Meteora: How Dynamic Liquidity Is Redefining Solana’s DeFi Infrastructure

What Is Meteora?

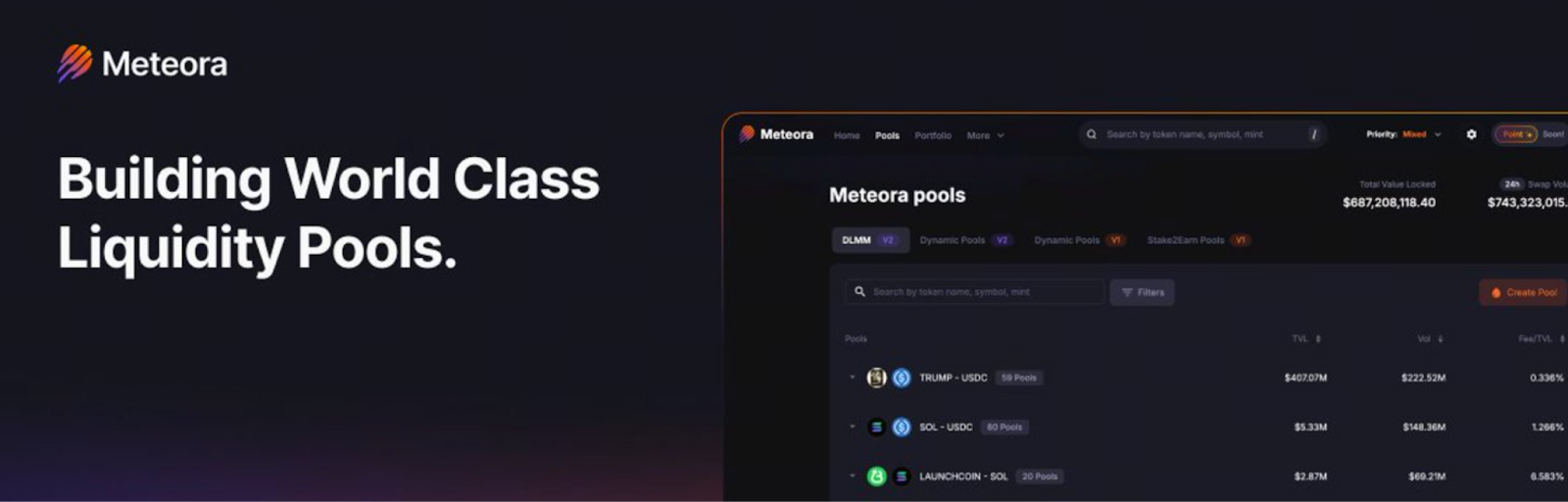

(Source: MeteoraAG)

Meteora is an all-in-one DeFi protocol built on Solana. Rather than serving as a simple decentralized exchange, Meteora acts as the primary liquidity engine for the entire ecosystem. With high-efficiency, customizable liquidity management tools, Meteora enables traders, project teams, and liquidity providers to maintain optimal capital allocation in fast-moving markets.

The protocol first launched as Mercurial Finance in 2021 and was fully upgraded to Meteora in 2023. This transition transformed it from a single product into a multi-module platform forming the backbone of Solana’s liquidity infrastructure.

Redefining Liquidity Efficiency

Meteora’s flagship innovation is the DLMM (Dynamic Liquidity Market Maker) model. Unlike traditional AMMs that spread liquidity evenly, DLMM dynamically allocates capital based on market conditions, allowing LPs to concentrate funds in the most efficient price ranges.

On Solana’s high-throughput, low-latency network, the DLMM delivers distinct advantages:

- Reduces slippage

- Deepens trading liquidity

- Maximizes LP capital efficiency

This approach transforms liquidity from a static resource into intelligent assets that instantly respond to market changes.

Systematic Solutions for Structural DeFi Challenges

Meteora addresses many of DeFi’s early structural pain points with a more precise liquidity framework. For instance:

- Fragmented liquidity causing shallow markets

- Poor capital efficiency leading to unstable LP returns

- High slippage degrading trading experience

- Inconsistent tools for token issuance and liquidity governance

Through mechanisms like dynamic market making, smart vaults, and flexible fee structures, Meteora delivers a scalable, adaptable liquidity foundation. This makes it the central hub for governance and trading flows on Solana.

Innovative Incentive Structure: A Shared Economic Model

Meteora’s economic model is built around shared growth. Revenues from liquidity and trading volume are no longer limited to the platform or LPs—they circulate throughout the entire ecosystem.

Perpetual Fee Rewards

Liquidity providers continuously earn trading fees on locked liquidity, resulting in long-term compounding returns for LPs. Project teams also benefit from ongoing rewards as token usage grows. This shifts token adoption from narrative-driven hype to real trading demand.

Dynamic Fee Structures

Meteora’s fees dynamically adjust between 0.15% and 15%, adapting to market volatility:

- Higher fees during volatile periods to better protect LPs

- Lower fees during stable periods to stimulate trading

This ensures liquidity pools maintain the most efficient yield strategies in any market environment.

Referral Rewards Program

To boost trading activity, Meteora distributes 20% of dynamic fees to partners who drive traffic, including arbitrage bots, aggregators, and trading tools. This incentive structure encourages more integrations with the Meteora ecosystem and accelerates liquidity network effects.

Core Infrastructure for the Solana Meme Economy

As meme coins on Solana experience explosive growth, Meteora serves as the launchpad and primary liquidity source for new tokens. With DLMM, perpetual incentive models, and next-generation token launch tools like M3M3, Meteora empowers creators and communities with a fairer, more transparent, and sustainable economic model.

Meteora shifts the focus of meme coins back to community collaboration, ongoing participation, and real governance—instead of short-term speculation—making it a foundation for Solana’s evolving narrative.

To learn more about Web3, register here: https://www.gate.com/

Summary

With dynamic market making, flexible fee structures, and shared incentive mechanisms, Meteora has built a liquidity framework that delivers efficiency, transparency, and sustainability. This strengthens Solana’s DeFi competitiveness and redefines how meme coins and new token economies are launched. As DeFi matures, Meteora’s design is poised to become the benchmark for future liquidity infrastructure. It paves the way for the next wave of on-chain innovation.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.com

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution