# What’sNextforBitcoin?

18.08K

Surrealist5N1K

#What’sNextforBitcoin?

Bitcoin is at a decision point.

After recent volatility, the market is asking the same question:

Is this consolidation before continuation — or distribution before another leg down?

Here’s what actually matters:

📌 Structure — Are higher lows forming, or are lower highs capping upside?

📌 Volume — Is the move supported by real demand, or thin liquidity?

📌 Macro backdrop — Are yields and the dollar helping or hurting risk assets?

📌 Liquidity flows — Is capital rotating back into BTC or staying defensive?

Short-term noise is everywhere.

But trends are built on liquidity

Bitcoin is at a decision point.

After recent volatility, the market is asking the same question:

Is this consolidation before continuation — or distribution before another leg down?

Here’s what actually matters:

📌 Structure — Are higher lows forming, or are lower highs capping upside?

📌 Volume — Is the move supported by real demand, or thin liquidity?

📌 Macro backdrop — Are yields and the dollar helping or hurting risk assets?

📌 Liquidity flows — Is capital rotating back into BTC or staying defensive?

Short-term noise is everywhere.

But trends are built on liquidity

BTC-1,39%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thnxxxxxxxx for for sharing information about crypto currency#What’sNextforBitcoin? WhatsNextForBitcoin

Headline: 🔥 $70K TAKEN BACK — Bitcoin Roars Again! 👑🚀

Bitcoin just delivered a strong comeback on Feb 15, reclaiming the $70,000 zone and invalidating the recent bearish fear. After shaking out weak hands near $60K, the market found its footing as softer US inflation data shifted sentiment back in favor of risk assets. 📊

Why the “Wait & Watch” crowd got sidelined:

🔹 Macro Tailwind: Inflation easing to 2.4% reduced pressure on risk markets

🔹 Battle-Tested Support: $60K proved to be a solid demand zone

🔹 Smart Money Flow: Spot ETF demand stayed f

Headline: 🔥 $70K TAKEN BACK — Bitcoin Roars Again! 👑🚀

Bitcoin just delivered a strong comeback on Feb 15, reclaiming the $70,000 zone and invalidating the recent bearish fear. After shaking out weak hands near $60K, the market found its footing as softer US inflation data shifted sentiment back in favor of risk assets. 📊

Why the “Wait & Watch” crowd got sidelined:

🔹 Macro Tailwind: Inflation easing to 2.4% reduced pressure on risk markets

🔹 Battle-Tested Support: $60K proved to be a solid demand zone

🔹 Smart Money Flow: Spot ETF demand stayed f

BTC-1,39%

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

February 15, 2026 , Bitcoin stands at a pivotal crossroads as it enters the next chapter of its evolution. After years of breaking new ground, defying skeptics, and growing from niche digital experiment to increasingly mainstream financial asset, the question no longer is if Bitcoin will matter but how it will continue to shape global finance, technology, and investor behavior. Whether you’re a dedicated hodler, a new crypto participant, or an institutional strategist, the landscape ahead is defined by innovation, adoption, and macroeconomic forces.

At its core, Bitcoi

February 15, 2026 , Bitcoin stands at a pivotal crossroads as it enters the next chapter of its evolution. After years of breaking new ground, defying skeptics, and growing from niche digital experiment to increasingly mainstream financial asset, the question no longer is if Bitcoin will matter but how it will continue to shape global finance, technology, and investor behavior. Whether you’re a dedicated hodler, a new crypto participant, or an institutional strategist, the landscape ahead is defined by innovation, adoption, and macroeconomic forces.

At its core, Bitcoi

BTC-1,39%

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

LFG 🔥View More

#What’sNextforBitcoin? Mid-February 2026 Market Outlook (Feb 15 Update) 📊

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

- Reward

- 6

- 6

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

Reset or Re-Accumulation? The 2026 Inflection Point

Bitcoin is hovering in the $66,000–$70,000 range in mid-2026, stabilizing after the sharp correction from the $126,000 peak seen in October 2025.

This is no longer a simple pullback.

It’s a structural test.

And unlike previous cycles, this one is not primarily about halving mechanics.

It’s about liquidity and institutional capital flows.

1️⃣ The Post-Halving Reality: Supply Shock Is Marginal

Following the 2024 halving, daily new issuance dropped to roughly 450 BTC.

Mathematically, the supply shock effect is now limited.

Price discovery is inc

Bitcoin is hovering in the $66,000–$70,000 range in mid-2026, stabilizing after the sharp correction from the $126,000 peak seen in October 2025.

This is no longer a simple pullback.

It’s a structural test.

And unlike previous cycles, this one is not primarily about halving mechanics.

It’s about liquidity and institutional capital flows.

1️⃣ The Post-Halving Reality: Supply Shock Is Marginal

Following the 2024 halving, daily new issuance dropped to roughly 450 BTC.

Mathematically, the supply shock effect is now limited.

Price discovery is inc

BTC-1,39%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 11

- 16

- Repost

- Share

CryptoSelf :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

After the CPI drop and easing inflation pressure, traders are asking one big question:

#What’sNextforBitcoin?

With U.S. Core CPI hitting a multi-year low, markets are pricing in possible rate cuts — and that could be bullish fuel for risk assets, especially Bitcoin.

🚀 Possible Scenarios: • 📈 Bullish breakout if macro sentiment improves

• 🔁 Consolidation as BTC digests news & volume stabilizes

• 🧠 Volatility spikes around Fed commentary & economic data

One thing’s clear: macro trends are back in the driver’s seat.

📊 Keep an eye on: • Fed signals on rate cuts

• Real

After the CPI drop and easing inflation pressure, traders are asking one big question:

#What’sNextforBitcoin?

With U.S. Core CPI hitting a multi-year low, markets are pricing in possible rate cuts — and that could be bullish fuel for risk assets, especially Bitcoin.

🚀 Possible Scenarios: • 📈 Bullish breakout if macro sentiment improves

• 🔁 Consolidation as BTC digests news & volume stabilizes

• 🧠 Volatility spikes around Fed commentary & economic data

One thing’s clear: macro trends are back in the driver’s seat.

📊 Keep an eye on: • Fed signals on rate cuts

• Real

BTC-1,39%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕#What’sNextforBitcoin?

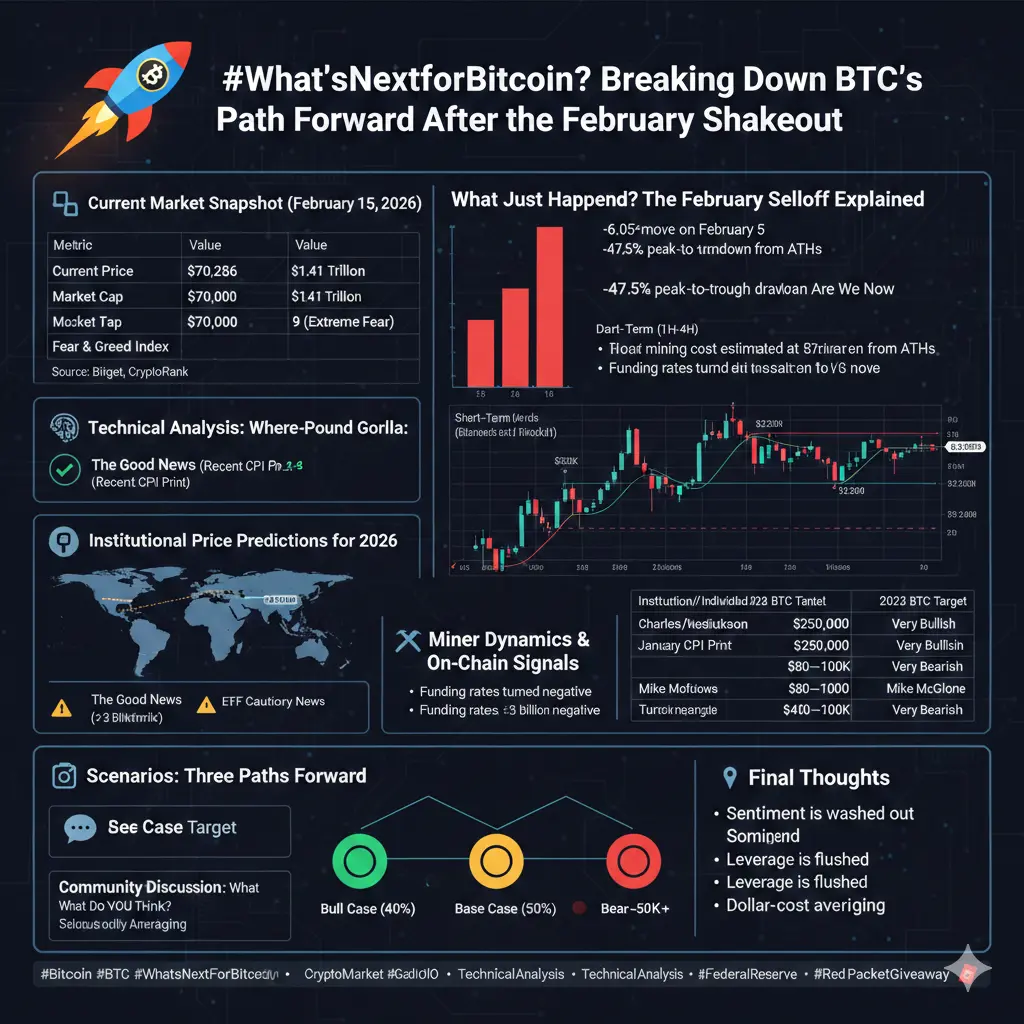

What’s Next for Bitcoin. BTC Path After the February Shakeout

Bitcoin has just experienced one of the sharpest corrections of this cycle, falling from record highs near 126K to test the 60K zone before staging a recovery back above 70K. As of mid February 2026, the market sits at a critical decision point. Traders, investors, and institutions are all asking the same question. Is this a bottom formation or just a pause before another leg down.

This post breaks down the current structure, key levels, macro drivers, on chain signals, and realistic scenarios for Bitcoin’s n

What’s Next for Bitcoin. BTC Path After the February Shakeout

Bitcoin has just experienced one of the sharpest corrections of this cycle, falling from record highs near 126K to test the 60K zone before staging a recovery back above 70K. As of mid February 2026, the market sits at a critical decision point. Traders, investors, and institutions are all asking the same question. Is this a bottom formation or just a pause before another leg down.

This post breaks down the current structure, key levels, macro drivers, on chain signals, and realistic scenarios for Bitcoin’s n

BTC-1,39%

- Reward

- 7

- 10

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

🚀 #What’sNextforBitcoin? (Feb 15, 2026 Update)

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

BTC-1,39%

- Reward

- 1

- 1

- Repost

- Share

Crypto_Exper :

:

follow me brother I will follow back we should support each other 🥰✅#What’sNextforBitcoin?

As of today (February 15, 2026), Bitcoin is trading around $69,000–$71,000 USD, reflecting ongoing volatility after recent swings between roughly $65,000 and $74,000. Its price has pulled back significantly from the all-time highs above $120,000 seen last year and remains well below that peak, but it continues to attract attention from traders and investors reacting to market sentiment and broader economic conditions. This level indicates that Bitcoin is still a major global digital asset with a market capitalization in the trillions, yet it faces both bullish hopes and

As of today (February 15, 2026), Bitcoin is trading around $69,000–$71,000 USD, reflecting ongoing volatility after recent swings between roughly $65,000 and $74,000. Its price has pulled back significantly from the all-time highs above $120,000 seen last year and remains well below that peak, but it continues to attract attention from traders and investors reacting to market sentiment and broader economic conditions. This level indicates that Bitcoin is still a major global digital asset with a market capitalization in the trillions, yet it faces both bullish hopes and

BTC-1,39%

- Reward

- 7

- 7

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

#What’s Next for Bitcoin? – Full Detailed Analysis in 5 Topics

1️⃣ Current Market Trend of Bitcoin

Bitcoin remains the world’s largest and most dominant cryptocurrency. Its price moves in cycles — bullish (uptrend) and bearish (downtrend).

🔹 What is happening now?

Market volatility is still high.

Institutional investors are active.

Price reacts strongly to global news and economic data.

🔹 Short-Term Outlook:

Possible consolidation (sideways movement).

Breakout depends on volume and global liquidity.

🔹 Long-Term Outlook:

Historically, Bitcoin follows a 4-year cycle li

#What’s Next for Bitcoin? – Full Detailed Analysis in 5 Topics

1️⃣ Current Market Trend of Bitcoin

Bitcoin remains the world’s largest and most dominant cryptocurrency. Its price moves in cycles — bullish (uptrend) and bearish (downtrend).

🔹 What is happening now?

Market volatility is still high.

Institutional investors are active.

Price reacts strongly to global news and economic data.

🔹 Short-Term Outlook:

Possible consolidation (sideways movement).

Breakout depends on volume and global liquidity.

🔹 Long-Term Outlook:

Historically, Bitcoin follows a 4-year cycle li

BTC-1,39%

- Reward

- 2

- 3

- Repost

- Share

AltafTrader :

:

LFG 🔥View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

119.65K Popularity

19.97K Popularity

18.08K Popularity

63.23K Popularity

8.65K Popularity

266.93K Popularity

294.51K Popularity

20.92K Popularity

10.53K Popularity

8.38K Popularity

8.85K Popularity

8.61K Popularity

7.82K Popularity

36.52K Popularity

News

View MoreThe Federal Reserve has a 90.2% probability of maintaining interest rates unchanged in March.

8 m

Traditional Finance Alert: EURTRY Has Increased by Over 3%

11 m

Data: 500 BTC transferred from an anonymous address, worth approximately 34.2 million USD

1 h

Data: 1,413,800 tons transferred out from the kiln, and after transit, flows into tons

2 h

Data: 318.24 BTC transferred from an anonymous address, routed through a relay, and flowed into Duelbits

2 h

Pin