Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-Stop Lending Hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

250K Popularity

42.9K Popularity

4.31K Popularity

6.99K Popularity

6.88K Popularity

- Pin

Cryptocurrency funds raise $1 billion in a week; Brazil performs well

Source: PortaldoBitcoin Original Title: Cryptocurrency funds raise $1 billion in a week; Brazil performs well Original Link: Cryptocurrency funds recorded inflows of $1.06 billion last week, marking a reversal in sentiment after four consecutive weeks of outflows totaling $5.7 billion. Brazil followed the strong global performance, and domestic products had a surplus of $9.7 million, according to data from CoinShares' weekly report.

According to the analysis firm, the change in sentiment follows the comments of FOMC member (, John Williams, who is part of the FED body that sets interest rate policy, stating that monetary policy remains tight, raising expectations for an interest rate cut this month.

Lower interest rates reduce the profitability of investments in Treasury bonds and favor the pursuit of riskier assets, such as cryptocurrencies. When it comes to the U.S. economy, the impact of this decision is global and resonates across all sectors of the economy.

Trading volumes in digital asset funds for the week were low, at $24 billion, likely due to the Thanksgiving holiday, in stark contrast to the previous week, which recorded the highest volumes in history, at $56 billion.

Despite the Thanksgiving holiday, the United States had inflows totaling US$ 994 million last week, with significant inflows from Canada )US$ 97.6 million( and Switzerland )US$ 23.6 million(. On the other hand, Germany was one of the few countries to record outflows, totaling US$ 57.3 million.

Performance by country: ![])https://img-cdn.gateio.im/webp-social/moments-becae359aa-927a56b4f6-153d09-6d5686.webp(

Performance by asset type

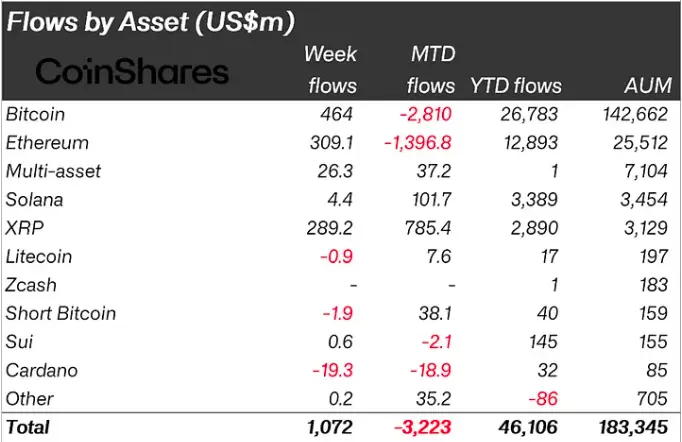

In the asset type breakdown, Bitcoin funds saw $461 million in inflows last week, as investors reversed bets on further price declines, as indicated by the $1.9 million in outflows from short-bitcoin ETPs ). Ethereum also benefited from the improved sentiment, with inflows of $308 million last week.

XRP recorded the largest weekly inflows ever, totaling $289 million, with the streak of inflows over the last six weeks representing 29% of assets under management (AuM), likely associated with the recent ETF launches in the US. On the other hand, Cardano recorded outflows of $19.3 million, equivalent to 23% of its AuM.

Performance of funds by asset type:

Performance by product

In the analysis by specific products, a surprise: BlackRock's iShares, the largest Bitcoin ETF that always leads the ranking, came in third with inflows of $120 million. In first place was the Fidelity Wise Bitcoin, which attracted $230 million. In second place is the Volatility Shares Trust, with $160 million.

On the loss side, the negative highlight was the Bitwise Funds Trust, which recorded outflows of US$ 18 million.