LordCrypto

No content yet

LordCrypto

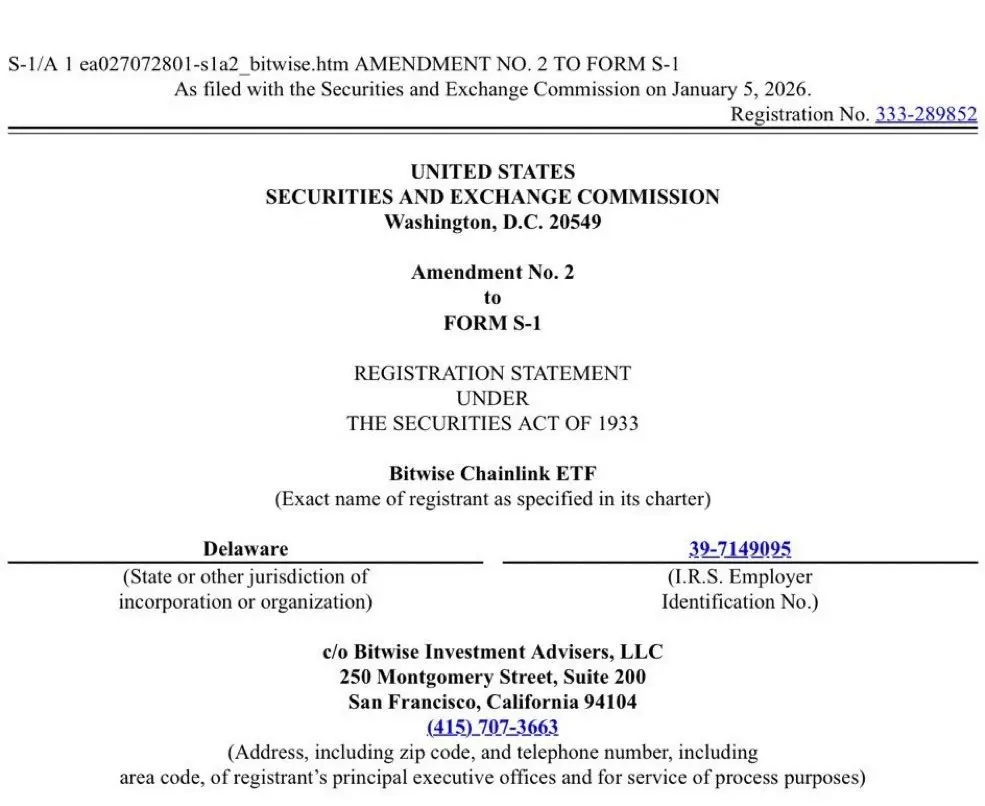

I’m constructive on @chainlink , and recent developments only reinforce that view.

The approval of a Chainlink ETF by Bitwise isn’t about short-term price action. It’s about where institutional attention is slowly migrating. Exposure is expanding beyond L1s and into infrastructure that actually underpins onchain finance.

Chainlink sits in a unique position.

As markets move toward tokenized assets, onchain settlement, and real-world financial instruments interacting with blockchains, reliable data becomes non-negotiable. Oracles aren’t optional plumbing they’re critical infrastructure. Chainlin

The approval of a Chainlink ETF by Bitwise isn’t about short-term price action. It’s about where institutional attention is slowly migrating. Exposure is expanding beyond L1s and into infrastructure that actually underpins onchain finance.

Chainlink sits in a unique position.

As markets move toward tokenized assets, onchain settlement, and real-world financial instruments interacting with blockchains, reliable data becomes non-negotiable. Oracles aren’t optional plumbing they’re critical infrastructure. Chainlin

LINK-3,28%

- Reward

- like

- Comment

- Repost

- Share

The break is over.

- Reward

- like

- Comment

- Repost

- Share

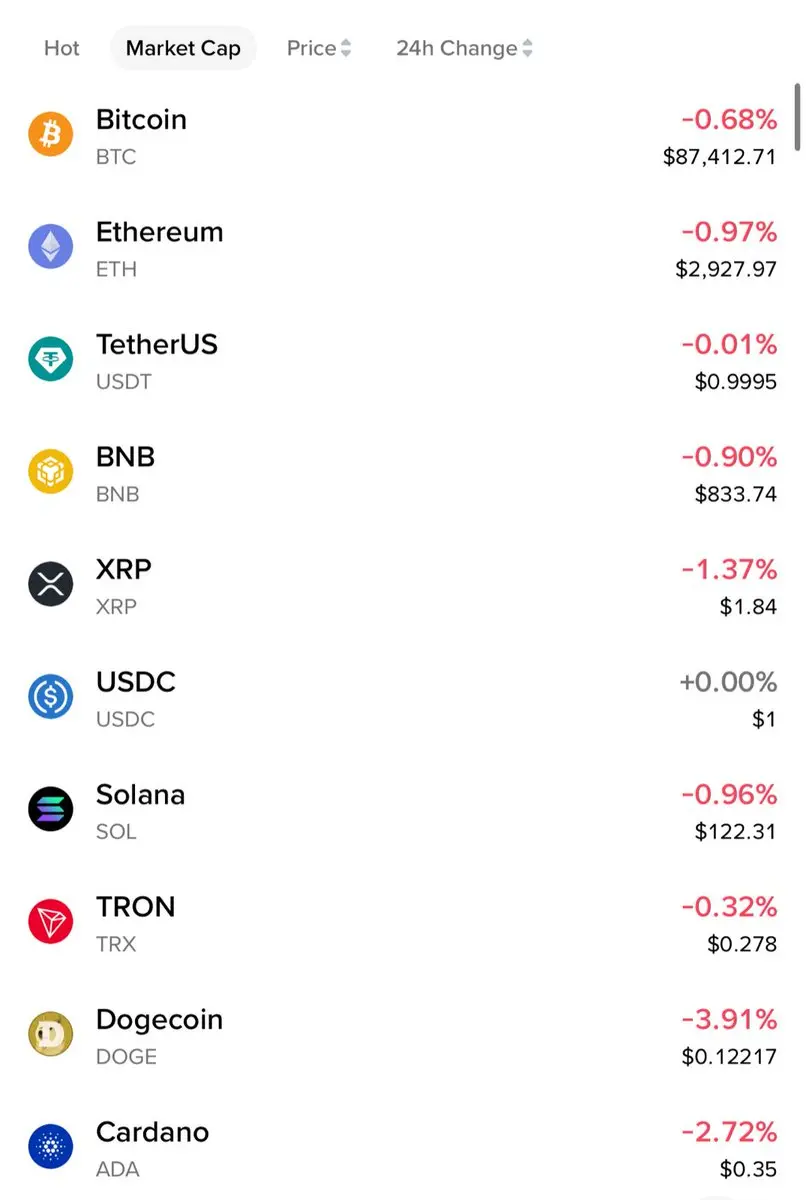

Markets reacting to macro headlines again, geopolitical noise around the U.S. and Venezuela is showing up in price action.

Short-term volatility was expected.

BTC has absorbed similar shocks before and tends to recover once uncertainty fades. Structure remains intact, even if sentiment temporarily weakens.

Altcoins are quietly holding up better than most realize. That usually matters more than a red heatmap on the day.

Patience is still the edge here.

Short-term volatility was expected.

BTC has absorbed similar shocks before and tends to recover once uncertainty fades. Structure remains intact, even if sentiment temporarily weakens.

Altcoins are quietly holding up better than most realize. That usually matters more than a red heatmap on the day.

Patience is still the edge here.

BTC-2,51%

- Reward

- like

- Comment

- Repost

- Share

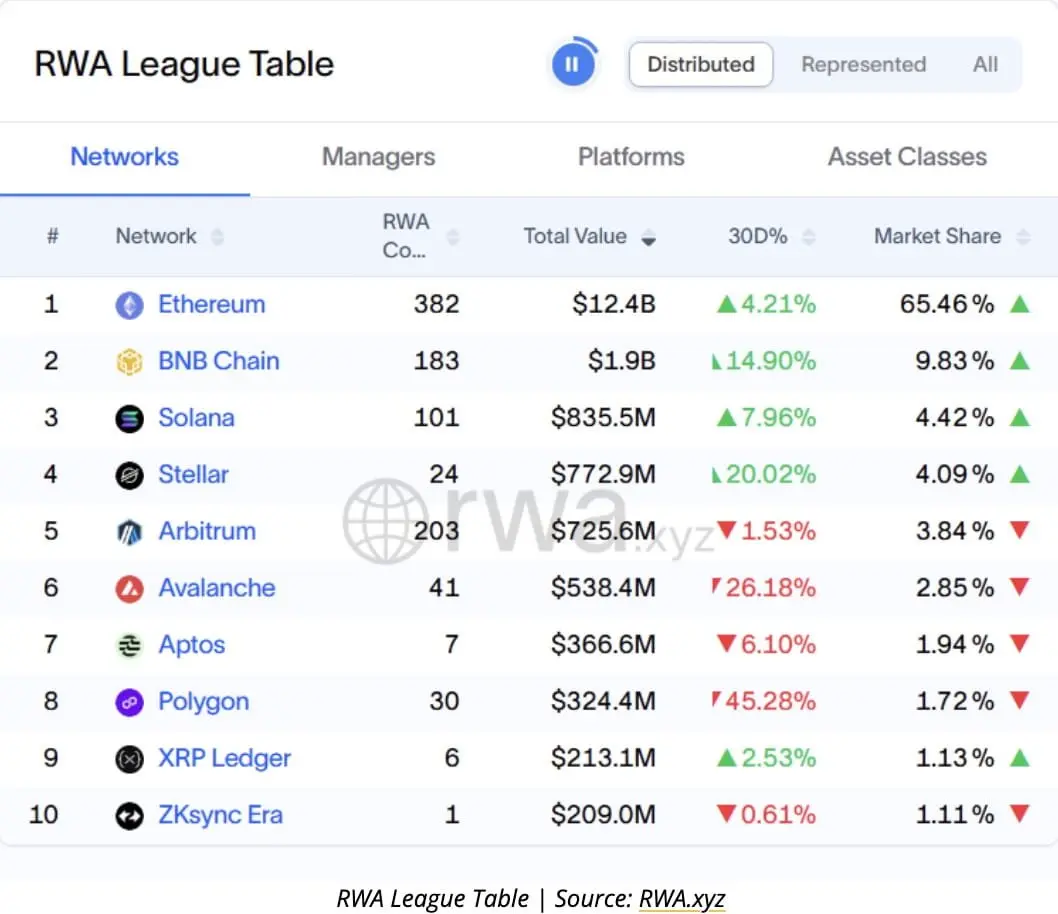

Ondo Finance and the RWA market are quietly moving into a different phase.

While much of crypto remains price-focused, real-world asset tokenization is expanding through institutional experimentation, not retail speculation.

RWAs tripled to ~$18.5B in 2025 and are now DeFi’s fifth-largest category by TVL, surpassing DEXs. Forecasts from Cantor Fitzgerald suggest this figure could exceed $50B by 2026 as more financial institutions test onchain settlement.

@OndoFinance sits at the center of this shift.

Rather than chasing experimental use cases, Ondo has focused on regulated, capital-efficient a

While much of crypto remains price-focused, real-world asset tokenization is expanding through institutional experimentation, not retail speculation.

RWAs tripled to ~$18.5B in 2025 and are now DeFi’s fifth-largest category by TVL, surpassing DEXs. Forecasts from Cantor Fitzgerald suggest this figure could exceed $50B by 2026 as more financial institutions test onchain settlement.

@OndoFinance sits at the center of this shift.

Rather than chasing experimental use cases, Ondo has focused on regulated, capital-efficient a

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The market has been relatively calm over the holidays.

That’s usually when positioning matters more than predictions.

That’s usually when positioning matters more than predictions.

- Reward

- like

- Comment

- Repost

- Share

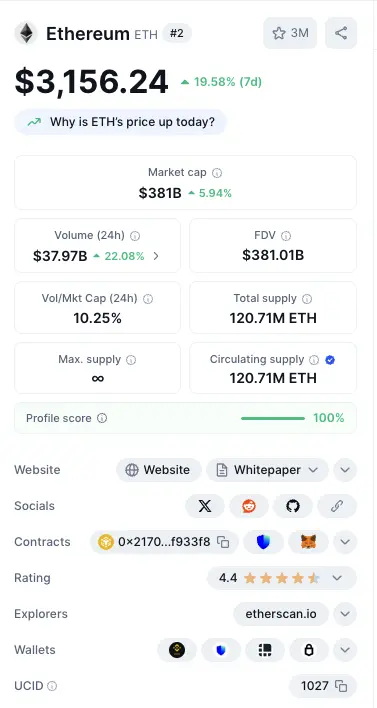

Suddenly those who were bearish on $ETH are now setting higher targets. It just goes t9o show how fickle many are in CT.

If you sold off your $ETH bag because someone else said Ethereum was going to zero, you have no one else to blame for your loss but yourself.

Also, the Fear & Greed index shows that the current prevailing sentiment is Greed.

I know that many on here will follow the "Buy Fear, Sell Greed" mantra, but I'd only start thinking of selling when we're in Extreme Greed territory.

That's anywhere from 75 and above. But of course, profit is profit, so if you decide to sell now, it's

If you sold off your $ETH bag because someone else said Ethereum was going to zero, you have no one else to blame for your loss but yourself.

Also, the Fear & Greed index shows that the current prevailing sentiment is Greed.

I know that many on here will follow the "Buy Fear, Sell Greed" mantra, but I'd only start thinking of selling when we're in Extreme Greed territory.

That's anywhere from 75 and above. But of course, profit is profit, so if you decide to sell now, it's

- Reward

- like

- Comment

- Repost

- Share

Last week, BTC ETFs lost their daily net inflow streak, coincidentally it was on the first day of July.

Unsurprisingly, Ethereum ETFs recorded another day of negative net inflows.

But the key point to note is that both assets have been gaining more bullish attention to make up for any outflows.

Both charts are also testing key resistance levels, and Ethereum’s upcoming developments are enough reason to stay bullish. Also, after the last pullback, I expect to see some green candles this week for $ETH.

Unsurprisingly, Ethereum ETFs recorded another day of negative net inflows.

But the key point to note is that both assets have been gaining more bullish attention to make up for any outflows.

Both charts are also testing key resistance levels, and Ethereum’s upcoming developments are enough reason to stay bullish. Also, after the last pullback, I expect to see some green candles this week for $ETH.

- Reward

- like

- Comment

- Repost

- Share

I saw some fellas on the TL argue about whether BTC price leads Global liquidity, or if Global Liquidity leads Bitcoin price.

If you don't know what that is, the idea is simple, it's a chart showing the correlation between the amount of money available in the world for people to invest with, and the price level of Bitcoin.

As you can see below, when liquidity trends bullish, it's only a matter of time before Bitcoin's price follows.

Of course, there were also some guys who offset the dates a bit to show the correlation a bit better, which showed that M2 (Global liquidity) actually is in the le

If you don't know what that is, the idea is simple, it's a chart showing the correlation between the amount of money available in the world for people to invest with, and the price level of Bitcoin.

As you can see below, when liquidity trends bullish, it's only a matter of time before Bitcoin's price follows.

Of course, there were also some guys who offset the dates a bit to show the correlation a bit better, which showed that M2 (Global liquidity) actually is in the le

- Reward

- like

- Comment

- Repost

- Share

Those who were crying about "Paper Bitcoin" weren't wrong afterall.

Clearly, there are exchanges selling more BTC than they have in their reserves, what happens when their customers want to withdraw their holdings to self custody?

I don't think I have to spell it out to you, but thhis reminds me of Luna all over again.

Any smart person should take this as a sign to keep their crypto holdings in a cold wallet.

Clearly, there are exchanges selling more BTC than they have in their reserves, what happens when their customers want to withdraw their holdings to self custody?

I don't think I have to spell it out to you, but thhis reminds me of Luna all over again.

Any smart person should take this as a sign to keep their crypto holdings in a cold wallet.

- Reward

- like

- Comment

- Repost

- Share

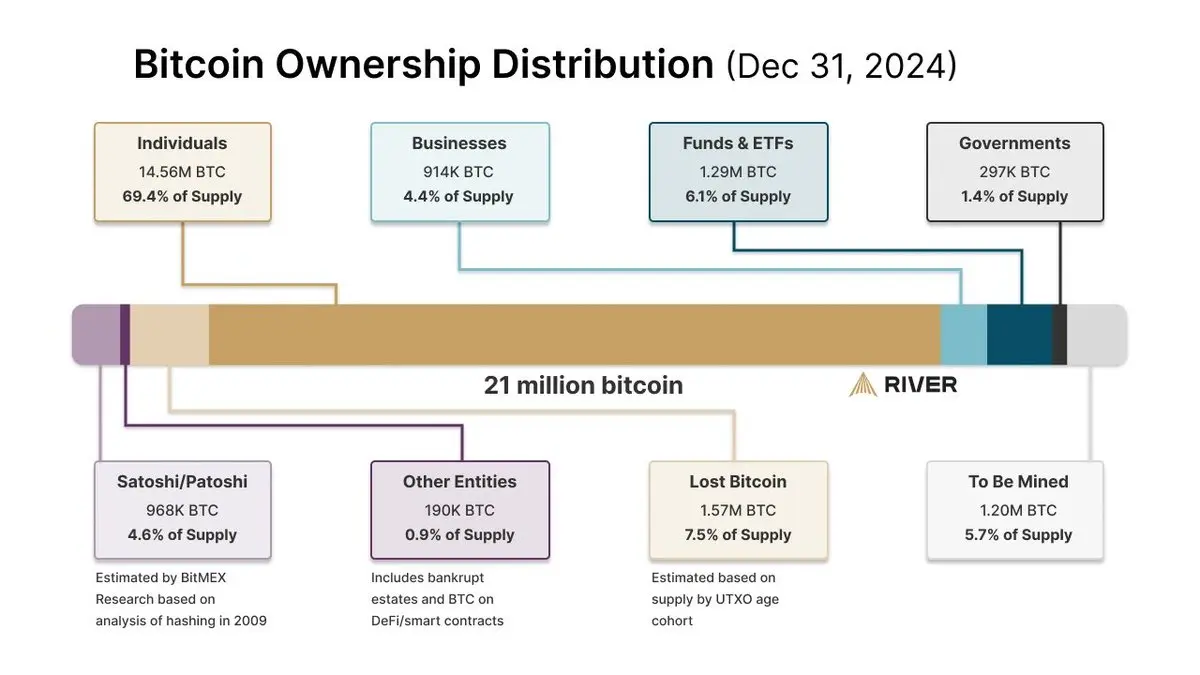

As much as the news would have you believe that less whales and individuals are holding BTC, don't believe it.

Individuals still hold about 9x what any organisation or government holds combined! Even the BTC that's attributed to exchanges belongs to individuals.

You should be able to see through the purpose of such headlines.

The most recent one on Bloomberg that's flying around says that Bitcoin whales dumped 500k BTC in the past year while organisations accumulated over 900k BTC.

It paints a picture that Bitcoin is becoming more of an institutional asset, and almost screams "individuals keep

Individuals still hold about 9x what any organisation or government holds combined! Even the BTC that's attributed to exchanges belongs to individuals.

You should be able to see through the purpose of such headlines.

The most recent one on Bloomberg that's flying around says that Bitcoin whales dumped 500k BTC in the past year while organisations accumulated over 900k BTC.

It paints a picture that Bitcoin is becoming more of an institutional asset, and almost screams "individuals keep

- Reward

- like

- Comment

- Repost

- Share

When you see some accounts say that the current market is unpredictable, it's not because they've lost their edge as technical analysts.

It's because this cycle we have more factors than before:

♦️ We've never had crypto ETFs before now,

♦️ More institutions hold crypto now more than ever

♦️ Introduction of regulations like Europe's MiCA

♦️ USD stablecoin debates, and the back and forth between Trump and Powell

It's because this cycle we have more factors than before:

♦️ We've never had crypto ETFs before now,

♦️ More institutions hold crypto now more than ever

♦️ Introduction of regulations like Europe's MiCA

♦️ USD stablecoin debates, and the back and forth between Trump and Powell

- Reward

- like

- Comment

- Repost

- Share

If a project team is trying to make you feel dumb, then that's a red flag because nothing is ever too complex to understand if it's legit.

We've gone from L1s to L2s, and now we have L3 blockchains pushing the scalability narrative, but the sad truth is that as high-sounding and innovative as a project's vision and mission statement is, it means nothing if people don't understand why they need you and your products.

Some weeks back a project accused its community of not reading its roadmap correctly, but that doesn't make any sense because the community members are way more than the team, so i

We've gone from L1s to L2s, and now we have L3 blockchains pushing the scalability narrative, but the sad truth is that as high-sounding and innovative as a project's vision and mission statement is, it means nothing if people don't understand why they need you and your products.

Some weeks back a project accused its community of not reading its roadmap correctly, but that doesn't make any sense because the community members are way more than the team, so i

- Reward

- like

- Comment

- Repost

- Share

Somehow everyone thinks they are right and give no room for the next person's opinion.

Some folks think NFTs are in season, others think AI is the current meta, while some others believe that if you're not investing in RWAs RIGHT NOW, YOU'RE a moron.

Even those who believe that memecoins are the only way to make profit in the market are pushing that narrative strongly. It's such a mess.

I believe that every narrative has its use and its audience, and while blockchain projects for instance, are important as the basis on which other protocols build, not every blockchain project will make it.

And

Some folks think NFTs are in season, others think AI is the current meta, while some others believe that if you're not investing in RWAs RIGHT NOW, YOU'RE a moron.

Even those who believe that memecoins are the only way to make profit in the market are pushing that narrative strongly. It's such a mess.

I believe that every narrative has its use and its audience, and while blockchain projects for instance, are important as the basis on which other protocols build, not every blockchain project will make it.

And

- Reward

- like

- Comment

- Repost

- Share

Glad to see that $XRP ended June on a high note.

So a retest to the support line at $2.1 is possible.

Plus, with the fine situation being pushed back by the court, this price action was impressive, otherwise, if $XRP HODLers had panicked, the chart would've been a mess.

As it stands, $XRP is gearing for another leg up.

So a retest to the support line at $2.1 is possible.

Plus, with the fine situation being pushed back by the court, this price action was impressive, otherwise, if $XRP HODLers had panicked, the chart would've been a mess.

As it stands, $XRP is gearing for another leg up.

XRP-5,75%

- Reward

- like

- Comment

- Repost

- Share

Think about it, when the market is doing well, people care less about the fees, but in slow times like now, every cent matters especially when you're paying based on the percentage of your trading capital.

As for Raydium and Pumpdotfun, it doesn't make sense to pay 0.3% on Pumpdotfun, and pay another 0.25%-1% on Raydium, when you can just trade directly on PUMP.

As people move to protocols with lower fees, I expect we'll see more protocols competing by offering lower trading fees, which will ultimately be great for users.

But there's no telling what happens once the market picks up and everyo

As for Raydium and Pumpdotfun, it doesn't make sense to pay 0.3% on Pumpdotfun, and pay another 0.25%-1% on Raydium, when you can just trade directly on PUMP.

As people move to protocols with lower fees, I expect we'll see more protocols competing by offering lower trading fees, which will ultimately be great for users.

But there's no telling what happens once the market picks up and everyo

- Reward

- like

- Comment

- Repost

- Share

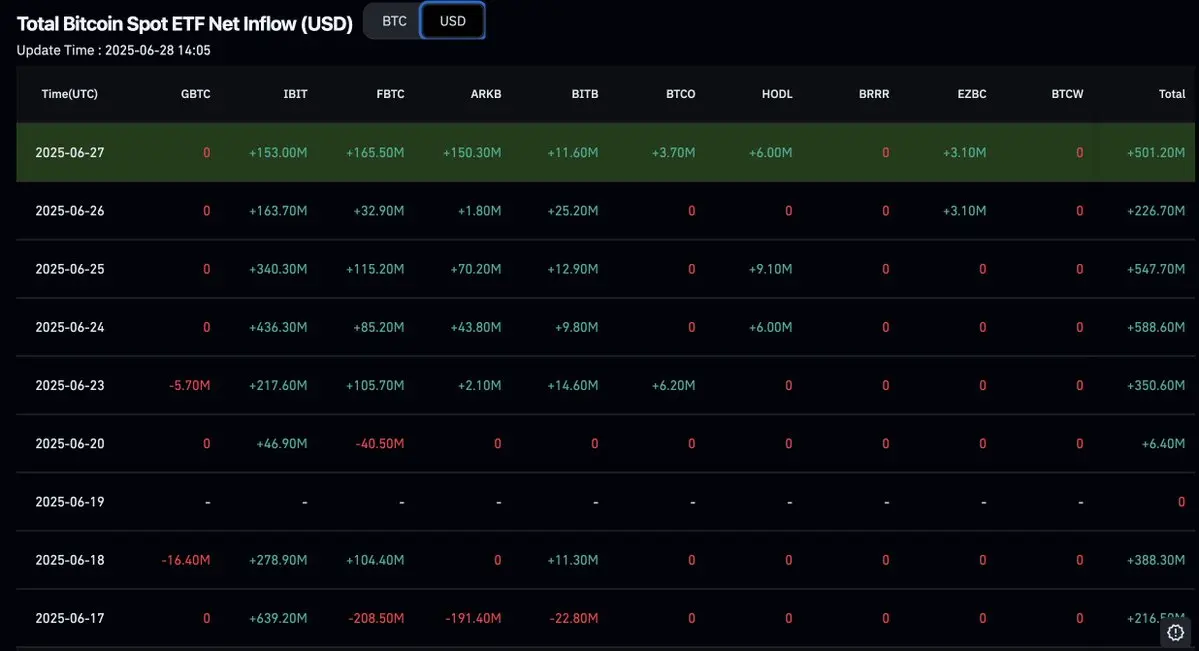

If anybody is still keeping tabs on the ETF inflows for BTC and ETH, this past week, $BTC maintained its inflow streak with higher numbers.

Daily net inflows went as high as $588 million on Tuesday, while Thursday saw the lowest inflows of $226 million.

Not bad at all since all days were net positive, which is not the case for $ETH.

Clearly the sentiment across board for both assets was briefly bearish on Thursday. Given the surge on prior days, a retest was expected, hence the low inflows/investments.

Hoping for a better flow next week.

Daily net inflows went as high as $588 million on Tuesday, while Thursday saw the lowest inflows of $226 million.

Not bad at all since all days were net positive, which is not the case for $ETH.

Clearly the sentiment across board for both assets was briefly bearish on Thursday. Given the surge on prior days, a retest was expected, hence the low inflows/investments.

Hoping for a better flow next week.

- Reward

- like

- Comment

- Repost

- Share

The price is dipping and clearly many $XRP holders don't understand what is going on, so the default response is panic. But let's get some things clear.

♦️ XRP is still NOT a security, so that's been settled and there's no issue with it being sold on the open market.

♦️ The $125 Million has already been paid, it's just sitting in escrow. So if the fine is not reduced, it's a matter of releasing it to the SEC. No XRP will be sold and no extra funds are needed to pay this fine.

♦️ The only reason why this ruling is even being mentioned is that Ripple is seeking favourable conditions, so instead

♦️ XRP is still NOT a security, so that's been settled and there's no issue with it being sold on the open market.

♦️ The $125 Million has already been paid, it's just sitting in escrow. So if the fine is not reduced, it's a matter of releasing it to the SEC. No XRP will be sold and no extra funds are needed to pay this fine.

♦️ The only reason why this ruling is even being mentioned is that Ripple is seeking favourable conditions, so instead

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share