"ORDER"的搜索結果

Polymarket 獲得美國 CFTC 批準,將重啓規範化交易平台

火星財經消息,11月26日,預測市場平台 Polymarket 宣布,美國商品期貨交易委員會(CFTC)已向其發出 修正後的「指定令」(Amended Order of Designation),允許其以中介(intermediated)方式運營。這意味着 Polymarket 將成爲一個完全受聯邦監管的交易所。

MarsBit News·2025-11-25 19:27

有序網路將分配60%的協議費用用於每兩周的ORDER回購

簡要

Orderly Network 引入了一種收入支持的回購和質押系統,將 60% 的協議費用與每兩周的 ORDER 回購掛鉤。

跨鏈流動性基礎設施提供商Orderly Network推出了一種新的基於收入的代幣回購機制,用於其本地資產ORDER,

Mpost Media Group·2025-11-05 23:09

Orderly Network推出Perp DEX創新產品“OrderlyOne”:ORDER創新高、TVL增長近170%

去中心化交易領域的關鍵參與者 Orderly Network 在 2025 年取得了顯著增長。作爲一家 B2B 交易基礎設施,其成功主要歸功於永續合約 DEX 的蓬勃發展和其創新產品 OrderlyOne 的推出。Orderly 的 總鎖定價值 (TVL) 從年初的 1910 萬美元飆升至 \$5130 萬美元,增長率高達 168.9%。同時,ORDER 代幣價格在 OrderlyOne 啓動後創下 0.47 美元的歷史新高 (ATH)。平台累計交易量達 372 億美元,這反映了市場對去中心化金融 (DeFi) 解決方案的強勁需求。

Market Whisper·2025-10-28 03:39

ORDER 代幣在 Upbit KRW 上市後上漲 30%

ORDER代幣在其Upbit上架後的15分鍾內激發了30.05%的價格衝鋒,達到了$0.386 USDT,因爲多鏈永久去中心化交易所在韓國最大的交易所上獲得了關注。

CryptoPulse Elite·2025-10-24 07:35

有序的 (訂單) 隨着新交易所上市提振了勢頭

Orderly (ORDER) 在韓國最大加密貨幣交易所 Upbit 上架後衝鋒 42%,將其市值提升至 $97 百萬。此次上架可能會增強該代幣在亞盤的流動性、可見性和採用率。

ORDER-4.4%

CoinsProbe·2025-10-24 06:48

Upbit Orderly 上市公告 (ORDER)

Upbit,韓國最大的加密貨幣交易所,將於10月24日上線ORDER/KRW交易對。ORDER是Orderly項目的原生代幣,在以太坊上運行。用戶在交易前必須驗證網路,並使用官方合約地址。

ORDER-4.4%

Tap Chi Bitcoin·2025-10-24 06:37

Hyperliquid 來時路(三): CLOB 無戰事

資產類型決定價格走勢

幣安人生是爲 Aster 反擼遮掩,極致的造富效應,哪怕是情緒,在陰雨連綿的深秋,也足以讓人忘卻倉位的煩惱,不論多空。

在報菜名的技術參數、費用表格對比之外,真正令我好奇的是,爲什麼 CLOB 架構(中央限價訂單簿,Central Limit Order Book )適合永續合約,以及 CLOB 架構的極限在哪裏?

資產決定價格

> 我生得太晚,沒有趕上 DeFi Summer 的時代;我又生得太早,沒能看得到 CLOB 閃耀於外匯之間。

>

>

傳統金融的歷史過於悠久,久到人們都忘了市場究竟是如何形成的。

一言以蔽之,金融圍繞資產和價格進行交易,價格

HYPE-3.44%

金色财经_·2025-10-11 07:32

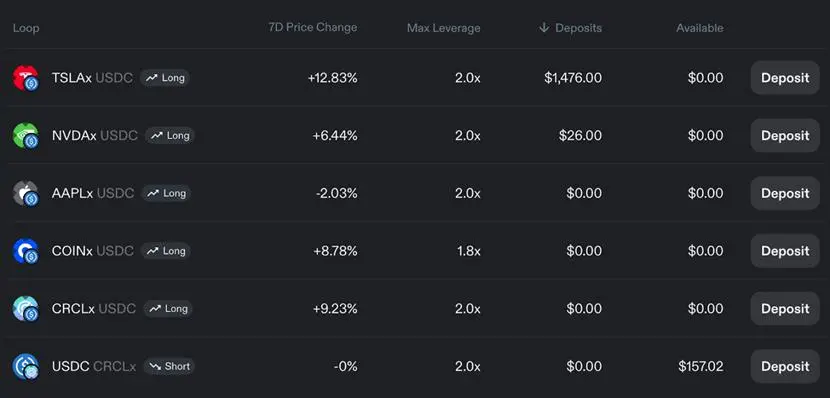

深度解析Loopscale:如何重構Solana DeFi借貸市場?

原標題:《Loopscale: Order book lending on Solana》

作者:Castle Labs

編譯:Luiza,ChainCatcher

盡管以太坊的DeFi總鎖倉價值(TVL)仍遠未達到2021年的峯值,但Solana的TVL已實現顯著增長,目前已創下歷史新高。

Solana 生態系統的特性使其成爲借貸協議的理想選擇。Solend等協議便是明證——該協議早在2021年存款規模已接近10億美元。盡管 FTX 崩盤在隨後幾年對 Solana 借貸生態的發展造成了嚴重衝擊,但 Solana 上的借貸協議展現出了強大的韌性,並催生了新一輪增長浪潮。

2024 年

PANews·2025-09-30 10:19

ORDER漲短時突破0.4美元,24小時漲約60%

火星財經消息,9 月 29 日,據 行情數據顯示,ORDER 漲短時突破 0.4 美元,先報價 0.3692 美元,24 小時漲約 60%。

ORDER-4.4%

MarsBit News·2025-09-29 09:36

UPBIT 上線 Orderly (ORDER) 並支持 BTC、USDT 交易

火星財經消息,UPBIT 將於 2025 年 9 月 29 日 20:30 上線 Orderly (ORDER) 的 BTC 和 USDT 交易,用戶可在公告發布後 2 小時內進行入金。請注意,入金需通過 Ethereum 網路進行。

MarsBit News·2025-09-29 09:34

ORDER 短時觸及 0.39 USDT,創歷史新高

火星財經消息,據 行情顯示,ORDER 短時觸及 0.39 USDT,現報 0.35 USDT,創歷史新高,24 小時漲幅 50.34%。

ORDER-4.4%

MarsBit News·2025-09-29 07:26

BF 團隊花費 18.5 萬美元買入 81.7 萬枚 ORDER

火星財經消息,據鏈上分析師 Ai 姨監測,BF 團隊在過去 15 小時內花費 18.5 萬美元買入 81.7 萬枚 ORDER,均價 0.2265 美元。ORDER 目前已成爲該團隊鏈上持倉第一的資產。

ORDER-4.4%

MarsBit News·2025-09-21 05:56

CoinRank 加密貨幣摘要 (8/26)|Sharplink 市值跌破其姨太 持倉價值

Orderly建議使用60%的協議淨收入進行ORDER代幣回購,旨在減少供應並改善質押和治理動態。

幣安CEO警告稱,有人利用API權限進行虛假支持電話。這一騙局凸顯了日益嚴重的威脅以及對更強用戶保護的需求。

ETH-3.93%

CoinRank·2025-08-26 09:31

XRP ETF審批遇阻價格承壓,以太坊、Solana現貨ETF吸金效應凸顯,比特幣機構需求強勁支撐 | 加密市場動態

美國SEC雖批準Bitwise 10加密指數基金(BITW)及灰度數字大盤基金(GDLC)轉型爲現貨ETF,但同步籤發暫緩令(Stay Order)延遲上市,致使XRP陷入短期監管真空。受此影響,XRP價格持續承壓,8月17日下跌0.59%至3.09美元,而同期以太坊(ETH)漲1.13%、Solana(SOL)漲0.72%。分析指出,已獲批的BTC、ETH、SOL現貨ETF正持續吸引資金流入,而XRP價格破局關鍵催化劑仍需等待專屬現貨ETF落地及瑞波案終審結果。

## SEC暫緩令重創XRP:現貨ETF審批陷僵局

美國SEC於7月22日批準Bitwise 10加密指數基金(BITW)轉

Market Whisper·2025-08-18 03:23

2029年的加密世界長什麼樣?

> 原文標題:Crypto 2029: The New Order

> 原文作者:@hmalviya9

> 原文編譯:zhouzhou,

編者按:2030 年,世界崩塌,島上 Bitcoiners 建起堡壘,而真正的重啓在廢墟中悄然發生。技術與靈性融合,「隱祕之環」與加密理想者聯合,拒絕消費主義與控制,重建價值與信仰。「去中心化靈魂」成爲口號,未來不在上層,而由地下重新書寫。

以下爲原文內容(爲便於閱讀理解,原內容有所整編):

2029 年的加密世界:新秩序

比特幣已經成爲全球投資者的新常態。今年,它的價格突破了 50 萬美元大關——不是靠一場突如其來的暴漲,而是經歷了長達

BTC-2.51%

世链财经_·2025-05-21 07:21

Orderly 在 Solana 上推出 $esORDER 和權益質押以提升跨鏈流動性

Orderly在Solana上的質押計劃已與追溯性$esORDER發獎一起啓動。

Solana用戶可以選擇將他們的$esORDER鎖倉並在稍後時間轉換爲$ORDER,或者質押他們的代幣以參與$ORDER質押計劃。

對於 Solana 用戶,Web3

SOL-2.4%

TheNewsCrypto·2025-05-10 10:33

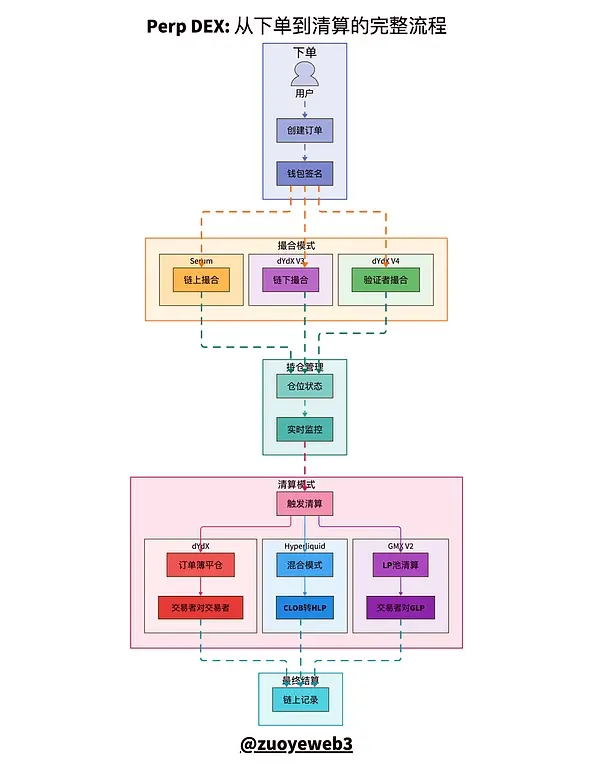

Perp DEX 的技術創新與市場競爭:淺談鏈上永續合約交易所的機會與挑戰

去中心化永續合約交易所 (Perp DEX) 已成為 DeFi 生態系中最具活力的領域之一。不僅是年交易量屢創新高,平台創新與策略產品更層出不窮。鏈上研究員 JasonZha 對此深入剖析了 Perp DEX 的發展脈絡、平台競爭與未來潛力,揭示鏈上衍生品市場的關鍵動向。

從 dYdX 到 Hyperliquid:Perp DEX 的演進歷程

Perp DEX 的起源可追溯至 2019 年,當時 dYdX 率先推出基於鏈上訂單簿 (order book) 的永續合約交易模式,為去中心化衍生品市場奠定基礎。

此後,GMX 引入資金池 (Liquidity Pool) 架構,因 HLP

鏈新聞abmedia·2025-04-14 08:07

川普簽署戰略比特幣儲備命令,不花錢買加密儲備,BTC 下殺至 84K

根據加密沙皇 David Sacks 的推文,美國總統川普 (Donald Trump) 已簽署行政命令,建立戰略比特幣儲備。這個儲備將由聯邦政府擁有的比特幣資本化,意味著美國政府將不會花錢買入額外的加密貨幣。比特幣下殺至 84K,之前被點名的儲備代幣 ETH、SOL、XRP 和 ADA 全面崩跌。

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized

鏈新聞abmedia·2025-03-07 01:31

止損:小工具 - 大威力,如何保護您的資產?

在充滿波動的金融市場中,保護投資資金並限制風險是實現長期成功的關鍵因素。其中一種幫助投資者有效管理風險的有用工具是止損單(Stop-Loss Order)。以下是有關止損單的詳細文章,c

ORDER-4.4%

blotienso·2025-03-04 04:06

Bitwise首席投資官關於BTC四年週期的思考:為什麼當前牛市會延續到 2026 年及以後

原文標題:Trump’s Executive Order: Can It Break Crypto’s Four-Year Cycle?

原文作者:Matt Hougan

原文來源:

MarsBit News·2025-01-31 11:03

一位聯邦法官剛剛對證券交易委員會進行了打擊。這意味著什麼。- BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

速覽美國戰略比特幣儲備總統行政令初稿全文

撰文:金色財經

美國的戰略比特幣儲備極大概率會成真。

2024年12月12日,特朗普在參加紐交所敲鐘後接受了CNBC時採訪確認,美國應該建立像石油那樣的加密戰略儲備。

2024年12月18日凌晨,美國比特幣政策研究所(The Bitcoin Policy Institute)起草的“戰略比特幣儲備”總統行政令初稿在行業流傳。此行政令全名為“Executive Order on Designating Bitcoin as a Strategic Reserve Asset within the Exchange Stabilization

金色财经_·2024-12-18 02:58

特朗普與馬斯克 2 小時 X Space 暢聊政策,一批政治 Meme 代幣玩梗建倉

就在雙方舉行對話之前和期間,特朗普原有的政治 Meme 代幣 MAGA、TRUMP 等漲幅明顯,也有一大批 Meme 代幣建倉,但漲跌幅波動較大,比如 Yeah、New World Order、Dark Space 等。

ForesightNews·2024-08-13 07:24

對話CoW Swap 聯創:引領意圖交易的DEX 的誕生

> CoW Swap 採用MEV 最小化方法而不是MEV 最大化方法。

嘉賓: Anna (@AnnaMSGeorge)

主持:Stephanie (@stephaniiee\_eth)

如果你對DeFi 和MEV 感興趣,你可能聽說過基於意圖的交易(intent-based trading)、頻繁批次拍賣(frequent batch auction)、求解者(solver) 模型、訂單流拍賣(order flow auctions, OFAs)等,CoW Swap 可以說是上述創新的典範,將它們有機地融入DEX 產品中,

ForesightNews·2024-01-03 01:16

Foresight Ventures:AMM能否架起一道新的彩虹橋?

作者: Jeff@Foresight Ventures

一、環繞Asgard 的城牆固若金湯,如何提高鏈上資產流動性是一個永恆的話題

Defi 的出現打開了一條直通Asgard 的彩虹橋,在那裡流動性得到了充分的釋放。以提高NFT 流動性為目的設計創新交易模型,也是所有NFT 交易平台的努力方向。雖然當前NFT 市場還未出現成熟統一的定價模型,但是從藍籌NFT 的交易量數據中可以看到,“撮合買賣盤”(Order Book)模型的交易市場(Marketplace)佔據了95% 以上的交易量;而基於AMM 模型的一眾Marketplace 只佔據不足5% 的成交量。

...

金色财经_·2023-07-03 13:37

加載更多