- Angebot

- 2

- 4

- Reposten

- Teilen

GateUser-6e00fa59 :

:

Nur weil es schlecht ist, kann der Marktführer nicht weggehen. Er kann nur durch das Explodieren der Short-Positionen etwas Geld verdienen.Mehr anzeigen

- Angebot

- 1

- 3

- Reposten

- Teilen

BigBossScared :

:

Ich verdiene nur 200u in einer StundeMehr anzeigen

- Angebot

- 2

- 3

- Reposten

- Teilen

WhatIsTheMudMeowing? :

:

Dieser Hundespekulant ist verrückt, er lässt die Long-Positionen unter 23 Millionen nicht verkaufen, während die Short-Positionen nur 1,5 Millionen betragen.Mehr anzeigen

$PIPPIN $PIPPIN Verdienen Sie jeden Tag ein bisschen ✌, liebe Rüben, tut es weh, wenn ihr geschlachtet werdet? Gewöhnen Sie sich daran, es ist gesünder, es zu schneiden, es wird wieder nachwachsen, keine Angst. 😅😅😅

$PIPPIN Verdienen Sie jeden Tag ein bisschen ✌, liebe Rüben, tut es weh, wenn ihr geschlachtet werdet? Gewöhnen Sie sich daran, es ist gesünder, es zu schneiden, es wird wieder nachwachsen, keine Angst. 😅😅😅

$PIPPIN Verdienen Sie jeden Tag ein bisschen ✌, liebe Rüben, tut es weh, wenn ihr geschlachtet werdet? Gewöhnen Sie sich daran, es ist gesünder, es zu schneiden, es wird wi

$PIPPIN Verdienen Sie jeden Tag ein bisschen ✌, liebe Rüben, tut es weh, wenn ihr geschlachtet werdet? Gewöhnen Sie sich daran, es ist gesünder, es zu schneiden, es wird wieder nachwachsen, keine Angst. 😅😅😅

$PIPPIN Verdienen Sie jeden Tag ein bisschen ✌, liebe Rüben, tut es weh, wenn ihr geschlachtet werdet? Gewöhnen Sie sich daran, es ist gesünder, es zu schneiden, es wird wi

PIPPIN10,27%

- Angebot

- 2

- 3

- Reposten

- Teilen

KhanhNguyen :

:

Nacht, in der sie wieder weinenMehr anzeigen

- Angebot

- 3

- 4

- Reposten

- Teilen

OnceGambleOCNTurnsIntoA :

:

Fünfmal leer, alles explodiertMehr anzeigen

- Angebot

- 3

- 2

- Reposten

- Teilen

GateUser-5dac3bfa :

:

Ich habe eindeutig zwei Bilder gesendet, warum wird nur eines angezeigt?Mehr anzeigen

#加密市场反弹 Bottom divergence established, bulls are dominant but pressure is clear

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low since July 2022, a historically extreme oversold signal appears. 4-hour MACD bottom divergence + golden cross, short-term bullish momentum is sufficient. Key zones: Strong support: 66500–67500. Strong resistance: 69500–70000. Structural judgment: rebound trend is clear, but the 7万 level is a watershed for bulls and bears.

🟢

Conclusion: Low leverage long positions have higher cost-effectiveness than high leverage short positions

Overall technical judgment: Ove

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low since July 2022, a historically extreme oversold signal appears. 4-hour MACD bottom divergence + golden cross, short-term bullish momentum is sufficient. Key zones: Strong support: 66500–67500. Strong resistance: 69500–70000. Structural judgment: rebound trend is clear, but the 7万 level is a watershed for bulls and bears.

🟢

Conclusion: Low leverage long positions have higher cost-effectiveness than high leverage short positions

Overall technical judgment: Ove

BTC2,98%

- Angebot

- 6

- 10

- Reposten

- Teilen

MasterChuTheOldDemonMasterChu :

:

Glück und Wohlstand 🧧Mehr anzeigen

1/26 Abend

Kozakura, die erste Hälfte dieses Monats war in Ordnung, aber die zweite Hälfte wurde hintereinander durchgezogen, das tut ziemlich weh.

Gouge sollte auch reflektieren, die Spielweise aktualisieren, um große Verluste zu vermeiden.

Original anzeigenKozakura, die erste Hälfte dieses Monats war in Ordnung, aber die zweite Hälfte wurde hintereinander durchgezogen, das tut ziemlich weh.

Gouge sollte auch reflektieren, die Spielweise aktualisieren, um große Verluste zu vermeiden.

Nur Abonnenten

Jetzt abonnieren, um exklusive Inhalte zu sehen- Angebot

- 1

- 5

- Reposten

- Teilen

WantToEatSweetAndSourPorkRibs :

:

Kann man den freien Platz bei 2147 noch nutzen?Mehr anzeigen

#GateSquare$50KRedPacketGiveaway

Kick Off the Lunar New Year with GateSquare’s $50,000 Red Packet Giveaway: A Personal Reflection on SocialFi, Community Engagement, and the Future of Web3 Rewards

Als das Lunarische Neujahr naht, ist GateSquare’s Neujahrskarneval nicht nur eine Feier – es ist ein Fenster in die sich entwickelnde Welt von Web3, in der Teilnahme, Beitrag und Engagement auf Weisen belohnt werden, die weit über traditionelle Plattformen hinausgehen. Die $50.000 Rotpaket-Verlosung ist ein perfektes Beispiel dafür, wie SocialFi die Online-Interaktion transformiert. Im Gegensatz zu h

Kick Off the Lunar New Year with GateSquare’s $50,000 Red Packet Giveaway: A Personal Reflection on SocialFi, Community Engagement, and the Future of Web3 Rewards

Als das Lunarische Neujahr naht, ist GateSquare’s Neujahrskarneval nicht nur eine Feier – es ist ein Fenster in die sich entwickelnde Welt von Web3, in der Teilnahme, Beitrag und Engagement auf Weisen belohnt werden, die weit über traditionelle Plattformen hinausgehen. Die $50.000 Rotpaket-Verlosung ist ein perfektes Beispiel dafür, wie SocialFi die Online-Interaktion transformiert. Im Gegensatz zu h

GT1,98%

- Angebot

- 5

- 4

- Reposten

- Teilen

Ryakpanda :

:

Ansturm 2026 👊Mehr anzeigen

- Angebot

- 2

- 4

- Reposten

- Teilen

CryptoSelf :

:

LFG 🔥Mehr anzeigen

- Angebot

- Gefällt mir

- 2

- Reposten

- Teilen

Tokyo119 :

:

Ich traue mich wirklich nicht mehr, es zu leeren [尴尬]Mehr anzeigen

#CLARITYActAdvances

📊 #CLARITYActAdvances – Krypto-Regulierung rückt näher an Durchbruch

Neueste Updates zum CLARITY Act

Nach Jahren der Debatte und regulatorischer Unsicherheit macht der Crypto CLARITY Act — ein bedeutender legislativer Versuch der USA, digitale Vermögenswerte zu definieren und zu strukturieren — Fortschritte in wichtigen Phasen in Washington. Diese Entwicklung hat bedeutende Auswirkungen auf die Zukunft der Krypto-Regulierung, die Beteiligung von Institutionen und die Rahmenbedingungen für Stablecoins.

📈 Was passiert jetzt

Gesetzgeber und Branchenvertreter intensivieren

📊 #CLARITYActAdvances – Krypto-Regulierung rückt näher an Durchbruch

Neueste Updates zum CLARITY Act

Nach Jahren der Debatte und regulatorischer Unsicherheit macht der Crypto CLARITY Act — ein bedeutender legislativer Versuch der USA, digitale Vermögenswerte zu definieren und zu strukturieren — Fortschritte in wichtigen Phasen in Washington. Diese Entwicklung hat bedeutende Auswirkungen auf die Zukunft der Krypto-Regulierung, die Beteiligung von Institutionen und die Rahmenbedingungen für Stablecoins.

📈 Was passiert jetzt

Gesetzgeber und Branchenvertreter intensivieren

BTC2,98%

- Angebot

- 5

- 3

- Reposten

- Teilen

MasterChuTheOldDemonMasterChu :

:

Ansturm 2026 👊Mehr anzeigen

Der Kurs schwankt weiterhin im Bereich von 2040-2080, das Handelsvolumen nimmt ab, die Liquidität ist begrenzt. Nach der Eröffnung der US-Aktienmärkte wird die Liquidität innerhalb des Bereichs ausgeglichen, wodurch ein neuer Seitwärtsbereich entsteht. Abonnieren Sie die Punktzahlen vor der Börseneröffnung #加密市场反弹

Original anzeigen- Angebot

- 2

- 2

- Reposten

- Teilen

ChivesQiTongwei :

:

空空空,住皇宫Mehr anzeigen

#BitdeerLiquidates943.1BTCReserves

Bitdeer Technologies (NASDAQ: BTDR), ein führendes Bitcoin-Mining-Unternehmen, gegründet von Jihan Wu (ehemaliger Mitbegründer von Bitmain), hat seine gesamte Unternehmens-Bitcoin-Reserve vollständig liquidiert und seine selbst gehaltenen Bestände bis zum 20. Februar 2026 auf null BTC (ohne Kundeneinlagen) reduziert. Dies markierte den Höhepunkt eines achtwöchigen schrittweisen Abbaus, der Ende 2025 mit etwa 2.000 BTC begann.

Zeitleiste der Liquidation

Ende 2025: Ca. 2.000 BTC auf der Bilanz.

Ende Januar 2026: Bestände auf etwa 1.530 BTC reduziert.

Mitte Feb

Bitdeer Technologies (NASDAQ: BTDR), ein führendes Bitcoin-Mining-Unternehmen, gegründet von Jihan Wu (ehemaliger Mitbegründer von Bitmain), hat seine gesamte Unternehmens-Bitcoin-Reserve vollständig liquidiert und seine selbst gehaltenen Bestände bis zum 20. Februar 2026 auf null BTC (ohne Kundeneinlagen) reduziert. Dies markierte den Höhepunkt eines achtwöchigen schrittweisen Abbaus, der Ende 2025 mit etwa 2.000 BTC begann.

Zeitleiste der Liquidation

Ende 2025: Ca. 2.000 BTC auf der Bilanz.

Ende Januar 2026: Bestände auf etwa 1.530 BTC reduziert.

Mitte Feb

BTC2,98%

- Angebot

- 6

- 3

- Reposten

- Teilen

MasterChuTheOldDemonMasterChu :

:

Glück und Wohlstand 🧧Mehr anzeigen

🔥 Gate ETH Handel-Event startet heiß

Limitierte 30 ETH Jackpot, 100% Gewinnchance

👉 Das Event läuft noch, mach jetzt mit: https://www.gate.com/zh/campaigns/4139

✅ Abschließen von Transaktionen, Einzahlungen, Freundereinladungen, um an der Verlosung teilzunehmen und 15 ETH zu gewinnen

✅ Es warten auch exklusive Cashback-Angebote + exklusives Airdrop-Paket für Neueinsteiger auf dich, maximal 6 ETH pro Person

Event-Details: https://www.gate.com/announcements/article/49960

Limitierte 30 ETH Jackpot, 100% Gewinnchance

👉 Das Event läuft noch, mach jetzt mit: https://www.gate.com/zh/campaigns/4139

✅ Abschließen von Transaktionen, Einzahlungen, Freundereinladungen, um an der Verlosung teilzunehmen und 15 ETH zu gewinnen

✅ Es warten auch exklusive Cashback-Angebote + exklusives Airdrop-Paket für Neueinsteiger auf dich, maximal 6 ETH pro Person

Event-Details: https://www.gate.com/announcements/article/49960

ETH5,6%

- Angebot

- 4

- 2

- 1

- Teilen

İnsanElGaib :

:

GOGOGO 2026 👊Mehr anzeigen

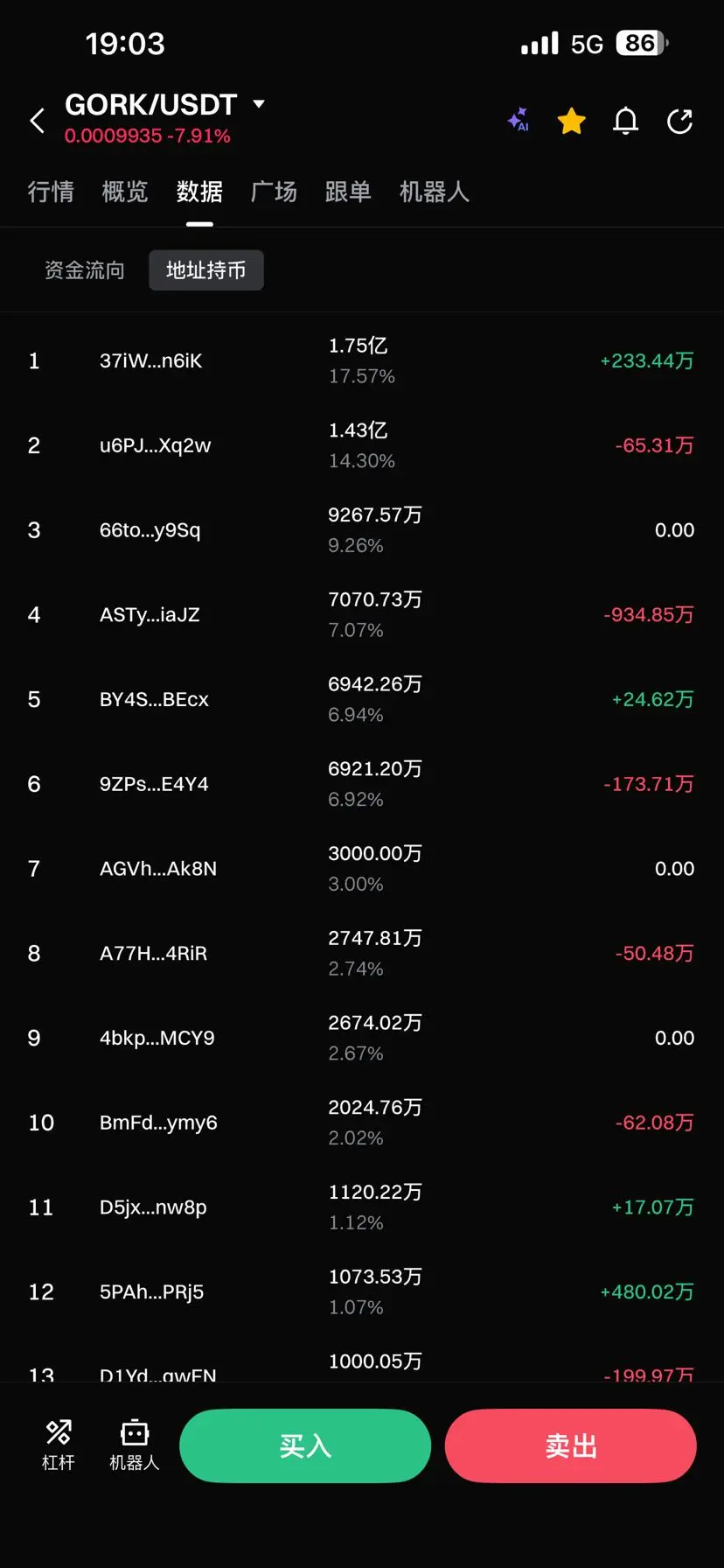

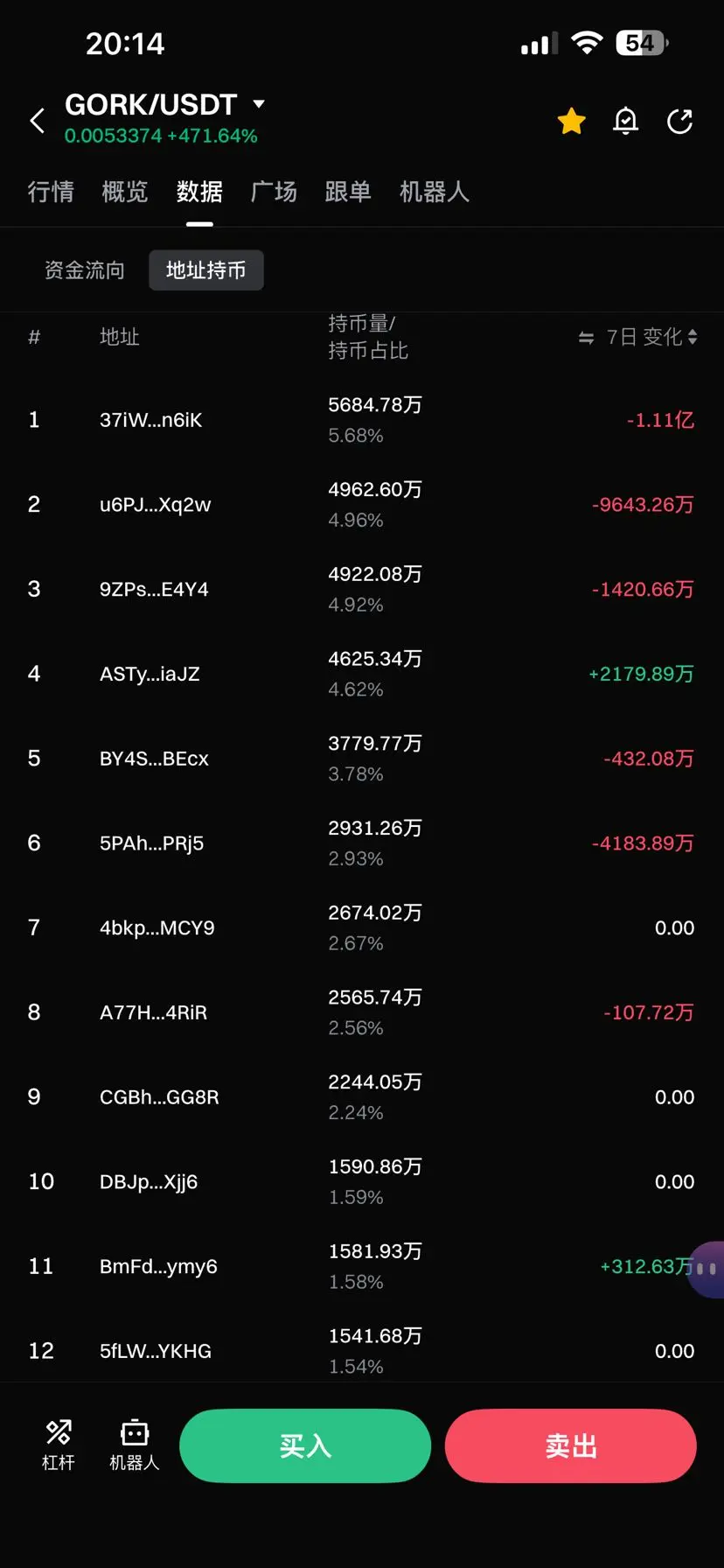

Nach Musks Tweet "Grok kehrt heute zurück" stieg die langjährige Meme-Münze gork an einem Tag um über 520% 🚀

GORK330,2%

- Angebot

- 3

- 1

- Reposten

- Teilen

GateUser-4dc1e303 :

:

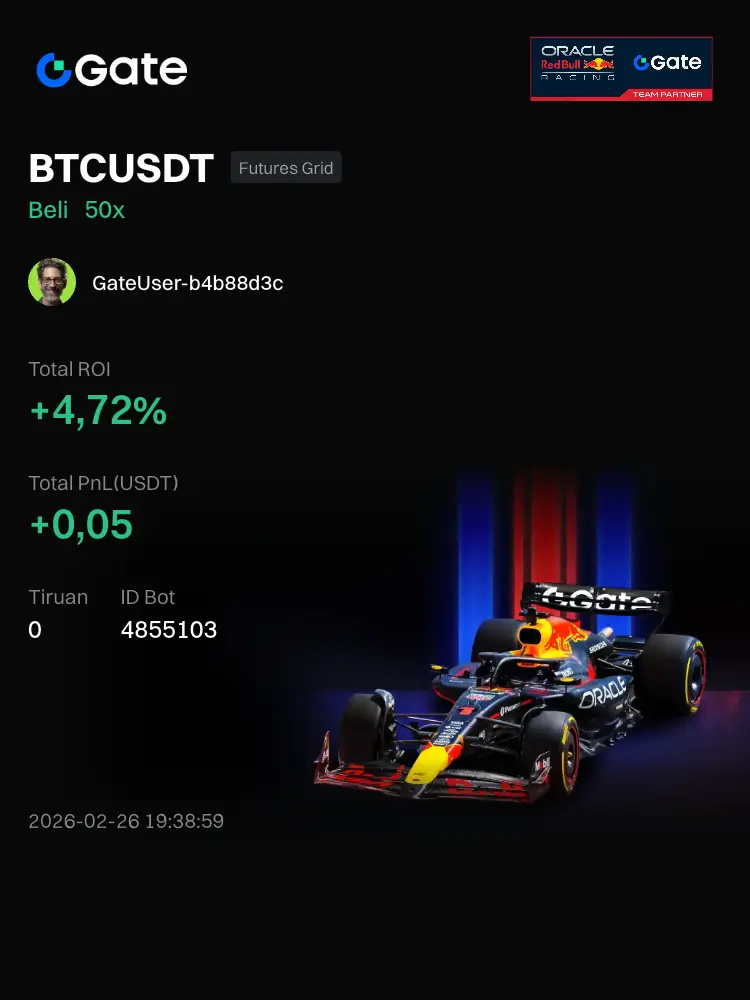

to the moon überraschend#Bot#Saat ini ich verwende den BTCUSDT Futures Grid Bot bei Gate. Die ROI seit der Erstellung des Bots hat +4,72% erreicht

Original anzeigen

- Angebot

- 3

- 50

- Reposten

- Teilen

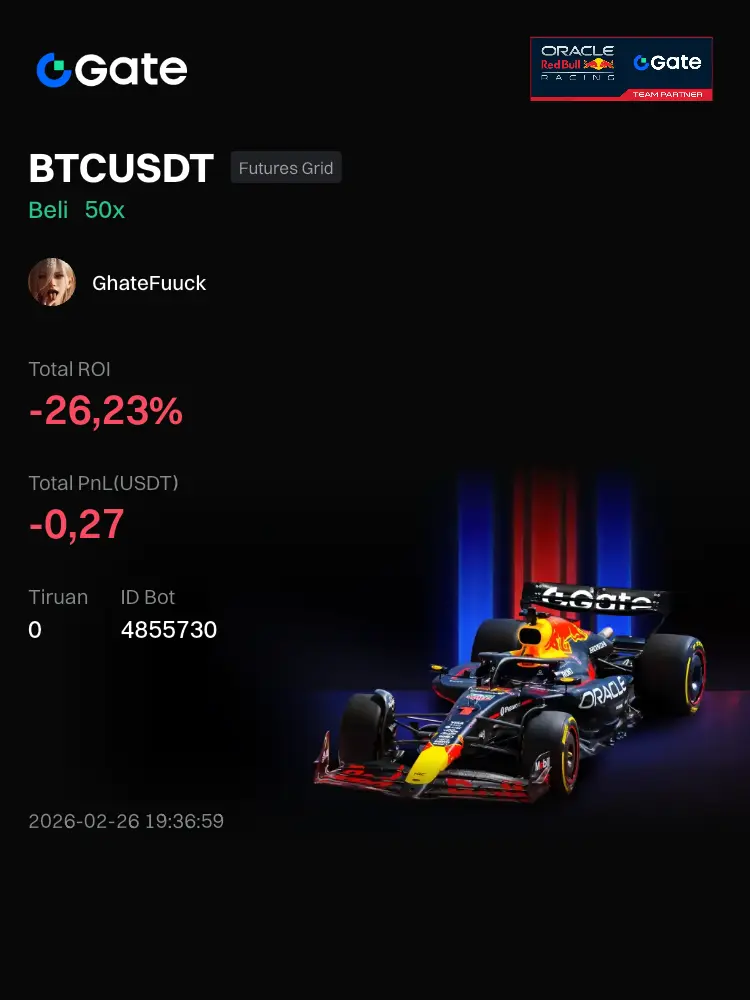

GhateFuuck :

:

HODL festhalten 💪Mehr anzeigen

#Bot#Saat ini ich verwende den BTCUSDT Futures Grid Bot bei Gate. Die ROI seit der Erstellung des Bots beträgt -26,23%

Original anzeigen

- Angebot

- 4

- 30

- Reposten

- Teilen

GateUser-b4b88d3c :

:

Ape In 🚀Mehr anzeigen

Ich habe kürzlich eine Veranstaltung auf Gate gesehen, den TradFi Goldrausch, und es scheint ziemlich solide zu sein.

📅Die Veranstaltung läuft bis zum 12. März um 16:00 (UTC+8).

Sie ist auch für Anfänger zugänglich—handel 100 USDT, um einen zufälligen roten Umschlag von 5–20 USDT zu erhalten, ganz einfach, folge einfach dem Prozess.

Für diejenigen, die bereits regelmäßig handeln, ist es sogar noch besser—sammle 50.000 USDT, um auf die Bestenliste zu kommen, und der Preisfonds von 35.000 USDT wird unter den Top-Händlern aufgeteilt. Es geht nur um einfache Teilnahme.

Es gibt auch einen kleinen

📅Die Veranstaltung läuft bis zum 12. März um 16:00 (UTC+8).

Sie ist auch für Anfänger zugänglich—handel 100 USDT, um einen zufälligen roten Umschlag von 5–20 USDT zu erhalten, ganz einfach, folge einfach dem Prozess.

Für diejenigen, die bereits regelmäßig handeln, ist es sogar noch besser—sammle 50.000 USDT, um auf die Bestenliste zu kommen, und der Preisfonds von 35.000 USDT wird unter den Top-Händlern aufgeteilt. Es geht nur um einfache Teilnahme.

Es gibt auch einen kleinen

XAUT-0,35%

- Angebot

- 5

- 3

- Reposten

- Teilen

MasterChuTheOldDemonMasterChu :

:

Frohes neues Jahr 🧨Mehr anzeigen

Mehr laden

Trendthemen

Mehr anzeigen6.8K Beliebtheit

339.17K Beliebtheit

Hot Gate Fun

Mehr anzeigen- MC:$2.52KInhaber:20.02%

- MC:$2.48KInhaber:10.00%

- MC:$2.45KInhaber:10.00%

- MC:$2.53KInhaber:00.10%

- MC:$2.49KInhaber:20.06%

Anheften