Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Arthur Hayes Predicts Bitcoin at $500K, Reveals Top Altcoins to Watch in 2026

Arthur Hayes forecasts Bitcoin could reach $500K by late 2026, influenced by global liquidity and U.S. political cycles. He identifies BTC, ETH, Solana, Zcash, and Athena as key players in the upcoming bull cycle.

BitcoincomNews·12m ago

Trump strongly recommends the explanation of Bitcoin

Bitcoin explanation strongly recommended by President Trump

BTC-4.94%

LinkFocus·15m ago

Japan's government bond Intrerest Rate has surpassed 1%, and the ghost stories of the global financial market have begun.

The yield on Japanese government bonds has surpassed 1% for the first time, marking the end of its extreme easing era. This change will affect global capital flows, Arbitrage trading, and the performance of risk assets. U.S. stocks and Asia-Pacific stock markets may face pressure from capital withdrawal, while the appreciation of the yen could aid in the rise of gold prices. Overall, the global market is entering a new Intrerest Rate cycle, and asset values are facing reevaluation.

BTC-4.94%

金色财经_·19m ago

Why Solana Price Fell Harder Than Bitcoin During the Recent Market Crash? Will it Hit $100?

Solana's price remains in a steep decline after falling below $140, with bearish market conditions. Although buyers are trying to stabilize prices, technical and on-chain indicators imply a potential for a deeper correction.

BitcoincomNews·51m ago

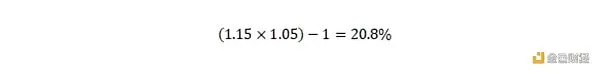

Altcoin season in 2026? Signs to watch out for

Each strong growth cycle of the crypto market since 2017 has been associated with the boom of the altcoin season, when the prices of altcoins grow significantly.

Although the year 2025 is nearing its end, the altcoin season has not yet appeared as expected, despite the great interest and anticipation from the community.

TapChiBitcoin·57m ago

Japan's government bond Intrerest Rate has surpassed 1%, and the "ghost stories" of the global financial market have begun.

Written by: Liam, Deep Tide TechFlow

Let me tell you a ghost story:

The yield on Japan's two-year government bonds has risen to 1% for the first time since 2008; the yield on five-year government bonds increased by 3.5 basis points to 1.345%, the highest since June 2008; the yield on 30-year government bonds briefly touched 3.395%, setting a new historical high.

The significance of this matter is not just that "the interest rate has exceeded 1%", but rather:

The extreme easing era in Japan over the past decade is being permanently written into history.

From 2010 to 2023, Japan's two-year government bond yield has almost always fluctuated between -0.2% and 0.1%. In other words, previously, money in Japan was free or even charged you to borrow.

This is due to the fact that the Japanese economy has been trapped in stagnant prices and stagnant wages since the bubble burst in 1990.

BTC-4.94%

DeepFlowTech·1h ago

BlackRock Consulted Michael Saylor During Bitcoin’s Bear Market

BlackRock sought Michael Saylor's guidance in 2020 when Bitcoin was low, influencing its crypto strategy. Eighteen months later, they launched the $IBIT ETF, now worth $86B, highlighting Bitcoin's growing institutional appeal.

BTC-4.94%

CryptoFrontNews·1h ago

Tom Lee’s Bitcoin and Ethereum Price Prediction 2026

Market analyst Tom Lee predicts 2026 will be a significant year for crypto and stock markets, highlighting favorable conditions for investors, particularly in Bitcoin and Ethereum.

BitcoincomNews·1h ago

$426,000,000 in Bitcoin and Crypto Liquidated As BTC Drops To $87,000

Crypto traders faced significant losses as $426 million in leveraged longs were liquidated in just four hours due to Bitcoin's price drop from $90,700 to $87,017. The decline also affected the stock futures market.

TheBitTimesCom·1h ago

Bitcoin price slides to $85K: How low can BTC go in December?

Bitcoin

Cryptocurrencies

Bitcoin Price

Markets

Market Analysis

Add reaction

Cointelegraph·1h ago

Bitunix Analyst: Bank of Japan's December Rate Hike Remarks, BTC Faces Liquidation Pressure

According to Mars Finance, on December 1, Bank of Japan Governor Kazuo Ueda released the clearest hawkish signal to date, with the market raising the probability of a rate hike in December by the Bank of Japan to 64%. The yen strengthened, and short-term Japanese government bond yields hit a new high since 2008. Influenced by expectations of Japan's policy normalization being advanced, global capital flows are being repriced, putting pressure on the dollar and high volatility assets simultaneously. Meanwhile, the sudden diplomatic friction between the United States and Venezuela escalated, further cooling risk appetite rapidly. Against the backdrop of rising macro risk aversion, the crypto market experienced severe fluctuations. BTC fell sharply in today's Asian session, accompanied by rapid accumulation of liquidation volume. According to the liquidation map, a high-density liquidation zone formed around $92,300, becoming the main axis of this decline; after the price broke through this area, the downward trend accelerated, consecutively hitting $88,300, $86,200, and other subsequent liquidity stacks.

BTC-4.94%

MarsBitNews·1h ago

Bitcoin (BTC) Didn’t Fail, the Monetary Order Did: Here’s the Real Reason the Crypto Market Crashed

The crypto market is deep in the red today. Total market cap is down 5.26% and sits at $2.92T, while the Bitcoin price has dropped sharply after losing key support levels overnight

Many traders called this a “Bitcoin failure,” but the truth is very different. BTC didn’t fail. The global monetary s

CaptainAltcoin·1h ago

Silver Breakout Continues, Becomes Bitcoin's 'Mirror Image' in Relentless Hike

Silver, the commodity metal that has awakened from a five‑decade slumber, has breached $58 for the first time and is once again making headlines. Analysts say the rally may have room to continue, as demand is poised to grow while supply remains constrained.

Silver Reaches Another Milestone as

Coinpedia·2h ago

Musk's Vision for the Future: AI Will Make Currency Disappear, Bitcoin Will Rise Due to Energy Value

Tesla CEO Elon Musk recently painted a disruptive vision of the future in an interview: when artificial intelligence and robotics are highly developed enough to meet all human needs, the concept of "currency" as a tool for labor allocation may disappear. He believes that "energy" based on physics will become the ultimate currency, and Bitcoin, due to its Proof of Work mechanism, will convert energy into digital scarcity, playing a central role as a value carrier in this future. This forward-looking discourse places Crypto Assets at the center of the grand narrative of AI, provoking deep market reflections on ultimate value storage.

BTC-4.94%

MarketWhisper·2h ago

Bitcoin Price Dips Below $87,000, Silver-Tongued Analyst Reveals What to Expect Next

Bitcoin and Ethereum prices have dipped, sparking bearish sentiment. Analyst Doctor Profit predicts a sideways phase before a significant drop, indicating a need for more liquidity below current levels before the market can decline further.

CryptoNewsLand·2h ago

Best Crypto to Invest While BTC Fades, Why Analysts Predict a 900% Climb By Mid-2026

Bitcoin's declining dominance and reduced volatility have led investors towards promising mid-cap DeFi projects like Mutuum Finance (MUTM), which offers unique lending models and strong demand ahead of its launch.

BTC-4.94%

BitcoincomNews·2h ago

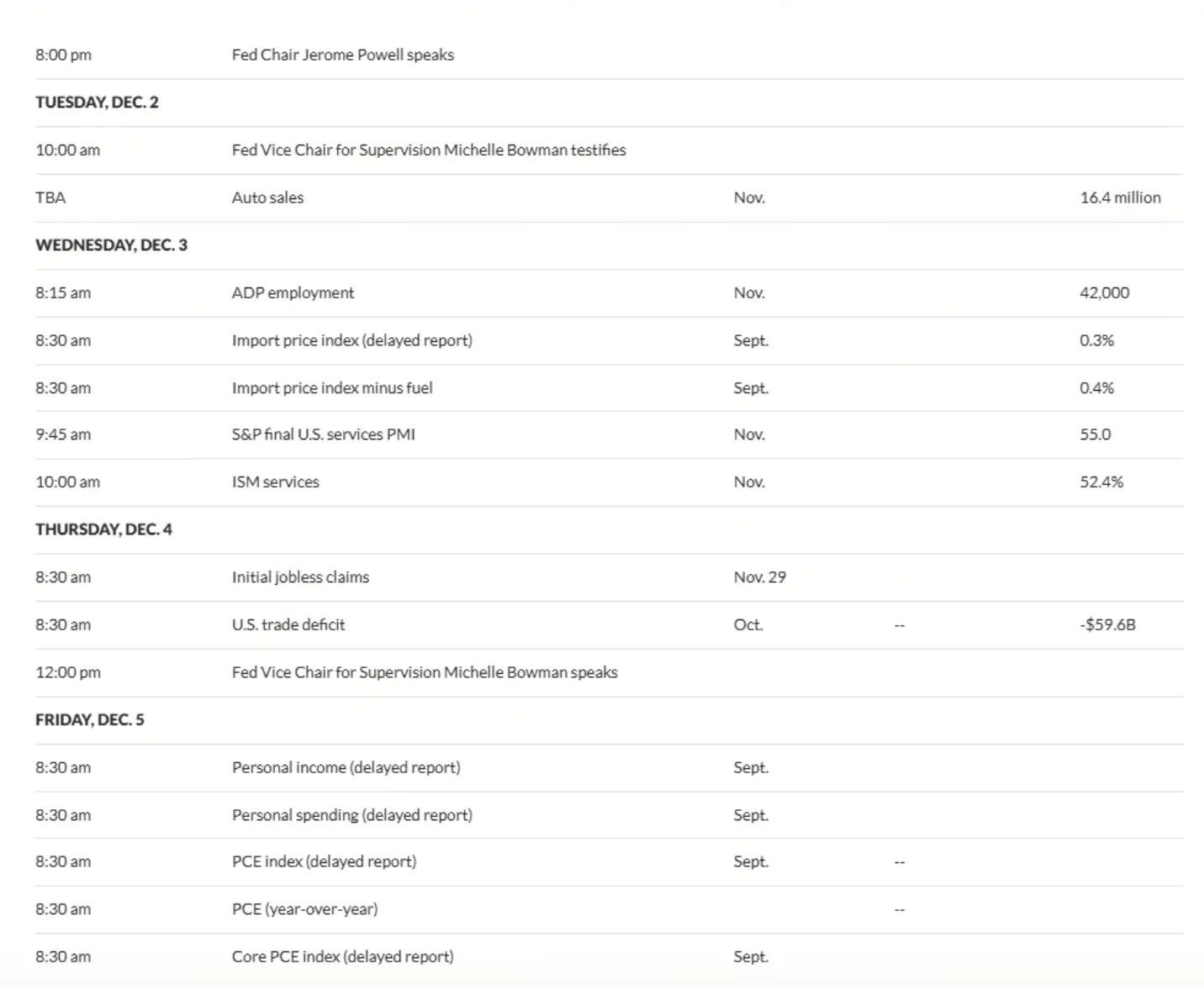

Bitcoin Showdown Week: Powell's Speech Leads, Four Macro "Nuclear Bombs" Will Ignite the Market

In the first week of December 2025, the Bitcoin market will face a decisive test as four major U.S. macroeconomic events occur in quick succession, which may reshape expectations for monetary policy and market liquidity. Fed Chairman Powell will give a speech on December 1, and on the same day, the Fed will officially end quantitative tightening, setting the tone for a shift in liquidity for the market. Subsequently, ADP employment, initial jobless claims, and core PCE inflation data will be released sequentially, with the market's expectation for a rate cut at the Fed meeting on December 10 reaching as high as 87.6%. This series of events will collectively determine whether Bitcoin can make a comeback or continue its downward trend.

BTC-4.94%

MarketWhisper·2h ago

Data: Spot Bitcoin ETF saw an outflow of 3.5 billion dollars in November, marking the largest monthly outflow since February.

According to Mars Finance, data from SoSoValue shows that the US Spot Bitcoin ETF recorded a net outflow of $3.5 billion in November, marking the largest monthly negative flow record since the beginning of this year. Since October 31, the Bitcoin ETF has seen net outflows for four consecutive weeks, totaling $4.34 billion. However, in the last three days of November, just before Thanksgiving in the US, it shifted to net inflows. Among them, BlackRock's IBIT, the largest Bitcoin ETF by net asset size, saw an outflow of $2.34 billion in November and recorded its largest single-day outflow since its inception on November 18, reaching $523 million. LVRG director Nick Ruck stated that this outflow mainly reflects institutions taking profits after Bitcoin reached an all-time high and adjusting their portfolios at the end of the year, rather than a loss of confidence.

MarsBitNews·2h ago

Qian Zhimin's 61,000 BTC big pump to 50 billion RMB, how much can China recover?

Qian Zhimin, this name has become a focus again after being silent for several years. On November 11 local time, Qian Zhimin, the main culprit of the Tianjin Lantian Ge Rui large-scale illegal fundraising case in China and the largest Bitcoin Money Laundering case in British history, was sentenced to 11 years and 8 months in prison in the UK. The British police have locked 61,000 Bitcoins, which, at the current market price, is close to 50 billion yuan. The question of who should benefit from the appreciation has become the focus of legal games between China and the UK.

BTC-4.94%

MarketWhisper·2h ago

Musk: AI era could erase money, boost Bitcoin

In Musk's AI- and robotics-driven future, traditional money fades as labor allocation becomes obsolete, while energy---and energy-backed assets like Bitcoin---persist as core value.

Summary

Musk says advanced AI and robotics could satisfy human needs, making money far less relevant as a way

BTC-4.94%

Cryptonews·2h ago

The BTC Holdings of Australia's Monochrome Spot Bitcoin ETF rose to 1161 coins.

According to Mars Finance news on December 1, the Australian Monochrome Spot Bitcoin ETF (IBTC) disclosed that as of November 28, the open interest had reached 1161 Bitcoins, and the Holdings market capitalization had exceeded 162 million Australian dollars.

BTC-4.94%

MarsBitNews·3h ago

MSTR's Tribulation: Shorting and Palace Intrigue

Author: Lin Wanwan

Recently, the holders of MSTR (Strategy) might have trouble sleeping.

The "Bitcoin Central Bank" that was once revered has experienced a bloodbath in its stock price. As Bitcoin rapidly corrected from its historical high of $120,000, MSTR's stock price and market value plummeted significantly in a short period, dropping more than 60%, and there is even a possibility that Strategy could be removed from the MSCI stock index.

The price of cryptocurrencies has pulled back, and stock prices have plummeted, but these are merely superficial signs. What truly makes Wall Street anxious is the growing number of indications that MSTR is caught up in a battle for monetary power.

This is not an exaggeration.

In the past few months, many seemingly unrelated events have started to connect: JPMorgan has been accused of significantly increasing its short-selling pressure on MSTR; users have encountered delivery issues when transferring MSTR shares from JPM.

BTC-4.94%

金色财经_·3h ago

A thunderclap! MicroStrategy clearly sets the bottom line for Bitcoin sales: mNAV falls below 1 and financing is cut off.

Phong Le, CEO of MicroStrategy, the world's largest corporate Bitcoin holder, clearly outlined the stringent trigger conditions for selling Bitcoin for the first time: sales will only be considered if the stock price falls below the net asset value (mNAV falls below 1) and the company is unable to finance through equity or debt. Facing pressure from preferred stock dividends of $750 million to $800 million annually, the company insists on paying through premium stock issuance and views Bitcoin sales as a "last resort" to protect shareholder value. At the same time, the company has launched the "BTC Credit Dashboard" to demonstrate to investors that even if Bitcoin falls to $25,000, its financial structure remains robust, and the long-term holding strategy remains unwavering.

BTC-4.94%

MarketWhisper·3h ago

4E: Bitcoin stabilizes and rebounds, macro expectations and capital flows still dominate the direction.

According to Mars Finance, Bitcoin has maintained stability after a slight rebound, with the current recovery leaning more towards improved risk sentiment rather than internal drivers within the encryption zone. The stock market has seen a slight rise, with the market expecting an approximately 85% probability of a rate cut in December. However, high inflation and weak employment data still weigh on the market, and Fed officials have expressed slightly dovish tones, but with limited impact. This week's macro focus will shift to unemployment claims and ADP employment data. Meanwhile, the credit spreads and CDS related to AI continue to rise, indicating that funds are reassessing the strongest trading logic from the past year. The liquidity remains weak, with continuous outflows from crypto ETFs and net liquidation of asset products, with several net values dropping below 1 dollar per unit, and risk-averse sentiment significantly increasing. Strategy has once again taken the spotlight due to Bitcoin reserves approaching breakeven and stock prices being included in the MSCI delisting observation list, which may become a key variable in the market before the end of the year. Currently, BT

BTC-4.94%

MarsBitNews·3h ago

Matrixport: Bitcoin has encountered resistance at the key resistance level of $92,000, and upward momentum has significantly slowed.

Matrixport analysis indicates that Bitcoin faces resistance at $92,000, and market sentiment is weak. Despite expectations of a Fed rate cut, capital inflows remain limited. Additionally, Japan's tightening monetary policy raises concerns, challenging the consistency of global Central Bank easing, prompting institutional investors to drop Bitcoin investments.

BTC-4.94%

MarsBitNews·3h ago

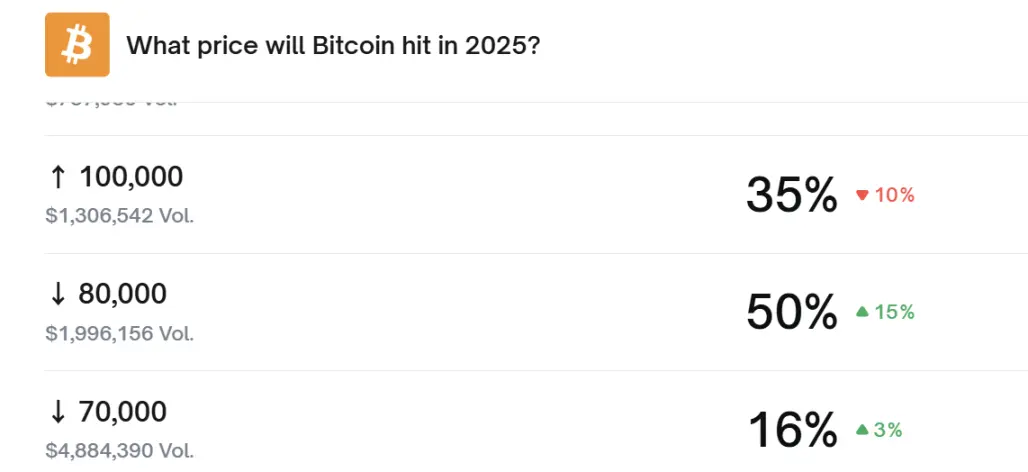

BTC Faces Sideways Phase as Liquidity Builds Up

Bitcoin remains below the EMA50, indicating market weakness and a tight range. Liquidity pockets at $97K and $105K may trigger stop runs before a potential decline towards $72K–$75K by early 2026.

BTC-4.94%

CryptoFrontNews·3h ago

How to apply the bank valuation framework to Bitcoin treasury companies

Author: Andrej Antonijevic, Source: Bitcoin Treasury, Translated by: Shaw Golden Finance

Introduction

Banks have existed in various forms for hundreds of years. Their business model is typically based on a simple economic mechanism: they absorb deposits and use this funding base to provide financial products such as mortgages, business loans, payment services, and credit facilities. The difference between asset returns and liability costs forms the basis of their profitability.

Due to the widespread, regulated, and measurable nature of this business model, capital markets have developed clear valuation methods for banks. One of the most widely used methods is the Price-to-Book (P/B) ratio framework, which directly connects the valuation of banks with their long-term return on equity, cost of capital, and sustainable growth rate.

Entering the twenty-first century, a new type of balance sheet entity has emerged: Bitcoin treasury.

BTC-4.94%

金色财经_·3h ago

Bitcoin "Black Monday": $86,000 defense line in jeopardy, risk aversion storm sweeps through the crypto market

According to Bloomberg, on the first trading day of December, the cryptocurrency market experienced a "Black Monday," with Bitcoin falling more than 6% in a single day, dropping below the key psychological level of 86000 USD, while Ethereum also plunged over 7% to around 2800 USD. This round of selling was triggered by multiple pieces of unfavourable information: the world's largest stablecoin USDT was downgraded by S&P, the Central Bank reiterated its crackdown on virtual money, and MicroStrategy admitted for the first time that it might sell Bitcoin to pay dividends. Market sentiment has turned sharply, and investors are now focusing on the more important technical support level of 80000 USD, worrying that a deeper pullback may be on the horizon.

MarketWhisper·3h ago

Strategy CEO: Bitcoin Sales Only as Absolute Last Resort if mNAV Collapses and Capital Markets Freeze

Strategy Inc. (MSTR) CEO Phong Le made it clear in a interview on the *What Bitcoin Did* podcast that the company would only sell Bitcoin under the most extreme circumstances — specifically if its stock price falls below net asset value (mNAV < 1.0) and all other sources of capital simultaneously disappear.

BTC-4.94%

CryptoPulseElite·4h ago

Who directed today's big dump? It wasn't Powell's resignation letter, but rather Ueda's interest rate hike.

Written by: Oliver, Mars Finance

On December 1st, the highly anticipated closing month of the crypto market kicked off with a brutal opening loss.

On Sunday evening Beijing time, Bitcoin plummeted from above $90,000 without any resistance, briefly touching $85,600, with a daily decline of over 5%. The altcoin market was even more severely affected, with the fear index skyrocketing.

The surface trigger is a horrifying rumor that has been spreading wildly on social media: Federal Reserve Chairman Powell will announce his resignation on Monday evening.

But this is just the surface.

In this information cocoon, traders are terrified by the political gossip from Washington, yet they overlook the real deadly danger signals coming from Tokyo. This is not just an emotional outburst triggered by rumors, but a textbook-level global macro deleveraging.

The real power of short selling comes from the one that is quietly closing the world's largest exemption.

BTC-4.94%

MarsBitNews·4h ago

Bitcoin Whale Flips Short to Leveraged Long on 1,000 BTC Amid $88K Break

A prominent Bitcoin whale tracked on Hyperliquid has executed a dramatic position reversal, closing a 1,000 BTC short worth approximately $91 million and immediately entering a leveraged long at $91,437, with liquidation priced at $59,112.

BTC-4.94%

CryptoPulseElite·4h ago

BlackRock Reports Bitcoin ETFs Now Lead All Product Revenue Despite November Withdrawals

BlackRock's Bitcoin ETFs have become the company's top revenue source, despite November withdrawals. The IBIT fund neared $100B demand and now holds over 3% of Bitcoin supply, generating $245M in annual fees as interest stabilizes with Bitcoin's price rebound.

BTC-4.94%

CryptoFrontNews·4h ago

MicroStrategy hints at continuing to increase the position! Saylor insists on buying the dip, CEO reveals the only condition for selling coins.

Michael Saylor hinted at a new Bitcoin purchase by MicroStrategy in a post with a "green dot". The chart shows that MicroStrategy's Bitcoin portfolio is worth approximately $59 billion, with a total of 649,870 Bitcoins purchased over 87 transactions. MicroStrategy CEO Phong Le stated that the company will only sell coins when mNAV falls below net asset value and cannot obtain new funds.

BTC-4.94%

MarketWhisper·4h ago

Record Capital Influx: $646.8 Billion in Foreign Investment Floods into US Stocks, Crypto Market's Ability to "Attract Capital" Faces Test

In the 12 months leading up to September 2025, foreign private investors net bought U.S. stocks at a record scale of $646.8 billion, up 66% from the peak in 2021, while the purchase of U.S. government bonds also reached $492.7 billion during the same period. Domestic investors were equally aggressive, pouring $900 billion into stock funds starting in November 2024, while U.S. credit card debt soared to a historic high of $1.233 trillion. This surge of global capital flowing into U.S. risk assets is reshaping the landscape of the TradFi market, while also bringing new challenges and opportunities for the "money-raising" ability of Crypto Assets as an alternative asset class.

MarketWhisper·4h ago

Fed QT end date: $6.57 trillion balance sheet frozen, crypto market "pump" begins?

The Fed will officially end its quantitative tightening policy on December 1, with its balance sheet frozen at $6.57 trillion, having withdrawn $2.39 trillion in liquidity from the market. Analysts point out that this is highly similar to the historical context after the pause of QT in 2019, when alts hit bottom and Bitcoin soared. Ending QT could release up to $95 billion in liquidity each month. Against the backdrop of tight bank reserves and overnight reverse repurchase agreements nearly dropping to zero, the cryptocurrency market is holding its breath for a potential "liquidity-driven" rise.

MarketWhisper·5h ago

The start of December is not good, why has Bitcoin fallen again?

Recently, the prices of Bitcoin and Ethereum have significantly fallen, causing panic in the market. The Central Bank of China has strengthened regulations on virtual money, further undermining market confidence. Analysts point out that the current situation seems similar to the bear market of 2022, and it is expected that the recovery of Bitcoin may not happen until the first quarter of next year.

PANews·5h ago

MSTR's Tribulation: shorting and Palace Intrigue

Original Title: MSTR's Tribulation: Shorting and Palace Intrigues

Original author: Lin Wanwan

Source:

Reprint: Mars Finance

Article by Lin Wanwan

Recently, holders of MSTR (Strategy) are probably having a hard time sleeping.

The "Bitcoin Central Bank" that was once revered has experienced a bloodbath in its stock price. As Bitcoin rapidly corrected from its historical high of $120,000, MSTR's stock price and market value have significantly shrunk in the short term, plummeting over 60%, and there is even a possibility that Strategy could be removed from the MSCI stock index.

The fluctuations in currency prices and the plummeting of stock prices are merely superficial. What truly makes Wall Street anxious is the increasing number of signs indicating that MSTR is being drawn into a power struggle over currency.

This is not an exaggeration.

In the past few months, many seemingly unrelated events have started to connect: JPMorgan

BTC-4.94%

MarsBitNews·5h ago

BTC Open Interest Drops From $45B to $28B and Sparks Talk of a Flush

BTC open interest dropped from $45B to $28B, which marked the largest fall of this cycle based on the chart.

The chart showed three large open interest collapses in the past, with each linked to heavy leverage unwinds.

CryptoQuant said the latest drop likely marked a leverage flush rather than the

BTC-4.94%

CryptoNewsLand·5h ago

Will MicroStrategy sell coins? Strategy CEO admits: If financing is difficult, selling BTC will be the last resort.

MicroStrategy, the largest independent holder of Bitcoin globally, has recently become the focus of investors again due to concerns over its weak stock price and massive dividend payouts. CEO Phong Le rarely admitted that once the company's mNAV remains below 1 for an extended period and financing channels become exhausted, "selling some BTC" will become the last resort to maintain the company's finances.

Strategy to activate coin selling mode? CEO names two major triggering conditions

Strategy CEO Phong Le recently stated in an interview on the What Bitcoin Did Podcast that if two conditions occur simultaneously, he will have to consider selling part of his BTC:

The stock price has fallen below the net asset value per share (mNAV

BTC-4.94%

ChainNewsAbmedia·6h ago

If Hasset becomes the new chairman of the Fed, is it favourable information for the crypto market?

The nomination of the Fed chairman has entered the final stages, with Kevin Hassett being favored to promote an aggressive interest rate cut policy, which is beneficial for the Crypto industry. The Fed will be responsible for the regulation of stablecoins, and its stance will affect the relationship between stablecoins and the U.S. Treasury market, determining whether the Crypto industry can integrate into the TradFi system. Hassett has deep ties to Crypto and may bring positive changes to the industry.

BTC-4.94%

PANews·6h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27