Post content & earn content mining yield

placeholder

Before00zero

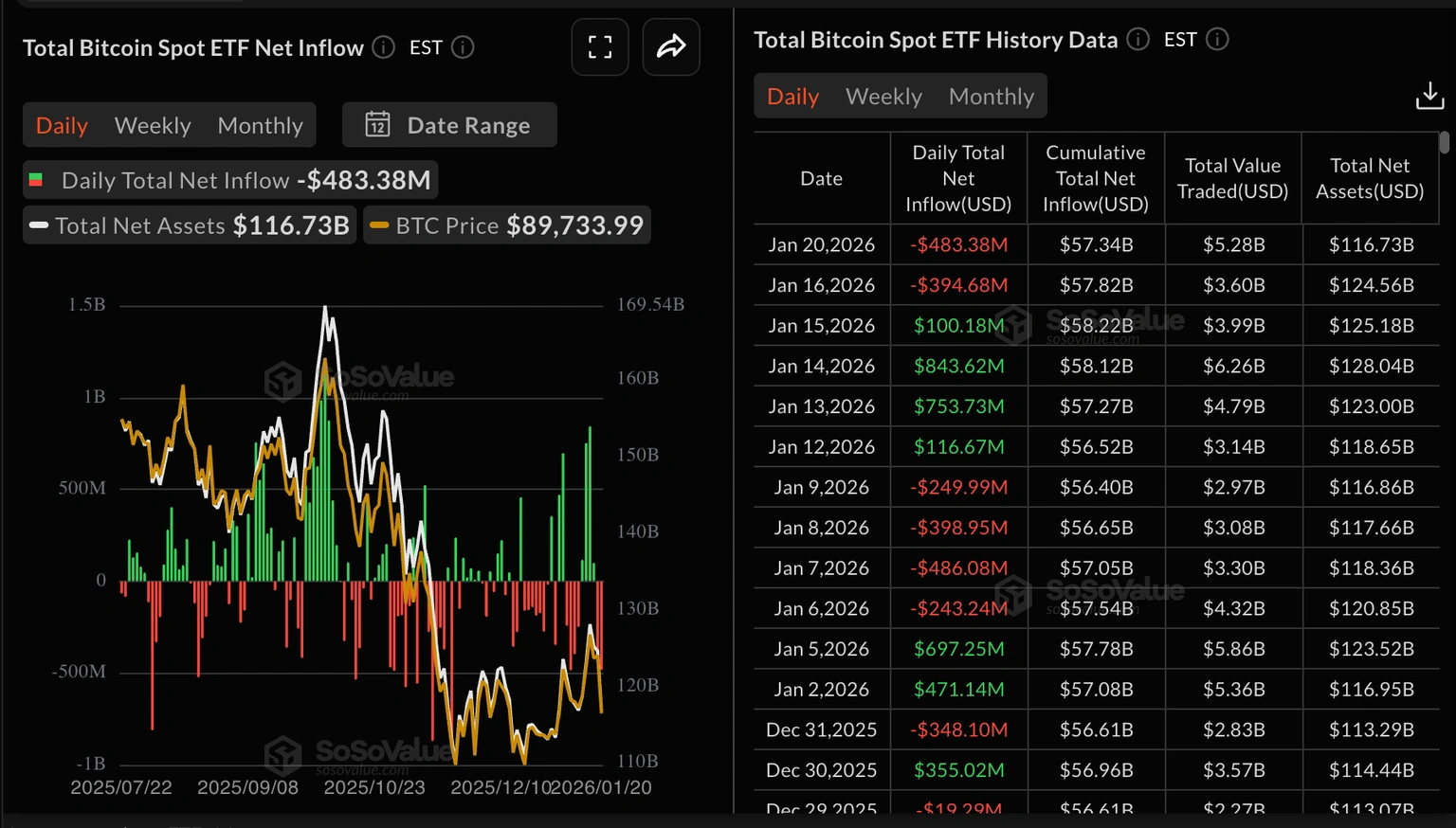

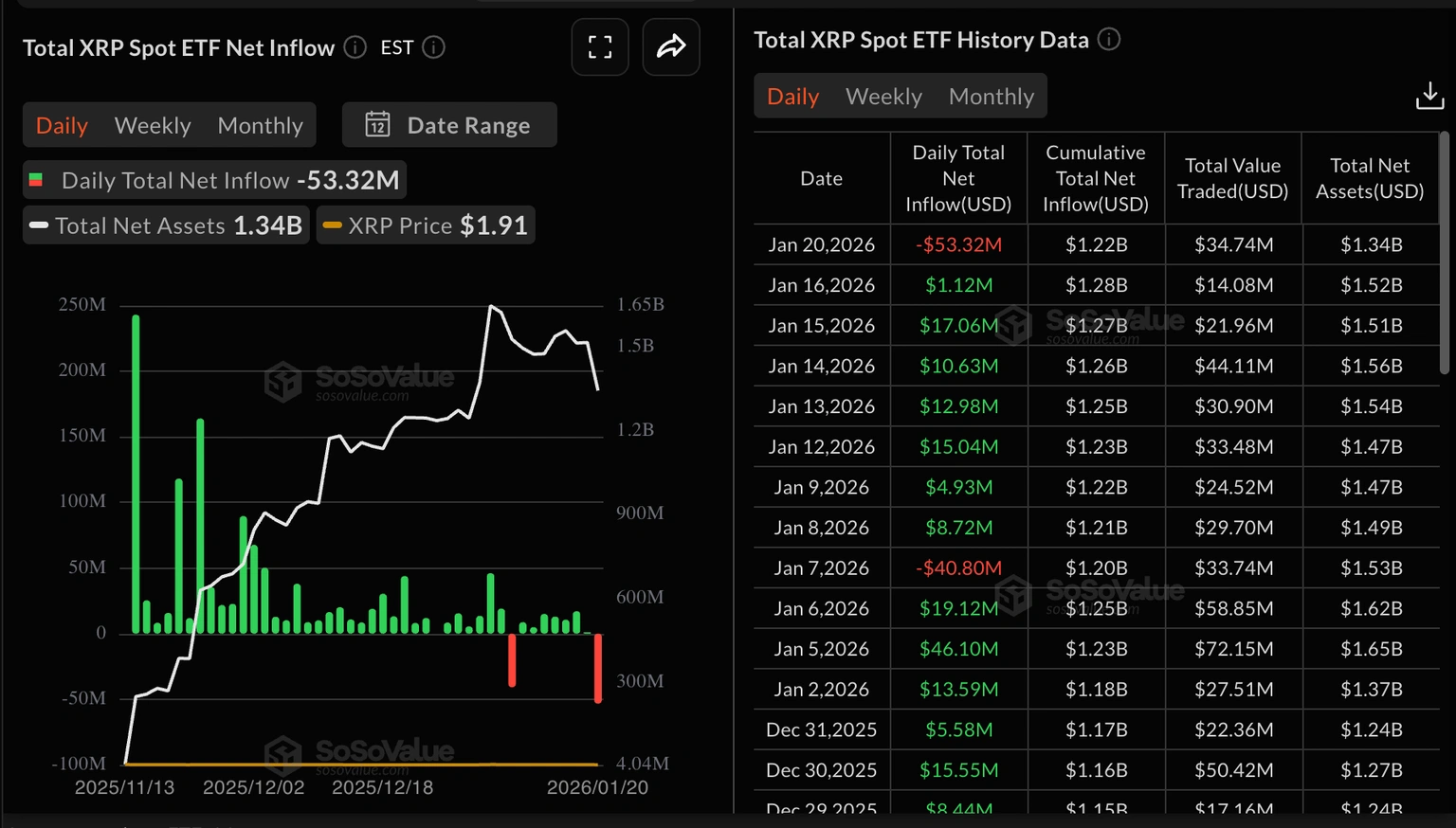

- Bitcoin, Ethereum, and XRP prices declined as outflows from exchange-traded funds (ETFs) continued:

The (ETFs) for spot Bitcoin continued to experience withdrawals for the second consecutive day, with $483 million pulled on Tuesday. The total cumulative inflows amount to approximately $57.3 billion, while the net asset value stands at $116.7 billion.

The resumption of investment flows last week led to an increase in total inflows by $1.42 billion, the highest since October. These flows contributed to pushing Bitcoin's price toward $98,000 on January 14, confirming the impact of ETFs on price

The (ETFs) for spot Bitcoin continued to experience withdrawals for the second consecutive day, with $483 million pulled on Tuesday. The total cumulative inflows amount to approximately $57.3 billion, while the net asset value stands at $116.7 billion.

The resumption of investment flows last week led to an increase in total inflows by $1.42 billion, the highest since October. These flows contributed to pushing Bitcoin's price toward $98,000 on January 14, confirming the impact of ETFs on price

XRP3,97%

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Bitcoin price settled below $90,000 on Wednesday, affected by weak institutional and retail demand. Ethereum is defending the support level at $2900 amid the resumption of withdrawals from spot exchange-traded funds.

XRP maintained its price above $1.90, while US-listed spot ETFs recorded their second outflow since launch.

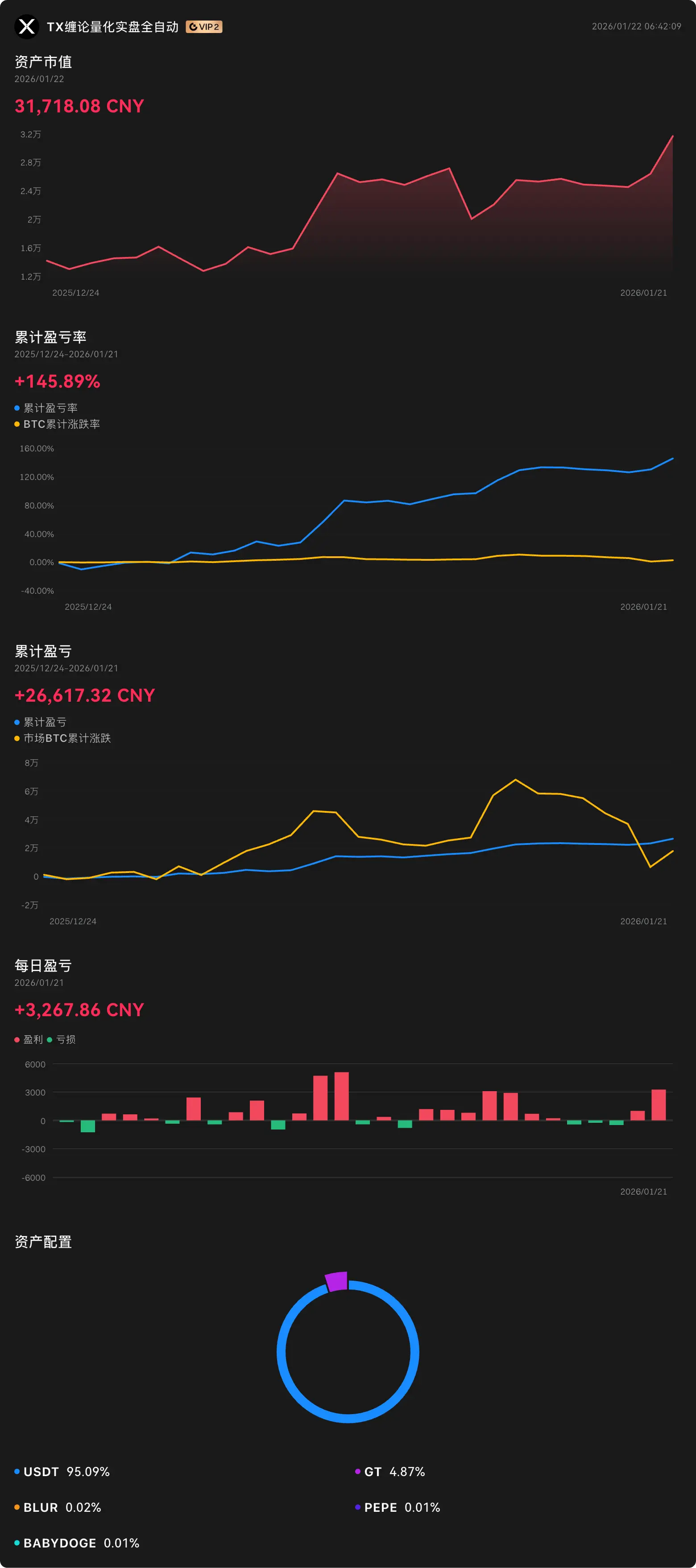

#资产分析# https://www.gate.com/wallet/assetsAnalysis Asset growth curve, choose to follow and copy trading, is stable and reliable.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 5

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$22.08K

Create My Token

- Reward

- 2

- 8

- Repost

- Share

BuyOneGetOne :

:

You really have a knack for fantasizing; you can connect anything to pi?View More

How to tell if a man has brains?

There is a type of man who, even if you give him a code, he won't look at it; you have to give him a seed.

And there is another type of man who, no matter what picture of a code you give him, can find the code you want on the internet.

He is just like Kill Bill @wolfyxbt.

The lives of these two types of men are completely different,

and this is also the difference between retail investors and KOLs.

View OriginalThere is a type of man who, even if you give him a code, he won't look at it; you have to give him a seed.

And there is another type of man who, no matter what picture of a code you give him, can find the code you want on the internet.

He is just like Kill Bill @wolfyxbt.

The lives of these two types of men are completely different,

and this is also the difference between retail investors and KOLs.

- Reward

- like

- Comment

- Repost

- Share

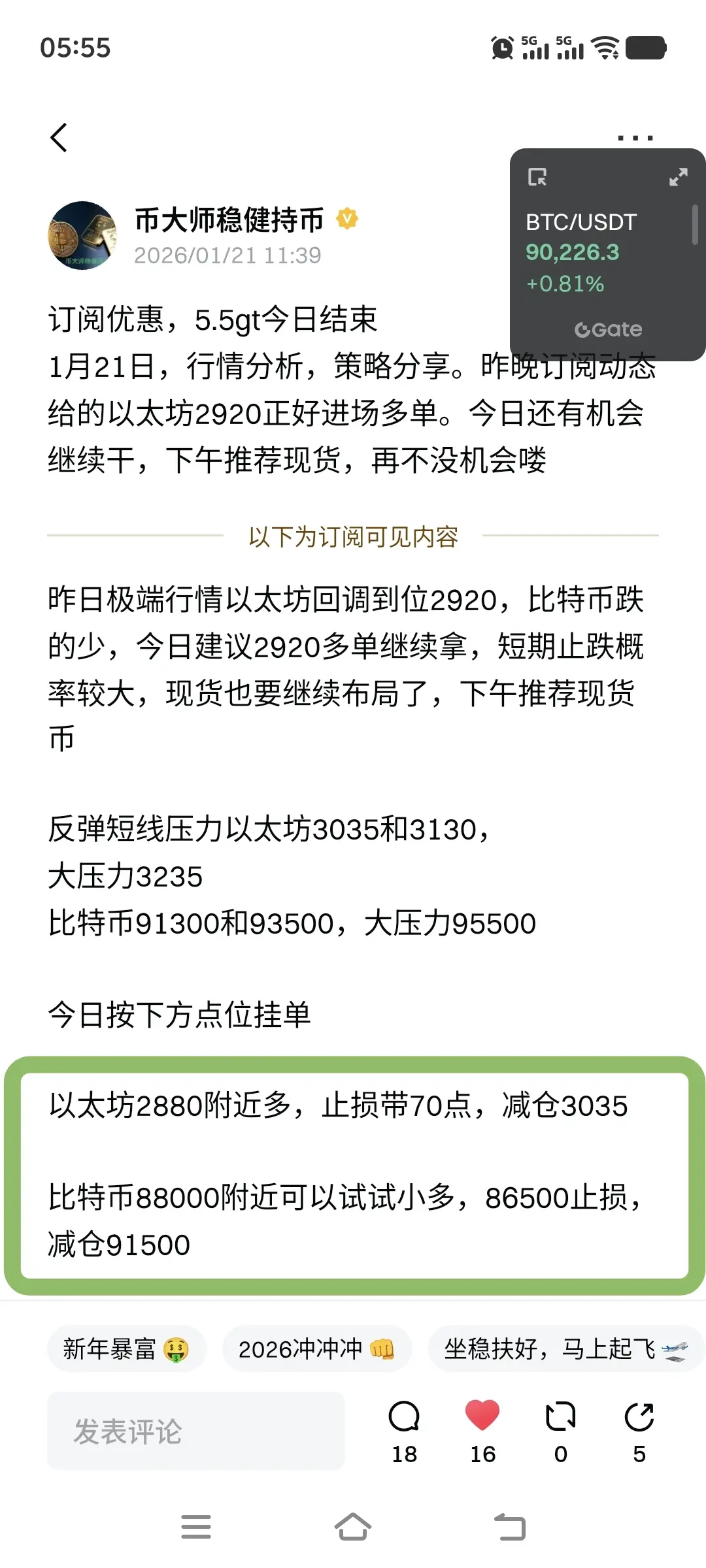

By following the subscription dynamic points to place orders steadily, everything is settled. The day before yesterday, Ethereum at 2920 was bought long based on the dynamic points. Yesterday, the dynamic Ethereum at over 2880 and Bitcoin at 88000 were both perfectly executed for profit. Just follow the subscription dynamic points to place orders, and profit is that simple.

We professionally provide subscription dynamic contract entry points, aiming for long-term stable profits, not for short-term frequent trading excitement.

Yesterday's recommended spot currencies have already rebounded, seiz

We professionally provide subscription dynamic contract entry points, aiming for long-term stable profits, not for short-term frequent trading excitement.

Yesterday's recommended spot currencies have already rebounded, seiz

ETH2,86%

- Reward

- 12

- 10

- Repost

- Share

Wealth,Peace,Happiness :

:

Hold on tight, we're about to take off 🛫View More

Coinbase CEO Challenges France’s Central Bank on Bitcoin’s Role - - #cryptocurrency #bitcoin #altcoins

BTC2,33%

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- like

- Comment

- Repost

- Share

This is called the true win rate, a perfect combination of profit/loss ratio and win rate.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 4

- Repost

- Share

InvincibleLuckyStar :

:

Hold on tight, we're about to take off 🛫View More

$BTC

Bitcoin ETFs Bitcoin Digital Gold Monetary Currency

$200000 ~$90000

Bitmine ACCUMULATE THE BTC ETH SOL

#GateSquareCreatorNewYearIncentives

#BTCMarketAnalysis

Bitcoin ETFs Bitcoin Digital Gold Monetary Currency

$200000 ~$90000

Bitmine ACCUMULATE THE BTC ETH SOL

#GateSquareCreatorNewYearIncentives

#BTCMarketAnalysis

BTC2,33%

- Reward

- like

- Comment

- Repost

- Share

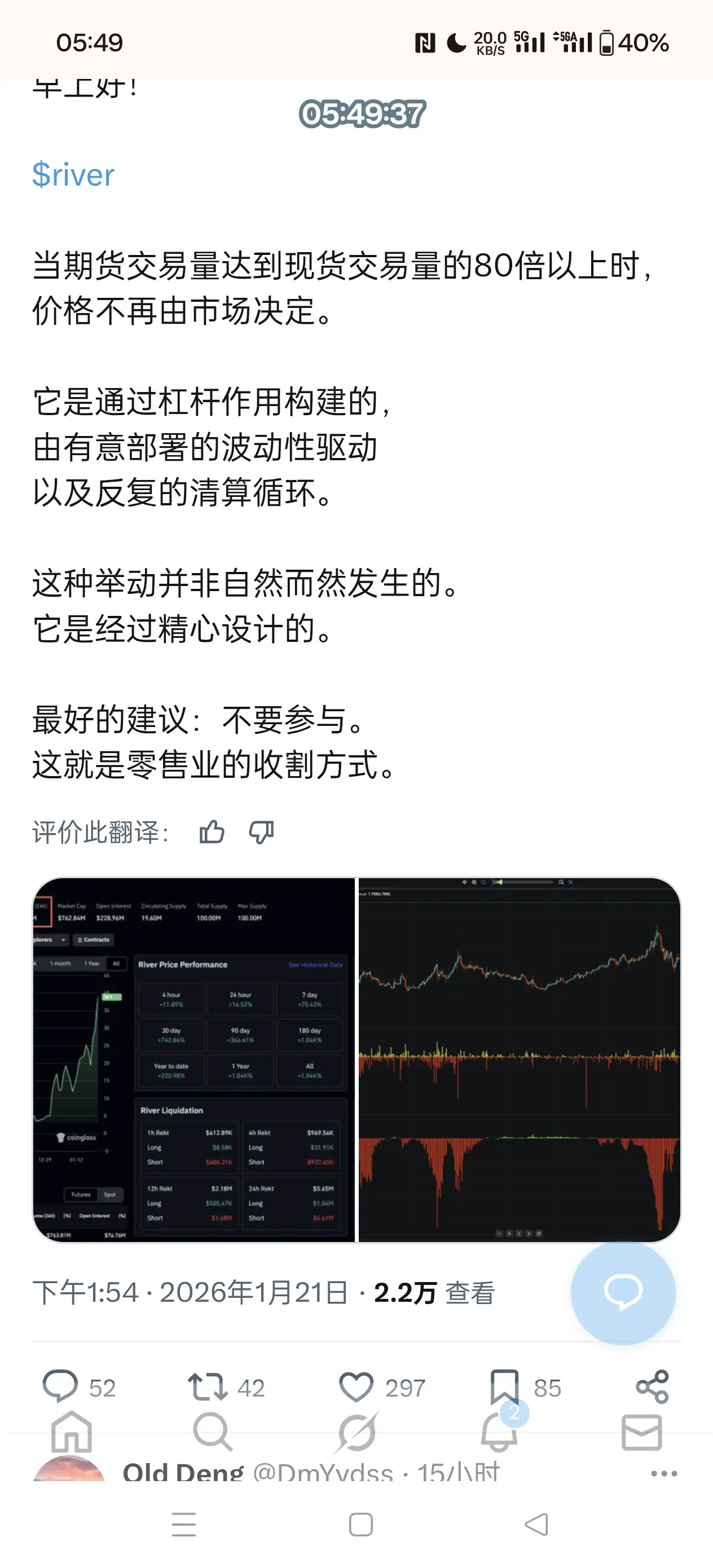

⚠️ Aggregated open interest just broke below the 28.6B support level - first time since MAY 2025. Unless we reclaim 29B quickly, this leg up is DONE. History shows this leads to lower lows in price. The deleveraging is far from over. \n#Bitcoin #OpenInterest #Crypto #BTC #MarketAnalysis

BTC2,33%

- Reward

- 1

- Comment

- Repost

- Share

Breaking: Trump makes a U-turn on EU tariffs after meeting Secretary General of NATO.

- Reward

- like

- Comment

- Repost

- Share

芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$3.37K

Create My Token

$RIVER Wake up and see 48, damn it, a 1.5 fee rate dog shit, really can pull this trash down to 46.7, didn't lose much, just broke even, should have closed earlier, damn it, otherwise I could have picked up 15u back, really a waste.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$RIVER Don't participate, losing a few hundred bucks is acceptable, it's really disgusting, too disgusting.

View Original

- Reward

- 1

- 1

- Repost

- Share

fcai :

:

You can settle accounts with them in the official channels.- Reward

- 1

- 1

- Repost

- Share

BlockchainDisaster :

:

Buy To Earn 💎Only with divine powers can one be called a god!

This is the God of Wealth!

Our prediction last night was extremely ahead of its time! It is unique in the world!

View OriginalThis is the God of Wealth!

Our prediction last night was extremely ahead of its time! It is unique in the world!

- Reward

- like

- Comment

- Repost

- Share

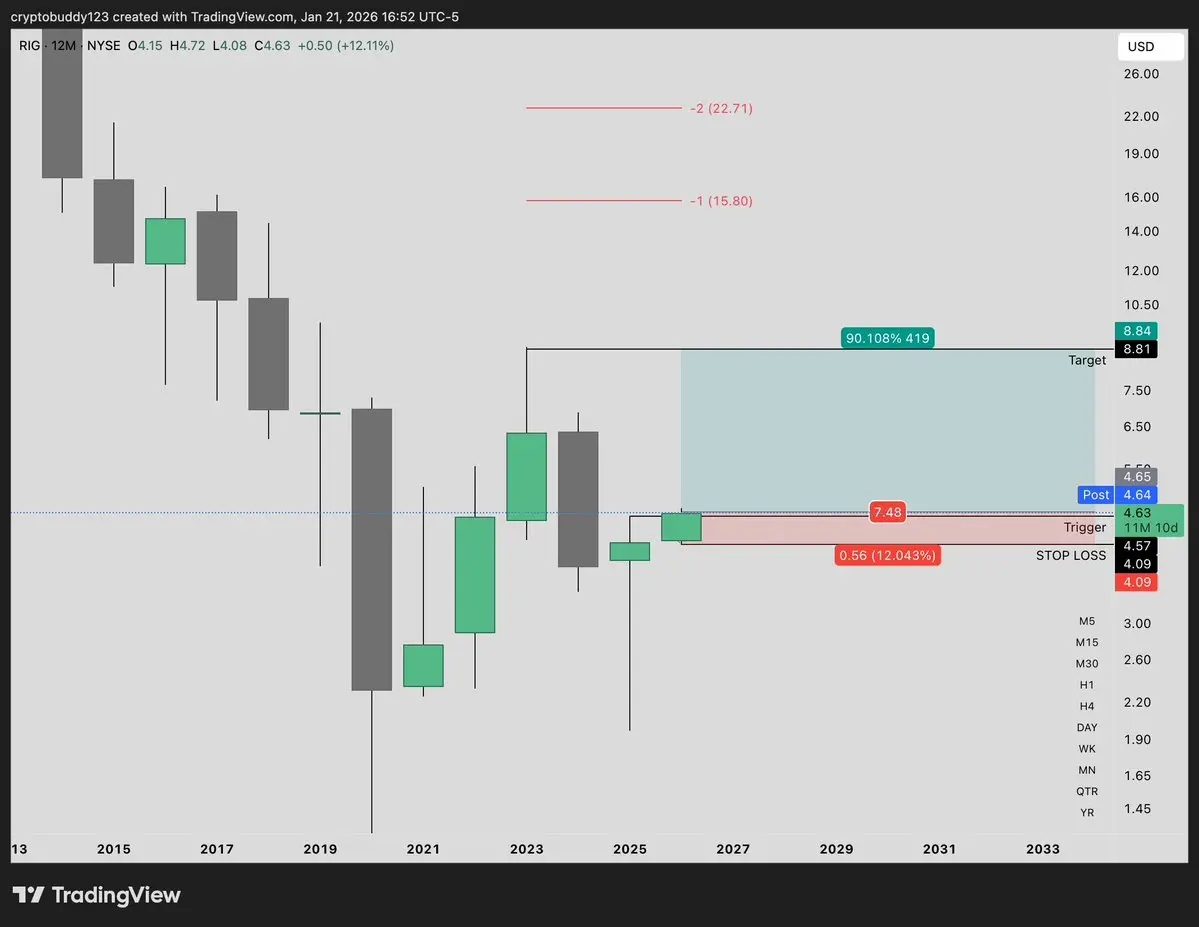

$RIG \n\n1M close above $4.57 to trigger the move up\nSL $4.09\nTP $6.91, $8.81

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More39.1K Popularity

21.35K Popularity

8.9K Popularity

58.55K Popularity

343.73K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

News

View MoreThe Federal Reserve has a 95% probability of maintaining interest rates in January, with only a 5% chance of a rate cut.

1 h

Data: 1,705 BTC transferred from anonymous addresses, worth approximately $136 million

1 h

US stocks close with the three major indices up over 1%, Trump’s post boosts the market

2 h

Trump: Hopes Hasset remains in office; the Federal Reserve Chair candidates have been narrowed down to two or three.

2 h

Data: In the past 24 hours, the total liquidation across the network was $1.005 billion, with long positions liquidated at $670 million and short positions at $335 million.

3 h

Pin