Cryptocurrency Marketing Trends and Forecasts for 2026

The cryptocurrency industry moves at breakneck speed. Users have limited attention spans, and trends are shorter-lived than ever.

Here, I’ve distilled my observations and insights from the past year and shared predictions for 2026.

This article is intended for founders, growth leaders, and marketers, offering the perspective my team at @hypepartners and I have developed regarding industry direction, how these trends will impact your market strategies, and what it takes to stay ahead.

10 Months Can Change Everything

Since my keynote at EthDenver in February 2025, we’ve seen the following:

- More than 319 new stablecoins launched (source: @ DefiLlama)

- Institutions and Wall Street entering via enterprise blockchain, DATs, and ETFs, with major fintechs adopting stablecoins

- A more favorable regulatory climate, driven by the GENIUS Act and a crypto-friendly US president

- Token issuance up over 27%, reaching 567 million tokens at the time of writing (source: @ Dune)

- Crypto payment card options have surged, with $375 million in on-chain card transactions tracked in October 2025 alone

- Prediction markets like @ Kalshi and @ Polymarket hit record volumes, with new entrants joining

- Crypto-based digital banks and mobile fintech apps launching (notably, @ aave’s major mobile app release this week)

Crypto Marketing: 2024 vs. Today

In 2024, dominant trends included team-led campaigns, founder branding, AI agents, “reply experts,” mascots, airdrops, intern accounts, and the “mindshare” concept launched by InfoFi.

The landscape has changed dramatically. Focus has shifted from APAC liquidity to a resurgence of ICOs and “CT Leads.” The pace of crypto remains relentless.

Is Mindshare Obsolete? Mindshare Does Not Equal Growth

Over the past year, several highly anticipated token launches have shown that even with exceptional mindshare, if token price performance fails to meet expectations on Crypto Twitter, buying interest remains weak.

Key performance indicators now center on user acquisition (both B2B and B2C) and retention. At the narrative and macro level, ecosystems and apps are emphasizing revenue and buyback messaging.

Internal discussions increasingly focus on token strategy, tokenomics, and incentive design to reduce selling pressure.

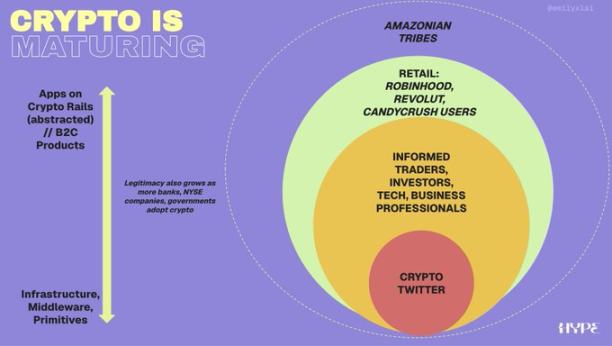

As infrastructure, core components, and middleware mature, ecosystems and public blockchains are shifting their focus to the application layer. When traditional financial institutions join and established fintech apps with millions of users adopt blockchain technology, crypto’s legitimacy is further strengthened.

Crucially, this allows us to reach new users beyond Crypto Twitter. As user experience improves, new apps launch, and trust grows, the addressable market and audience for conversion expands. As a result, Web2 user acquisition strategies that previously delivered negative ROI or ROAS may now be viable again.

Trend Radar: What’s Hot, What’s Not

Here’s a subjective, non-exhaustive list of what’s trending and what’s fading, reflecting insights from myself, crypto VCs, marketers, and the Crypto Twitter community.

I’ve distilled these trends into seven key themes. Below is a top-level summary for 2025.

Growth Hiring and the Job Market

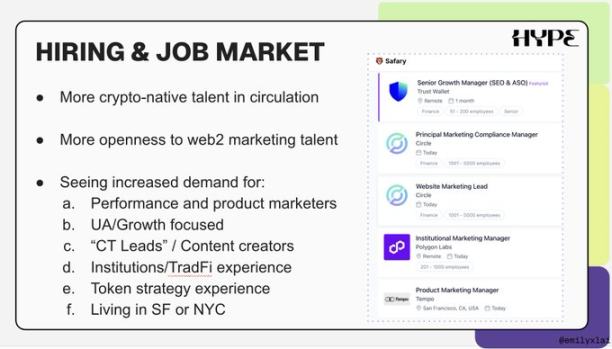

- As the industry matures, late-stage and Web2 companies increasingly favor specialized crypto marketing talent over generalist marketing leads.

- Recruiters report rising demand for senior and leadership marketing roles (such as Chief Marketing Officer), less flexibility for remote work, and greater openness to Web2 marketers.

- Entry-level marketers without Web2 experience face much higher barriers, as the market is saturated with crypto-native talent (think of the failed or downsized ecosystems over the past four years).

Performance Marketing Is Back

- With user acquisition and retention back in focus, performance marketing is resurging. This calls for robust tracking systems (on-chain, product/website, channel), growth experiments, blending paid and organic media, evolving from social tasks to liquidity tasks, and precision influencer marketing.

- There’s increased use of specialized tools like @ spindl_xyz, @ gohypelab, @ themiracle_io, @ tunnl_io, @ yapdotmarket, @ turtledotxyz, @ liquidity_land, and others.

- Strategies are sharper: some perpetual DEXs offer white-glove and one-on-one services for whales, or leverage APAC trading influencers for initial traffic.

- Web2 paid ad channels (social, search, outdoor) remain vital. Telegram ads are an underutilized opportunity.

- As OpenAI and other LLM/AI ecosystems develop ad products, new ad placements are on the horizon.

Content Saturation: Quality Over Quantity

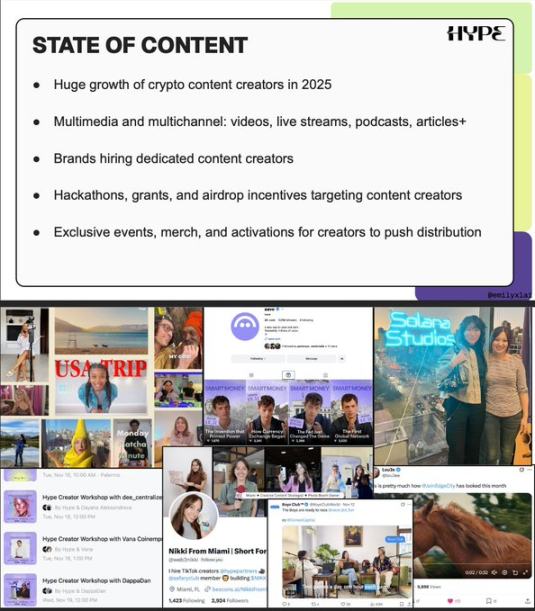

In 2025, content creators and video dominate timelines. Creators range from vloggers and short-form video producers to technical explainers, livestreamers, and cinematic storytellers.

The InfoFi platform has fueled a wave of “ambassador” accounts aiming for rewards through active engagement. But I see this trend fading—“talkers” are now on my outdated list.

Brands are hiring actors, working with Hollywood-grade studios and videographers, and producing high-end content and ads. For example, @ aave built its Instagram presence before launching its mobile app, and @ ethereumfnd brought in storytellers like @ lou3ee.

Content formats are diverse: live series (such as @ boysclubworld), static series, podcasts, short clips, 3D/AI announcement videos, and more.

@ OctantApp provides creator grants, and I run workshops for creators to help them understand brand psychology.

Key takeaway: Content saturation will persist. Quality, substance, and production value are increasingly critical. Breaking out of the Crypto Twitter bubble and reaching new audiences is just as important.

Events Are More Experiential and Exclusive

This year, we’ve branched out to YouTube, Reddit, AI-powered SEO (like Perplexity and GPT), Instagram, Whop, and more. My talks spotlighted LinkedIn and TikTok.

LinkedIn case: @ Scroll_ZKP co-founder @ sandypeng scaled from zero to 6.3 million impressions and 31,000 followers in 2025. (She shared her data and insights.)

TikTok strategy: In January 2025, demand for expansion into Instagram, YouTube, and TikTok surged. We brought in @ web3nikki to build a short-form video team focused on TikTok and similar platforms for brand growth and user acquisition. The team consists of TikTok natives who understand the algorithm and viral logic, and can tailor strategies for crypto. Since launch, they’ve served 12 clients and built deep expertise.

Side events are oversaturated (often over 500 per week), so organizers must work harder to attract attendees. The same applies to merchandise—quality, design, and exclusivity are in high demand.

Private dinners are booming. @ metamask’s invite-only event at EthCC Cannes in July (with speedboats, helicopters, and planes for KOLs/creators) set a new benchmark. @ raave continues to lead in crypto music event standards.

Ticketing is becoming more tiered, exclusive, and sequentially activated. Digital experiences are rising: airdrop unboxing, mini-games, Buzzfeed-style shareable personality quizzes, and more. Many concepts are borrowed from Web2 brand events, pop-ups, and influencer activations, then adapted for crypto.

Incentive Programs: Redesign and Reinvention

The trend is moving from airdrops back to ICOs, with some incentives reframed as “privileges”:

- “Access to buy this token is a privilege” (think NFT whitelists in 2021).

- “Buy now for exclusive discounts.”

- “Stake now for boosted yields or points across multiple protocols.”

- To maximize airdrops, discounts, or points, you must be in the top tier (mirroring airline and hotel loyalty programs).

- This echoes how banks and Web2 fintechs market their products as “Congratulations, you’re pre-qualified!”.

Prediction: Incentive programs will evolve further, closely resembling traditional loyalty and membership schemes.

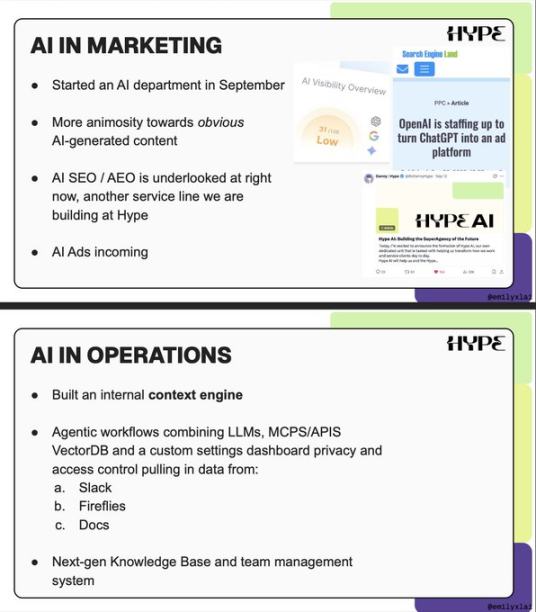

AI in Marketing and Operations

AI-powered SEO and LLM SEO ensure your company appears in AI training data for prompts. Tools like Ahrefs and SEMrush now measure AI visibility. OpenAI has announced plans for an ad platform, opening new ad placements and marketing strategies.

How to Stay Ahead

Trend lifecycles are shrinking for several reasons:

- Defensible moats are eroding—AI, the internet, and new tools lower barriers for content creation and more.

- The crypto audience is relatively small.

- New companies are constantly vying for attention.

Winning in marketing requires ongoing innovation, testing, and experimentation. First movers can leverage novelty until a tactic is saturated. Sometimes, reviving old tactics or aesthetics can spark renewed interest. The cycle repeats.

“When they turn right, you go left. When they sway, you sit beneath a tree, seeking higher consciousness and exploring new territory. Then the cycle begins again.”

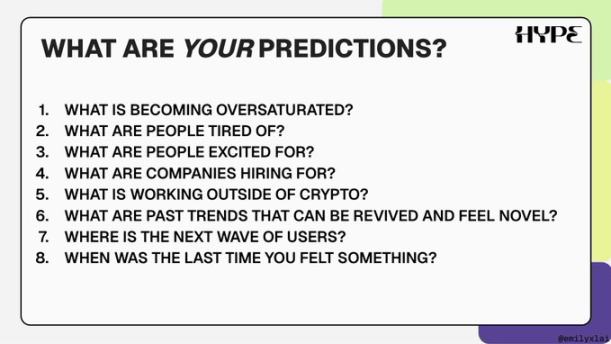

To stay ahead, stay in tune with the industry, draw inspiration from outside crypto, and think from first principles. These questions can help shape your predictions and marketing strategy:

Ultimately, you’re placing your bet on the future.

Statement:

- This article is reposted from [Foresight News], Copyright © Emily Lai. If you have concerns about this repost, contact the Gate Learn team, and we will address it promptly.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is cited, translated articles may not be copied, distributed, or plagiarized.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market