Gate Ventures Weekly Crypto Recap (December 1, 2025)

TL;DR

- The Fed released the latest Beige Book, indicating key points including softening labor market, moderate inflation pressure, consumer spending contraction, etc.

- This week’s incoming data includes the US ISM Manufacturing and Service PMI, ADP employment change, UoM sentiment and initial jobless claim.

- BTC +4.07% / ETH +6.82% last week; sentiment remains in Extreme Fear (24). Market cap +3.91%, but altcoins lagged — ex-top-10 assets only +1.09%.

- Top 30 tokens averaged -3.14%; only Monero (+11.44%) and LEO (+4.18%) outperformed.

- Hyperliquid unlock: 1.75M HYPE released; selling limited, with most tokens held or re-staked.

- Kinetiq launch: 25% supply airdropped; traded from $0.12 → $0.22 → ~$0.134 ($133M mcap); currently exclusive to Hyperliquid (USDH pair).

- Ethereum lifts block gas limit to 60M as network ramps capacity ahead of Fusaka.

- DWF Labs rolls out $75M fund targeting institutional-grade DeFi.

- Paxos acquires Fordefi for $100M+ to strengthen institutional custody stack.

Macro Overview

The Fed released the latest Beige Book, indicating key points including softening labor market, moderate inflation pressure, consumer spending contraction, etc.

Last Wednesday, the Federal Reserve released its latest Beige Book, compiled by the Dallas Fed. The report indicated that during the survey period, US economic activity was largely unchanged, with labor demand weakening, price pressures rising moderately, and consumer spending coming under pressure. Data were collected from the twelve regional Federal Reserve Banks, with information current as of November 17th 2025. Due to the recent government shutdown, Fed policymakers will not have access to much of the real‑time economic data they typically rely on before the December FOMC meeting, making this report particularly significant for policy deliberations.

The Beige Book highlighted a gradually softening labor market, with six of the twelve districts reporting a decline in employers’ hiring intentions. Across most regions, the recruitment challenges are easing, suggesting that fewer firms are urgently expanding or seeking to retain staff. Inflation pressures remained moderate, though manufacturers and retailers experienced rising input costs, and some attempted to pass these costs on to consumers, contributing to upward pressure on prices. Consumer spending showed signs of contraction, and the government shutdown placed financial stress on federal workers. The Beige Book also emphasized the growing influence of AI, which has fueled an investment boom in certain sectors but led to slower hiring in others.

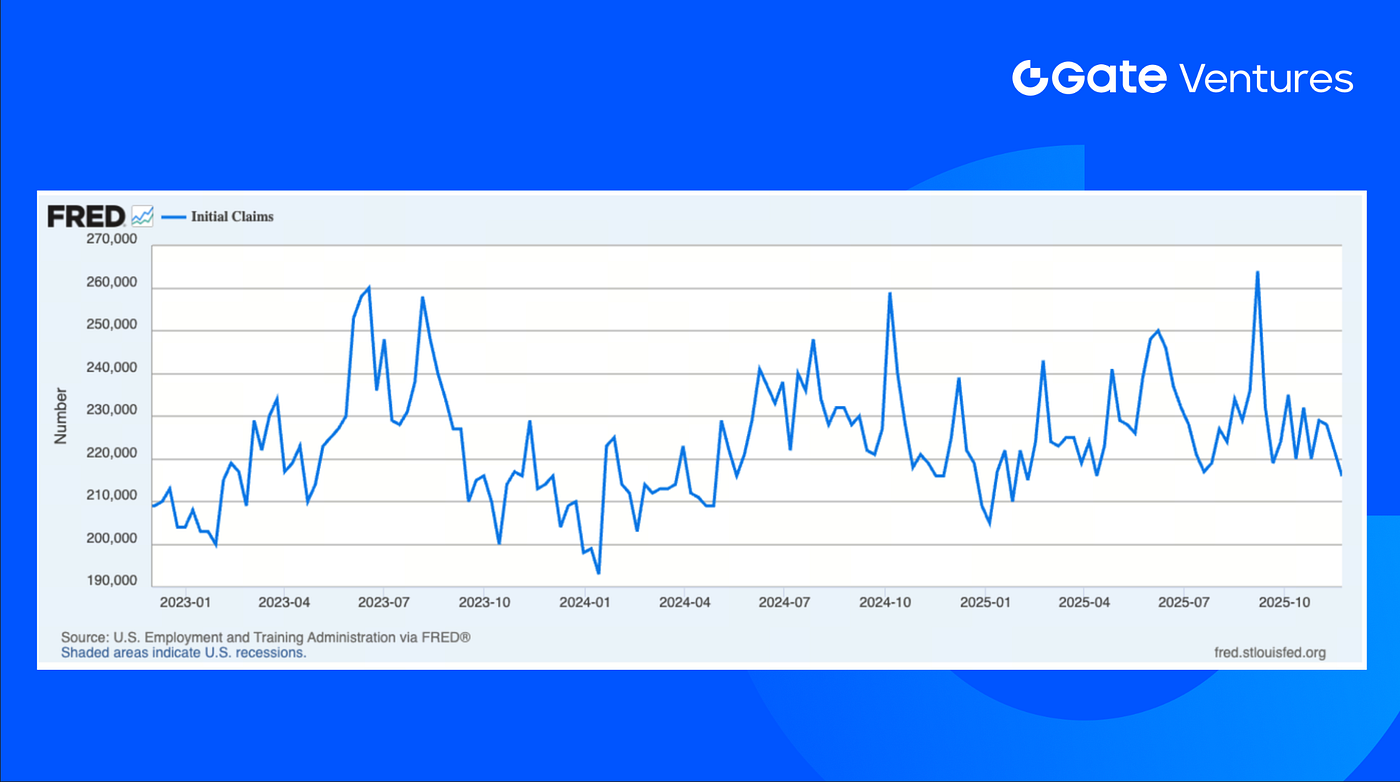

This week’s incoming data includes the US ISM Manufacturing and Service PMI, ADP employment change, UoM sentiment, initial jobless claim, etc. The macroeconomic data in the US market still demonstrate a reliance on both public and private sector sources, as the US government shutdown led to delayed official data releases. Last week, the initial jobless claims report for Nov 22nd was 216k, lower than the market forecast of 225k and previous value of 222k, marking the lowest level since mid April. This is mostly a result of the aggressive trade and immigration policies as the firms are now reluctant to lay off or hire more employees. (1, 2)

Initial Claims by Federal Reserve Economic Data (FRED), St. Louis Fed

DXY

The US dollar experienced a week of price adjustment, with the price dropping from above $100 to current level of $99.479, as the bet that the Fed will cut rate led to the retreat of investors on the US dollar. (3)

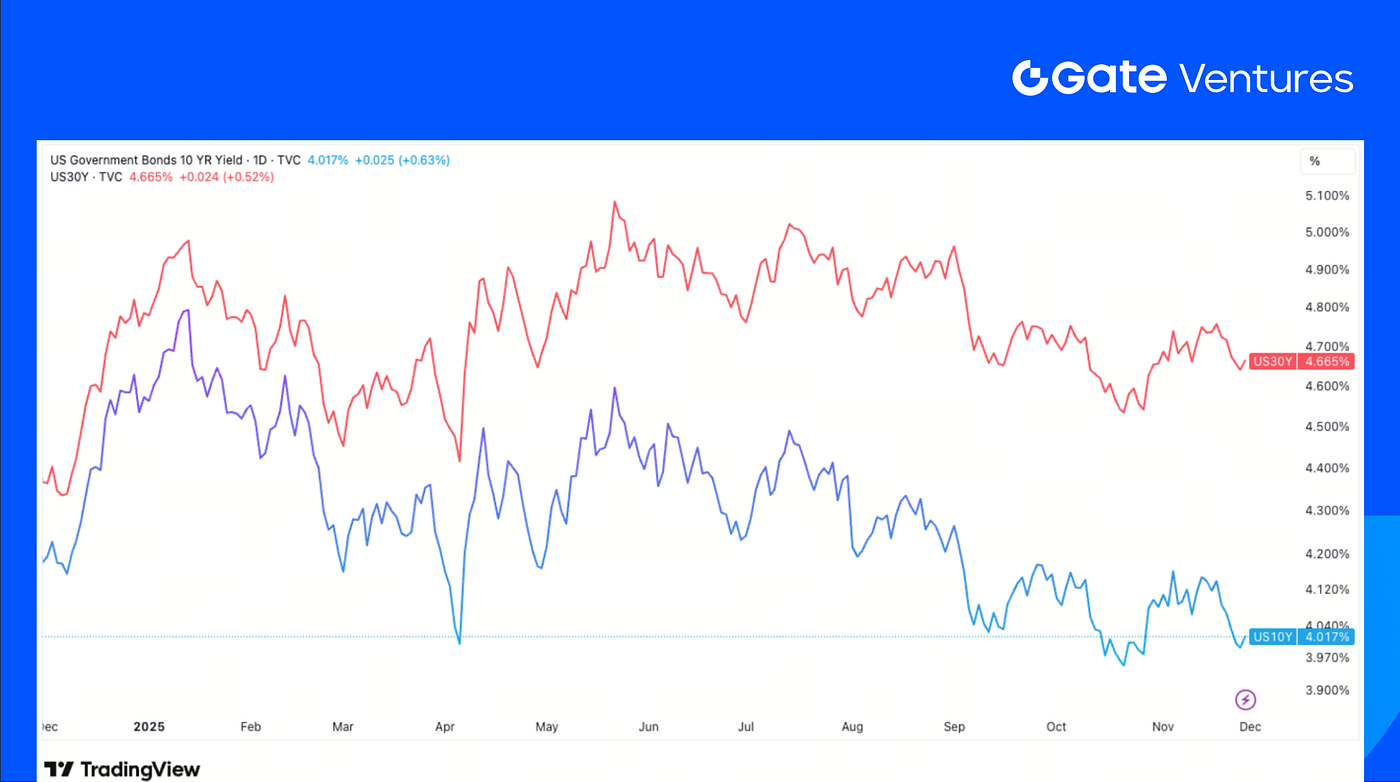

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields both had a little rebound from the weekly low on Wednesday, with the 10-year bond yield dropping below 4% on that day. The bond yield traded higher on Friday after the CME disrupted trading. (4)

Gold

Gold prices rose 1% to a two-week high last Friday, securing the fourth straight monthly gain. This was driven by the expectation that the Fed will cut interest rates in the upcoming meeting, which lifted demands for non-yield-bearing assets like gold and silver. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC gained 4.07% last week and ETH rose 6.82%. Despite the rebound, the market has since pulled back again at the start of this week. BTC ETFs recorded a modest $70.05M in net inflows, while ETH ETFs saw a stronger $312.62M of inflows. (6)

The ETH/BTC ratio edged up 2.57% to 0.032. Overall sentiment remains fragile, with the Fear & Greed Index still in “Extreme Fear” territory at 24. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap increased 3.91% last week, while the market excluding BTC and ETH rose 2.2%. Broader market gains were more limited, excluding the top 10 assets, market cap grew only 1.09%, highlighting continued weakness in altcoins relative to BTC and ETH.

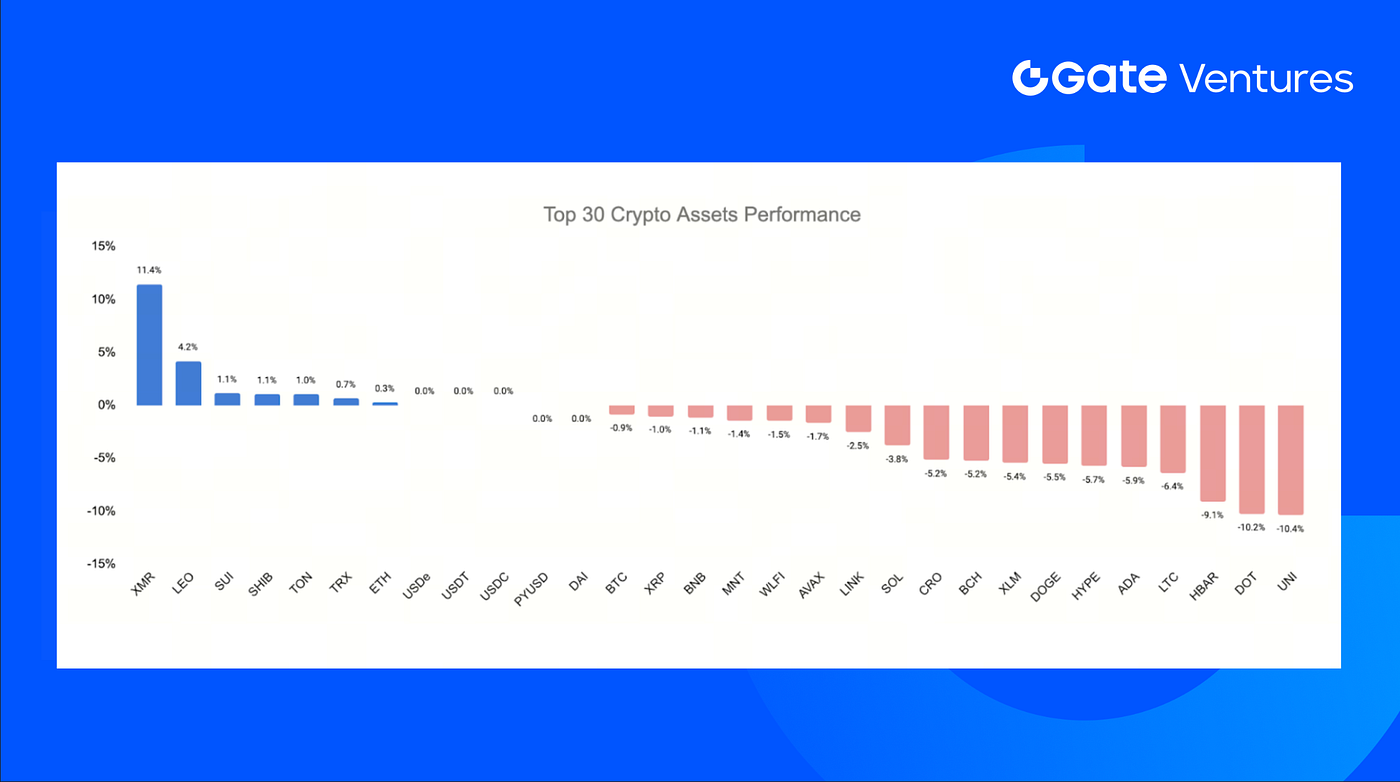

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Dec 1st 2025

Top 30 crypto assets posted an average return of -3.14% last week, with Monero (+11.44%) and LEO (+4.18%) standing out as the few notable gainers.

Despite the price performance, The first major Hyperliquid unlock released 1.75M HYPE across team and early contributors. Post-unlock behavior showed limited selling pressure:

- 23.4% (609,100 HYPE) was sold OTC to Flowdesk

- 9% (234,600 HYPE) was re-staked

- 35% (902,000 HYPE) remained untouched

- 33% (854,254 HYPE) was re-staked by Hyperlabs

Overall, holding and re-staking far outweighed selling. If this pattern continues, future unlocks may exert significantly less downward pressure than initially expected. (8)

4. New Token Launched

Kinetiq is Hyperliquid’s largest native liquid-staking protocol, allowing users to stake HYPE and receive kHYPE, with TVL consistently above $1B.

With the launch of HIP-3, Kinetiq introduced an Exchange-as-a-Service model that removes the need for a single party to stake the full 500k $HYPE to deploy a market. Instead, it fractionalizes the requirement into multiple pooled markets, where participants receive exLSTs representing their share of each exchange and earn the corresponding trading fees.

25% of the total supply was airdropped, and the token opened trading at $0.12. It briefly surged to $0.22 on launch day before pulling back to around $0.134, giving it a $133M market cap. The token is currently tradable exclusively on Hyperliquid, paired against the new native stablecoin USDH.

The Key Crypto Highlights

1. Ethereum lifts block gas limit to 60M as network ramps capacity ahead of Fusaka

Ethereum’s block gas limit has risen to 60M for the first time in four years after more than 513,000 validators signaled support, effectively doubling L1 execution capacity ahead of the Fusaka upgrade. The change allows more transactions and contract calls per block, easing congestion and improving base-layer throughput. The increase follows the community-led “Pump the Gas” campaign and marks the first stage of a broader scaling push, with Vitalik Buterin emphasizing future, more targeted adjustments that expand capacity while mitigating new bottlenecks. (9)

2. DWF Labs rolls out $75M fund targeting institutional-grade DeFi

DWF Labs unveiled a $75M proprietary DeFi fund aimed at founders building institutional-grade infrastructure across liquidity, settlement, credit and on-chain risk management. Target sectors include dark-pool perpetual DEXs and yield or fixed-income products on Ethereum, BNB Chain, Solana and Base, reflecting expectations that liquidity is structurally migrating on-chain. The initiative expands DWF’s venture footprint amid a broader downturn in crypto VC activity, positioning the firm to support teams with MVPs developing tools needed for large-scale, privacy-preserving institutional participation in DeFi. (10)

3. Paxos acquires Fordefi for $100M+ to strengthen institutional custody stack

Paxos acquired Fordefi for over $100M, adding the startup’s MPC wallet architecture, policy controls and DeFi integrations to its regulated custody platform. The deal supports rising institutional demand for stablecoin issuance, tokenized assets and crypto payment workflows, complementing Paxos’ role as custodian for PayPal, Mastercard and the issuers of PYUSD and USDG. Fordefi’s technology, already used by nearly 300 institutional clients, enhances security and operational flexibility as Paxos consolidates core infrastructure for on-chain financial services. (11)

Key Ventures Deals

1. SpaceComputer lands $10M Seed to launch satellite-powered confidential smart contracts

SpaceComputer raised a $10M Seed round co-led by Maven11 and Lattice with Superscrypt, Ethereal, Arbitrum Foundation and other investors to launch its Celestial in-orbit network and SpaceTEE trusted execution units. The capital supports satellite deployment, custom space-grade hardware, and consensus development for tamper-resistant off-Earth computation. As demand grows for secure, censorship-resistant compute beyond terrestrial attack surfaces, SpaceComputer targets a new trust layer where satellites extend cryptographic security into space for high-assurance onchain applications. (12)

2. Revolut secures $75B valuation round amid rapid global expansion

Revolut completed a secondary share sale led by Coatue, Greenoaks, Dragoneer and Fidelity with participation from a16z, Franklin Templeton, T. Rowe Price Associates, NVentures and other investors, establishing a $75B valuation. The transaction delivered employee liquidity while reinforcing strategic partnerships as Revolut posts strong financial growth and expands into Mexico, Colombia and India. The round reflects rising demand for globally integrated, AI-enabled financial platforms positioned to operate as full-stack digital banks. (13)

3. Ondo invests $25M Strategic Round into Figure’s YLDS for OUSG backing

Ondo Finance completed a $25M strategic investment round into Figure’s YLDS stablecoin to strengthen the backing of OUSG, its $780M tokenized U.S. Treasuries fund. The purchase diversifies OUSG’s yield mix alongside products from BlackRock, Fidelity, Franklin Templeton and other managers. As institutions seek more liquid, compliant onchain yield instruments, integrating YLDS positions OUSG as a deeper, multi-source treasury alternative and reflects rising demand for tokenized credit infrastructure. (14)

Ventures Market Metrics

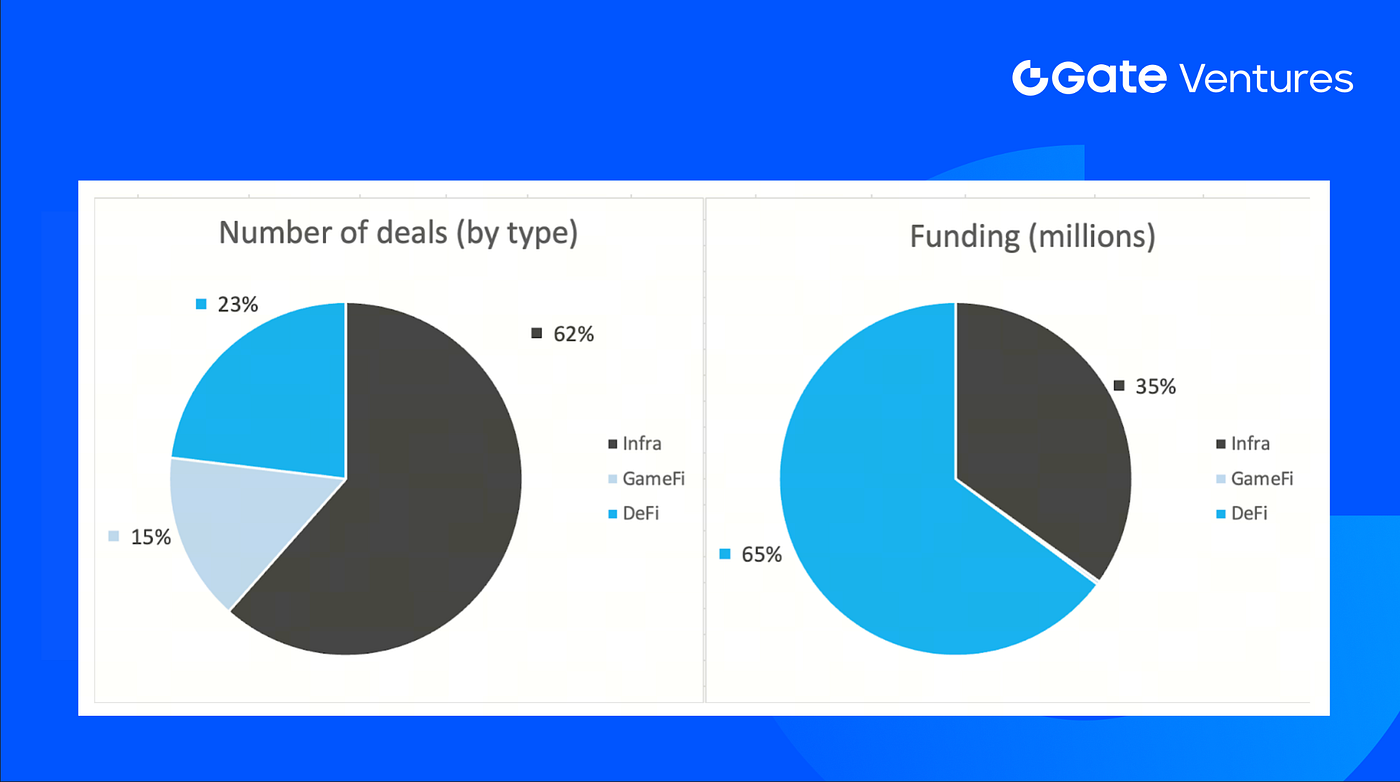

The number of deals closed in the previous week was 13, with Infra having 8 deals, representing 62% of the total number of deals. Meanwhile, GameFi had 2 (15%) and DeFi had 3 (23%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 01st Dec 2025

The total amount of disclosed funding raised in the previous week was $164M, 30% (4/13) deals in the previous week didn’t public the raised amount. The top funding came from DeFi sector with $1,237M. Most funded deals: FORDeFi $100M, Figure $25M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 01st Dec 2025

Total weekly fundraising fell to $164M for the 4th week of Nov-2025, a decrease of -88% compared to the week prior. Weekly fundraising in the previous week was up -83% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-1-december-2025.html

- Initial Claims, Federal Reserve Economic Data, https://fred.stlouisfed.org/series/ICSA#

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow: https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index: https://alternative.me/crypto/fear-and-greed-index/

- Hyperliquid core contributor token unlock: https://hypurrscan.io/address/0x43e9abea1910387c4292bca4b94de81462f8a251

- Ethereum lifts block gas limit to 60M as network ramps capacity ahead of Fusakahttps://cointelegraph.com/news/ethereum-validators-push-gas-limit-60m-scaling

- DWF Labs rolls out $75M fund targeting institutional-grade DeFi, https://www.theblock.co/post/380469/dwf-labs-defi-investment-fund-crypto-institutional-phase

- Paxos acquires Fordefi for $100M+ to strengthen institutional custody stack, https://www.coindesk.com/business/2025/11/25/paxos-acquires-crypto-wallet-startup-fordefi-to-expand-custody-services

- SpaceComputer lands $10M Seed to launch satellite-powered confidential smart contracts, https://blog.spacecomputer.io/spacecomputer-raises-10m-to-bring-trusted-execution-to-orbit-merge-cryptography-satellites-and-confidential-smart-contracts/

- Revolut secures $75B valuation round amid rapid global expansion, https://www.revolut.com/news/revolut_completes_fundraising_process_establishing_75_billion_valuation/

- Ondo invests $25M Strategic Round into Figure’s YLDS for OUSG backing, https://ondo.finance/blog/ondo-ylds-25m-investment

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)