an influx of XRP and Dogecoin whales into the Digitap ($TAP) presale. Is this the best crypto to buy now? While the Dogecoin price and XRP price hover below key levels, $TAP has soared by 160%, highlighting investors’ trust and

CaptainAltcoin·20h ago

Dogecoin ETFs Flat At Launch, But Technical Analysis Points To $1 If This Support Holds

The launch of spot exchange-traded funds (ETFs) tracking Dogecoin in the United States was met with muted enthusiasm. Inflows into Grayscale and Bitwise’s ETFs were limited in their first week of trading, despite the hype around the first-ever Dogecoin ETFs. But even as ETF inflows sputter, some

AsiaTokenFund·22h ago

Dogecoin Shows Renewed Strength as Weekly Demand Zone Holds and Short-Term Range Tightens

DOGE sits inside a strong weekly demand zone while interacting with the MA200, signaling steady accumulation.

Traders track $0.205 as the first breakout marker, with $0.27 acting as the next major level.

Intraday charts show low volatility and a tight range near $0.149 as traders await

DOGE-9.58%

CryptoFrontNews·22h ago

Dogecoin Eyes Massive 315% Upside as Analysts Point to a “Wide Expansion Phase”

Dogecoin shows potential for a 174% rise towards $0.6533, supported by higher lows and TVL growth since 2023. Key levels at $0.08, $0.20, and $0.1595 guide momentum, indicating a bullish trend and possible breakout phases ahead.

DOGE-9.58%

CryptoFrontNews·11-30 04:01

DOGE Maintains Its Wide $0.10–$0.15 Range After Multi-Year Cycles — Will Momentum Hold?

Dogecoin's monthly chart reveals a significant consolidation above long-term support, suggesting potential upward movement. Historical patterns show that previous consolidations led to price increases. The current structure is the largest yet, raising anticipation among market participants as it approaches a critical support level, hinting at a possible price reversal.

DOGE-9.58%

CryptoNewsLand·11-29 19:35

Dogecoin Holds $0.1494 As Cost Basis Data Highlights Key $0.08–$0.20 Range

Dogecoin trades at $0.1494, holding just above short-term support at $0.1489 after a 7-day gain of 8.2%.

Cost basis clusters show major supply at $0.08 and $0.20, reinforcing Dogecoin’s broader support and resistance structure.

The 24-hour range between $0.1489 and $0.1552 signals compressed

DOGE-9.58%

CryptoNewsLand·11-29 18:34

Dogecoin Price Prediction: DOGE Targets $0.18 While DeepSnitch AI, Soon to Launch, Could See 100x...

Dogecoin is sending mixed signals as memecoins hit traditional finance. BONK just became the first memecoin ETP on Switzerland’s SIX exchange, while Grayscale’s DOGE ETF opened with only $1.4M in volume. Visa’s USDC push with Aquanow shows institutions are moving faster than memes

The Dogecoin

CaptainAltcoin·11-29 14:54

Dogecoin Price Shows Cyclical Strength Ahead of Potential Surge

DOGE exits third accumulation phase, trading near $0.20–$0.30, signaling possible new bullish cycle.

MACD crossover suggests mild upward momentum, while RSI near 40 indicates easing bearish pressure.

The Price support $0.14–$0.15 and resistance near $0.18–$0.20 are critical for short-term

DOGE-9.58%

CryptoFrontNews·11-29 13:32

Dogecoin Maintain Bullish Strength as Price Eyes $0.65 Technical Target

Dogecoin broke its long-term descending resistance, forming higher highs and higher lows that confirm a developing macro bullish structure.

Momentum indicators show stabilization as MACD histogram fades and RSI holds above recent lows, supporting a potential bullish continuation.

Current price

DOGE-9.58%

CryptoFrontNews·11-29 12:32

Top Crypto to Hit $1, MUTM Delivers Utility While DOGE Depends on Hype

The 2025 crypto market is shifting toward projects with real utility, and each crash has exposed the weakness of hype-driven assets. While meme coins once dominated attention, traders now prefer platforms offering value and long-term purpose. This is where Mutuum Finance (MUTM) stands out with its f

CaptainAltcoin·11-29 12:03

Argentina Takes a Bold Step as Buenos Aires Embraces Dogecoin for Taxes

Argentina continues to drive global attention with another surprising move in its fast-growing crypto journey. Buenos Aires approved a new law that allows citizens to settle taxes using Dogecoin, and this decision signals a major shift in public finance. The city now positions itself among the

DOGE-9.58%

Coinfomania·11-29 11:35

Dogecoin (DOGE) ETF Rakes in $2M: Two Key Levels Emerge - Coinspeaker

Dogecoin (DOGE) rebounded 9% to around $0.1493 after a 22% decline. The new DOGE ETFs have attracted significant inflows, but key price levels indicate potential resistance at $0.20 and support at $0.08, which will influence future movements.

Coinspeaker·11-29 10:06

The price of Dogecoin (DOGE) is at risk of falling 12% as 'whales' withdraw capital.

Dogecoin (DOGE) trades around $0.1525, facing bearish pressure post a significant crash. Demand remains low, with small inflows into Dogecoin ETFs. Whales are withdrawing funds, risking further declines. Technical analysis shows limited recovery potential without breaking resistance levels.

DOGE-9.58%

TapChiBitcoin·11-29 03:10

Dogecoin Returns to Its Multi-Year Support Line as Price Action Repeats a Familiar Pattern

Dogecoin is testing a significant multi-year support line that previously led to major price rallies. Analysts project potential growth toward $1 by early 2026, with current trading around $0.1522. Accumulation patterns and market sentiment suggest ongoing support, though short-term resistance is noted at 16c.

DOGE-9.58%

CryptoFrontNews·11-28 20:17

DOGE Holds $0.1499 Support, Reviving Long-Term Bullish Structure and $1 Projection

Historically, Dogecoin has been up more than 86 percent to over 440 percent following its playback of its upward weekly line.

The points above the support zone of $0.1499 are also vital in the continuation process by bulls and the short term expansion is limited by the resistance of

DOGE-9.58%

CryptoNewsLand·11-28 17:37

Dogecoin Holds $0.144 Support As Price Climbs to $0.1484 in Tight Reversal Range

Dogecoin was trading around the level of support of $0.144 with a small range of 24 hours defining the short-term structure.

The price drifted to the level of the resistance to reach the $0.1535, where traders were following the response inside the user-defined reversal band of $0.10 to $0.155.

Th

DOGE-9.58%

CryptoNewsLand·11-28 17:35

LivLive ($LIVE) Becomes the Face of the Next 100x Crypto Presale As Little Pepe and Maxi Doge Hit...

Next 100x crypto presale interest reaches its highest point in November 2025 as dip buyers search for top Black Friday crypto deals. This season always creates life changing moments because strong early stage projects offer the best entry points. LivLive ($LIVE) stands out this month with a real

LIVE-9.23%

CaptainAltcoin·11-28 16:34

Dogecoin extends decline as descending resistance line caps every rally attempt

Dogecoin trades below a firm descending resistance line, with repeated failed rallies, bearish momentum and extreme fear keeping downside continuation the base case.

Summary

Price sits well below major moving averages, with lower highs, persistent bearish momentum and elevated volatility

DOGE-9.58%

Cryptonews·11-28 13:54

Meme Coin Hype Is Over: Why DOGE and PEPE Whales Are Turning to BlockchainFX for Real Utility and...

The meme coin era dominated much of the market’s attention over the past few years, with Dogecoin (DOGE) and Pepe (PEPE) leading the charge through viral moments, explosive pumps and unpredictable waves of community-driven hype. But sentiment is changing. As liquidity thins and meme coin rallies los

CaptainAltcoin·11-28 11:36

DOGE Holds Support, XLM Faces Resistance, ZKP Launches Live Presale Auction

Market momentum is beginning to shift again, and traders are watching closely for the top crypto to buy before the next round of movement. Dogecoin’s latest price prediction highlights a tightening wedge structure that could trigger a breakout, while Stellar’s (XLM) price continues to slip under a s

CryptoNinjas·11-28 10:09

2025 DOGE Investment Strategy: Blockchain Security and Platform Selection Guide

[Doge](https://www.gate.com/post/topic/Doge) [Blockchain Security](https://www.gate.com/post/topic/%E5%8D%80%E5%A1%8A%E9%8F%88%E5%AE%89%E5%85%A8) [Trading Platform](https://www.gate.com/post/topic/%E4%BA%A4%E6%98%93%E5%B9%B3%E5%8F%B0) On the stage of Crypto Assets, DOGE has become the focus with its unique charm and sustained market influence. Understand the latest security developments of the DOGE Blockchain, the key factors behind the astonishing rise projected by the 2025 market analysis, formulate effective DOGE investment strategies, and evaluate the dog

DOGE-9.58%

幣圈動態·11-28 01:00

Dogecoin Faces Intense Selling Pressure—Will Bulls Defend the Market’s Most Important Support Level?

Whales sold nearly 7 billion DOGE over a month, creating synchronised pressure that pushed the asset toward its weakest point through late November.

Chart updates showed Dogecoin sliding back to a pivotal support range after prior bullish cycles failed to hold momentum against persistent selling ac

DOGE-9.58%

CryptoFrontNews·11-28 00:32

DOGE Holds $0.1440 Support While Wedge Structure Narrows on the Daily Chart

Dogecoin's price remained stable within a support range of $0.1440, showing bullish momentum per MACD indicators. It approached a resistance level of $0.1535 while maintaining a narrowing wedge pattern, indicating potential short-term price advances.

CryptoNewsLand·11-27 17:35

Dogecoin Consolidates in Third-Wave Deadlock as Whales Buy 100 Million Tokens

Dogecoin remains inside the third-wave channel and is consolidating near the lower half, building energy for either a decisive breakout or deeper retracement.

Whale activity surged as over 100 million DOGE were bought within 24 hours, indicating strong accumulation before the potential market

DOGE-9.58%

CryptoFrontNews·11-27 15:50

Dogecoin (DOGE) Price Rally Cools, But Here’s Why the Uptrend Isn’t Over Yet

Story Highlights Dogecoin ETF inflows collapsed 80% overnight, dampening sentiment, yet on-chain data shows whales quietly accumulating instead of exiting.

Despite DOGE struggling to hold the $0.15 level, on-chain data suggest the pullback is sentiment-driven, not a breakdown in market

DOGE-9.58%

BitcoincomNews·11-27 15:41

Dogecoin’s Cycle 3 Pattern Forms With the Same Structure That Led to Its Earlier Breakouts

DOGE’s long-term chart mirrors prior cycles, forming a similar wedge-based Cycle 3 structure.

Analysts note repeated fractal behavior that could guide long-term trend expectations.

The $0.14 support level remains resilient after five tests, reinforcing structural stability.

Dogecoin presents a re

DOGE-9.58%

CryptoFrontNews·11-27 08:18

Top Crypto Picks for 2026: Analysts Compare Ethereum (ETH), GeeFi (GEE) and Dogecoin (DOGE)

The crypto market faces challenges as Ethereum deals with price volatility and DeFi issues, while Dogecoin's ETF launch has not attracted the expected investor interest.

BitcoincomNews·11-27 06:13

Gao City Saimai launches the Japanese version DOGE! 30-person special attack team implements special tax system black box.

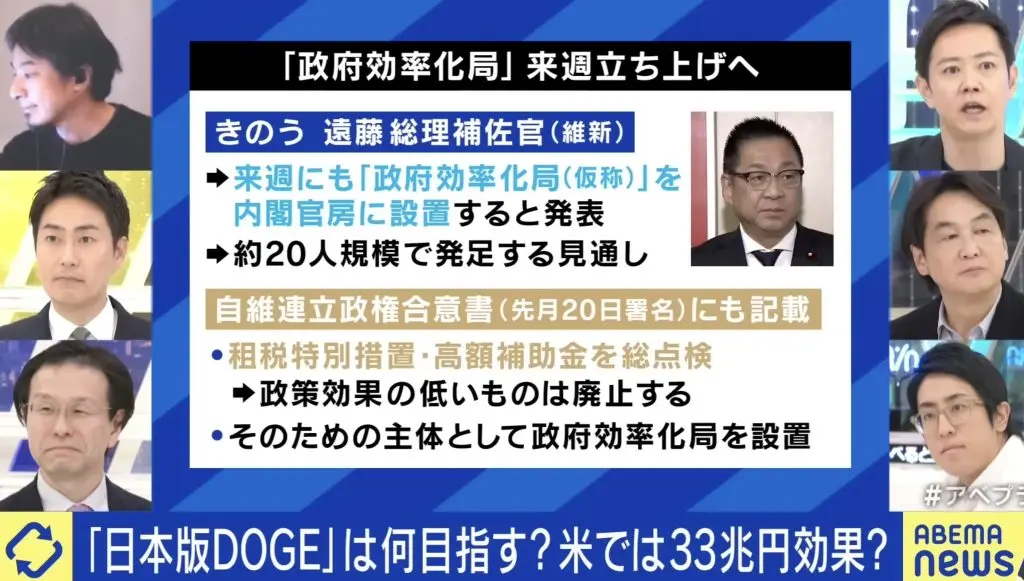

On November 25, the Japanese government launched the "Japanese version of the DOGE Government Efficiency Department" review mechanism, aiming to comprehensively review special tax policies and government subsidies, strengthen fiscal discipline, and reduce waste. Japanese Prime Minister Sanae Takaichi clearly instructed Finance Minister Katayama and relevant cabinet members of the Ministry of Finance to work together to promote reforms, emphasizing the long-term accumulated issues of the special tax system and subsidy structure that urgently need to be reassessed. The Cabinet Secretariat will recently establish a new office, with about 30 staff members from different ministries participating in the review.

MarketWhisper·11-27 05:11

The mayor of Kaohsiung, Tsao Mei, announced the official launch of the Japanese version of "DOGE Government Efficiency Department", aiming to innovate special tax systems and subsidies.

The Japanese government officially launched the "Japanese version of the DOGE Government Efficiency Department" review mechanism on the 25th of this month, aiming to comprehensively examine special tax policies and government subsidies, strengthen fiscal discipline, and reduce waste. The Cabinet Secretariat will establish a new office shortly, with about 30 staff members from different ministries dedicated to the review, responsible for inventorying the "hidden subsidies" and tax incentives that have been difficult to address over the years. Finance Minister Katayama stated at a press conference that he would widely solicit public opinion through social platforms like X, emphasizing that reforms need societal support.

Japanese Prime Minister Sanae Takaichi has clearly instructed Finance Minister Kato and relevant cabinet members of the Ministry of Finance to work together to promote reforms. Takaichi believes that the long-standing issues with the special tax system and subsidy structure urgently need to be re-examined. Internal government sources also reveal that Chief Cabinet Secretary Kihara is expected to take charge of the efficiency department. What kind of policy impact will the establishment of the Japanese version of DOGE have on the Liberal Democratic Party led by Sanae Takaichi?

ChainNewsAbmedia·11-27 03:05

Bitwise DOGE Spot ETF launched, with a total net inflow of $365,000 in US DOGE Spot in a single day.

Bitwise Dogecoin ETF (BWOW) was officially listed on the NYSE on November 26, becoming the second DOGE Spot ETF. The trading volume on the first day was $2.83 million, but there was no net inflow. The Grayscale DOGE ETF had a net inflow of $365,000 that day, bringing the total to $2.16 million. Currently, the total net asset value of the DOGE Spot ETF is $6.48 million, with a management fee rate of 0.34% from Bitwise.

DeepFlowTech·11-27 02:39

Qwen AI Shocking Prediction: XRP will surge to $10 in 2026, with DOGE and ADA's doubling potential skyrocketing.

China's local ChatGPT competitor, Alibaba's Qwen AI, holds a cautious attitude towards the recent prospects of Ripple (XRP), Cardano (ADA), and DOGE. However, Qwen AI's predictive model indicates that in an optimistic scenario, XRP could rise to $10, ADA might reach $8 by early 2026, and DOGE even has the potential to hit $2.

MarketWhisper·11-27 00:27

H4 Charts Show SOL At $137 and DOGE At $0.153 Near Major Break Zones

Both charts show a long H4 downtrend, with each pair moving toward the same clear break zone above the trendline.

SOL trades near $137 and presses against a trendline that has held for many weeks and now creates a tight decision point.

DOGE sits near $0.153 and moves toward a similar trendline as

CryptoNewsLand·11-26 21:54

Dogecoin Price Prediction: Strategy’s Bitcoin Bet Backfires, Leaving Altcoins Scrambling for Supr...

Strategy’s stock has entered a sharp decline after dropping around $300 in October to the $170 level, raising questions about the stability of its Bitcoin-centric approach. The downturn comes even as the company’s Bitcoin holdings remain in profit, creating a split between its long-term thesis and s

CaptainAltcoin·11-26 19:54

Dogecoin Holds Above $0.1465 As Breakout Targets the $0.1545 Resistance Zone

After bending a long-term growing downward trendline, Dogecoin established bigger highs and bigger lows on the 4-hour chart.

The breakout was preceded by the ascending triangle bottom and the price supported on the zone of the support of $0.1465.

Current price movement remains confined

DOGE-9.58%

CryptoNewsLand·11-26 17:34

Bitwise launched a DOGE Spot ETF on the NYSE, code BWOW.

According to Mars Finance, The Block reported that Bitwise has officially launched the Bitwise Dogecoin ETF (code: BWOW) on the New York Stock Exchange, providing compliance investment channels for DOGE holders.

DOGE-9.58%

MarsBitNews·11-26 15:56

Grayscale Dogecoin Trust ETF (Ticker: GDOG) Begins Trading on NYSE Arca as First Dogecoin ETP in ...

STAMFORD, Conn., November 24, 2025 – Grayscale Investments®, the world’s largest digital asset-focused investment platform\, today announced that Grayscale Dogecoin Trust ETF (Ticker: GDOG) has begun trading on NYSE Arca, the first pure spot Dogecoin ETP available in the United States. GDOG, an

CryptoBreaking·11-26 09:55

The debut of the Grayscale DOGE ETF was cold; what are the reasons behind it?

Author: Blockchain Knight

On November 24, the Grayscale Dogecoin ETF (GDOG) was listed on the NYSE Arca but faced a "cold opening."

On the first day, the trading volume in the secondary market was only 1.41 million USD, far below the 12 million USD predicted by Bloomberg analysts, and the net inflow of funds was 0, indicating no new capital was injected into the ecosystem. This performance clearly reveals that the market's demand for regulated products has been seriously overestimated.

The cooling of GDOG forms a stark contrast with the successful cases during the same period. The Solana ETF (BSOL), launched in late October, attracted $200 million in its first week, primarily due to its practical attribute of staking rewards, providing a difficult-to-access investment mechanism for traditional investors.

GDOG only provides exposure to social sentiment, as an ordinary spot product, with its underlying asset being Robi.

PANews·11-26 07:10

Dogecoin Rises 9%: ETF Speculation Ignites DOGE Momentum

DOGE bounces 9%: Price rises from $0.1568 after testing $0.14-$0.15 demand zone.

Key resistance ahead: Break above $0.21 could trigger a rally toward $0.27.

ETF speculation boosts momentum: Grayscale filing and November 24 decision drive trader optimism.

Dogecoin — DOGE, recently bounced

CryptoNewsLand·11-26 06:43

Bitwise rolls out Dogecoin ETF as community demand surges

The era of altcoin ETFs officially began on October 28 with Litecoin, Hedera, and Solana exchange-traded funds.

These financial products have witnessed impressive appetite as they outperform leading Bitcoin and Ethereum ETFs.

For instance, Solana’s exchange-traded funds have seen positive flows s

BitcoinInsider·11-26 06:29

DOGE ETF had a cold debut! Grayscale GDOG only 1.4 million,惨输 XRP hundred times.

Grayscale's first U.S. Spot DOGE ETF had a debut volume lower than analysts' expectations. Bloomberg analysts noted that the Grayscale Dogecoin Trust ETF (GDOG) had a trading volume of $1.4 million on Monday, below their expected $12 million. While this is still solid for an average debut, it is considered low for a "historically first Spot" product.

MarketWhisper·11-26 05:46

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27