2025 BCUT Price Prediction: Expert Analysis and Market Forecast for Bitcoin's Next Bull Run

Introduction: Market Position and Investment Value of BCUT

bitsCrunch Token (BCUT) serves as a decentralized, AI-enhanced data network providing unparalleled analytics and forensic data for NFTs, wallets, and other digital assets on public blockchains. Since its launch in February 2024, the project has established itself as an innovative player in the blockchain analytics sector. As of December 2025, BCUT has achieved a market capitalization of approximately $2.53 million USD with a circulating supply of approximately 610.32 million tokens, currently trading around $0.004152. This asset, characterized as a "community-driven blockchain analytics solution," is increasingly playing a critical role in NFT analysis and digital asset intelligence applications.

This article will provide a comprehensive analysis of BCUT's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors considering positions in this emerging analytics token.

I. BCUT Price History Review and Current Market Status

BCUT Historical Price Evolution Trajectory

- February 2024: BCUT token was published at an initial price of $0.08, marking the entry of bitsCrunch's native token into the market.

- March 2024: BCUT reached its all-time high of $0.6115 on March 13, 2024, representing a significant appreciation from its launch price and reflecting strong market interest in the project.

- 2024-2025: BCUT experienced a substantial decline over the year, with a one-year price change of -94.65%, indicating significant market pressure and sentiment shift.

- December 2024-2025: BCUT reached its all-time low of $0.003936 on December 24, 2025, demonstrating extreme bearish pressure in the market.

BCUT Current Market Situation

As of December 25, 2025, BCUT is trading at $0.004152, reflecting a modest recovery of 2.48% over the past hour and 3.11% over the past 24 hours. However, the broader trend remains decidedly negative, with losses of 4.10% over the past week and 42.12% over the past month. The fully diluted market capitalization stands at approximately $4.15 million, while the circulating market cap is $2.53 million based on a circulating supply of 610.32 million tokens out of a total supply of 1 billion BCUT tokens.

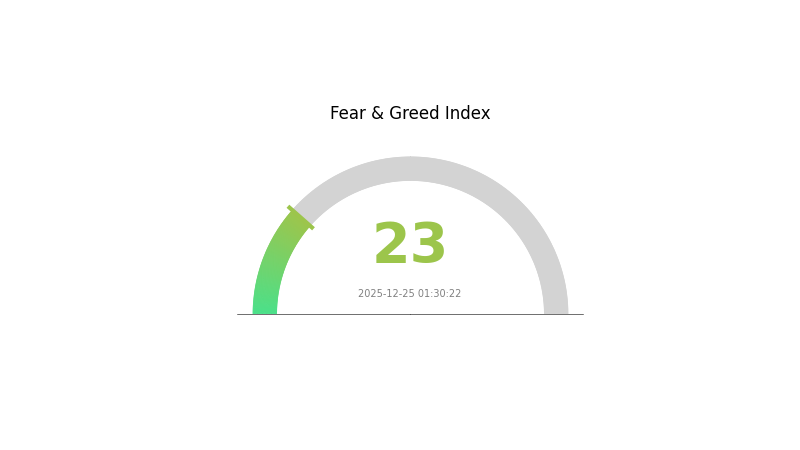

The current market sentiment reflects extreme fear, with a VIX score of 23. BCUT maintains a 24-hour trading volume of $69,476.96 across six exchanges, and is held by 4,531 token holders. The token's market dominance remains minimal at 0.00013%, indicating limited influence on the broader cryptocurrency market. The circulating supply represents 61.03% of the total supply, with unlimited maximum supply configured for the token.

View current BCUT market price

BCUT Market Sentiment Index

2025-12-25 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 23. This level typically indicates panic-driven selling and significant market pessimism. During such periods, investors should exercise caution and conduct thorough research before making trading decisions. Extreme fear often presents contrarian opportunities for long-term investors, though timing the market bottom remains challenging. Consider diversifying your portfolio and maintaining a disciplined investment strategy on Gate.com while market sentiment remains heightened. Monitor macroeconomic factors and project fundamentals carefully during this volatile period.

BCUT Holdings Distribution

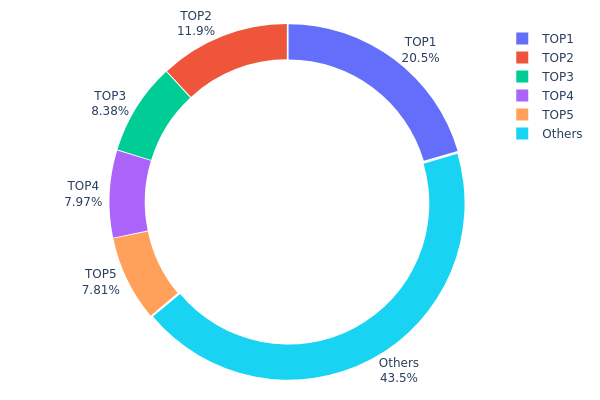

The address holdings distribution chart illustrates the concentration of BCUT tokens across blockchain addresses, revealing the degree of token decentralization and potential market structure dynamics. By analyzing the top holders and their respective percentages of total supply, this metric provides critical insights into ownership concentration, liquidity fragmentation, and vulnerability to coordinated selling pressure or market manipulation.

BCUT's current holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively control approximately 56.51% of the total token supply, with the largest holder commanding 20.45% and the second-largest holding 11.90%. While no single entity demonstrates extreme dominance, the cumulative concentration of the top five positions warrants attention. Notably, the remaining addresses account for 43.49% of the circulating supply, indicating a relatively dispersed secondary holder base. This bifurcated structure—where a minority of addresses control over half the tokens while the majority of addresses hold the remaining portion—suggests a moderate level of decentralization with manageable concentration risk.

The current distribution pattern presents both stability and volatility considerations for market participants. The concentration among top holders creates potential liquidity constraints and could theoretically facilitate significant price movements should these addresses execute large transactions. However, the substantial proportion held by dispersed addresses mitigates extreme centralization risks and indicates a foundation of broader stakeholder participation. The 43.49% allocation to other addresses demonstrates adequate distribution depth, reducing the likelihood of unilateral market control while maintaining sufficient institutional or major stakeholder engagement to support market infrastructure and price discovery mechanisms.

Click to view current BCUT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 204515.19K | 20.45% |

| 2 | 0xacc3...63943c | 119000.00K | 11.90% |

| 3 | 0xf42c...60f0af | 83833.33K | 8.38% |

| 4 | 0xe63f...1b0811 | 79721.72K | 7.97% |

| 5 | 0x39c7...8b6b0f | 78125.00K | 7.81% |

| - | Others | 434804.76K | 43.49% |

II. Core Factors Influencing BCUT's Future Price

Market Demand and Investor Sentiment

-

Market Trends: BCUT's future price is influenced by overall cryptocurrency market trends and general investor sentiment across the digital asset space.

-

Regulatory Environment: Regulatory news represents an essential factor affecting BCUT's price movements and market adoption prospects.

Technological Advancements

- Technology Development: Technological advancements in the broader cryptocurrency ecosystem serve as key catalysts that can impact BCUT's long-term value proposition and market positioning.

III. 2025-2030 BCUT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00323-$0.00415

- Neutral Forecast: $0.00415

- Optimistic Forecast: $0.00506 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth trajectory, reflecting consolidation and ecosystem maturation

- Price Range Predictions:

- 2026: $0.00373-$0.00635

- 2027: $0.00471-$0.00652

- 2028: $0.00324-$0.00672

- Key Catalysts: Platform adoption acceleration, partnership announcements, blockchain infrastructure improvements, and market cycle progression

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00381-$0.00896 by 2029, advancing to $0.00597-$0.01111 by 2030 (assumes stable regulatory environment and continued ecosystem development)

- Optimistic Scenario: $0.00896 in 2029 with potential for sustained momentum toward $0.01111 in 2030 (assumes accelerated adoption and positive macroeconomic conditions)

- Transformation Scenario: $0.01111 or higher by 2030 (assumes breakthrough in institutional adoption, major technological upgrades, or significant market expansion)

- 2030-12-31: BCUT reaching $0.01111 (representing 84% cumulative appreciation potential over the forecast period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00506 | 0.00415 | 0.00323 | 0 |

| 2026 | 0.00635 | 0.0046 | 0.00373 | 10 |

| 2027 | 0.00652 | 0.00548 | 0.00471 | 31 |

| 2028 | 0.00672 | 0.006 | 0.00324 | 44 |

| 2029 | 0.00896 | 0.00636 | 0.00381 | 52 |

| 2030 | 0.01111 | 0.00766 | 0.00597 | 84 |

bitsCrunch Token (BCUT) Professional Investment Strategy and Risk Management Report

IV. BCUT Professional Investment Strategy and Risk Management

BCUT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with medium to long-term investment horizons who believe in the fundamental value of decentralized blockchain analytics infrastructure

- Operation Recommendations:

- Establish a core position during periods of market volatility, taking advantage of price corrections below the 30-day moving average

- Set a disciplined dollar-cost averaging (DCA) approach to reduce the impact of price fluctuations, particularly given the token's -42.12% decline over the past 30 days

- Hold tokens through market cycles while monitoring the project's ecosystem development and adoption metrics for NFT and wallet analytics services

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor for bullish/bearish crossovers, particularly relevant given the current 1-hour price momentum of +2.48%

- Relative Strength Index (RSI): Identify overbought/oversold conditions to determine optimal entry and exit points

- Support and Resistance Levels: Reference the all-time high of $0.6115 (March 13, 2024) and the recent all-time low of $0.003936 (December 24, 2025) to establish trading boundaries

-

Wave Trading Key Points:

- Monitor 24-hour price volatility; the token showed +3.11% movement in the last 24 hours, indicating potential intraday trading opportunities

- Establish profit-taking targets at 15-25% gains from entry points, given the token's historical volatility

- Implement stop-loss orders at 8-10% below entry price to manage downside risk

BCUT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Aggressive Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation, with additional hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Combine BCUT holdings with established blockchain analytics platforms and broader crypto infrastructure tokens to reduce concentration risk

- Position Sizing: Never allocate more than your predetermined risk tolerance allows; given the token's -94.65% decline over 12 months, strict position sizing is critical

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com Web3 Wallet for frequent trading and active management of BCUT tokens, with the advantage of integrated trading functionality and security features

- Cold Storage Approach: Transfer larger holdings to hardware wallets for long-term storage away from online exposure

- Security Considerations:

- Enable multi-factor authentication on all exchange and wallet accounts

- Never share private keys or seed phrases

- Regularly verify smart contract addresses before token transfers (ETH: 0xbef26bd568e421d6708cca55ad6e35f8bfa0c406; MATIC: 0x3fb83A9A2c4408909c058b0BfE5B4823f54fAfE2)

- Be cautious of phishing attacks targeting blockchain analytics platforms

V. BCUT Potential Risks and Challenges

BCUT Market Risks

- Extreme Price Volatility: The token has declined 94.65% over 12 months and 42.12% over 30 days, indicating substantial price instability and significant downside risk potential

- Low Trading Volume: Daily volume of approximately $69,476.95 relative to market capitalization suggests liquidity constraints that could result in slippage during large transactions

- Diluted Market Position: With market dominance of only 0.00013% and ranking 1,988 among all cryptocurrencies, BCUT faces intense competition from larger and more established blockchain analytics projects

BCUT Regulatory Risks

- Evolving Regulatory Landscape: Blockchain analytics platforms face increasing scrutiny from financial regulators globally, potentially impacting the platform's operational capabilities and token utility

- Compliance Requirements: Changes in data privacy regulations or anti-money laundering requirements could necessitate platform modifications that affect network value

- Jurisdictional Restrictions: Different countries may impose restrictions on data analytics services, limiting the platform's addressable market

BCUT Technology Risks

- Network Adoption Risk: The platform's value depends on achieving critical mass adoption; failure to attract sufficient users could undermine the token's utility and value proposition

- Data Accuracy and Reliability: As an AI-enhanced analytics network, errors or false positives in forensic data could undermine user confidence and limit platform expansion

- Smart Contract Vulnerability: Despite operating on established blockchains (Ethereum and Polygon), smart contract bugs or exploits could compromise token security and platform functionality

VI. Conclusion and Action Recommendations

BCUT Investment Value Assessment

bitsCrunch Token represents a speculative play on decentralized blockchain analytics infrastructure. While the project addresses a legitimate market need for NFT and wallet analytics on public blockchains, the 94.65% decline over 12 months and severely depressed price relative to all-time highs indicate significant market skepticism. The token's positioning within a community-driven ecosystem offers potential for long-term value creation if adoption accelerates, but current market metrics suggest elevated risk. Investors should carefully weigh the speculative nature against their risk tolerance and investment objectives.

BCUT Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) on Gate.com, focusing on dollar-cost averaging during sustained downturns to reduce average entry costs while learning about blockchain analytics infrastructure

✅ Experienced Investors: Consider tactical accumulation during periods of extreme selling pressure, combining with technical analysis to identify potential bottoming patterns while maintaining strict position size limits

✅ Institutional Investors: Conduct comprehensive due diligence on project fundamentals, ecosystem adoption metrics, and governance structure before considering allocation; use hedging strategies to offset concentrated risk

BCUT Trading Participation Methods

- Direct Purchase on Gate.com: Acquire BCUT through Gate.com's spot trading markets against major trading pairs (ETH, USDT) with real-time price discovery and deep liquidity

- Staking or Governance Opportunities: Monitor the bitsCrunch ecosystem for community participation opportunities that generate additional token-based rewards

- Portfolio Rebalancing: Use price rallies as opportunities to trim positions and lock in gains, particularly if the token recovers above key resistance levels

Cryptocurrency investment carries extremely high risk and this report does not constitute investment advice. Investors should make careful decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with a professional financial advisor before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for Bcut crypto in 2030?

Based on current market analysis, BCUT is projected to reach approximately $0.061516 by 2030, representing an estimated growth rate of 27.63% from current levels.

What is bcut crypto?

BCUT is a utility token native to the bitsCrunch ecosystem, providing access to enriched blockchain data and services within the bitsCrunch network.

What are the main use cases and technology behind BCUT?

BCUT serves as the native token for governance and transaction payments on the bitsCrunch network. The platform leverages advanced AI technology to protect and enhance the NFT ecosystem, providing security solutions and intelligence for NFT market participants.

What factors influence BCUT price movements and market trends?

BCUT price movements are influenced by market sentiment, trading volume, regulatory developments, and blockchain adoption trends. Supply and demand dynamics, macroeconomic conditions, and investor confidence also significantly impact price volatility and market direction.

AR vs FLOW: Exploring the Future of Immersive Technologies in Retail

2025 LOOKS Price Prediction: Analyzing Key Market Factors and Long-term Growth Potential for the NFT Platform Token

Is APENFT (NFT) a good investment?: Exploring the potential and risks of this digital art token

2025 MUSE Price Prediction: Analyzing Trends and Factors Shaping the Future of the Digital Music Token

Is OPEN Ticketing Ecosystem (OPN1) a good investment?: Analyzing the Potential and Risks of This Blockchain-Based Ticketing Platform

2025 ROA Price Prediction: Analyzing Potential Growth and Market Trends for Real Options Associates

Is Crypto Legal in Netherlands?

Marina Protocol Daily Quiz Answer for 7 january 2026

Spur Protocol Daily Quiz Answer Today 7 january 2026

Top dApps in The Open Network (TON) Ecosystem

Dropee Question of the Day for 7 january 2026