#USCoreCPIHitsFourYearLow — 2026年1月のインフレが暗示する本当の意味 🧵

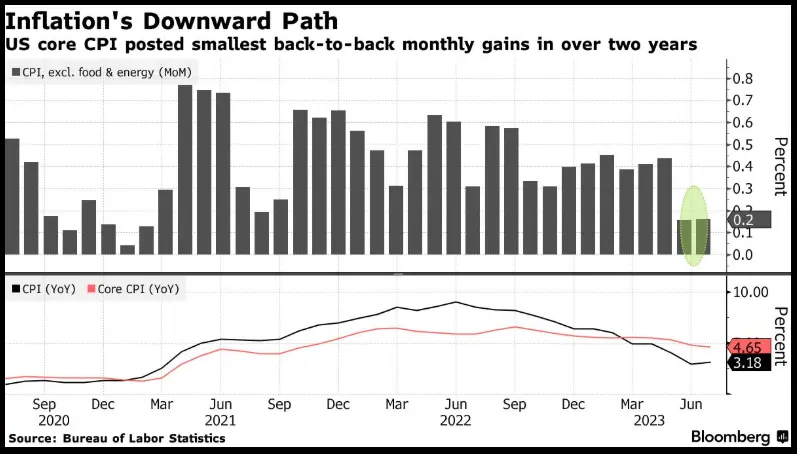

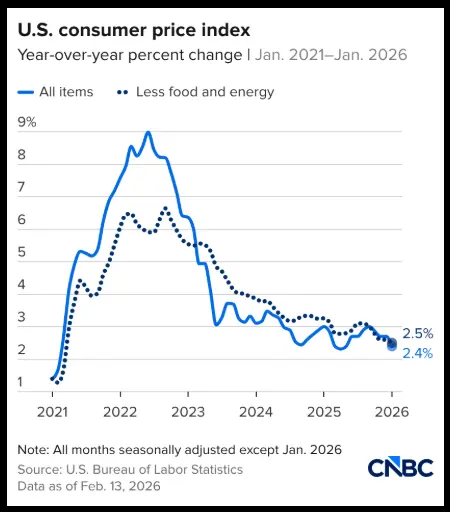

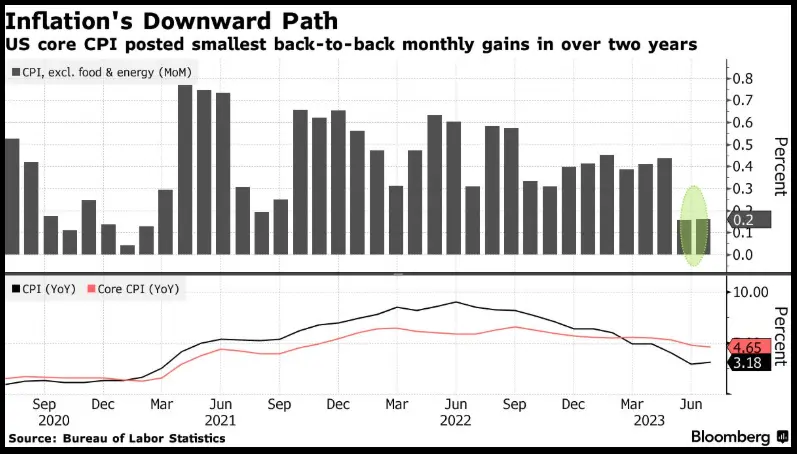

1/ 労働統計局からの新しい1月のデータは、インフレが予想よりも早く冷却していることを示しています。ヘッドラインCPIは前月比+0.2%、前年比+2.4%で、数ヶ月ぶりに最も穏やかな年間ペースとなりました。食品とエネルギーを除くコアCPIは前年比+2.5%に鈍化し、4年ぶりの低水準に近づいています。エネルギー価格は下落し、食品は安定を保ち、住宅インフレもついに緩和しています。

2/ より大きなストーリーはトレンドの方向性です。デフレーションの動きが明らかに再び進行しています。商品価格は軟化しており、中古車や消費財は依然としてデフレ傾向にありますが、サービス価格は粘り強いものの、もはや加速していません。これは連邦準備制度理事会(FRB)が望む、徐々に冷え込む兆候そのものです。

3/ 政策の見通し:これは「ゴルディロックス」的な結果です—インフレが緩やかに冷却しつつも、経済に明らかなダメージを与えない状態です。これにより即時の利下げ圧力は軽減されますが、トレンドが続けば2026年後半に緩和の可能性が高まります。市場は今のところ、今後のPCEデータが減速を確認すれば、年央の利下げを見込んでいます。

4/ 市場の反応は即座でした。トレーダーは緩やかな金融環境を織り込み、ビットコインは急騰しました。インフレ期待の低下はドルを弱め、債券利回りを圧縮し、これが歴史的にリスク資産を押し上げる要因となっています。流動性の期待—現在の金利だけでなく将来の見通しも—が暗号資産のセンチメントを左右しています。

5/ 暗号資産の観点:持続的なデフレーションは、デジタル資産市場全体にとって追い風です。インフレが引き続き冷却すれば、世界的な流動性状況が改善し、資金がハイベータ資産に回帰します。これにより、ビットコインやイーサリアムはより高い抵抗ゾーンを試す余地が生まれます。ただし、将来のデータで予想外に高いインフレが示されると、状況が急激に引き締まり、ボラティリティを引き起こす可能性もあります。

6/ 結論:インフレは冷却しつつあり、コア圧力も緩和されており、マクロ環境は徐々にリスクオンに傾いています。暗号資産にとっては、この環境はパニックよりも積み増しを促すものです。次の重要なきっかけは、今後のPCEレポートです—これがこのトレンドを裏付けるか、あるいは挑戦するかを左右します。

あなたのマクロ設定に対する見解は何ですか?強気の継続か、それとも短期的な調整か? 👇

1/ 労働統計局からの新しい1月のデータは、インフレが予想よりも早く冷却していることを示しています。ヘッドラインCPIは前月比+0.2%、前年比+2.4%で、数ヶ月ぶりに最も穏やかな年間ペースとなりました。食品とエネルギーを除くコアCPIは前年比+2.5%に鈍化し、4年ぶりの低水準に近づいています。エネルギー価格は下落し、食品は安定を保ち、住宅インフレもついに緩和しています。

2/ より大きなストーリーはトレンドの方向性です。デフレーションの動きが明らかに再び進行しています。商品価格は軟化しており、中古車や消費財は依然としてデフレ傾向にありますが、サービス価格は粘り強いものの、もはや加速していません。これは連邦準備制度理事会(FRB)が望む、徐々に冷え込む兆候そのものです。

3/ 政策の見通し:これは「ゴルディロックス」的な結果です—インフレが緩やかに冷却しつつも、経済に明らかなダメージを与えない状態です。これにより即時の利下げ圧力は軽減されますが、トレンドが続けば2026年後半に緩和の可能性が高まります。市場は今のところ、今後のPCEデータが減速を確認すれば、年央の利下げを見込んでいます。

4/ 市場の反応は即座でした。トレーダーは緩やかな金融環境を織り込み、ビットコインは急騰しました。インフレ期待の低下はドルを弱め、債券利回りを圧縮し、これが歴史的にリスク資産を押し上げる要因となっています。流動性の期待—現在の金利だけでなく将来の見通しも—が暗号資産のセンチメントを左右しています。

5/ 暗号資産の観点:持続的なデフレーションは、デジタル資産市場全体にとって追い風です。インフレが引き続き冷却すれば、世界的な流動性状況が改善し、資金がハイベータ資産に回帰します。これにより、ビットコインやイーサリアムはより高い抵抗ゾーンを試す余地が生まれます。ただし、将来のデータで予想外に高いインフレが示されると、状況が急激に引き締まり、ボラティリティを引き起こす可能性もあります。

6/ 結論:インフレは冷却しつつあり、コア圧力も緩和されており、マクロ環境は徐々にリスクオンに傾いています。暗号資産にとっては、この環境はパニックよりも積み増しを促すものです。次の重要なきっかけは、今後のPCEレポートです—これがこのトレンドを裏付けるか、あるいは挑戦するかを左右します。

あなたのマクロ設定に対する見解は何ですか?強気の継続か、それとも短期的な調整か? 👇