Federal Reserve News: Rate Cut Outlook & Meeting Updates

Get the latest Federal Reserve updates, including rate cut expectations, FOMC meeting coverage, interest rates changes, and key news today impacting global markets.

Federal Reserve's 2026 Hidden QE Initiation! Will Bitcoin Crash to $70,000?

The total market capitalization of Crypto has evaporated over $1.45 trillion from the October all-time high. Despite the Federal Reserve cutting interest rates three times in 2025, Bitcoin and Ethereum did not rebound due to dovish policies. The key lies in liquidity rather than the rate cuts themselves. The Federal Reserve's policy direction in the first quarter of 2026 will determine the fate of BTC and ETH. If the Fed pauses rate cuts and inflationary pressures persist, Bitcoin could fall to $70,000, and Ethereum could drop to $2,400.

MarketWhisper·4h ago

2026 Central Bank Divergence! Federal Reserve Data Confusion, European Central Bank Hints at Long-term Stable Interest Rates

In 2026, central bank monetary policies show a cross-Atlantic divergence. The Federal Reserve experienced data gaps due to a 43-day government shutdown, and the December meeting unusually saw three dissenting votes. Jerome Powell admitted that it was like navigating in fog. Despite the unemployment rate rising to 4.6%, a four-year high, the market still prices an 80% chance of holding interest rates steady in January. In contrast, the European Central Bank has kept its deposit rate at 2.0% for four consecutive meetings, with inflation approaching the target, and Lagarde's leadership remains stable until 2027.

MarketWhisper·12-25 01:48

BlackRock warns: Only two Fed rate cuts in 2026, neutral interest rate has peaked

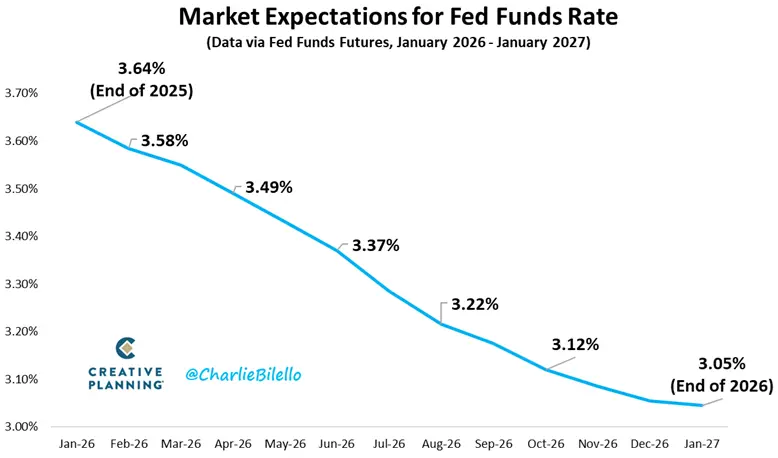

BlackRock senior strategists Amanda Lynam and Dominique Bly released a new report indicating that the Federal Reserve's room to cut interest rates by 2026 is quite limited. After accumulating a 175 basis point cut since September 2024, the Federal Reserve's policy rate is approaching a neutral level. LSEG data shows that the market currently expects only two rate cuts by the Federal Reserve in 2026.

MarketWhisper·12-25 00:44

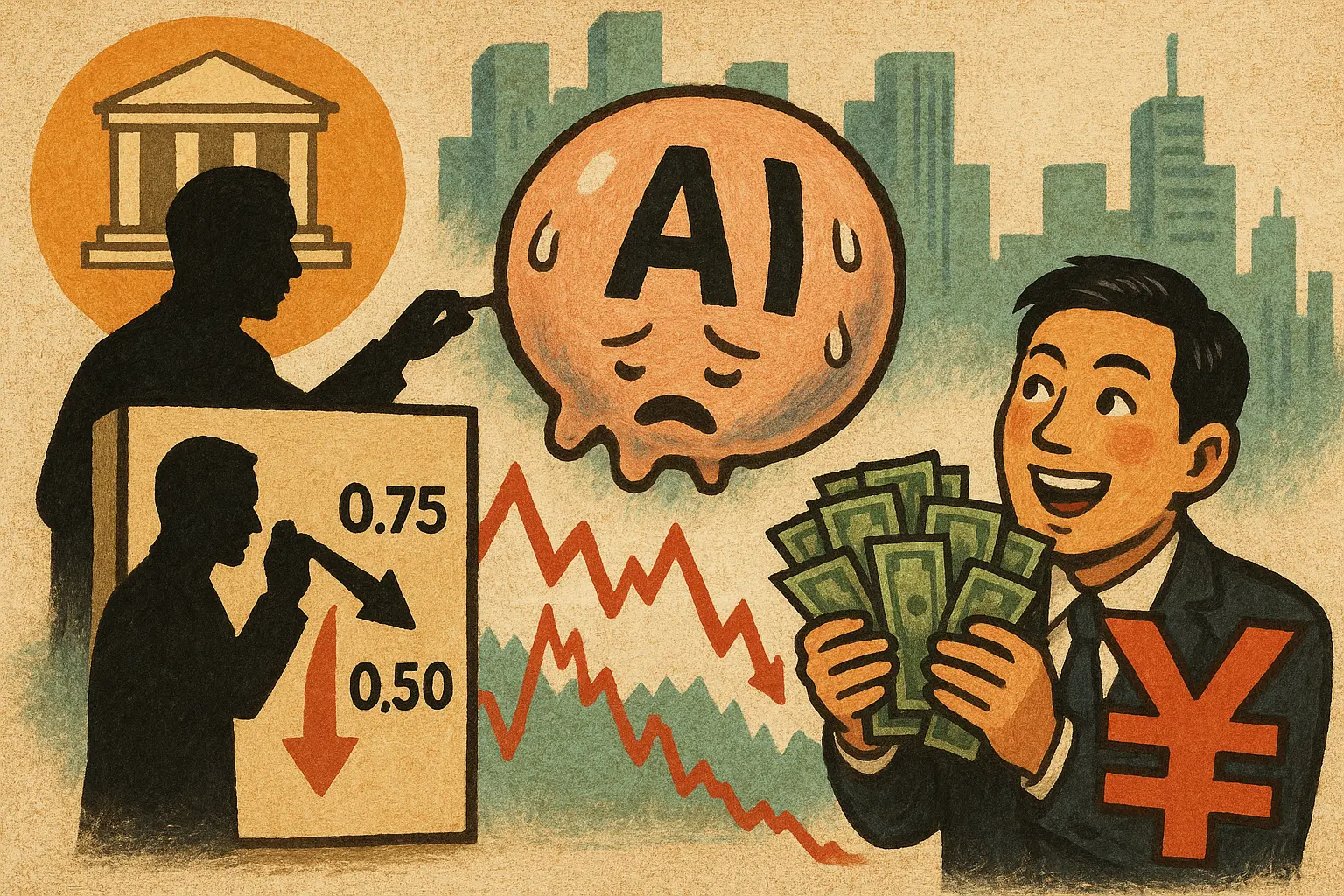

The Federal Reserve (FED) lowering interest rates by 100 basis points is unlikely to save the AI bubble! The renminbi has broken 7 and foreign capital is rushing in.

The Federal Reserve Board of Governors member Waller expects that the interest rate should be cut by 100 basis points in 2026, lowering the rate from the current 3.5%-3.75% to 2.5%-2.75%, but the US stock market has no reaction to this. As Bitcoin falls below 85,000 USD, the exchange rate of the Chinese Yuan against the US Dollar breaks 7.0315, appreciating over 5.3% compared to April. China's trade surplus reaches 1.18 trillion USD, setting a new historical high, with foreign capital accelerating the purchase of RMB assets for hedging.

MarketWhisper·12-23 07:38

Trump is expected to appoint a new chairman of The Federal Reserve (FED) by January 2026, marking the end of the Powell era.

Sources told CNBC that U.S. President Trump may appoint a new Chairman of the Federal Reserve Board of Governors in the first week of January next year, marking the end of the Powell era. Trump is currently considering three final candidates and has clearly stated that support for interest rate cuts is a prerequisite for nomination. Federal Reserve Board of Governors member Stephen Miran indicated earlier this week that he would remain in his position until Trump's nominee is confirmed by the Senate, highlighting the sensitivity of the transition period.

MarketWhisper·12-23 05:21

Trump's appointed conditions for the Federal Reserve chair: must be a "super dove" and immediately cut interest rates.

U.S. President Trump recently stated that he will soon announce his nomination for the next chairman of the Federal Reserve (FED) to replace the current chairman Powell, whose term ends in May next year, and said that the person he nominates must be a "super dove." The list of candidates has been narrowed down to four, and Trump indicated that he will make a decision this week or "in the coming weeks."

MarketWhisper·12-22 08:14

The warning bell for a recession in the U.S. economy has sounded! Top economists criticize the Federal Reserve (FED) for turning a blind eye.

Henrik Zeberg, the chief macroeconomist at Swissblock Wealth Management, warned that the U.S. economy is heading in an unfavorable direction and believes that the Federal Reserve (FED) has failed to identify clear signals. He pointed out that the U.S. unemployment rate reached 4.6% in November, the highest level in four years, approaching the threshold of the "Sam Rule," raising the likelihood of an economic recession to around 40%.

MarketWhisper·12-22 02:54

Hasset pressures the Federal Reserve (FED) to cut interest rates immediately! Can strong GDP shake Powell's determination?

Kevin Hassett, the Director of the National Economic Council, urged the Federal Reserve (FED) to cut interest rates immediately. His remarks echo President Trump’s push for more significant rate cuts, and Hassett himself is one of the candidates for the chair of the Federal Reserve (FED). The key test will come on Tuesday when the final annualized GDP rate for the third quarter will be announced. If the GDP confirms strong growth at 3.2%, it will question why the Federal Reserve (FED) is cutting rates amid an overheating economy.

MarketWhisper·12-22 02:40

The race for Federal Reserve Chair! Trump interviews 4 candidates, "Two Kevins" become favorites

President Trump stated that he is interviewing four Federal Reserve Chair candidates and expects to decide soon who to nominate to succeed Jerome Powell. Trump particularly praised Federal Reserve Board member Waller and Vice Chair for Supervision Barr. Last week, Trump hinted that National Economic Council Director Kevin Hassett and former Federal Reserve Board member Kevin Warsh are top contenders, and he thinks both Kevins are great. Trump called for a significant rate cut, saying that interest rates should be lowered to 1%.

MarketWhisper·12-19 04:50

Just now! The Federal Reserve officially withdrew the 2023 restriction on banks' crypto activities ban

The Federal Reserve officially withdraws the 2023 policy statement restricting banks from engaging in crypto activities and replaces it with new regulations, opening a new path for state member banks to conduct innovative activities. This historic shift means that stablecoin companies like Circle, Tether, Paxos, and BitGo can now hold customer reserves directly at the Federal Reserve, rather than all funds being routed through commercial banks. The new policy adopts a tiered review system, recognizing that different activities should be subject to different levels of regulation.

MarketWhisper·12-18 00:47

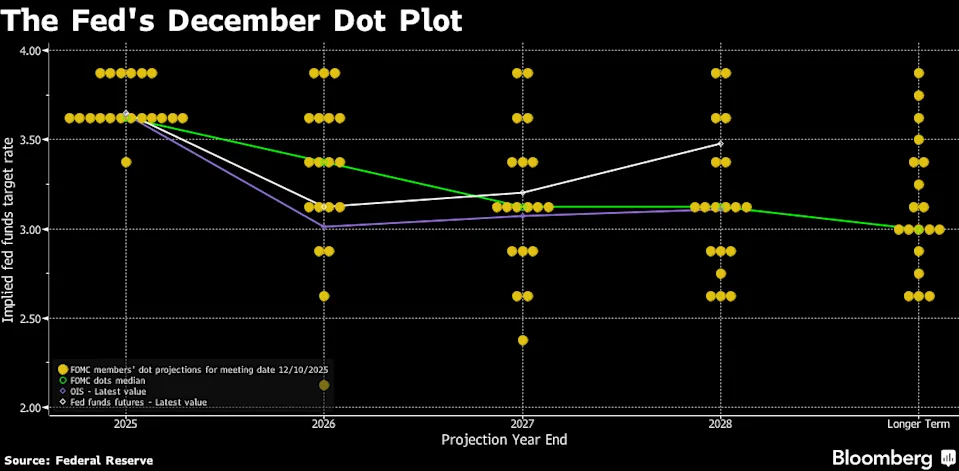

Fed internal conflicts intensify! Atlanta Fed President: Zero interest rate cuts may occur by 2026

Atlanta Federal Reserve Chair Raphael Bostic stated that due to the Republican tax bill potentially exerting upward pressure on inflation, the Federal Reserve is likely unable to cut interest rates in 2026. He mentioned in his forecast for next year that "no rate cuts are written in," because the Federal Reserve must maintain a tightening stance just to hold the line on inflation. This hawkish comment stands in stark contrast to the Fed's three consecutive rate cuts last week, and Bostic does not support that rate cut decision.

MarketWhisper·12-17 06:59

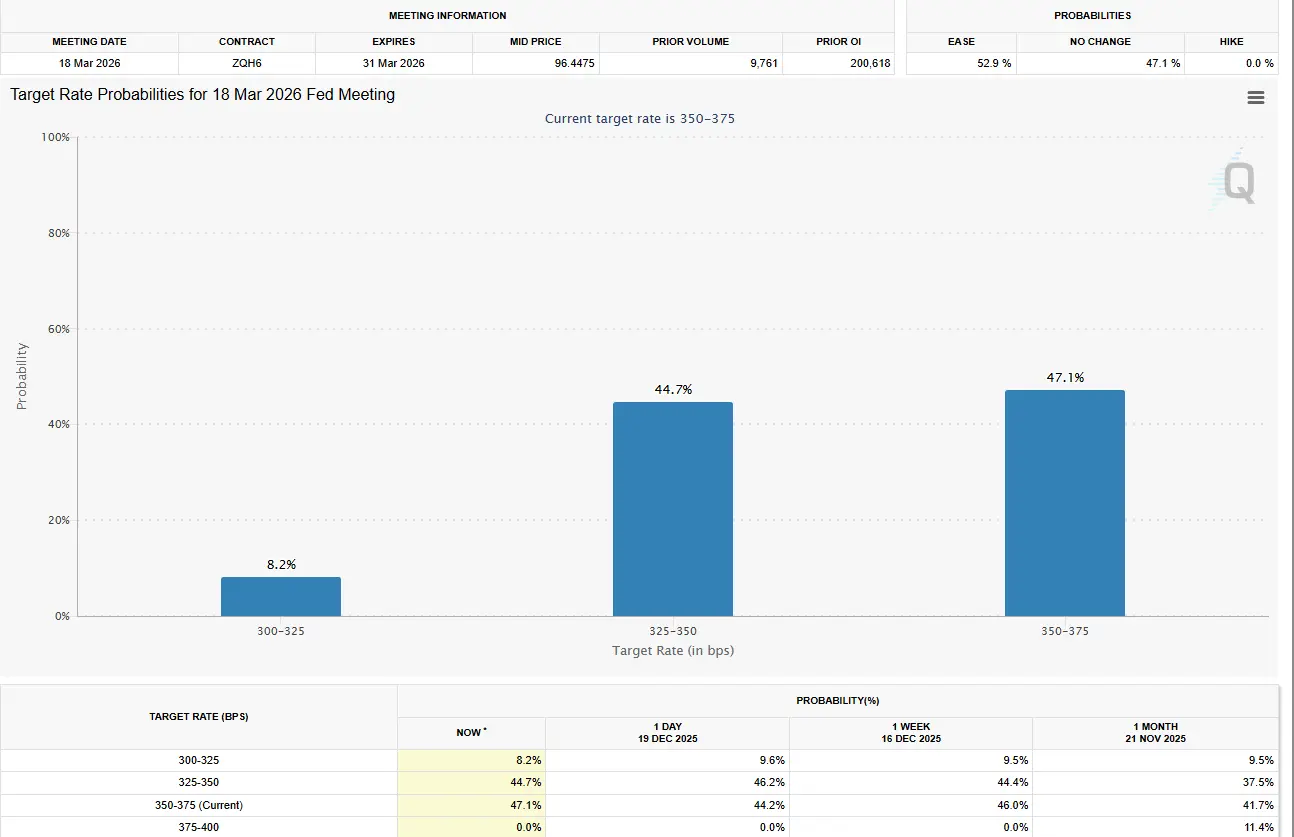

Federal Reserve 2026 dual rate cuts become consensus! Non-farm payrolls boost January rate cut probability to 31%

After the US non-farm payroll data was released, US federal funds futures slightly increased the probability of a rate cut in January 2026 from 22% to 31%. US interest rate futures still expect the Federal Reserve to cut rates twice in 2026, with an expected easing of 58 bps next year. The market-implied probability of a rate cut in March jumped above 55%, reflecting growing market confidence that the Federal Reserve's easing policy will resume soon.

MarketWhisper·12-17 02:11

Is the Fed's monthly purchase of 40 billion in government bonds QE? Powell clarifies: This is not quantitative easing

The Federal Reserve purchases $40 billion in US Treasuries every month, and the market is calling for a return of quantitative easing (QE). However, Powell's move is not to stimulate the economy, but to prevent issues in the financial system's operation. This is the Reserve Management Purchase Program (RMP), which differs fundamentally from traditional QE in terms of mechanism, purpose, and effect. Although technically RMP meets the definition of QE, its role is stabilizing rather than stimulating. Understanding the difference between the two is key to judging market trends.

MarketWhisper·12-16 10:01

Trump appoints two successors! The Federal Reserve spends 40 billion to buy bonds, causing volatility in the US stock market and Bitcoin

President Trump of the United States, in an interview with The Wall Street Journal, named Kevin Hassett and Kevin Warsh as the preferred candidates to succeed current Federal Reserve Chair Jerome Powell, and called for a significant cut in interest rates. The New York Federal Reserve Bank's trading department has begun purchasing short-term Treasury bonds, with an initial batch of $40 billion worth of bonds maturing in about 30 days. What impact will this have on the US stock market and Bitcoin?

MarketWhisper·12-16 02:48

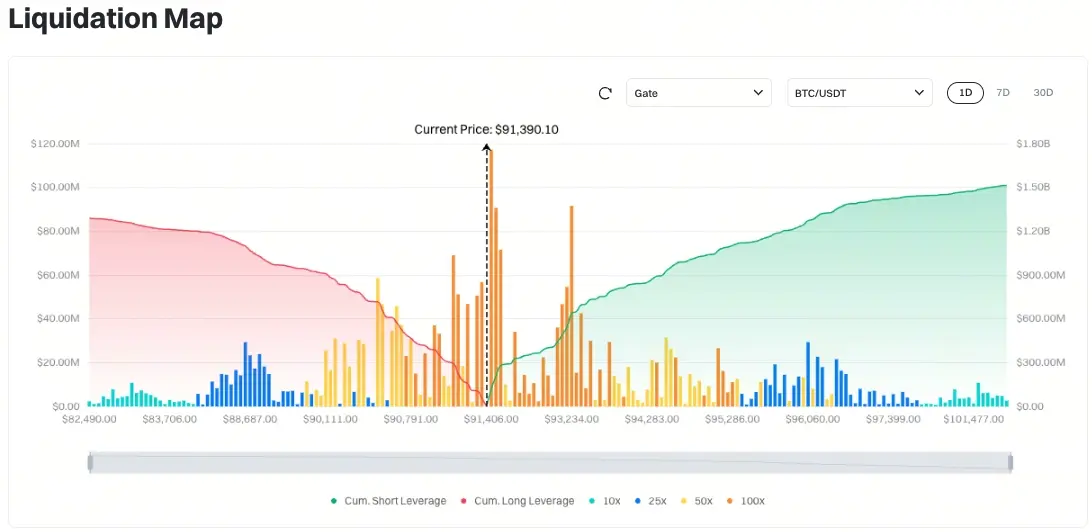

Federal Reserve Nominee Changes, AI Bubble Warning! Bitcoin Clears $527 Million in a Single Day

December 16, Bitcoin retested the $85,000 level, with over $527 million in bullish leverage positions being liquidated in a single day. This plunge was triggered by the convergence of two major systemic risks: Trump's core circle pushing for a more independent Federal Reserve Chair candidate, reducing the likelihood of Kevin Hasset replacing Powell; and hedge fund giant Bridgewater warning that tech companies' over-reliance on the debt market for AI investment financing has entered a dangerous phase.

ETH0.61%

MarketWhisper·12-16 02:26

What Is The Federal Reserve? World's Most Powerful Bank Explained

What is the Federal Reserve? It's the US central bank managing monetary policy by setting interest rates, regulating banks, and controlling money supply. Created by the 1913 Federal Reserve Act, it operates through 12 regional banks and a Board of Governors led by Chair Jerome Powell, with the federal funds rate at 3.50%-3.75% and next meeting January 27-28, 2026.

MarketWhisper·12-12 09:07

Federal Reserve cuts interest rates three times! Bitcoin's "buy the rumor, sell the news" rebound pattern revealed

After the Federal Reserve's third interest rate cut of the year, Bitcoin rebounded from the low of below $90,000 to $93,500. On-chain analytics firm Santiment pointed out that this follows the classic "buy the rumor, sell the news" pattern. Analysts said that the rate cut, which was anticipated, has been digested by the market, and the $40 billion short-term Treasury bond purchase plan is interpreted as a slightly bullish signal.

MarketWhisper·12-12 07:31

Federal Reserve internal conflict! Powell pushes aggressively for rate cuts, 8 Fed presidents face collective resistance

Federal Reserve Chair Jerome Powell pushed for a 25 basis point rate cut on December 10, but a series of details revealed the severity of the central bank's division. Only two officials officially voted against the decision, but quarterly interest rate forecasts showed that six policymakers believe rates should remain in the 3.75% to 4% range before the cut, constituting a "silent dissent." Even more surprisingly, only 4 out of the 12 regional Fed banks requested a rate reduction, implying that perhaps 8 presidents opposed the cut.

MarketWhisper·12-12 02:07

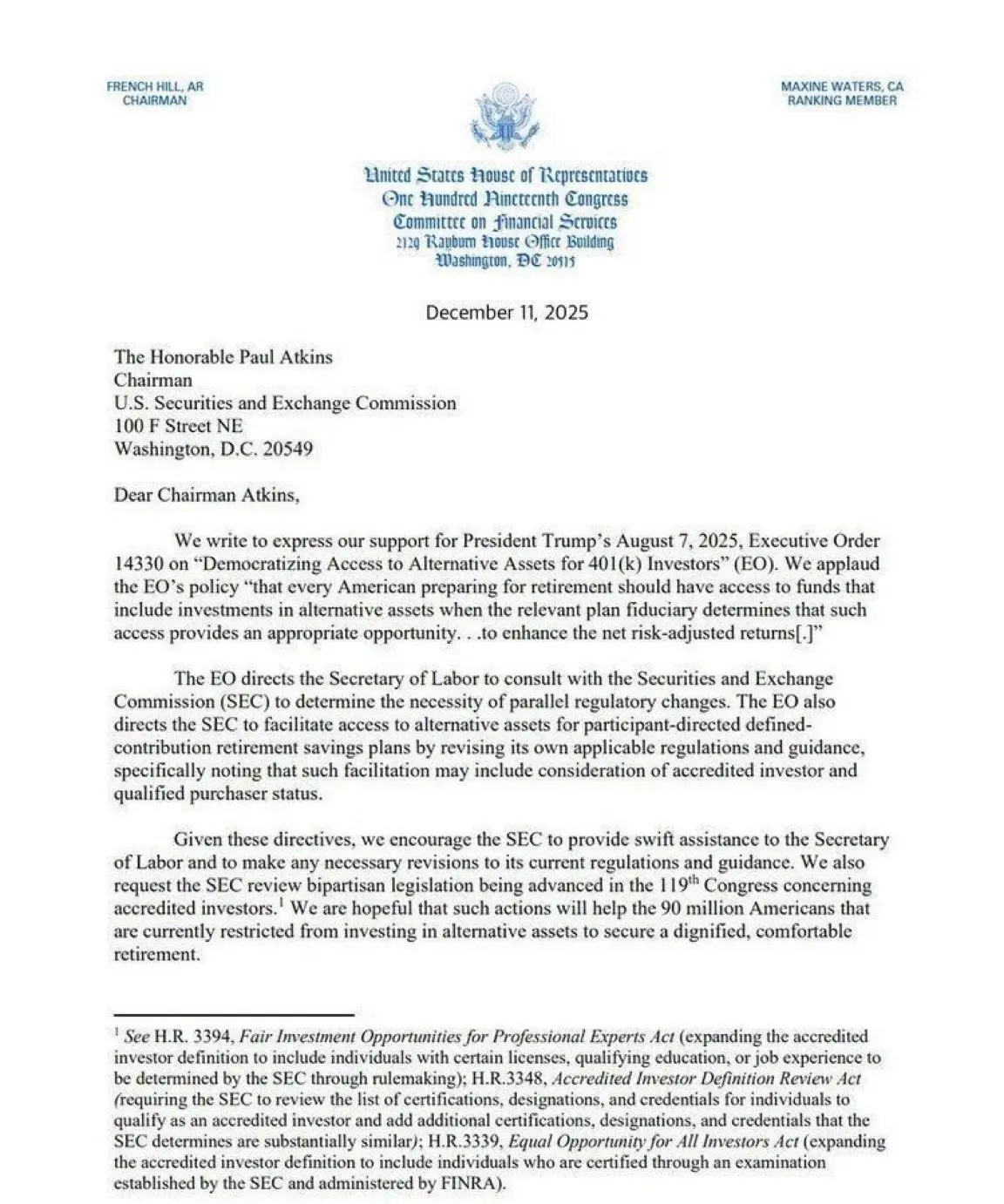

Why did Bitcoin rise today? Congress urges the SEC to allow cryptocurrencies in retirement plans

The reason for Bitcoin's rise today comes from favorable policies. The U.S. Congress has sent a letter to the SEC urging the enforcement of allowing cryptocurrencies to be included in 401(k) retirement accounts, with a moderate 1-3% allocation generating a buying pressure of $125 billion to $375 billion. The Federal Reserve also announced that starting December 12, it will purchase $40 billion worth of short-term government bonds. Driven by these dual catalysts, Bitcoin's target price is aimed at $131,000.

MarketWhisper·12-12 00:28

The Federal Reserve cuts interest rates but hides a deadly crisis! Trump controls independence, and the US dollar's credibility is counting down to collapse

After the Federal Reserve's 25 basis point rate cut in December, the market's expected "hawkish stance" did not materialize. Powell downgraded inflation prospects and announced the purchase of $40 billion in short-term government bonds starting this month. However, "Big Short" Michael Burry warned that if Trump intends to strengthen control over the Federal Reserve, this central bank "might face an end," and an independence crisis could trigger a collapse in dollar credit and chaos in asset markets.

MarketWhisper·12-11 06:38

Trump angrily slams Powell for too small a rate cut! The Federal Reserve should cut interest rates by 50 basis points

President Trump harshly criticized the Federal Reserve's latest rate cut decision during a roundtable with business executives at the White House, stating that the 25 basis points cut was too small and should be "at least doubled" to 50 basis points. Trump directly criticized Federal Reserve Chairman Jerome Powell, calling him "a rigid person," and said the size of the rate cut was too small and too slow. He also revealed plans to interview Federal Reserve Board member Waller that evening, who, along with National Economic Council Director Hasset, is a leading candidate to succeed Jerome Powell.

MarketWhisper·12-11 02:24

Gate Daily (December 11): After Powell's rate cut, "two sentences" ignite market bullishness; Japan's cryptocurrency shifts to securities law

Bitcoin (BTC) surged briefly before pulling back, currently trading around $91,220 as of December 11. The Federal Reserve announced a 25 basis point cut to the benchmark interest rate, with Chair Powell stating that "rate hikes are not anyone's basic expectation." Starting from December 12, a 30-day period of purchasing $40 billion in government bonds ignited bullish sentiment. Japan is preparing to move crypto asset regulation out of the country's payment system and into a framework specifically designed for investment and securities markets.

MarketWhisper·12-11 01:37

The Federal Reserve's "hawkish rate cut" arrived as expected. Why did the market rise instead of fall?

The Federal Reserve cut interest rates by 25 basis points to 3.5-3.75%, but the decision was passed with a 9-3 vote, the highest opposition record since 2019. The market reaction was unexpectedly strong, with the Dow Jones soaring 497 points, up 1.1%, and Bitcoin briefly surged to $94,000. Fed Chairman Powell stated, "Rate hikes are not part of anyone's basic expectations," and announced the purchase of $40 billion in government bonds within 30 days starting December 12, igniting bullish market sentiment.

MarketWhisper·12-11 00:57

Why did Bitcoin suddenly skyrocket today? The Federal Reserve cuts interest rates by 25 bps, and Jerome Powell's one statement triggered a buying spree.

After the Federal Reserve cut interest rates by 25 basis points to 3.5% to 3.75%, global financial markets instantly surged. The Dow Jones Industrial Average soared over 600 points, spot gold jumped from lows to $4,238.78, and Bitcoin briefly surged above $94,000. Federal Reserve Chairman Powell explicitly ruled out the possibility of a rate hike, stating "a rate hike is not anyone's baseline expectation," and announced the purchase of $40 billion in government bonds within 30 days starting December 12.

MarketWhisper·12-11 00:24

Trump continues to fight Bauer! "Shadow Fed Chairman" Hassett: There is plenty of room for interest rate cuts

Kevin Hassett, director of the National Economic Council, said at the Wall Street Journal CEO Council event that there is "ample room" for rate cuts in the coming months, and that the rate cut could exceed the current expectation of 0.25%, a position consistent with President Trump's call to reduce borrowing costs. Hassett is seen as a popular successor to current Fed Chairman Powell, who will serve until May next year. Trump criticized Powell for showing reluctance to cut interest rates and hinted at a desire to fire him during his second term.

MarketWhisper·12-10 06:20

Bitcoin FOMO returns to 9.4M! The Fed's words may trigger a crash

Bitcoin surged to $94,625 on December 10, a three-week high, with Santiment data showing a surge in calls for "higher" and "beyond" on social media, and FOMO sentiment has clearly returned. However, the Fed's interest rate decision has become the biggest variable, with the market expecting an 88.6% chance of a 25 basis point rate cut but only a 21.6% chance of another rate cut in January, and any hesitation about future rate cuts could be bearish.

MarketWhisper·12-10 05:24

What Is the Fed's Expected Rate Cut and Why It Could Derail Bitcoin's Rally in December 2025

Bitcoin has surged back above $94,000, climbing over 4% in the past 24 hours to reach highs near $94,640 amid renewed risk appetite in crypto markets.

CryptopulseElite·12-10 02:30

Jerome Powell repeating 2019 tactics? Fed mouthpiece: Half of officials oppose rate cuts, triggering internal conflict

Nick Timiraos, a Wall Street Journal reporter known as the "Fed mouthpiece," revealed that as many as 5 out of the 12 voting members of the Federal Reserve have publicly expressed reservations about cutting interest rates, and 10 out of the 19 total members believe there is no sufficient reason for easing. The market expects Fed Chair Powell to repeat the strategy from 2019: first lowering the interest rate to the 3.50%-3.75% range, and then adding stricter policy thresholds in the statement.

MarketWhisper·12-10 01:41

Why is Bitcoin up today? Trump kicks off the final round of interviews, Hassett predicts a rate-cut frenzy ahead

Bitcoin rose to $92,526 on December 10, with a daily increase of 1.92%. The core reason for Bitcoin's rise today is that Trump will interview candidates for Federal Reserve Chair this week. The leading candidate, Hassett, is seen as extremely dovish and may push rates further down from the current 3.5% to 3.75% to Trump's requested 1%. The market expects the Federal Reserve to cut rates by 25 bps on Wednesday, marking the third consecutive rate cut.

MarketWhisper·12-10 00:27

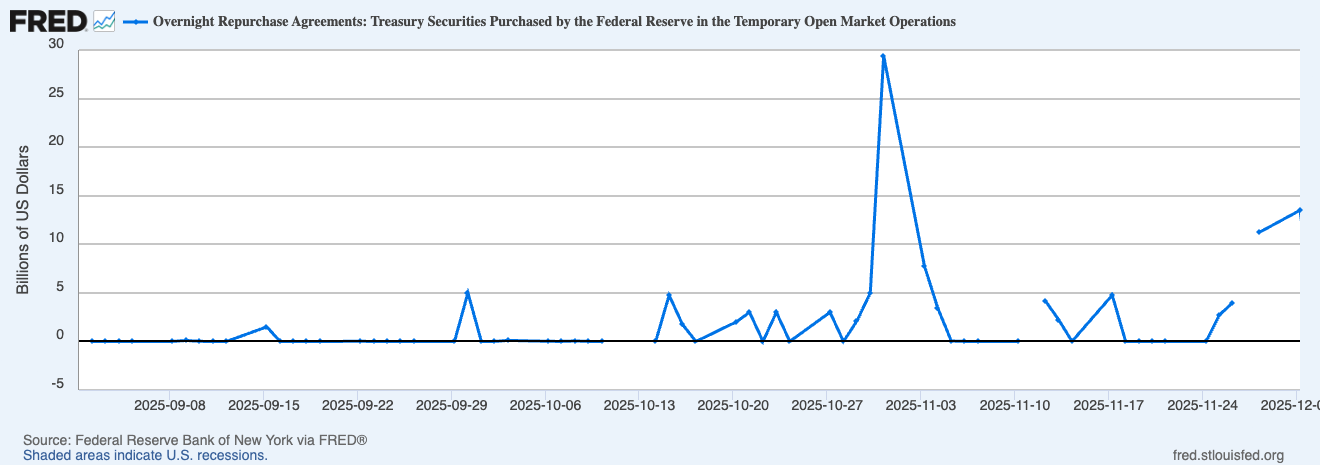

The Federal Reserve injects $13.5 billion overnight! Bitcoin gives early warning of a US dollar liquidity crisis

The Federal Reserve's overnight reverse repo operations reached $13.5 billion, which is a significant anomaly for professional traders tracking dollar liquidity. This sudden surge indicates a sharp increase in demand for short-term dollars within the banking system, possibly signaling tightening in the funding markets or shaken confidence among institutions. As a liquidity-sensitive asset, Bitcoin was the first to react to this change over the weekend, experiencing price volatility. Bitcoin is no longer independent from the US dollar system; instead, it is deeply embedded within the global liquidity cycle.

MarketWhisper·12-08 03:34

Fed rate cut expected in December! Stopping QT activates $8 trillion in liquidity, Bitcoin aims for $100,000 by year-end

Whether Bitcoin can reach $100,000 before New Year's Eve depends on investors' reactions to the Federal Reserve's policy shift, as well as the market's response to the soaring debt of major tech and AI companies. The Fed officially ended its quantitative tightening policy on December 1, and this week’s rate cut is all but certain. U.S. money market funds have reached a record $8 trillion in size, and rising tech credit risk could drive capital flows into scarce assets like Bitcoin.

MarketWhisper·12-08 02:33

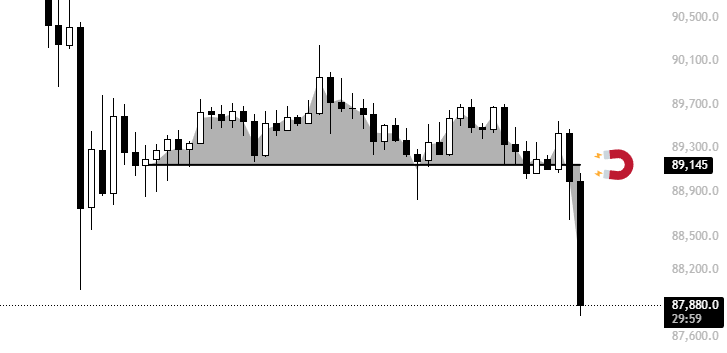

Bitcoin News Today: FOMC Tensions Trigger Pullback, Sharp Rebound After Falling Below 88,000

The price of Bitcoin dropped by $2,000 before Sunday’s close, falling to nearly $87,000 at one point, but rebounded to around $90,000 on December 8. Cryptocurrency analyst Michaël van de Poppe predicts that FOMC-related jitters may trigger a pullback, after which Bitcoin will quickly rebound and move toward $100,000 within the next 1 to 2 weeks.

BTC1.2%

MarketWhisper·12-08 00:27