2025 UMA Price Prediction: Expert Analysis and Market Outlook for the Universal Market Access Token

Introduction: UMA's Market Position and Investment Value

UMA (UMA) as a decentralized financial contract platform has been establishing itself since its inception in 2020. As of 2025, UMA's market capitalization has reached approximately $88.94 million, with a circulating supply of around 89.1 million tokens, with prices currently hovering around $0.6999. This innovative protocol, which enables parties to design and create their own unique financial contracts through an open-source framework, is playing an increasingly vital role in promoting various financial innovations within the decentralized finance ecosystem.

This article will provide a comprehensive analysis of UMA's price trends from 2025 through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors looking to understand this decentralized finance asset's future trajectory.

UMA Price Analysis Report

I. UMA Price History Review and Market Status

UMA Historical Price Evolution

- 2020 (Project Launch): UMA protocol launched with an initial price of $1.1627, establishing itself as a decentralized financial contract platform.

- February 2021 (All-Time High): UMA reached its historical peak of $41.56 on February 4, 2021, marking the height of market enthusiasm for the project.

- 2021-2025 (Extended Decline): Following the peak, UMA experienced a prolonged downtrend, declining approximately 78.85% over the one-year period, reflecting broader market cycles and project maturation phases.

UMA Current Market Status

As of December 18, 2025, UMA is trading at $0.6999, reflecting significant price compression from historical highs. The 24-hour trading volume stands at $36,639.08, with the token experiencing a -4.23% decline over the past 24 hours. The 1-hour performance shows marginal gains of +0.59%, indicating short-term consolidation.

The token's market capitalization is approximately $62.36 million, while the fully diluted valuation reaches $88.94 million. With a circulating supply of 89,100,247.68 UMA tokens out of a total supply of 127,072,799.08 tokens (77.76% circulating), the project maintains a market dominance of 0.0028%. Currently ranked 441st by market cap, UMA is listed on 40 exchanges, demonstrating reasonable liquidity and accessibility.

Price pressure continues with 7-day and 30-day declines of -13.61% and -22.64% respectively, though the 1-hour timeframe suggests potential stabilization. The token's 24-hour trading range spans from $0.6879 to $0.7403, indicating moderate volatility containment within the current market cycle.

Click to view current UMA market price

UMA Market Sentiment Index

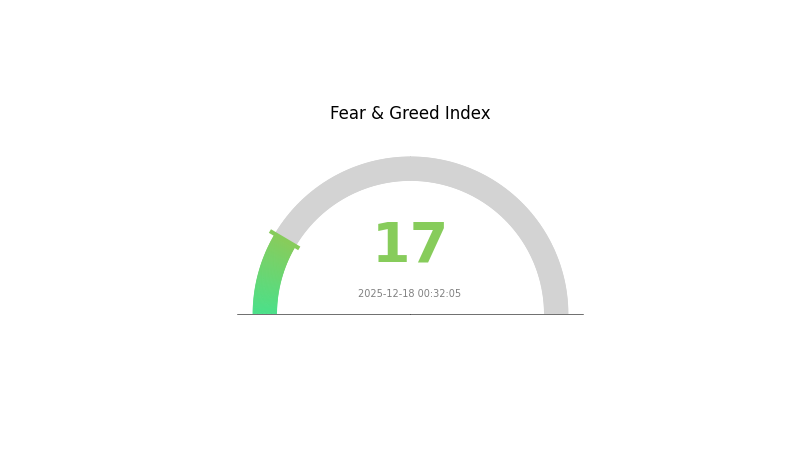

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 17. This exceptionally low sentiment indicates severe pessimism among investors, presenting potential opportunities for contrarian traders. Market participants are showing heightened anxiety, likely driven by adverse news or significant price declines. During such periods, savvy investors on Gate.com often prepare to capitalize on potential reversals. It's crucial to conduct thorough research and risk management while navigating these volatile conditions. The extreme fear sentiment suggests assets may be oversold, though patience and strategy remain essential.

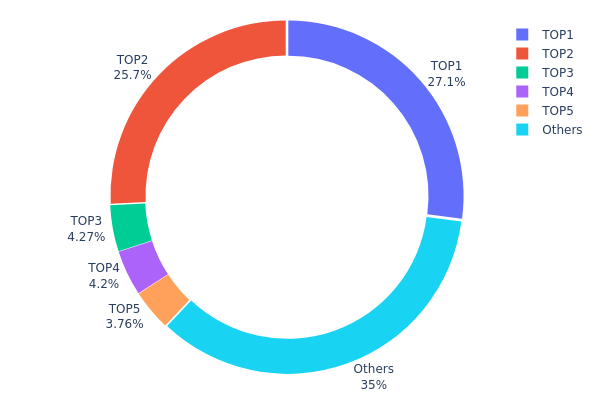

UMA Holdings Distribution

The address holdings distribution represents the concentration of UMA tokens across different wallet addresses on-chain, serving as a critical indicator of token ownership structure and market decentralization. This metric reveals how UMA tokens are allocated among major holders and the broader community, providing insights into potential market vulnerabilities and governance dynamics.

Current analysis of UMA's holdings distribution presents a moderately concentrated structure. The top two addresses collectively control 52.79% of the token supply, with the leading address (0x7b29...463fa8) holding 27.08% and the second address (0x0043...bd34ac) holding 25.71%. The top five addresses account for approximately 64.99% of total holdings, while the remaining addresses constitute 35.01% of the distribution. While this concentration level indicates some degree of centralization, it remains within a range commonly observed among established cryptocurrency projects. The relatively balanced split between the top two holders, rather than extreme dominance by a single entity, suggests a more distributed power structure compared to highly concentrated tokens.

The current address distribution presents moderate implications for market structure and stability. The significant holdings by top addresses could theoretically influence price movements or governance decisions, yet the presence of a substantial "Others" category (35.01%) provides a counterbalance to prevent absolute control. This distribution pattern reflects a typical post-launch phase where early investors and strategic holders maintain meaningful positions while community participation continues to expand. The data suggests UMA maintains reasonable decentralization characteristics for protocol governance purposes, though ongoing monitoring of holder behavior and token migration patterns remains important for assessing long-term sustainability.

Click to view current UMA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7b29...463fa8 | 34413.11K | 27.08% |

| 2 | 0x0043...bd34ac | 32677.47K | 25.71% |

| 3 | 0x61d6...5c9fcd | 5424.86K | 4.26% |

| 4 | 0xf977...41acec | 5332.83K | 4.19% |

| 5 | 0x8bd1...6e370c | 4775.29K | 3.75% |

| - | Others | 44449.25K | 35.01% |

II. Core Factors Influencing UMA's Future Price

Macro-economic Environment

-

Regulatory Policy Impact: The evolution of regulatory environments across different countries will significantly influence UMA's future development. As countries gradually refine their cryptocurrency asset regulatory policies, investor confidence in digital assets is expected to strengthen accordingly. Improved regulatory clarity can provide a more stable foundation for UMA's price appreciation.

-

Decentralized Finance Trends: UMA's price trajectory is further influenced by broader DeFi market trends. As the decentralized finance ecosystem continues to mature and expand, protocols like UMA that serve as infrastructure components (such as oracle solutions) benefit from increased adoption and utility within the growing DeFi landscape.

Tokenomics and Governance

- Token Economic Model: UMA's token plays a crucial role in governance and dispute resolution mechanisms. The project's economic model and market performance are subject to multiple factors. Token concentration and governance friction may impact market valuation and require ongoing attention from investors.

Market Dynamics

- Supply and Demand: UMA's future price is primarily driven by market supply and demand dynamics. Historical price trends, supply changes, and ecosystem development all contribute to price volatility. Understanding these market mechanics is essential for predicting future price movements.

III. 2025-2030 UMA Price Forecast

2025 Outlook

- Conservative Estimate: $0.67-$0.70

- Neutral Estimate: $0.70-$0.75

- Optimistic Estimate: $0.80-$0.85 (requiring sustained derivatives market demand and protocol adoption acceleration)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and expansion phase with increasing institutional interest in decentralized finance infrastructure

- Price Range Forecast:

- 2026: $0.63-$0.92

- 2027: $0.62-$1.19

- 2028: $0.78-$1.37

- Key Catalysts: Enhanced protocol functionality upgrades, expansion of UMA's synthetic asset ecosystem, growing adoption by DeFi platforms, increased on-chain derivatives trading volume, and strategic partnerships with major market participants

2029-2030 Long-term Outlook

- Base Case: $1.03-$1.67 (assuming steady market maturation, normalized regulatory environment, and consistent ecosystem growth)

- Optimistic Case: $1.24-$1.64 (contingent on breakthrough adoption in institutional derivatives markets and successful integration with emerging DeFi primitives)

- Transformational Case: $1.66+ (contingent on UMA becoming the dominant standard for decentralized price feeds and synthetic assets, coupled with mainstream blockchain adoption)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.85302 | 0.6992 | 0.67123 | 0 |

| 2026 | 0.91581 | 0.77611 | 0.62865 | 10 |

| 2027 | 1.19281 | 0.84596 | 0.61755 | 20 |

| 2028 | 1.36597 | 1.01938 | 0.78493 | 45 |

| 2029 | 1.66975 | 1.19268 | 1.0257 | 70 |

| 2030 | 1.63159 | 1.43122 | 1.24516 | 104 |

UMA Investment Strategy & Risk Management Report

IV. UMA Professional Investment Strategy and Risk Management

UMA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, long-term value believers in decentralized financial infrastructure, and DeFi protocol enthusiasts

- Operational Recommendations:

- Establish positions gradually during market corrections when UMA demonstrates fundamental utility in synthetic asset creation

- Monitor governance participation to understand protocol development direction and community engagement

- Hold through market volatility cycles, as UMA's value proposition centers on becoming foundational DeFi infrastructure

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Monitor 24-hour price movements: Current -4.23% decrease indicates short-term bearish pressure

- Track 7-day trends: -13.61% weekly decline suggests consolidation phase

- Watch resistance/support levels around $0.6879 (24H low) and $0.7403 (24H high)

-

Trading Execution Points:

- Watch volume patterns on Gate.com to identify genuine breakout opportunities versus false signals

- Use limit orders during peak trading hours when volume reaches typical 24-hour average of ~$36,639

UMA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum, emphasizing core DeFi protocol exposure with limited volatility tolerance

- Active Investors: 3-7% allocation, allowing for position scaling during identified technical opportunities

- Institutional Investors: Up to 10% allocation, incorporating UMA alongside diversified DeFi protocol holdings

(2) Risk Mitigation Approaches

- Position Sizing: Never exceed 5% of total portfolio in any single position; maintain clear stop-loss orders at -20% from entry

- Hedging Considerations: Utilize dollar-cost averaging when building positions to reduce timing risk and market entry concentration

(3) Secure Storage Solutions

-

Non-custodial Management: Maintain private keys under your complete control for long-term holdings above $10,000 value

-

Security Best Practices:

- Enable multi-signature verification for high-value holdings

- Utilize hardware security modules for amounts exceeding personal risk tolerance thresholds

- Never share seed phrases or private keys; store recovery phrases in physically secure, offline locations

-

Critical Safety Notes: UMA tokens exist on Ethereum network (Contract: 0x04Fa0d235C4abf4BcF4787aF4CF447DE572eF828); verify contract addresses on Etherscan before any transaction to prevent phishing attacks

V. UMA Potential Risks and Challenges

UMA Market Risks

- Extreme Volatility: UMA has declined 78.85% over the past year, with all-time high of $41.56 compared to current $0.6999. This represents severe drawdown risk and potential for further downside

- Liquidity Constraints: Trading volume of $36,639 in 24 hours indicates relatively thin liquidity; large trades can experience significant slippage on standard trading pairs

- Competitive Pressure: Multiple decentralized finance platforms competing for similar use cases in synthetic asset and derivative creation

UMA Regulatory Risks

- Classification Uncertainty: Decentralized financial contracts may face regulatory scrutiny regarding derivatives trading and market manipulation concerns

- Jurisdictional Challenges: Different regulatory frameworks across regions may restrict UMA protocol usage or governance participation for certain users

- Compliance Evolution: Future financial regulations could impact UMA's positioning as a DeFi infrastructure layer

UMA Technical Risks

- Protocol Complexity: UMA's open-source protocol design requires continuous security audits and community monitoring for smart contract vulnerabilities

- Scalability Limitations: Ethereum network congestion and transaction costs may impact UMA's competitive advantage versus alternative platforms

- Upgrade Dependencies: Protocol improvements require community consensus through governance voting, potentially slowing critical updates

VI. Conclusion and Action Recommendations

UMA Investment Value Assessment

UMA operates as a foundational decentralized financial contract platform enabling synthetic asset creation and unique financial innovation. The token's 77.76% circulating supply-to-fully diluted valuation ratio indicates moderate dilution potential. However, the -78.85% one-year decline and current market capitalization of $88.9 million reflect significant market skepticism regarding current DeFi protocol valuations. Long-term viability depends on protocol adoption in synthetic asset markets and sustaining developer ecosystem growth.

UMA Investment Recommendations

✅ For Beginners: Start with minimal positions (under 1% portfolio) to understand UMA's technical protocol and DeFi ecosystem context before increasing exposure. Use Gate.com for secure, regulated access to UMA trading and liquidity.

✅ For Experienced Investors: Consider 3-5% portfolio allocation using disciplined dollar-cost averaging during identified technical weakness. Implement protective stop-losses at -20% and take profits at 50%+ gains to lock in volatility-driven opportunities.

✅ For Institutional Investors: Evaluate UMA as part of comprehensive DeFi protocol diversification, capped at 5-10% allocation. Conduct thorough due diligence on governance participation, developer activity, and competitive positioning versus alternative synthetic asset platforms.

UMA Trading Participation Methods

- Spot Trading: Direct purchase on Gate.com provides immediate exposure with full custody control and transparent pricing

- Technical Analysis Trading: Utilize charting tools within Gate.com platform to identify support/resistance levels and execute swing trades

- Dollar-Cost Averaging: Establish recurring purchase schedules to reduce timing risk and benefit from long-term protocol maturation

Cryptocurrency investment carries extreme risk. This analysis is educational content and does not constitute investment advice. Investors must conduct independent research aligned with personal risk tolerance and financial objectives. Consult qualified financial advisors before deploying capital. Never invest funds you cannot afford to lose completely.

FAQ

Is uma good crypto?

UMA is a notable DeFi cryptocurrency focused on synthetic assets and decentralized price feeds. It offers strong utility in the crypto ecosystem. Whether it's good depends on your investment strategy and market outlook, but UMA has demonstrated solid fundamentals and community support in the Web3 space.

What is the future of Uma?

UMA is positioned for growth with strong fundamentals in decentralized prediction markets. The protocol's innovative oracle technology and expanding ecosystem suggest positive long-term potential. Market sentiment indicates bullish prospects ahead.

Could assemble AI reach $1?

Yes, Assemble AI (ASM) has potential to reach $1 based on expert projections. Some analysts forecast it could surpass $1 by 2034, depending on market adoption and ecosystem growth. Price targets vary, but bullish scenarios support this milestone as achievable.

What is the all time high of Uma coin?

The all-time high of UMA coin is $41.56, reached in the past. UMA is currently trading significantly below this peak price level.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Prominent NFT Creators and Their Masterpieces

Efficient Crypto Payment Solutions: A Guide for Modern Businesses

Spur Protocol Daily Quiz Answer Today 19 december 2025

Dropee Question of the Day for 19 december 2025

Guide to Starting Your Journey as an NFT Creator