USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Circle has added minting of 100 million USDC on the Ethereum blockchain.

According to news from Mars Finance, Whale Alert monitored that at 22:46 Beijing time, USDC issuer Circle minted an additional 100 million USDC on the Ethereum on-chain.

USDC0.01%

MarsBitNews·2h ago

Thirteen departments in China jointly crack down on "Cryptocurrency Trading"! stablecoins rarely become a regulatory target.

On November 28, the People's Bank of China held a meeting of the working coordination mechanism to combat virtual money trading speculation, attended by relevant leaders from 13 departments, including the Ministry of Public Security, the Supreme People's Court, and the Supreme People's Procuratorate. The meeting notably singled out "stablecoin," clearly stating that stablecoins are a form of virtual coins and pose risks of being used for Money Laundering, fundraising fraud, and illegal cross-border fund transfers. The meeting emphasized that activities related to virtual money business are considered illegal financial activities.

USDC0.01%

MarketWhisper·12h ago

The stablecoin market bounces back thanks to USDC, reaching 306 billion USD.

After dropping to a low of $302 billion, the stablecoin economy is recovering, now reaching $306.157 billion. Tether remains dominant, while USDC has seen notable growth. Overall, recent recovery signals a resilient market, potentially boosting liquidity and confidence in crypto.

TapChiBitcoin·14h ago

The People's Bank of China names stablecoins! 13 departments target Money Laundering risks, Hong Kong's layout is embarrassing.

The Central Bank of China reiterated after a multi-department meeting held last Friday that digital assets have no legal status in China, and specifically pointed out that stablecoins fail to meet AML and customer identification requirements, claiming they pose a threat to financial stability. The People's Bank of China convened representatives from 13 government departments in Beijing to discuss the "resurgence" of speculative activities related to digital assets, marking the strongest public comments the Central Bank has made on Crypto Assets issues since the comprehensive ban on trading and Mining in September 2021.

USDC0.01%

MarketWhisper·15h ago

A new Address stores 3.86 million USDC to Hyperliquid, placing an order to go long 196 BTC.

According to Mars Finance, a newly created wallet 0x0c0B deposited 3.86 million USDC to Hyperliquid one hour ago and placed a limit order to go long 196 BTC in the price range of 86,500–86,750 USD, estimating the order size at approximately 16.97 million USD based on the midpoint of the range.

MarsBitNews·15h ago

Circle minted an additional 1 billion USDC on the Solana network.

Circle has minted an additional 1 billion USD in USDC on the Solana network, totaling 12.25 billion since October 11. This increase reflects rising demand for USDC in DeFi and on-chain activities, highlighting Circle's efforts to enhance liquidity and strengthen its stablecoin position amid growing competition.

USDC0.01%

TapChiBitcoin·11-29 11:00

Visa Expands USDC Settlement Across Africa & Middle East Through Aquanow Partnership

Visa has officially partnered with Aquanow to expand

USDC0.01%

BitcoinInsider·11-29 00:32

What is the real profitable track for encryption payments?

Written by: Shao Jiadian

People engaged in crypto payments are all asking the same question:

Which road really can make money?

I've heard many industry stories, but those that can actually make money are really few.

Today I want to strip away all the "mysticism" outside and just talk about reality:

The real profitable directions for crypto payments now are actually only three categories: channels, compliance, and high-risk services. Other directions are basically powered by love.

By understanding these three categories, you basically know where the money flows in this industry, where the barriers are, and how you should enter the market.

Channel: The Everlasting First Source of Profit (and it will become more expensive)

If you strip down the business models of all cryptocurrency payment institutions to the bone, there is only one question left:

Who can send money to the destination the fastest, the most securely, and with the least trouble?

If you can do this, you can collect fees, take a margin, and gain traction.

(1) U ↔ fiat currency deposit / withdrawal

This is the entire industry's

USDC0.01%

DeepFlowTech·11-28 09:50

North Korean hackers strike again! The Lazarus Group steals 30.6 million, and South Korean exchanges suffer for the third time.

The notorious North Korean cybercrime group Lazarus is suspected of orchestrating a major crypto assets attack that resulted in losses of approximately $30.6 million for South Korea's largest cryptocurrency exchange. The exchange operator Dunamu confirmed that assets related to Solana worth 44.5 billion won were transferred to an unauthorized wallet on Thursday, and the company stated it would use its own reserves to fully compensate users.

MarketWhisper·11-28 06:36

2026 Crypto Assets Major Changes! Forbes: Stablecoins Are Everywhere, Four-Year Cycle Disappears

Two Prime CEO Alexander S. Blume wrote in Forbes that after fluctuations are adjusted in 2025, the Crypto Assets market will still be sluggish, but this does not mean stagnation. On the contrary, with the acceleration of institutionalization and the gradual improvement of regulatory frameworks, in 2026 DAT 2.0 will gain legitimacy, stablecoins will be ubiquitous, the Bitcoin four-year cycle will end, U.S. investors will gain offshore Liquidity, and product refinement will occur.

USDC0.01%

MarketWhisper·11-28 02:53

A newly created Wallet deposits 3 million USD into HyperLiquid and places a shorting order for HYPE.

According to Mars Finance news, Onchain Lens monitored that a newly created Wallet deposited 3 million USDC into HyperLiquid and placed an order to short HYPE in the range of 35.7-36.7 USD.

MarsBitNews·11-27 05:45

What is the real profitable track for encryption payments?

People who make encryption payments all ask the same question:

"Which road can really make money?"

I've heard many industry stories, but there are really not many that can make money in practice.

Today I want to strip away all the "mysticism" outside and just talk about reality:

The real profitable directions for encryption payments now are actually only three categories: channels, compliance, and high-risk services. Other directions are basically powered by love.

Understanding these three categories, you basically know where the money flows in this industry, where the barriers are, and how you should enter the market.

Channel: The Forever First Source of Profit (and it will become more expensive)

If you strip down the business models of all encryption payment institutions to the bone, only one question remains:

Who can send money to its destination the fastest, most securely, and with the least trouble?

If you can do this, you can collect fees, take some spreads, and gain adhesion.

(1) U ↔ fiat currency deposits/withdrawals

This is the "vascular system" of the entire industry.

USDC0.01%

金色财经_·11-26 14:05

Myriad Surpasses $100M in USDC Trading Volume, Boosting Prediction Markets 10x in Just 3 Months

This is a growth of ten times in only three months, highlighting the quick adoption of Myriad and its aim to build prediction markets as a significant pillar.

Myriad launched quick Automated Markets and expanded its operations to BNB Chain before the end of the previous month.

With more

TheNewsCrypto·11-26 11:41

USDC Supply Growth on Arbitrum: Key Trends and Insights into DeFi Adoption

USDC supply on Arbitrum has seen remarkable expansion, with the stablecoin's market share on the Layer 2 network climbing from 44% to 58% in recent months.

USDC0.01%

CryptoPulseElite·11-25 06:01

A Whale spent 1.35 million USDC to purchase 37 million MON.

According to Mars Finance news, monitoring by Onchain Lens shows that about 5 hours ago, a Whale spent 1.35 million USDC to purchase 37 million MON at a unit price of 0.036 USD.

MarsBitNews·11-25 01:17

The European Central Bank warns of the cross-border regulatory arbitrage risks of stablecoins, calling for a unified regulatory framework on a global scale.

According to Mars Finance, the financial stability review preview released by the European Central Bank today (the official report will be published on Wednesday) shows that by 2025, the total market capitalization of stablecoins will exceed 280 billion USD, accounting for about 8% of the entire crypto market. Among them, USDT and USDC together account for nearly 90%, with reserve assets reaching the scale of the top 20 global money market funds. The European Central Bank's report points out that if stablecoins are widely adopted, it may lead households to convert some bank deposits into stablecoin holdings, weakening banks' retail funding sources and increasing financing fluctuations. Although MiCAR has prohibited European issuers from paying interest to curb such transfers, banks are still calling for similar restrictions to be implemented in the U.S. In addition, the rapid rise of stablecoins and their connection to the banking system may also trigger a concentration of fund withdrawals during crises. The report emphasizes the risks of cross-border "multi-issuance mechanisms," warning that EU issuers may struggle to meet global redemption.

USDC0.01%

MarsBitNews·11-24 10:44

Pump.fun Hits $436M USDC After 53% Revenue Drop Post-October Crypto Crash

Memecoin Platform Pump.fun Moves Over $436 Million in Stablecoins Amid Market Turmoil

Since October’s historic crypto market decline, the Solana-based memecoin launchpad Pump.fun has liquidated more than $436 million in stablecoins, signaling significant cash-outs by its operators. The platform’s l

USDC0.01%

CryptoBreaking·11-24 10:36

Pump.fun cashed out $436.5 million USDC, PUMP down 24% weekly, sparking a community trust crisis

Since mid-October 2025, the Solana ecosystem meme coin launch platform Pump.fun has continuously extracted $436.5 million USDC stablecoins from the protocol, with $405 million transferred to major CEXs in just the past week. On-chain data shows that these funds mainly originated from the project's private sale of PUMP tokens to institutions in June. As a result, the price of PUMP tokens has plummeted 24% over the past week, now trading at $0.0026, falling below the institutional private sale price of $0.004. This has sparked strong community concerns and accusations that the team is "cashing out and running away."

MarketWhisper·11-24 05:44

A Whale deposited 1 million USDC into HyperLiquid and went long on SOL with 20x leverage.

According to Mars Finance, Onchain Lens monitored that a Whale "0x184" deposited 1 million USDC into HyperLiquid and opened a 20x leveraged long position in SOL.

MarsBitNews·11-24 01:15

A newly created Wallet deposited 1.7 million USDC into HyperLiquid and opened a 20x leverage long positions on BTC.

According to Mars Finance, monitoring by the on-chain analysis platform Onchain Lens shows that a newly created Wallet deposited 1.7 million USDC into HyperLiquid and opened a 20x leveraged long position in BTC. The Whale has already made a profit of 705,000 USD in another Wallet.

MarsBitNews·11-22 01:47

Binance has completed the integration of USDC (USDC) on the Sei network and has opened deposit and withdrawal services.

According to Mars Finance, Binance has now completed the integration of USDC (USDC) on the Sei network and has opened deposit and withdrawal services. Users can obtain their exclusive Token deposit Address through this page and check the Token's smart contracts Address on the aforementioned network.

MarsBitNews·11-21 06:46

Monad public sale exceeds $140 million! Over $200 million in funding, Layer 1 new star mainnet launching soon

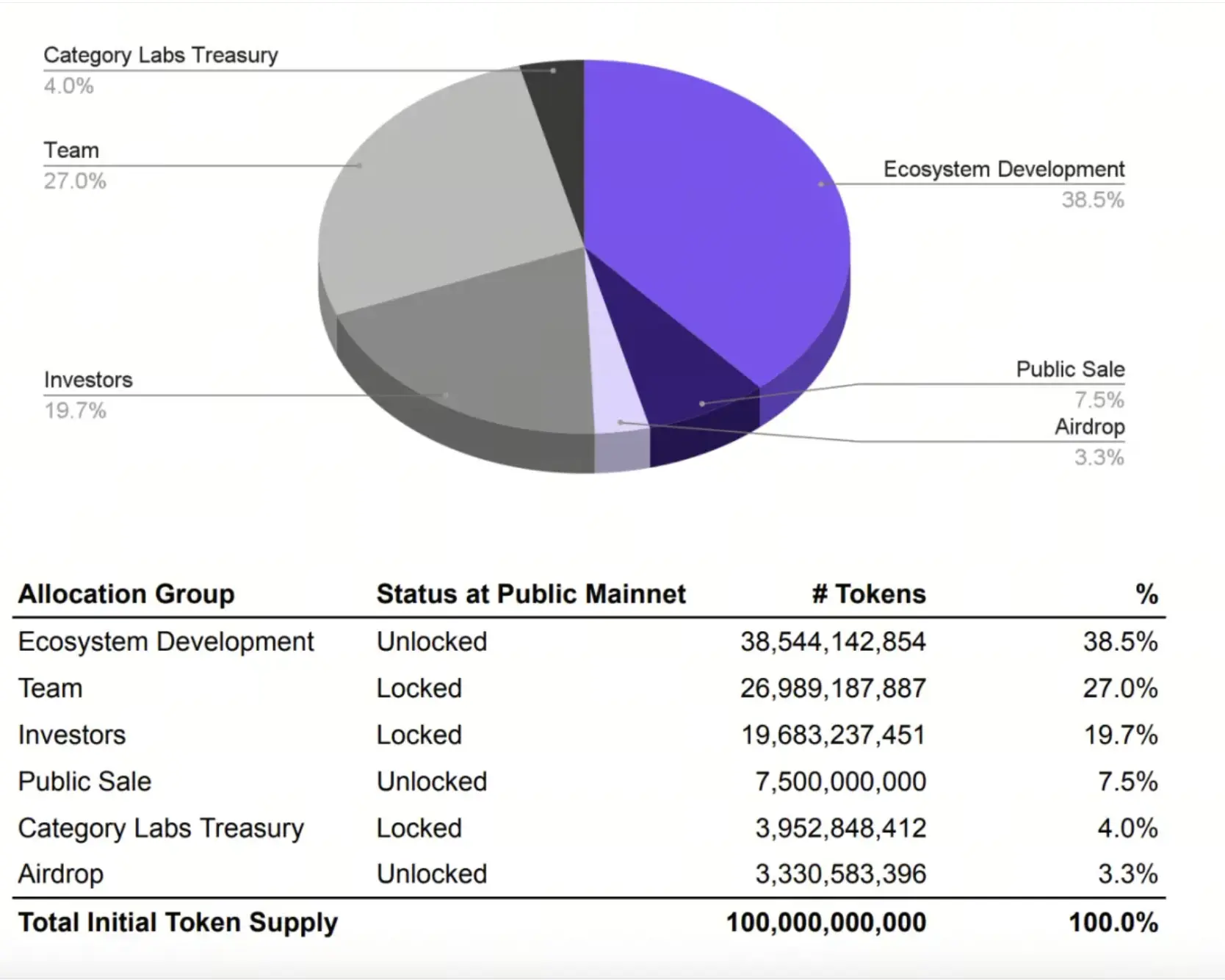

Monad's MON token public sale performed strongly, raising $147.1 million as of November 20, completing 78.4% of the total goal of $187 million. The sale offered 7.5 billion MON tokens at a price of 0.025 USDC each (accounting for 7.5% of the total supply), with a fully diluted valuation of $2.5 billion.

The public sale will end on November 23 at 10:00, followed by the mainnet launch scheduled for November 24. Market expectations for this public sale are positive, with Polymarket prediction platform data showing an 84% probability of reaching a total fundraising amount of $300 million, reflecting strong investor interest in high-performance EVM-compatible Layer 1 solutions.

MarketWhisper·11-21 05:31

Coinbase rolls out Ethereum-backed loans for users to borrow USDC without selling

Ether holders on the exchange can borrow up to $1M in USDC using ETH as collateral.

That ensures access to liquidity/cash without selling their holdings.

The service is available in all US states, excluding New York.

Leading exchange Coinbase has introduced a new feature that will likely

BitcoinInsider·11-20 18:29

USDC Treasury has minted 50 million USDC on the Ethereum blockchain.

According to Deep Tide TechFlow news on November 20, Whale Alert monitored that USDC Treasury minted 50 million USDC on the Ethereum blockchain.

USDC0.01%

DeepFlowTech·11-20 15:08

A Whale has spent 3 million USDC to buy 16,991 AAVE.

According to Mars Finance news, Onchain Lens monitoring shows that a Whale has spent 3 million USDC to buy 16,991 AAVE at a transaction price of 177 USD. The Whale still holds 5.79 million USDC and may continue to increase its holdings.

MarsBitNews·11-19 09:38

2025 USD Withdrawal Platform Comparison: OSL, Kraken, Bitfinex, Backpack Which one is the most suitable for your withdrawal?

For investors, "withdrawal" is very important, especially when you are making profits in the market or want to transfer invested money for daily use, you need to "withdraw". There are many ways to withdraw, but choosing a method that is "low-risk", "cost-effective", and "highly convenient" is very important. The "USD withdrawal" happens to meet the above conditions, but the platforms that allow USD withdrawal include: OSL, Backpack, Kraken, Bitfinex, etc. Which one is more suitable? (Background: Wire transfer withdrawal tutorial》OSL exchange profit guardian: zero slippage 1:1 USD exchange withdrawal) (Background information: OSL global exchange now supports USDT and USDC on the Solana network) Now, using the link to sign up for Dongqu, you can enjoy 3 withdrawal fee discount vouchers and receive $15 worth of Bit.

USDC0.01%

動區BlockTempo·11-19 09:13

Revolut chooses Polygon as the main infrastructure for cryptocurrency payments, having processed a volume of 690 million dollars.

Revolut has integrated Polygon as its main blockchain infrastructure for stablecoin transfers and transactions, allowing users to use USDC and USDT within the app with zero fees, as well as to trade and stake POL tokens. By 2025, the volume is expected to reach 690 million USD.

DeepFlowTech·11-18 16:05

Bybit EU Referral Code: 144088 (Get Your Exclusive 20 USDC Airdrop)

Are you ready to start your crypt journey? We will help you get started with one of world’s leading exchanges, specifically tailored for the European market: Bybit EU! With following Bybit EU Referral Code: 144088 you will be able to start your trading experience with a 20 USDC Signup Airdrop. Use t

Blockzeit·11-18 13:10

LIBRA Team Spends $61.59M USDC to Buy 456K SOL

The LIBRA project on Solana faced controversy after a significant cashout by its team, leading to investigation and skepticism within the crypto community. Despite trading issues, some view the activity as a future opportunity.

Coinfomania·11-18 10:52

Circle minted approximately 2.25 billion USDC on-chain on Solana in the past 7 days.

According to Mars Finance, Circle has minted approximately 2.25 billion USDC on the Solana blockchain in the past 7 days, according to SolanaFloor statistics. This brings the total minted amount of USDC on the Solana blockchain to 41.75 billion USD by 2025.

USDC0.01%

MarsBitNews·11-18 09:59

Two wallets related to the LIBRA scandal will exchange 60 million USDC for SOL after a period of silence.

According to Mars Finance, the blockchain analysis platform Bubblemaps has monitored that two wallets related to the Meme coin LIBRA scandal supported by Argentine President Milei, after a period of silence, exchanged 60 million USDC for SOL.

MarsBitNews·11-18 09:58

What are the Bitcoin concept stocks? 12 recommendations for US and Taiwan stocks in 2025: MicroStrategy Holdings dominates.

Bitcoin concept stocks refer to publicly listed companies whose business is related to Bitcoin, including Bitcoin mining, crypto assets trading platforms, digital payment services, and blockchain technology development. With the approval of the Bitcoin spot ETF by the U.S. SEC in early 2024, crypto assets officially enter the mainstream financial system, making Block, MicroStrategy, and other Bitcoin concept stocks highly followed. These types of stocks have high leverage characteristics, and when Bitcoin prices rise, the increase may surpass that of Bitcoin itself.

MarketWhisper·11-18 09:14

2025 USDC Coin Investment Strategy: Stablecoin Market Analysis and Decentralized Finance Application Guide

[USDC](https://www.gate.com/post/topic/USDC) [DeFi](https://www.gate.com/post/topic/DeFi) [监管](https://www.gate.com/post/topic/%E7%9B%A3%E7%AE%A1) In the rapid changes of digital finance, stablecoin investment strategies are becoming increasingly important. USDC coin has become the focus of the stablecoin market in 2025, attracting investors with its stability and transparency. Exploring the price movement of USDC coin not only reveals its market resilience, but the comparison of USDC coin trading platforms and Risk Management also provides investors with a comprehensive perspective. Furthermore, the comparison of USDC coin with other stablecoins and its applications in Decentralized Finance showcase the revolution of emerging financial tools.

幣圈動態·11-18 06:08

A Address deposits 9 million USDC, leveraging to go long ETH and SOL.

According to Mars Finance news, it is reported that the on-chain Address "0x8d0" deposited 9 million USD USDC to the HyperLiquid platform and opened a Long Position with 20x leverage on ETH and SOL. This address had previously incurred a loss of approximately 7.4 million USD in trading.

MarsBitNews·11-18 05:30

Data: A certain Whale deposited 1.84 million USDC into Hyperliquid and placed a limit order to go long Bitcoin.

According to Mars Finance, on-chain analysis platform Lookonchain monitored that a certain Whale deposited 1.84 million USDC into Hyperliquid and placed a Bitcoin limit long order between $88,611 and $89,211.

MarsBitNews·11-18 02:19

Gate GUSD minting limited-time rewards: Deposit to enjoy an annualized 50% return

Gate has launched a new GUSD minting rewards mechanism, allowing users with a net deposit of 5000 USDT to enjoy an annualized return of up to 50%, alongside a base return of 4.4%. The event runs from November 14, 2025, to November 28, 2025, during which users can participate in various financial projects through GUSD holdings to enhance asset returns.

GateLearn·11-18 01:22

VALR & Mukuru Collaborate to Launch USDC Wallet for African Users

This partnership promotes the wider use of alternative savings choices in regions where currency volatility is a problem.

With more than 200 crypto asset service providers approved since April 2024, South Africa’s legislative framework for crypto assets has also brought significant clarity to the

USDC0.01%

TheNewsCrypto·11-17 14:04

The number of merchants using Binance Pay has surpassed 20 million, rising over 1700 times in ten months.

According to Mars Finance, Binance disclosed in its official blog that at the beginning of 2025, only about 12,000 merchants were connected to Binance Pay, while currently, over 20 million businesses accept its payment services. In other words, within ten months, the scale of the Binance Pay network has risen more than 1,700 times. This significant growth trend is mainly attributed to the widespread use of stablecoins. This year, over 98% of its B2C transactions used stablecoins such as USDT, USDC, EURI, and FDUSD, and the variety of this basket of stablecoins is also continuously increasing. In addition, since its launch in 2021, Binance Pay has processed a cumulative transaction amount of over 250 billion USD, with its user base exceeding 45 million.

MarsBitNews·11-17 09:39

Deribit and SignalPlus Launch 2025 Trading Competition, Featuring a $450,000 USDC Prize Pool

Press Release

Panama City, Panama, November 17th, 2025, Chainwire

Deribit, a leading digital asset derivatives exchange, and SignalPlus, a leading provider of cutting-edge software and infrastructure solutions for crypto derivatives, today announced the launch of their latest trading

BitcoinInsider·11-17 08:48

Deribit and SignalPlus Launch 2025 Trading Competition, Featuring a $450,000 USDC Prize Pool

Panama City, Panama, November 17th, 2025, Chainwire

Deribit, a leading digital asset derivatives exchange, and SignalPlus, a leading provider of cutting-edge software and infrastructure solutions for crypto derivatives, today announced the launch of their latest trading competition, running from No

USDC0.01%

CryptoNewsLand·11-17 08:05

Binance launches 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs on November 18, 2025, at 16:00, and will provide Bots services for these trading pairs. In addition, ASTER/USDC and ZEC/USDC will also support spot grid and spot Dollar Cost Averaging (DCA) services. Users can enjoy Taker fee discounts on existing and newly added USDC spot and Margin Trading pairs, and specific trading permissions should comply with local laws and regulations.

MarsBitNews·11-17 07:11

A Address deposits 3.617 million USDC go long on alts, with a position value of nearly 20 million USD.

According to Mars Finance, on-chain data shows that Address 0xa2c...b3126 deposited approximately 3.617 million USDC to the HyperLiquid platform an hour ago as Margin, and quickly opened 22 long positions in alts. The total position valuation is currently about 19.86 million USD, and there are still 10 positions (valued at approximately 1.42 million USD) waiting for execution in TWAP.

MarsBitNews·11-17 07:10

a16z: Arcade Tokens Surpass Stablecoins! Airline Mileage Model Reshapes the Encryption Economy

Venture capital firm a16z believes that ecosystem-locked tokens, similar to airline miles, could be key for developers in creating a stable digital economy. a16z points out that one of the most undervalued types of tokens in crypto assets is "Arcade Tokens." These tokens maintain a relatively stable value within specific software or product ecosystems, akin to airline mileage rewards, allowing users to perform specific functions within the ecosystem rather than speculate.

USDC0.01%

MarketWhisper·11-17 05:38

Mizuho Securities has downgraded Circle's rating to "Underperform", with a target stock price lowered to $70.

Mizuho Securities has downgraded Circle Internet Group to "Underperform" with a target price cut from $84 to $70. Analysts pointed out that despite a good performance in the third quarter, the future earnings outlook is pressured by interest rate cuts and increased competition, while the expiration of lock-up periods and new competitors will impact market share.

USDC0.01%

DeepFlowTech·11-15 00:39

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27