# Slippage

259.39K

Novialanis

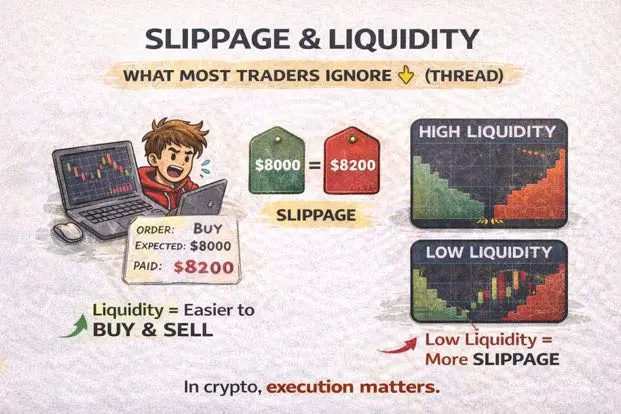

Slippage & Liquidity: What Most Traders Ignore 👇 (Thread)

1/

You planned the perfect entry.

Clicked buy.

But your execution price is… different.

That’s slippage.

2/

Slippage = the difference between

the price you expect

and the price you actually get.

It happens when the market moves

before your order is fully filled.

3/

Why does it happen?

Because of liquidity.

Liquidity = how easily an asset can be bought or sold

without significantly affecting its price.

4/

High liquidity:

– Tight spreads

– Faster execution

– Minimal slippage

Low liquidity:

– Wide spreads

– Delays

– Bigger slippage

5/

Exam

1/

You planned the perfect entry.

Clicked buy.

But your execution price is… different.

That’s slippage.

2/

Slippage = the difference between

the price you expect

and the price you actually get.

It happens when the market moves

before your order is fully filled.

3/

Why does it happen?

Because of liquidity.

Liquidity = how easily an asset can be bought or sold

without significantly affecting its price.

4/

High liquidity:

– Tight spreads

– Faster execution

– Minimal slippage

Low liquidity:

– Wide spreads

– Delays

– Bigger slippage

5/

Exam

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

76.09K Popularity

5.12K Popularity

4.41K Popularity

51.17K Popularity

2.51K Popularity

259.14K Popularity

236.28K Popularity

14.58K Popularity

2.06K Popularity

1.63K Popularity

1.41K Popularity

1.91K Popularity

2.13K Popularity

30.98K Popularity

News

View MoreJPMorgan: A weakening US dollar will benefit global stock markets rather than drag down risk assets

10 m

"Long-term short BTC" whale cancels $55,125 "bottom-fishing" BTC limit buy order

23 m

Vitalik Buterin: Prediction markets should shift towards risk hedging rather than short-term speculation

1 h

Data: Hyperliquid platform whales currently hold positions worth $2.867 billion, with a long-short position ratio of 0.94.

1 h

Jake Paul's fund, holding $65 million in assets, invests in OpenAI and Polymarket

1 h

Pin