Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

67.95K Popularity

26.97K Popularity

8.82K Popularity

2.84K Popularity

1.92K Popularity

- Hot Gate FunView More

- MC:$3.53KHolders:10.00%

- MC:$3.55KHolders:10.00%

- MC:$3.56KHolders:20.09%

- MC:$3.52KHolders:10.00%

- MC:$3.52KHolders:10.00%

- Pin

One year into the Trump administration, the transformation of the American encryption industry.

This report is authored by Tiger Research. In 2025, the U.S. government is implementing a policy that supports Crypto Assets, with a clear goal: to regulate the existing Crypto Assets industry in the same way that the TradFi sector operates.

Key Points Summary

1. The United States' Acceptance of Crypto Assets Industry

After President Trump was re-elected, the government launched a series of radical pro-Crypto Assets policies. This marks a sharp turn from past positions—previously, the Crypto Assets industry was mainly seen as a target for regulation and control. The United States has entered a phase that was once unimaginable, rapidly integrating the Crypto Assets industry into its existing system with an almost unilateral decision-making pace.

The shift in positions of the SEC and CFTC, along with traditional financial institutions venturing into Crypto Assets-related businesses, signals that widespread structural changes are underway.

It is particularly noteworthy that all of this has happened just a year after President Trump's re-election. What specific changes have occurred in the United States in terms of regulation and policy so far?

2. The Year of Change in the U.S. Crypto Assets Position

In 2025, with the Trump administration coming to power, the United States' Crypto Assets policy reached a significant turning point. The executive branch, Congress, and regulatory agencies acted in concert, focusing on reducing market uncertainty and integrating Crypto Assets into the existing financial infrastructure.

2.1. U.S. Securities and Exchange Commission

In the past, the SEC primarily relied on enforcement actions to address activities related to Crypto Assets. In significant cases involving Ripple, Coinbase, Binance, and Kraken staking services, the SEC filed lawsuits without providing clear standards regarding the legal attributes of tokens or what activities are permitted, often basing its enforcement on ex post facto interpretations. This has led Crypto Assets companies to focus more on managing regulatory risks rather than business expansion.

This stance began to shift after the resignation of Chairman Gary Gensler, who held a conservative attitude towards the Crypto Assets industry. Under the leadership of Paul Atkins, the SEC has moved towards a more open approach, starting to build foundational rules aimed at incorporating the Crypto Assets industry into a regulatory framework rather than solely relying on litigation for oversight.

A key example is the announcement of the “Crypto Assets project.” Through this project, the SEC has indicated its intention: to establish clear standards to define which tokens are securities and which are not. This once ambiguous regulatory body is beginning to reshape itself into a more inclusive institution.

2.2. U.S. Commodity Futures Trading Commission

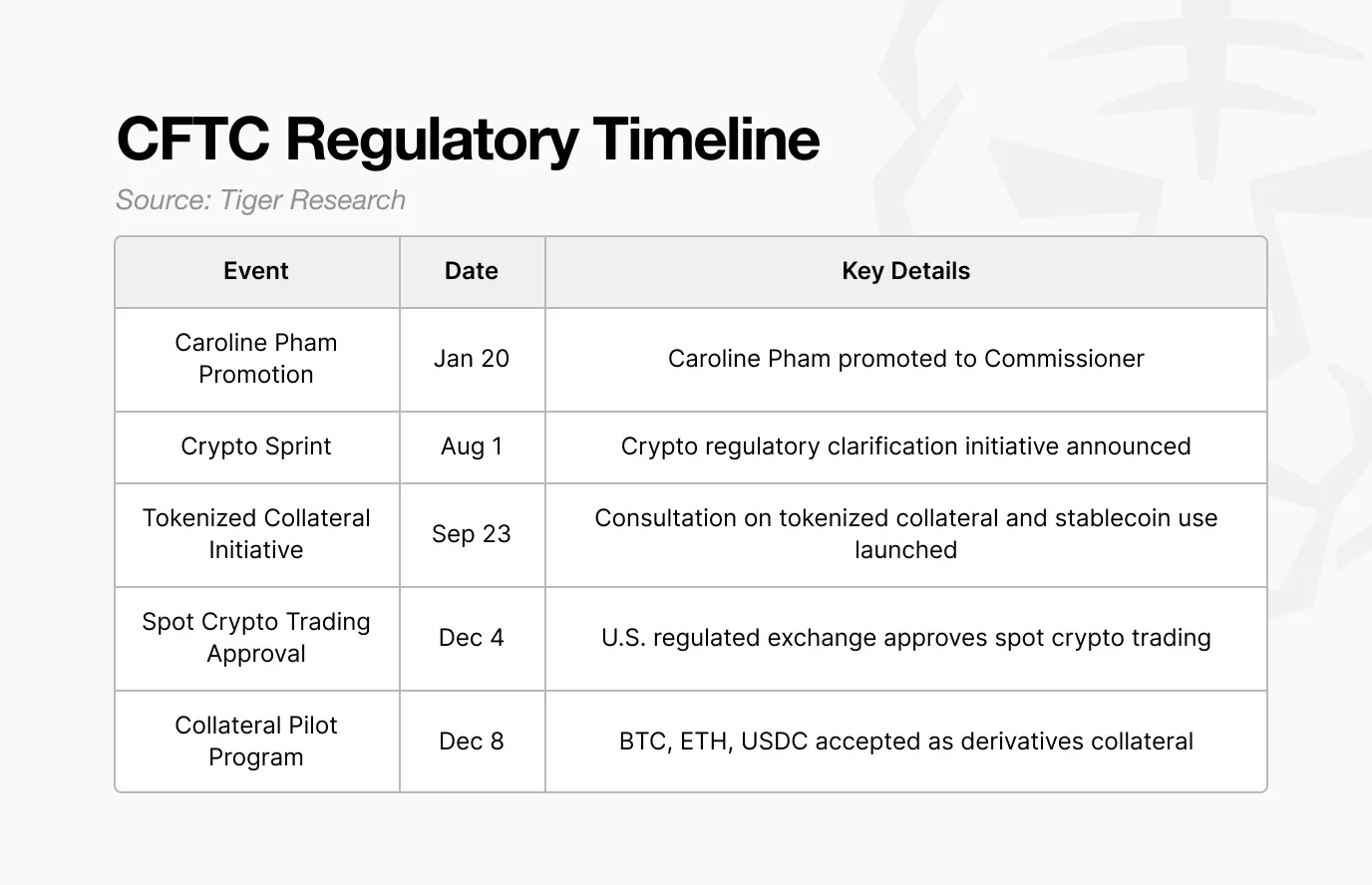

** **Source: Tiger Research

**Source: Tiger Research

In the past, the CFTC's involvement in Crypto Assets was largely limited to the regulation of the derivatives market. However, this year, it has taken a more proactive stance, officially acknowledging Bitcoin and Ethereum as commodities and supporting TradFi institutions in using them.

The “Digital Asset Collateral Pilot Program” is a key initiative. Under this program, Bitcoin, Ethereum, and USDC are approved as collateral for derivatives trading. The CFTC applies haircut ratios and risk management standards to treat these assets in the same manner as traditional collateral.

This shift indicates that the CFTC no longer views crypto assets purely as speculative tools, but rather begins to recognize them as stable collateral assets that can be placed alongside traditional financial assets.

2.3. Currency Supervision Bureau

** **Source: Tiger Research

**Source: Tiger Research

In the past, the OCC maintained distance from the Crypto Assets industry. Crypto Assets companies had to apply for licenses on a state-by-state basis, making it difficult to enter the federal banking regulatory system, restricting business expansion, and structurally hindering connections with the TradFi system, which meant that most could only operate outside of the regulated system.

Today, this practice has changed. The OCC has chosen to incorporate crypto asset companies into the existing banking regulatory framework rather than exclude them from the financial system. It has issued a series of interpretive letters (formal documents clarifying whether specific financial activities are permitted), gradually expanding the scope of allowed activities, including crypto asset custody, trading, and even bank payment transaction fees on the blockchain.

This series of reforms reached a climax in December: the OCC conditionally approved national trust bank charters for major companies such as Circle and Ripple. This move is significant as it grants these Crypto Assets companies the same status as TradFi institutions. Under a single federal regulator, they can operate nationwide, and transfers that previously required intermediary banks can now be processed directly like traditional banks.

2.4. Legislation and Executive Orders

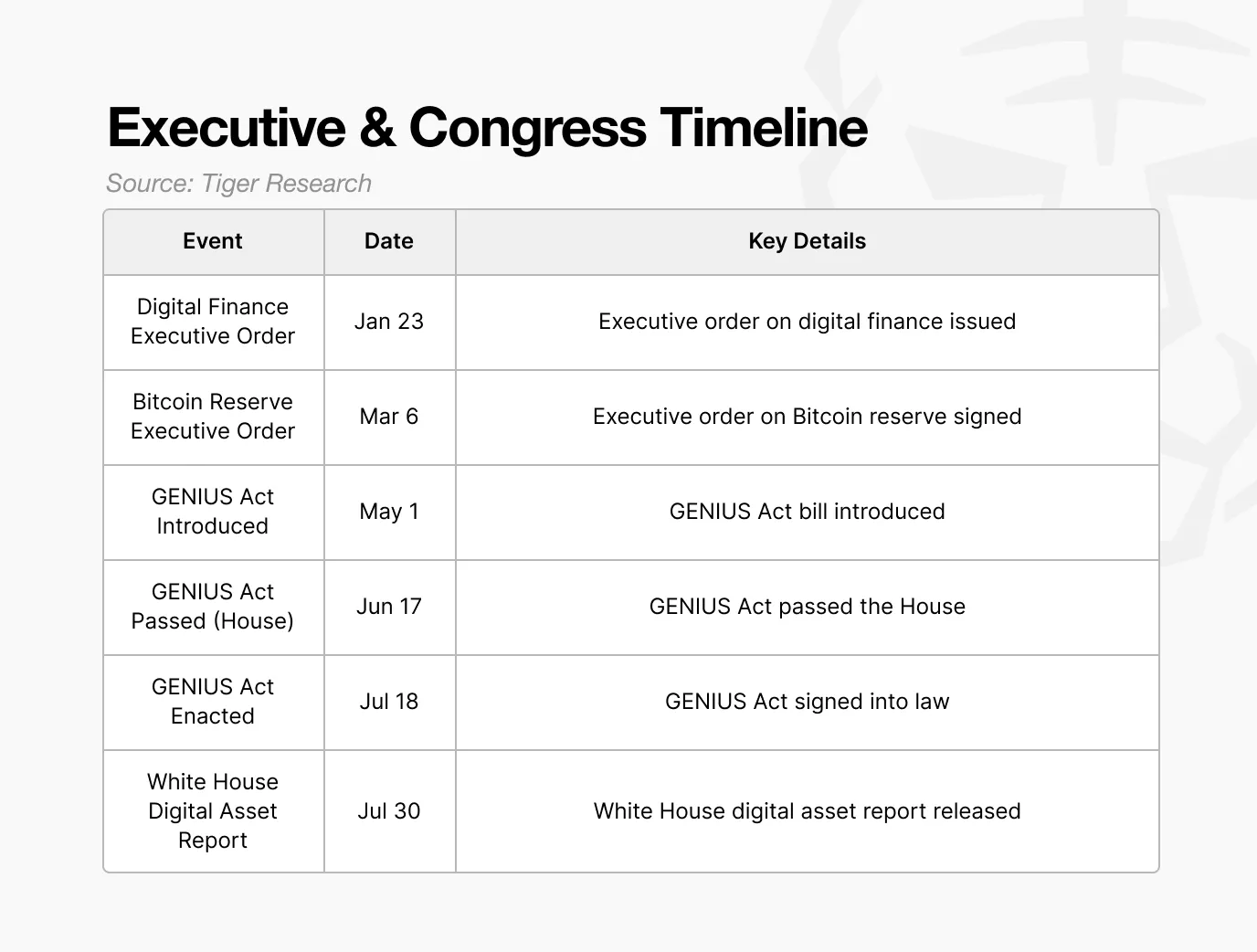

** **Source: Tiger Research

**Source: Tiger Research

In the past, the United States has been brewing stablecoin legislation since 2022, but repeated delays have led to a regulatory vacuum in the market. There is a lack of clear standards regarding reserve composition, regulatory authority, and issuance requirements, making it impossible for investors to reliably verify whether issuers hold sufficient reserves, which has raised concerns about the transparency of reserves held by certain issuers.

The “GENIUS Act” addresses these issues by clearly defining the requirements for stablecoin issuance and reserve standards. It requires issuers to hold reserves equivalent to 100% of the issued amount and prohibits re-pledging of reserve assets, while centralizing regulatory authority under federal financial regulators.

Thus, stablecoins have become digital dollars backed by legal payment capabilities and recognized by law.

3. The direction is set, competition and checks and balances coexist

Over the past year, the direction of U.S. Crypto Assets policy has been clearly visible: integrating the Crypto Assets industry into the formal financial system. However, this process has not been uniform and frictionless.

Differences in internal views in the United States still exist. The debate surrounding the privacy-mixing service Tornado Cash is a typical example: the executive branch actively enforces the law under the pretext of blocking illegal funds, while the SEC chairman publicly warns against excessive suppression of privacy. This indicates that the U.S. government’s understanding of Crypto Assets is not completely unified.

However, these differences are not equivalent to policy instability; they are more akin to the inherent characteristics of the U.S. decision-making system. Agencies with different responsibilities interpret issues from their own perspectives, occasionally expressing dissent publicly, and moving forward through mutual checks and persuasion. The tension between strict enforcement and protecting innovation may lead to short-term friction, but in the long run, it helps to make regulatory standards increasingly specific and precise.

The key is that this tension has not stalled the process. Even in the debate, the U.S. is advancing on multiple fronts simultaneously: the SEC's rule-making, the CFTC's infrastructure integration, the OCC's institutional absorption, and congressional legislation establishing standards. It does not wait for complete consensus, but instead allows competition and coordination to proceed in parallel, driving the system forward continuously.

Ultimately, the United States neither completely let go of Crypto Assets nor attempted to suppress their development, but instead reshaped regulation, leadership, and market infrastructure simultaneously. By transforming internal debates and tensions into momentum, the United States chose a strategy that directs the global Crypto Assets industry center towards itself.

The past year has been critical because this direction has transcended declarations and has been effectively transformed into concrete policies and implementations.