TopCryptoNews

No content yet

TopCryptoNews

- Reward

- like

- 1

- Repost

- Share

OgYoung :

:

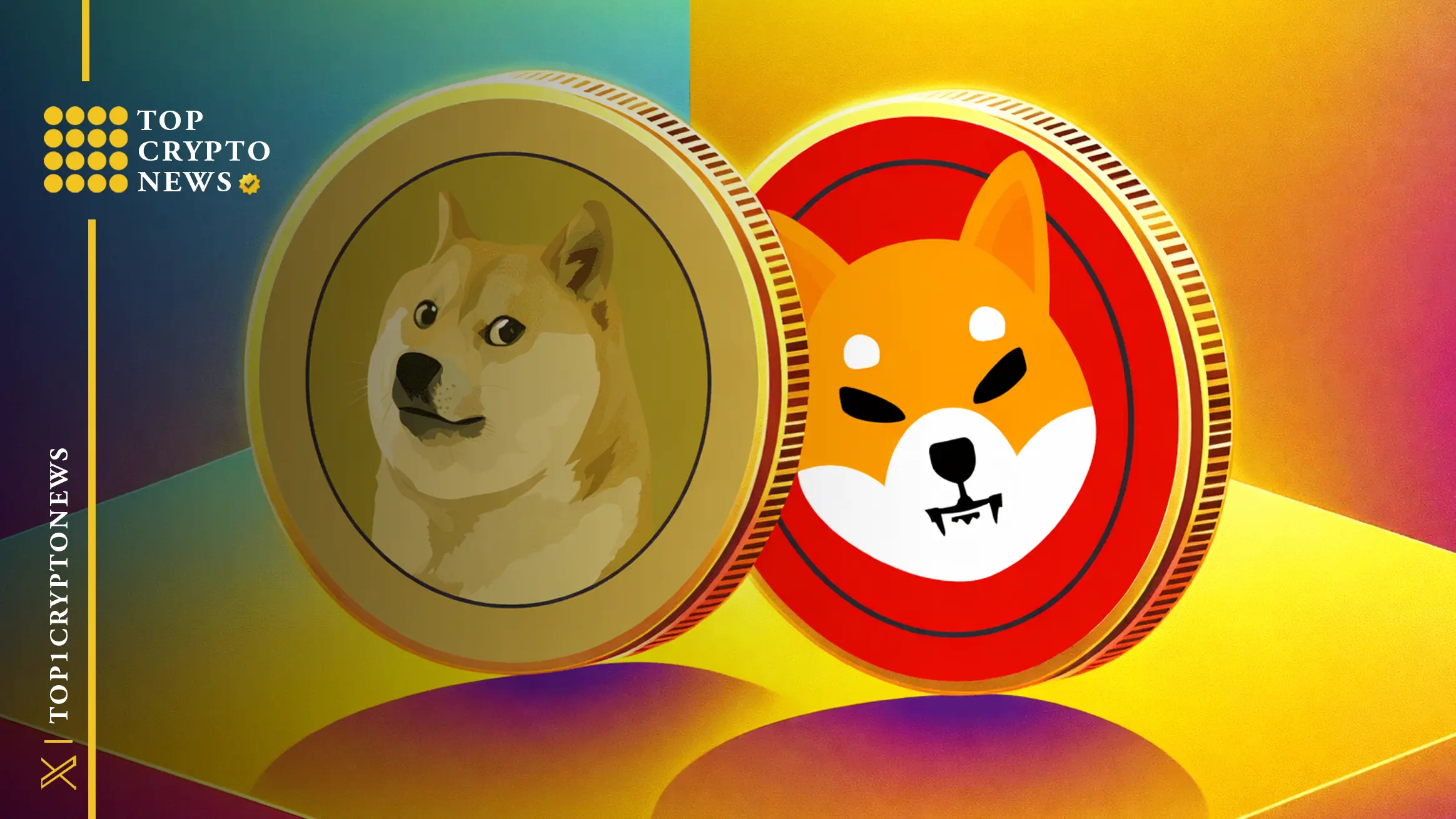

Happy New Year! 🤑📣 Dogecoin Leaves Shiba Inu Behind in Spot ETF Race After SEC Approval

Dogecoin pulls ahead of Shiba Inu after its spot ETF gains SEC approval and begins trading, highlighting a growing gap in meme coin ETFs.

🔸 Dogecoin Secures First SEC-Approved Meme Coin ETF

Dogecoin strengthened its position after a spot ETF tied to the token received approval from the U.S. Securities and Exchange Commission. Earlier this week, the 21Shares Dogecoin ETF began trading on Nasdaq under the ticker TDOG, according to regulatory filings. The approval makes Dogecoin the first and only meme coin with a standalone

Dogecoin pulls ahead of Shiba Inu after its spot ETF gains SEC approval and begins trading, highlighting a growing gap in meme coin ETFs.

🔸 Dogecoin Secures First SEC-Approved Meme Coin ETF

Dogecoin strengthened its position after a spot ETF tied to the token received approval from the U.S. Securities and Exchange Commission. Earlier this week, the 21Shares Dogecoin ETF began trading on Nasdaq under the ticker TDOG, according to regulatory filings. The approval makes Dogecoin the first and only meme coin with a standalone

- Reward

- like

- Comment

- Repost

- Share

⚡️ Render holds above $2 – Will bulls face one more shakeout?

Render [$RENDER ] saw a good start to 2026. It saw a price growth of 85% in the first week of January, far outstripping its artificial sector peers Chainlink [LINK] and Bittensor [TAO].

Since then, the Open Interest has tailed off by nearly 30%, Coinalyze data showed. While the breakout past the psychological $2 former resistance was encouraging, the price has come back to the same demand zone.

A recent measured the on-chain metrics of RENDER against another AI token, Artificial Superintelligence Alliance [FET]. The report found th

Render [$RENDER ] saw a good start to 2026. It saw a price growth of 85% in the first week of January, far outstripping its artificial sector peers Chainlink [LINK] and Bittensor [TAO].

Since then, the Open Interest has tailed off by nearly 30%, Coinalyze data showed. While the breakout past the psychological $2 former resistance was encouraging, the price has come back to the same demand zone.

A recent measured the on-chain metrics of RENDER against another AI token, Artificial Superintelligence Alliance [FET]. The report found th

RENDER-6,16%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎🇯🇵 Japan to Regulate $XRP as a Financial Asset in 2026

Japan Moves to Classify XRP as a Financial Product, Eyeing Q2 2026 Implementation

Japan, a global crypto leader, is reportedly set to formally classify Ripple’s XRP as a financial product under its updated regulatory framework.

Market analyst Xaif Crypto notes the change could take effect by Q2 2026, bringing XRP under the country’s Financial Instruments and Exchange Act (FIEA).

Japan’s proposed classification of XRP under the Financial Instruments and Exchange Act marks a major step in formalizing digital asset regulation. By clarifyin

Japan Moves to Classify XRP as a Financial Product, Eyeing Q2 2026 Implementation

Japan, a global crypto leader, is reportedly set to formally classify Ripple’s XRP as a financial product under its updated regulatory framework.

Market analyst Xaif Crypto notes the change could take effect by Q2 2026, bringing XRP under the country’s Financial Instruments and Exchange Act (FIEA).

Japan’s proposed classification of XRP under the Financial Instruments and Exchange Act marks a major step in formalizing digital asset regulation. By clarifyin

XRP-4,48%

- Reward

- 2

- 5

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

⚡️ Can $XRP Overtake Bitcoin? Analyst Warns of Global Liquidity Crisis

Crypto analyst Jake Claver believes XRP will overtake Bitcoin as the top digital asset. In Part 4 of his “XRP Domino Theory” series, he explains how a global financial crisis could force markets to adopt instant settlement infrastructure.

Claver calls it “the largest wealth transfer in our lifetimes.”

Here’s a deep dive.

🔸 Oil Shock Could Break the Yen Carry Trade

Claver points to rising geopolitical tensions involving Iran, Venezuela, China, and Russia. A 20-40% spike in oil prices, he says, would break the Japanese yen

Crypto analyst Jake Claver believes XRP will overtake Bitcoin as the top digital asset. In Part 4 of his “XRP Domino Theory” series, he explains how a global financial crisis could force markets to adopt instant settlement infrastructure.

Claver calls it “the largest wealth transfer in our lifetimes.”

Here’s a deep dive.

🔸 Oil Shock Could Break the Yen Carry Trade

Claver points to rising geopolitical tensions involving Iran, Venezuela, China, and Russia. A 20-40% spike in oil prices, he says, would break the Japanese yen

XRP-4,48%

- Reward

- like

- Comment

- Repost

- Share

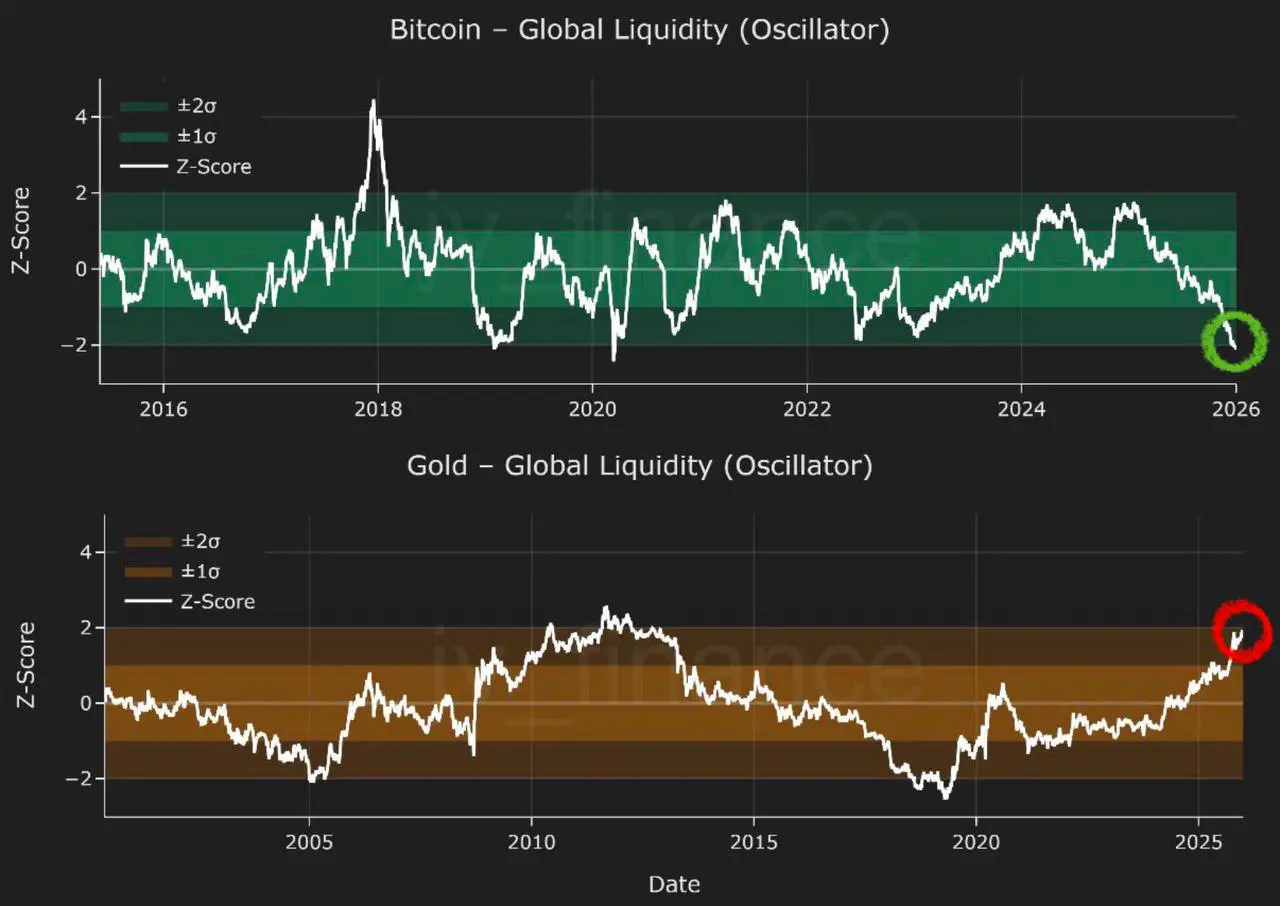

📊 Analysis Company: ‘Bitcoin’s Major Rally May Depend on This News Coming from Japan’

In its latest assessment, cryptocurrency asset analysis company Delphi Digital pointed to a striking negative correlation between Bitcoin and Japan’s 10-year government bonds.

According to the analysis, tensions in the Japanese bond market are putting pressure on Bitcoin prices, but a potential central bank intervention could reverse this trend.

A Delphi Digital report notes that while Bitcoin prices are trading sideways, gold continues to rise, arguing that the primary reason for this could be Japanese gove

In its latest assessment, cryptocurrency asset analysis company Delphi Digital pointed to a striking negative correlation between Bitcoin and Japan’s 10-year government bonds.

According to the analysis, tensions in the Japanese bond market are putting pressure on Bitcoin prices, but a potential central bank intervention could reverse this trend.

A Delphi Digital report notes that while Bitcoin prices are trading sideways, gold continues to rise, arguing that the primary reason for this could be Japanese gove

BTC-2,43%

- Reward

- like

- Comment

- Repost

- Share

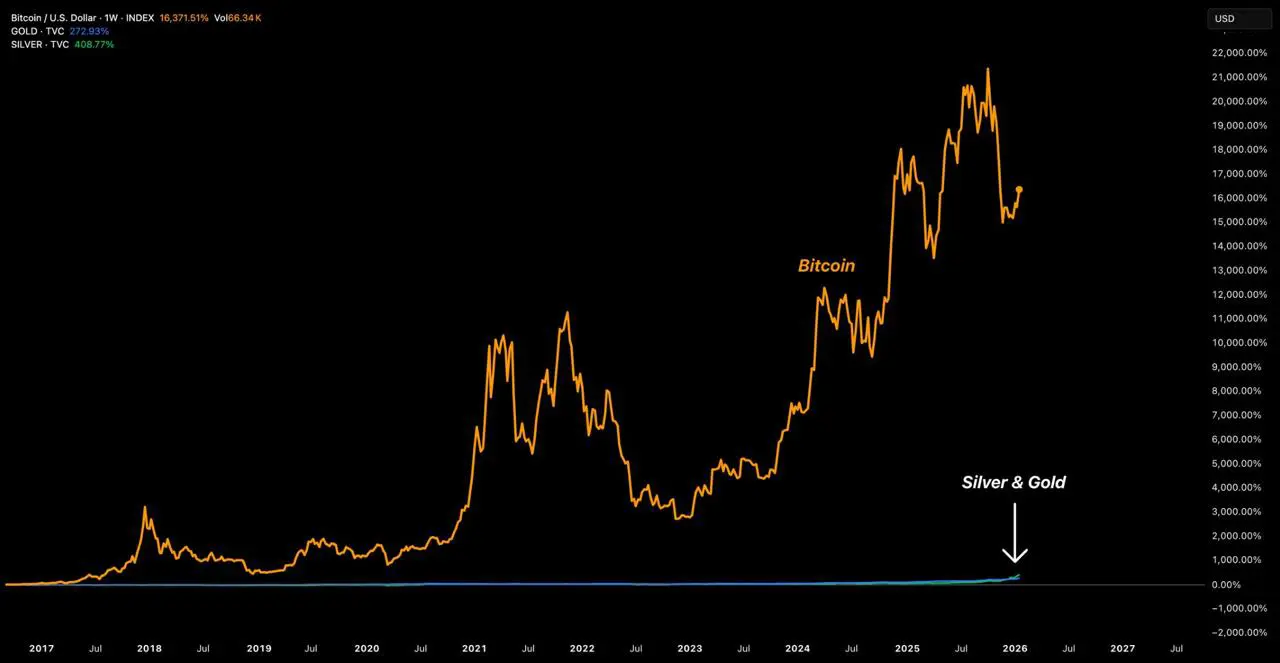

📣 Bitcoin vs Gold.

On the chart, it can be seen that the indicator of Bitcoin's undervaluation is at historically low levels.

At the same time, gold is historically greatly overvalued.

This divergence foreshadows a potentially impressive growth for $BTC in the long term ↗️

#GOLD #BTC $BTC

On the chart, it can be seen that the indicator of Bitcoin's undervaluation is at historically low levels.

At the same time, gold is historically greatly overvalued.

This divergence foreshadows a potentially impressive growth for $BTC in the long term ↗️

#GOLD #BTC $BTC

BTC-2,43%

- Reward

- like

- Comment

- Repost

- Share

📌 Cardano Founder Hoskinson Warns of U.S. Recession

Cardano founder Charles Hoskinson warned that the United States faces a significant risk of recession if several global forces converge.

In a recent commentary, he said a potential AI bubble burst, combined with long-time U.S. allies shifting trade and investment toward China, could push the economy into recession.

As a result, Hoskinson argued that prolonged economic decoupling would sharply reduce U.S. consumption and could become economically catastrophic without timely policy intervention.

🔸 What Could Drive US Into Recession

The Cardan

Cardano founder Charles Hoskinson warned that the United States faces a significant risk of recession if several global forces converge.

In a recent commentary, he said a potential AI bubble burst, combined with long-time U.S. allies shifting trade and investment toward China, could push the economy into recession.

As a result, Hoskinson argued that prolonged economic decoupling would sharply reduce U.S. consumption and could become economically catastrophic without timely policy intervention.

🔸 What Could Drive US Into Recession

The Cardan

ADA-5,4%

- Reward

- like

- Comment

- Repost

- Share

🔘 Hedera ($HBAR) price drops toward $0.10 despite McLaren F1 partnership

Hedera’s price fell alongside other cryptocurrencies on Friday, reaching intraday lows near $0.10.

After seeing a sharp decline on January 19, HBAR rebounded slightly to around $0.115.

However, sell-off pressure across the risk assets market has pushed bulls into the woods to leave the brief upside as a mask of a likely deeper rot.

It’s an outlook mirrored across the altcoin ecosystem as Bitcoin struggles below $90,000.

Due to profit-taking amid macroeconomic and geopolitical headwinds, BTC has touched lows of $87,700 an

Hedera’s price fell alongside other cryptocurrencies on Friday, reaching intraday lows near $0.10.

After seeing a sharp decline on January 19, HBAR rebounded slightly to around $0.115.

However, sell-off pressure across the risk assets market has pushed bulls into the woods to leave the brief upside as a mask of a likely deeper rot.

It’s an outlook mirrored across the altcoin ecosystem as Bitcoin struggles below $90,000.

Due to profit-taking amid macroeconomic and geopolitical headwinds, BTC has touched lows of $87,700 an

- Reward

- like

- Comment

- Repost

- Share

🟠 Bitcoin surges to $91,000, showing signs of life on suspected Bank of Japan intervention

Bitcoin $BTC $90,657.36 reclaimed the $91,000 level in early U.S. afternoon hours on Friday, continuing volatile action and threatening to sustainably break out of its tight week-long range of roughly $88,000-$90,000.

Possibly behind the quick 2% move off of the morning’s lows was suspected intervention in the foreign exchange market by Japanese authorities. The Bank of Japan overnight left monetary policy unchanged, but was somewhat hawkish in its policy statement. That had the yen modestly stronger v

Bitcoin $BTC $90,657.36 reclaimed the $91,000 level in early U.S. afternoon hours on Friday, continuing volatile action and threatening to sustainably break out of its tight week-long range of roughly $88,000-$90,000.

Possibly behind the quick 2% move off of the morning’s lows was suspected intervention in the foreign exchange market by Japanese authorities. The Bank of Japan overnight left monetary policy unchanged, but was somewhat hawkish in its policy statement. That had the yen modestly stronger v

BTC-2,43%

- Reward

- like

- Comment

- Repost

- Share

🐸 $PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

PEPE Coin price prediction has reached the stage of definite phase as the price stabilized above the recent demand. The market has since moved on a narrowed range following the lack of downside momentum as it approached structural support.

This stabilization comes after a definite change in participation behavior which, in turn, pits price under a distinct resistance band. The structure has now become a directional resolution where structure, as opposed to sentiment, is the key factor to the next move.

🔸 PEPE Coin P

PEPE Coin price prediction has reached the stage of definite phase as the price stabilized above the recent demand. The market has since moved on a narrowed range following the lack of downside momentum as it approached structural support.

This stabilization comes after a definite change in participation behavior which, in turn, pits price under a distinct resistance band. The structure has now become a directional resolution where structure, as opposed to sentiment, is the key factor to the next move.

🔸 PEPE Coin P

PEPE-4,71%

- Reward

- like

- Comment

- Repost

- Share

Retrodrops - next level 🧠

Someone decided not to skimp and assembled a real farm of Solana Phones, ordering 100 phones (~ $500 each).

Yesterday, the owners received a drop of the SKR token - an average of $500 per account, and those who actively engaged in on-chain activity received $2,000-5,000 each.

As the crypto enthusiasts write on Twitter, the guy who assembled this farm ended up earning about $200k just from the SKR drop - and this is not counting all the previous drops that came to the phone owners from various ecosystem projects.

#SOL #Solana $SOL

Someone decided not to skimp and assembled a real farm of Solana Phones, ordering 100 phones (~ $500 each).

Yesterday, the owners received a drop of the SKR token - an average of $500 per account, and those who actively engaged in on-chain activity received $2,000-5,000 each.

As the crypto enthusiasts write on Twitter, the guy who assembled this farm ended up earning about $200k just from the SKR drop - and this is not counting all the previous drops that came to the phone owners from various ecosystem projects.

#SOL #Solana $SOL

SOL-4,65%

- Reward

- like

- 3

- 1

- Share

GateUser-16e6ff21 :

:

Go full throttle 🚀View More

- Reward

- 1

- Comment

- Repost

- Share

🪙 U.S. first spot $XRP ETF crashes over 20%

The first U.S. spot XRP exchange-traded fund (ETF) has fallen more than 20% from its post-launch peak, despite strong early institutional demand.

In this context, the Canary XRP ETF, which trades on Nasdaq under the ticker XRPC, closed the last session at $20.26, leaving it down about 23.9% from its launch.

Notably, the ETF rallied into the mid-$26 range shortly after launch before reversing lower. At the same time, XRPC has fallen about 8.5% in the latest session and is down more than 10% over the past five trading days.

While the ETF remains margi

The first U.S. spot XRP exchange-traded fund (ETF) has fallen more than 20% from its post-launch peak, despite strong early institutional demand.

In this context, the Canary XRP ETF, which trades on Nasdaq under the ticker XRPC, closed the last session at $20.26, leaving it down about 23.9% from its launch.

Notably, the ETF rallied into the mid-$26 range shortly after launch before reversing lower. At the same time, XRPC has fallen about 8.5% in the latest session and is down more than 10% over the past five trading days.

While the ETF remains margi

XRP-4,48%

- Reward

- like

- Comment

- Repost

- Share

📉 Bitcoin bounces to $89,500 as Trump strikes calmer tone in Greenland acquisition in Davos

Bitcoin BTC $89,109.82 mounted a modest bounce on Wednesday U.S. morning in the U.S. as Trump struck a more conciliatory tone on Greenland during a keynote speech at the World Economic Forum at Davos.

"I'm seeking immediate negotiations to once again discuss the acquisition of Greenland by the United States, just as we have acquired many other territories throughout our history," Trump said. "This will not be a threat to NATO."

"All I'm asking is a piece of ice," he added later during the speech, notin

Bitcoin BTC $89,109.82 mounted a modest bounce on Wednesday U.S. morning in the U.S. as Trump struck a more conciliatory tone on Greenland during a keynote speech at the World Economic Forum at Davos.

"I'm seeking immediate negotiations to once again discuss the acquisition of Greenland by the United States, just as we have acquired many other territories throughout our history," Trump said. "This will not be a threat to NATO."

"All I'm asking is a piece of ice," he added later during the speech, notin

BTC-2,43%

- Reward

- 1

- Comment

- Repost

- Share

🐻 Aggressive short position

Kit opened a series of short positions with an aggressive stop-loss, where the actual stop-loss is actually liquidation.

💵 Since the market is declining, he has no reason to worry yet - the profit from the shorts is already almost $13 million.

Either he knew something, or he was lucky - he conducted a thorough analysis 😉

Kit opened a series of short positions with an aggressive stop-loss, where the actual stop-loss is actually liquidation.

💵 Since the market is declining, he has no reason to worry yet - the profit from the shorts is already almost $13 million.

Either he knew something, or he was lucky - he conducted a thorough analysis 😉

- Reward

- 1

- Comment

- Repost

- Share

🟠 Bitcoin plunges below $90,000 amid global risk asset selloff

Bitcoin BTC $90,533.33 dropped 3% to below $90,000 during U.S. morning trading on Tuesday after a meltdown in Japan’s government bond market combined with U.S. President Trump’s ongoing tariff threats against Europe to push risk assets sharply lower.

Ether ETH$3,027.68 fell more than 7% over the past 24 hours, sending the native cryptocurrency of the Ethereum network back below a crucial $3,000 mark for the first time since January 2.

Highlighting altcoin weakness, bitcoin's grip over the crypto market has been steadily climbing.

Bitcoin BTC $90,533.33 dropped 3% to below $90,000 during U.S. morning trading on Tuesday after a meltdown in Japan’s government bond market combined with U.S. President Trump’s ongoing tariff threats against Europe to push risk assets sharply lower.

Ether ETH$3,027.68 fell more than 7% over the past 24 hours, sending the native cryptocurrency of the Ethereum network back below a crucial $3,000 mark for the first time since January 2.

Highlighting altcoin weakness, bitcoin's grip over the crypto market has been steadily climbing.

- Reward

- 2

- Comment

- Repost

- Share

📊 Cardano Needs This Level to Confirm End of Consolidation in Valid 1-2 Wave Pattern

The recent price development for Cardano (ADA) mirrors a 1-2 wave in a broader Elliot Wave Theory structure. However, Cardano needs to reach an identified price level to confirm the structure and the end of the wave 2 correctional push.

🔸 Cardano in a Valid 1-2 Wave Pattern?

Research firm More Crypto Online identified in its recent X post that Cardano is in a valid 1-2 wave pattern. An accompanying chart provides further context, showing whats appears to be an Elliott Wave pattern on the 30-minute timeframe.

The recent price development for Cardano (ADA) mirrors a 1-2 wave in a broader Elliot Wave Theory structure. However, Cardano needs to reach an identified price level to confirm the structure and the end of the wave 2 correctional push.

🔸 Cardano in a Valid 1-2 Wave Pattern?

Research firm More Crypto Online identified in its recent X post that Cardano is in a valid 1-2 wave pattern. An accompanying chart provides further context, showing whats appears to be an Elliott Wave pattern on the 30-minute timeframe.

ADA-5,4%

- Reward

- 1

- Comment

- Repost

- Share