2025 TED Price Prediction: Unveiling the Future Value of Trust, Empathy, and Discourse

Introduction: TED's Market Position and Investment Value

Tezos Domains (TED), as an innovative project on the Tezos blockchain, has established itself as a decentralized and adaptable naming system since its inception. As of 2025, TED's market capitalization stands at $93,122.8531, with a circulating supply of approximately 19,750,340 tokens, and a price hovering around $0.004715. This asset, known as the "Tezos name resolver," is playing an increasingly crucial role in facilitating user-friendly interactions within the Tezos ecosystem.

This article will comprehensively analyze TED's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. TED Price History Review and Current Market Status

TED Historical Price Evolution

- 2023: TED reached its all-time high of $0.115496 on October 10, marking a significant milestone.

- 2025: The project experienced a substantial decline, with the price dropping to its all-time low of $0.002525 on June 29.

TED Current Market Situation

As of November 29, 2025, TED is trading at $0.004715, showing a 3.54% increase in the last 24 hours. The current price represents a significant recovery from its all-time low but remains 95.92% below its all-time high. The token has demonstrated positive momentum in the short term, with a 11.14% increase over the past week. However, the long-term trend remains bearish, as evidenced by the 63.1% decrease in value over the past year.

TED's market capitalization currently stands at $93,122.85, ranking it 4977th in the cryptocurrency market. The circulating supply is 19,750,340 TED, which is 21.51% of the total supply of 91,826,365 tokens. The fully diluted market cap is $432,961.31, indicating potential for growth if the entire supply enters circulation.

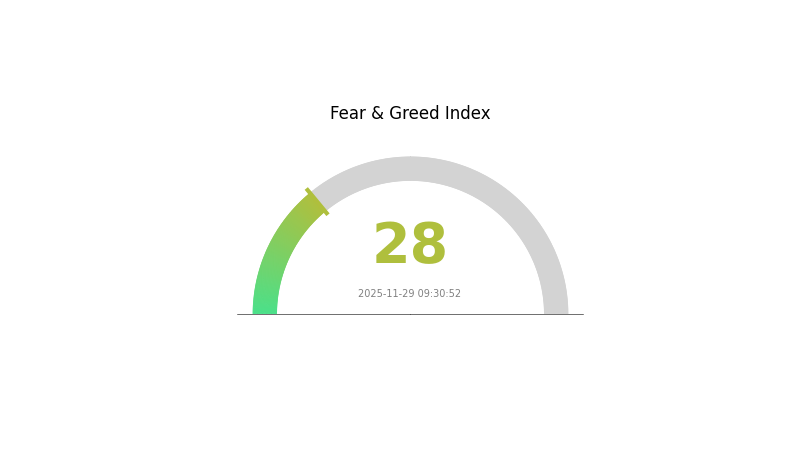

The 24-hour trading volume is $28,362.10, suggesting moderate liquidity and trading activity for the token. The market sentiment, as indicated by the VIX index of 28, is currently in the "Fear" zone, which may impact short-term price movements.

Click to view the current TED market price

TED Market Sentiment Indicator

2025-11-29 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. While fear can signal a good time to invest for contrarians, it's crucial to conduct thorough research and consider your risk tolerance. Gate.com offers a range of tools and resources to help navigate these market conditions. Remember, market sentiment can shift rapidly, so stay informed and trade responsibly.

TED Holdings Distribution

The address holdings distribution data for TED reveals a relatively decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation by large individual holders appears to be minimal. This distribution pattern suggests a healthy level of dispersion among TED token holders, which is generally viewed as a positive indicator for market stability and resistance to sudden price fluctuations caused by large sell-offs.

The absence of heavily concentrated holdings also implies a more equitable distribution of voting power within the TED ecosystem, assuming the token confers governance rights. This could potentially lead to more democratic decision-making processes and align with the principles of decentralization that many blockchain projects strive for. However, it's important to note that while the current distribution appears favorable, ongoing monitoring is crucial as ownership patterns can shift over time, potentially impacting the token's market dynamics and overall project governance.

Click to view the current TED holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting TED's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, TED may potentially serve as a hedge against inflation, similar to other digital assets. However, its specific performance in inflationary environments would depend on various factors including market adoption and overall cryptocurrency market trends.

Technical Development and Ecosystem Building

- Ecosystem Applications: While specific details are not provided, as a cryptocurrency, TED likely aims to develop a ecosystem of decentralized applications (DApps) and projects built on its blockchain. The growth and success of these ecosystem projects could significantly impact TED's future value and adoption.

III. TED Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00367 - $0.00471

- Neutral prediction: $0.00471 - $0.00584

- Optimistic prediction: $0.00584 - $0.00697 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00484 - $0.00730

- 2027: $0.00532 - $0.00893

- Key catalysts: Increased adoption and positive market sentiment

2028-2030 Long-term Outlook

- Base scenario: $0.00775 - $0.00886 (assuming steady market growth)

- Optimistic scenario: $0.00945 - $0.01187 (assuming strong market performance)

- Transformative scenario: Above $0.01187 (extremely favorable market conditions)

- 2030-12-31: TED $0.00886 (potential peak in long-term growth cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00697 | 0.00471 | 0.00367 | 0 |

| 2026 | 0.0073 | 0.00584 | 0.00484 | 23 |

| 2027 | 0.00893 | 0.00657 | 0.00532 | 39 |

| 2028 | 0.00945 | 0.00775 | 0.0055 | 64 |

| 2029 | 0.00912 | 0.0086 | 0.00585 | 82 |

| 2030 | 0.01187 | 0.00886 | 0.00461 | 87 |

IV. TED Professional Investment Strategies and Risk Management

TED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and Tezos ecosystem supporters

- Operation suggestions:

- Accumulate TED tokens during market dips

- Stay informed about Tezos Domains project developments

- Store tokens in a secure Tezos-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

TED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Tezos ecosystem projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets supporting Tezos

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TED

TED Market Risks

- Volatility: TED price may experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Correlation with Tezos: TED performance closely tied to Tezos ecosystem growth

TED Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on crypto assets

- Compliance challenges: Possible issues with regulatory compliance in different jurisdictions

- Tax implications: Evolving tax laws may impact TED holders

TED Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Tezos Domains system

- Scalability issues: Challenges in handling increased demand on the Tezos network

- Competitive threats: Emergence of alternative naming systems on Tezos or other blockchains

VI. Conclusion and Action Recommendations

TED Investment Value Assessment

TED offers long-term potential as a utility token within the Tezos ecosystem, but faces short-term volatility and adoption challenges. Its value is closely tied to the growth and development of the Tezos blockchain.

TED Investment Recommendations

✅ Beginners: Start with small positions, focus on understanding the Tezos ecosystem ✅ Experienced investors: Consider a balanced approach, combining long-term holding with tactical trading ✅ Institutional investors: Evaluate TED as part of a broader Tezos ecosystem investment strategy

TED Trading Participation Methods

- Spot trading: Available on Gate.com

- Long-term holding: Accumulate and store in secure wallets

- Tezos domain registration: Participate directly in the Tezos Domains ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will tether USDT go up?

No, USDT is designed to maintain a stable value of $1. It's unlikely to go up significantly as its purpose is to provide stability in the crypto market.

Can telcoin reach $1?

While ambitious, reaching $1 is possible for Telcoin in the long term with increased adoption and market growth. However, it would require significant developments and favorable market conditions.

What will Ton be worth in 2025?

Based on market trends and adoption rates, TON could potentially reach $10-$15 by 2025, driven by increased blockchain usage and ecosystem growth.

What is the Theta prediction for 2025?

Based on market trends and expert analysis, Theta is predicted to reach around $15 to $20 by 2025, showing significant growth potential in the Web3 and crypto space.

Share

Content