Post content & earn content mining yield

placeholder

DefiInsider哥

Current conservative approach

Exit with small profit in the worst-case scenario

View OriginalExit with small profit in the worst-case scenario

- Reward

- 2

- Comment

- Repost

- Share

MicroStrategy scooped up $2.13B in BTC (22,305 coins) from Jan 12-19, now holding 709,715 BTC despite price volatility and their stock dropping 6.6%. The sell-off triggered $709M liquidations, with longs hit hardest ($649M), as BTC fell 1.9% on the session. Analysts eye $90K reclaim; Standard Chartered predicts 55% surge potential in 2026. #TariffTensionsHitCryptoMarket #CryptoMarketPullback $BTC

BTC-3,17%

MC:$3.46KHolders:1

0.00%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

马年大富大贵

马年大富大贵

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.00%

MC:

$0.1

Create My Token

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$25.23KHolders:126

64.50%

- Reward

- like

- Comment

- Repost

- Share

Good luck and prosperity in the Year of the Horse! Just released, bottom chips, about to go public. Still hesitating? The consensus in the Year of the Horse is a money-making market! Keep up with the rhythm, and you'll be on the fast track to wealth and prosperity in the crypto world. No more nonsense, just do it. Financial freedom in the crypto space has always belonged to those who dare to take action. This time, don't miss out again.

#fogo

#fogo

FOGO2,75%

MC:$9.04KHolders:2

23.55%

- Reward

- 1

- Comment

- Repost

- Share

Ethereum really reaching 2920, impressive. Bitcoin hasn't dropped much. Ethereum reaching 2920 is true, not bad, not bad. Truly giving an opportunity to enter the market. It will come soon at the end of January and early February. The Year of the Horse is here. Maybe this opportunity is the last one. Keep going, brothers. There isn't much time left for bottom-price chips. The pullback is an opportunity.

View Original

- Reward

- 9

- 10

- Repost

- Share

StarGg :

:

Awesome, Chart 2 shows last month's data points.View More

Where do you go back and forth to do swing trading without fearing losing fees?

Soon it will take you in, allowing you to do swing trading#

View OriginalSoon it will take you in, allowing you to do swing trading#

MC:$25.23KHolders:126

64.50%

- Reward

- like

- Comment

- Repost

- Share

With such low trading volume, it should be taken down soon! I wonder how many more retail investors have been cut again?

View Original

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$50.11KHolders:2052

100.00%

- Reward

- like

- Comment

- Repost

- Share

This week's coin price has changed the previous trend, with the price experiencing a continuous rapid pullback. The low point once again tested below 88,000. After touching the support level below, the price showed a certain rebound. Last night, after a large and rapid pullback, the price entered the current rebound correction phase. Recent real trading layouts have consistently followed the rhythm and achieved good returns. Moving forward, we will continue to update our real trading ideas and strategies in real time as always. The four-hour chart shows that after a quick decline with consecut

View Original

- Reward

- like

- Comment

- Repost

- Share

Shard migration isn't just housekeeping it's a cornerstone of Walrus's security model. By continuously rebalancing based on stake, Walrus ensures Byzantine tolerance (up to n/3 faulty control) remains effective even as nodes join, leave, or gain/lose delegations. The combination of stable assignment, low-friction cooperation, and punishing recovery creates powerful economic alignment: nodes are incentivized to stay honest, coordinate efficiently, and provision responsibly.

In a world of volatile participation and potential adversarial behavior, shard migration keeps the Walrus network fluid, s

In a world of volatile participation and potential adversarial behavior, shard migration keeps the Walrus network fluid, s

- Reward

- like

- Comment

- Repost

- Share

Mallego Coin, high popularity, first in voting rate, unlimited future potential♾️

View Original

- Reward

- like

- Comment

- Repost

- Share

星建

SPa

Created By@GateUser-5720a727

Listing Progress

0.00%

MC:

$3.36K

Create My Token

Why does Pooh Bear always look like he has passed some gas.

- Reward

- like

- Comment

- Repost

- Share

【ETH 4H Structure Projection | Framework of Bull-Bear Battle After Breakdown】

Core Structural Status

Ethereum has completed a valid breakdown of the $3000 level on the 4-hour chart. This move is not a simple retracement but a downward break of the previous overall consolidation zone, marking a qualitative change in market structure — from “bull-bear confrontation on support levels” to “bearish trend dominated after breakdown.”

Bull-Bear Logic and Key Transition

1. Bearish Dominance Logic:

· Space Opening: $3000 serves as a long-term psychological and technical resonance point. Losing it dir

Core Structural Status

Ethereum has completed a valid breakdown of the $3000 level on the 4-hour chart. This move is not a simple retracement but a downward break of the previous overall consolidation zone, marking a qualitative change in market structure — from “bull-bear confrontation on support levels” to “bearish trend dominated after breakdown.”

Bull-Bear Logic and Key Transition

1. Bearish Dominance Logic:

· Space Opening: $3000 serves as a long-term psychological and technical resonance point. Losing it dir

ETH-6,49%

- Reward

- like

- Comment

- Repost

- Share

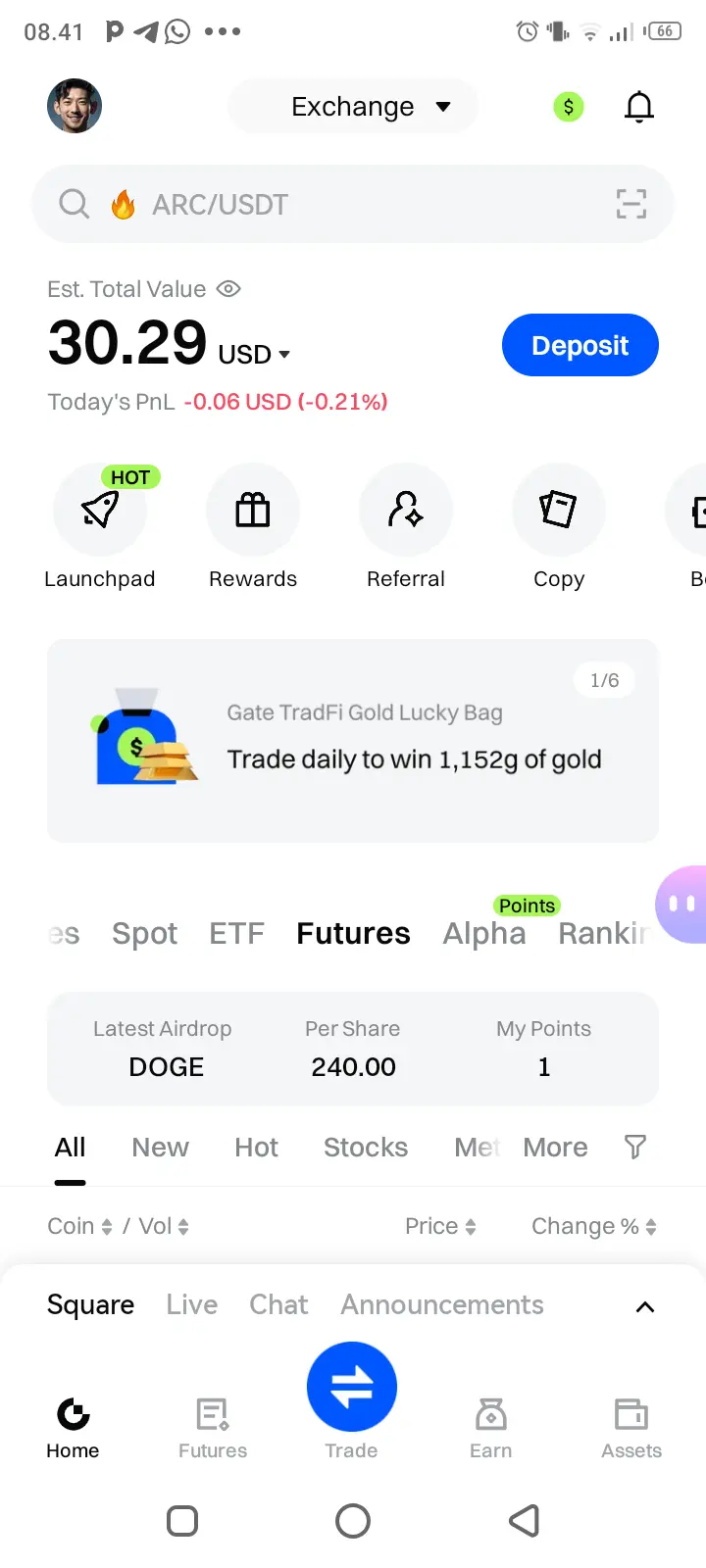

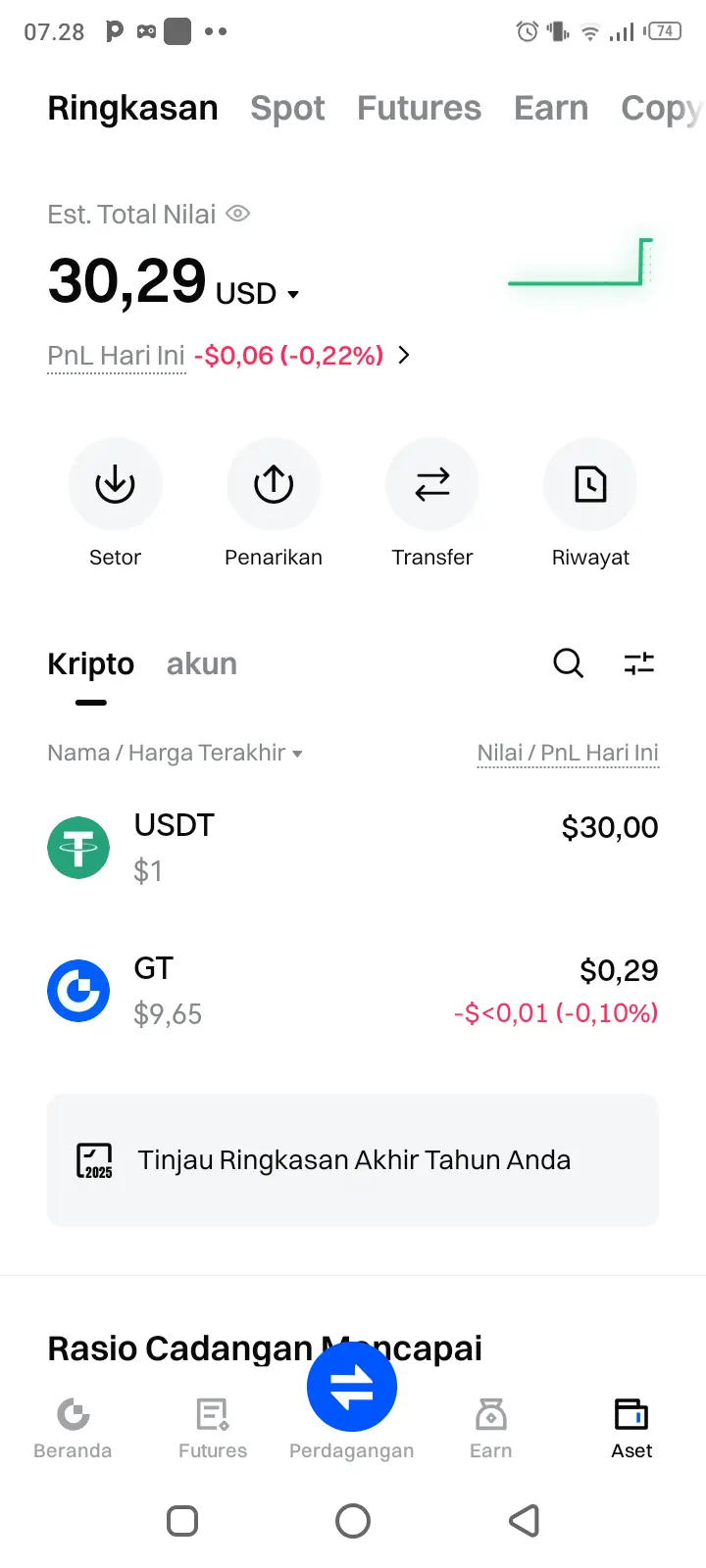

Gate Annual Report is out! Let's take a look at my yearly performance.

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=AVDDUVWL&ref_type=126&shareUid=VldFUFhZBAYO0O0O.

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=AVDDUVWL&ref_type=126&shareUid=VldFUFhZBAYO0O0O.

- Reward

- like

- Comment

- Repost

- Share

【$AIA Signal】Long | Healthy Cooldown After Explosive Breakout

$AIA After a single-day surge of 64%, the price is consolidating within a narrow range at high levels. This pattern is a typical “cooling down after a volume breakout,” rather than a top distribution. The market shows that after a massive increase, selling pressure is very light, and the price refuses to undergo a deep correction, indicating that main funds are still present in the market.

🎯 Direction: Long

🎯 Entry: 0.315 - 0.325

🛑 Stop Loss: 0.295 ( Rigid Stop Loss )

🚀 Target 1: 0.380

🚀 Target 2: 0.420

The market logic of $A

$AIA After a single-day surge of 64%, the price is consolidating within a narrow range at high levels. This pattern is a typical “cooling down after a volume breakout,” rather than a top distribution. The market shows that after a massive increase, selling pressure is very light, and the price refuses to undergo a deep correction, indicating that main funds are still present in the market.

🎯 Direction: Long

🎯 Entry: 0.315 - 0.325

🛑 Stop Loss: 0.295 ( Rigid Stop Loss )

🚀 Target 1: 0.380

🚀 Target 2: 0.420

The market logic of $A

AIA153,44%

- Reward

- 1

- Comment

- Repost

- Share

Tariff threats resurface! Crypto market flashed down overnight – can BTC hold?

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More19.04K Popularity

148 Popularity

55.51K Popularity

43.36K Popularity

339.76K Popularity

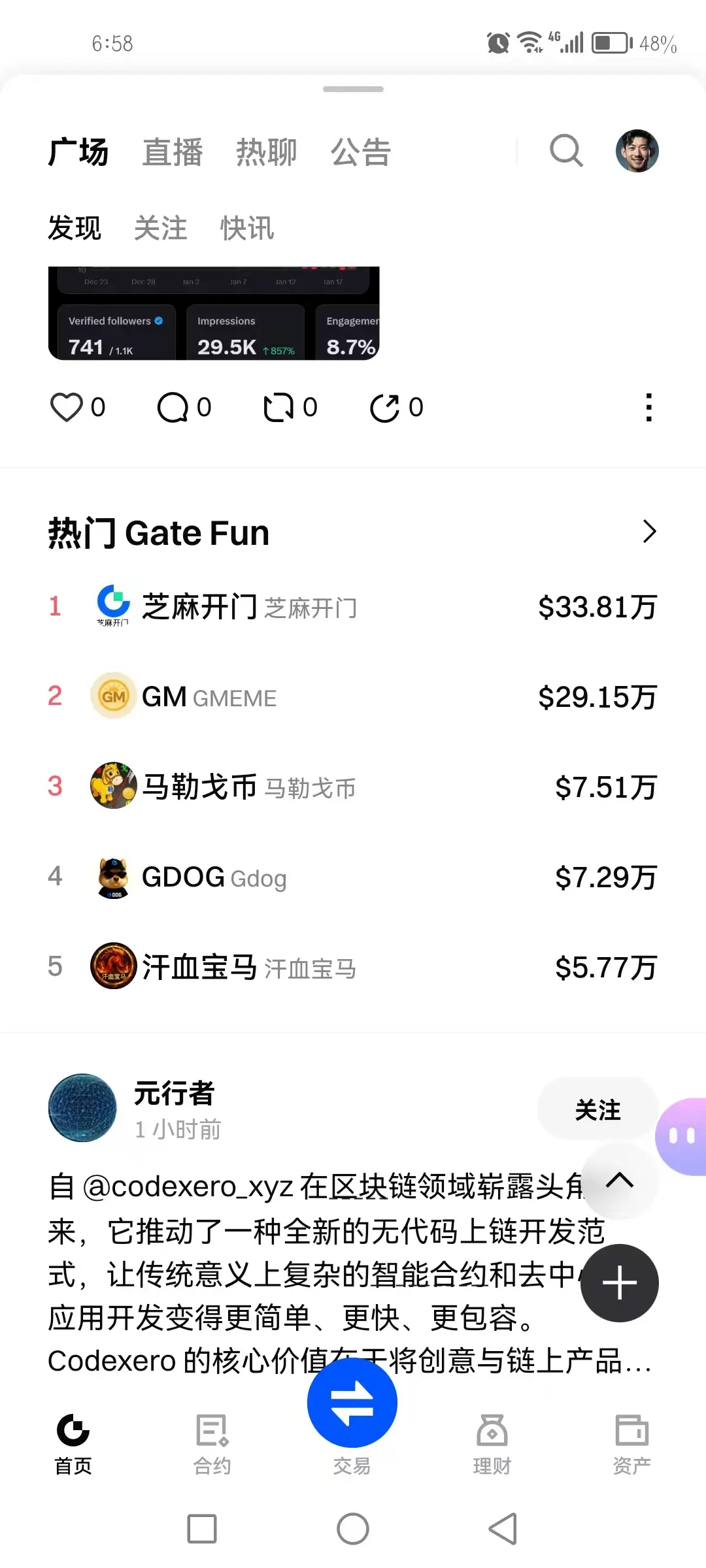

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.36KHolders:10.00%

- MC:$3.36KHolders:10.00%

- MC:$9.04KHolders:223.55%

- MC:$3.36KHolders:10.00%

News

View MoreSnap Store security vulnerability allows hackers to steal users' crypto assets by hijacking expired domains

1 m

Data: If Bitcoin rebounds and breaks through $97,000, the total liquidation strength of long positions on mainstream CEXs will reach 1.489 billion.

4 m

Data: If BTC breaks through $93,803, the total liquidation strength of short positions on mainstream CEXs will reach $2.616 billion.

5 m

Data: If ETH breaks through $3,128, the total liquidation strength of mainstream CEX short positions will reach $1.464 billion.

6 m

"100% Win Rate" Trader Experiences First Loss, Stops Loss and Closes Position, Holds 20-Day SOL Short Position

9 m

Pin