2025 PIN Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: PIN's Market Position and Investment Value

PinLink (PIN) operates as a decentralized computing infrastructure project that bridges artificial intelligence (AI), real-world assets (RWA), and DePin by leveraging global compute power. Since its launch in November 2024, PIN has established itself as a marketplace connecting users with tokenized GPUs, miners, and cloud storage resources. As of December 2025, PIN has achieved a market capitalization of approximately $9.09 million, with a circulating supply of 80 million tokens and a current price of around $0.11368. This innovative asset, recognized as a "RWA tokenization solution for distributed computing," is playing an increasingly critical role in enabling efficient, secure, and decentralized access to high-performance computational resources for developers and enterprises pursuing AI and machine learning initiatives.

This article will provide a comprehensive analysis of PIN's price trends through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

PinLink (PIN) Market Analysis Report

I. PIN Price History Review and Market Status

PIN Historical Price Evolution

- January 2025: PIN reached its all-time high of $3.8399 on January 6, 2025, marking the peak of its market performance during this period.

- December 2025: PIN declined significantly throughout the month, reaching its all-time low of $0.09176 on December 19, 2025, representing a dramatic correction from previous peaks.

PIN Current Market Situation

As of December 22, 2025, PIN is trading at $0.11368, with a 24-hour trading volume of $62,164.47. The token has experienced recent volatility, gaining 3.21% over the past 24 hours while declining 1.22% over the 7-day period and 15.9% over the 30-day period. Over the past year, PIN has experienced a substantial decline of 94.51% from higher levels.

The current market capitalization stands at $9,094,400, with a fully diluted valuation of $11,368,000. PIN maintains a market dominance of 0.00035% among all cryptocurrencies. The token has 80,000,000 tokens in circulation out of a total supply of 100,000,000, representing an 80% circulation ratio, with 25,153 token holders.

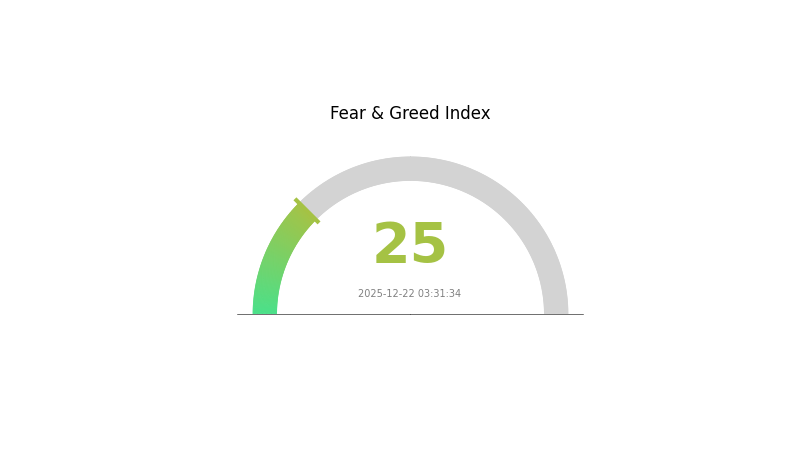

The current market sentiment indicates extreme fear conditions (VIX: 25), reflecting significant market uncertainty and volatility.

Click to view current PIN market price

PIN Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and heightened risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as panic selling can create attractive entry points. However, caution is advised, as further downside risk may still exist. Traders should maintain strict risk management and avoid emotional decision-making during periods of extreme fear.

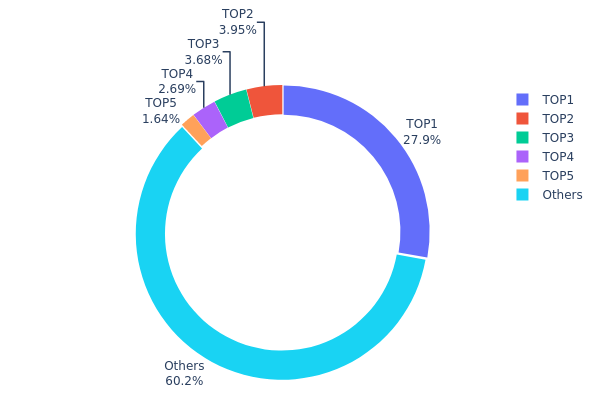

PIN Holdings Distribution

The address holdings distribution represents the concentration of PIN tokens across the top holders and the broader market. This metric is critical for assessing tokenomics health, market structure stability, and the degree of decentralization within the ecosystem. By analyzing how tokens are distributed among addresses, investors and analysts can identify concentration risks, evaluate governance implications, and understand potential price dynamics.

PIN exhibits moderate concentration characteristics, with the top holder commanding 27.85% of total supply—a significant position that warrants attention. The top five addresses collectively hold 39.79% of outstanding tokens, indicating that a relatively small number of stakeholders control a meaningful portion of the asset. However, the remaining 60.21% of tokens distributed among other addresses suggests reasonable fragmentation beyond the largest holders. This distribution pattern reflects a hybrid structure where neither extreme centralization nor full decentralization predominates.

The current holdings configuration presents both opportunities and considerations for market participants. While the concentration level does not indicate excessive centralization, the substantial stake held by the largest address introduces potential liquidity risks and could influence short-term price movements if significant transfers occur. The relatively balanced tail distribution—with 60% dispersed among numerous other addresses—provides some counterbalance against manipulation concerns and indicates a foundation of distributed participation. This structure suggests the PIN market maintains moderate decentralization characteristics while remaining dependent on the decisions and actions of principal stakeholders, typical of established blockchain assets navigating the balance between institutional concentration and community ownership.

For current PIN holdings distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0622...6ac68a | 27851.11K | 27.85% |

| 2 | 0x14d0...897162 | 3945.93K | 3.94% |

| 3 | 0x241f...3b81b6 | 3683.21K | 3.68% |

| 4 | 0x3cc9...aecf18 | 2689.82K | 2.68% |

| 5 | 0x9642...2f5d4e | 1642.72K | 1.64% |

| - | Others | 60187.21K | 60.21% |

II. Core Factors Influencing PIN's Future Price

Supply Mechanism

-

Mining Rewards Distribution: Mining rewards account for 65% of total supply (approximately 6.5 billion PI tokens), utilizing an exponential decay model to maintain token scarcity and ensure long-term sustainability.

-

Historical Patterns: Following Pi Network's mainnet launch on February 20, 2025, initial circulating supply was estimated at approximately 1 billion PI tokens (based on assumptions of 10 million users holding an average of 100 PI each). This limited initial circulation created significant price discovery dynamics as the network transitioned from a closed ecosystem to open network status.

-

Current Impact: The opening of the network removed firewall restrictions, enabling PI to achieve interoperability with external blockchains, exchanges, and commercial systems. Initial circulating supply constraints are expected to support price appreciation in the short term, though long-term price stability will depend on ecosystem adoption and actual utility development.

Institutional and Whale Dynamics

-

Enterprise Adoption: Pi Network's mainnet launch gained support from major exchanges including Gate.com, facilitating improved trading liquidity and market confidence recovery. The project transitioned from IOU token disputes to legitimate exchange listings, reducing concerns about its legitimacy.

-

User Base Foundation: Pi Network boasts over 19 million KYC-verified users, with particularly strong adoption in Asian markets such as South Korea, where downloads exceeded 100 million. This substantial user foundation provides unique growth potential if the network successfully engages these users and promotes active participation.

Technology Development and Ecosystem Building

-

Mainnet Launch: The February 20, 2025 mainnet activation represented a critical milestone, transitioning Pi Network from a closed test environment to a fully open blockchain ecosystem. This launch enabled external blockchain integration and commercial system interoperability.

-

Ecosystem Applications: Pi Network is developing through Pi Browser applications, utility functions, and a large user community to build a complete blockchain ecosystem. The project targets payment scenarios and plans to expand into emerging fields including artificial intelligence (AI), asset tokenization, and blockchain gaming applications.

-

Strategic Partnerships: Long-term success depends on establishing key partnerships and building robust payment and DeFi solutions. If Pi Network successfully develops as a decentralized payment network with strong ecosystem support, it could capture significant market share in the Web3 and DeFi sectors.

III. PIN Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.0910 - $0.1110

- Base Case Forecast: $0.1138

- Optimistic Forecast: $0.1240 (requires sustained market interest and positive ecosystem developments)

2026-2028 Mid-term Perspective

- Market Stage Expectation: Gradual accumulation phase with increasing institutional adoption and protocol maturation

- Price Range Forecast:

- 2026: $0.0713 - $0.1343

- 2027: $0.0658 - $0.1621

- 2028: $0.0794 - $0.2107

- Key Catalysts: Ecosystem expansion, partnership announcements, technological upgrades, and broader market sentiment shifts

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1065 - $0.2272 (assumes steady adoption growth and market recovery cycles)

- Optimistic Scenario: $0.1862 - $0.2267 (assumes accelerated mainstream adoption and regulatory clarity)

- Transformative Scenario: $0.2272+ (extreme favorable conditions including widespread institutional integration and protocol breakthrough innovations)

- 2030-12-22: PIN reaches $0.2267 (historical peak in long-term projection cycle)

Note: Price predictions are subject to market volatility and unforeseen macroeconomic factors. Users are encouraged to conduct thorough research and risk assessment before making investment decisions. Trading and investment activities carry inherent risks and should be executed through reputable platforms such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.124 | 0.11376 | 0.09101 | 0 |

| 2026 | 0.13433 | 0.11888 | 0.07133 | 4 |

| 2027 | 0.16206 | 0.12661 | 0.06584 | 11 |

| 2028 | 0.21072 | 0.14433 | 0.07938 | 26 |

| 2029 | 0.22724 | 0.17753 | 0.10652 | 56 |

| 2030 | 0.22667 | 0.20238 | 0.18619 | 78 |

PinLink (PIN) Professional Investment Strategy and Risk Management Report

IV. PIN Professional Investment Strategy and Risk Management

PIN Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Crypto enthusiasts interested in decentralized computing infrastructure and RWA tokenization; technology-focused investors with medium to high risk tolerance; believers in the convergence of AI, DePin, and real-world assets.

-

Operational Recommendations:

- Accumulate PIN tokens during market downturns, leveraging the -94.51% one-year decline as a potential entry point for long-term believers

- Dollar-cost averaging (DCA) over 6-12 months to reduce timing risk and average entry prices

- Establish a core position and hold through market cycles to capture potential upside from ecosystem development

-

Storage Solutions:

- Use Gate Web3 Wallet for convenient access to PIN token management and potential staking opportunities

- For larger holdings, consider secure self-custody with proper backup of private keys and seed phrases

- Maintain separate storage for different portfolio segments: trading portion on exchange, long-term holdings in secure wallet

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support/Resistance Levels: Monitor key levels at $0.11368 (current price), $0.11566 (24H high), and $0.11023 (24H low) to identify breakout opportunities

- Volume Analysis: Track 24-hour trading volume ($62,164.47) to confirm price movements and identify liquidity conditions

-

Wave Trading Key Points:

- Capitalize on 24-hour volatility: PIN showed +3.21% in 24H performance, suggesting potential intraday trading opportunities

- Monitor resistance at historical highs ($3.8399) for swing trading targets

- Watch support at historical lows ($0.09176) as a potential strong buying zone

- Trade the -1.22% 7-day and -15.9% 30-day downtrends for potential reversal signals

PIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation to PIN; focus on small experimental positions to test the technology thesis without material portfolio impact

- Active Investors: 3-5% portfolio allocation; balance exploration of DePin opportunities with portfolio stability

- Professional Investors: 5-10% allocation possible; supported by comprehensive due diligence and conviction in ecosystem thesis

(2) Risk Hedging Solutions

- Diversification Strategy: Pair PIN holdings with established cryptocurrency assets or blockchain infrastructure tokens to reduce concentration risk in early-stage projects

- Position Sizing: Use stop-loss orders at 15-20% below entry price to limit downside exposure; take partial profits at predetermined targets (25-50% gains)

(3) Secure Storage Solutions

- Hot Wallet Method: Gate Web3 Wallet recommended for active trading and frequent transactions; provides convenient access while maintaining reasonable security for non-critical holdings

- Cold Storage Approach: For significant long-term positions, transfer PIN to hardware wallets or offline storage with verified recovery phrases

- Security Precautions: Never share private keys or seed phrases; verify contract address (0x2e44f3f609ff5aa4819b323fd74690f07c3607c4) before transfers; enable multi-factor authentication on all exchange accounts

V. PIN Potential Risks and Challenges

PIN Market Risks

-

Extreme Volatility: PIN has declined 94.51% over the past year, indicating extreme price instability. The gap between ATH ($3.8399) and current price ($0.11368) represents a 97% drawdown, reflecting high speculative nature.

-

Low Liquidity: Daily trading volume of $62,164.47 relative to a $9.09M market cap suggests limited liquidity. Large trades could cause significant price slippage and impact execution.

-

Early-Stage Project Risk: With a market cap ranking of 1,220, PIN remains a micro-cap asset with limited institutional adoption and unproven revenue models.

PIN Regulatory Risks

-

Tokenization Regulatory Uncertainty: RWA tokenization remains in early regulatory stages globally. Changes in how jurisdictions treat tokenized real-world assets could impact PIN's core value proposition.

-

GPU/Computing Asset Classification: Regulatory clarity on how tokenized computing power and hashrate should be classified and taxed is still evolving across jurisdictions.

-

Decentralized Marketplace Compliance: Operating a global peer-to-peer marketplace for computing resources may face regulatory challenges regarding commodity classification, taxation, and jurisdictional compliance.

PIN Technical Risks

-

Smart Contract Vulnerabilities: As an ERC-20 token built on Ethereum, PIN's ecosystem depends on smart contract security. Undiscovered vulnerabilities could result in fund losses.

-

Network Scalability: The effectiveness of Pinlink's RWA tokenization model depends on Ethereum's scaling solutions. Network congestion could impact market functionality and token utility.

-

Ecosystem Adoption Risk: Project success requires significant developer and enterprise adoption of the Pinlink marketplace. Failure to achieve network effects could limit token utility and value.

VI. Conclusion and Action Recommendations

PIN Investment Value Assessment

PinLink presents an interesting thesis combining AI computing infrastructure, RWA tokenization, and decentralized physical infrastructure (DePin). The project addresses a real market need for distributed computing power access. However, the extreme 94.51% annual decline, micro-cap status, and low trading liquidity present significant risks. The project remains in early stages with unproven revenue models and limited institutional validation. PIN should be considered a high-risk, speculative position suitable only for risk-capital allocation.

PIN Investment Recommendations

✅ Beginners: Start with a 0.5-1% portfolio allocation through Gate.com as an experimental position. Use limit orders to build positions gradually at support levels. Prioritize learning about RWA and DePin technologies before increasing exposure.

✅ Experienced Investors: Consider 3-5% allocation if convinced by the ecosystem thesis. Implement systematic DCA strategy during downtrends; establish clear entry/exit rules based on technical levels. Monitor project development milestones and ecosystem adoption metrics.

✅ Institutional Investors: Conduct comprehensive due diligence on Pinlink's competitive positioning, tokenomics sustainability, and regulatory compliance framework. Consider larger positions only if satisfied with governance, team credentials, and market opportunity sizing.

PIN Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold PIN tokens directly; suitable for long-term investors and those seeking direct asset ownership

- DCA Investment Approach: Set up automatic recurring purchases over weeks or months through Gate.com to reduce timing risk and average entry prices

- Technical Trading: Use Gate.com's trading tools to execute swing trades based on support/resistance levels, capitalizing on the token's volatility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and conduct thorough due diligence. Consult professional financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

What is pins price target for 2030?

Based on current market analysis, PIN is projected to reach a price range of $17.32 to $28.00 by 2030. This forecast considers existing market trends and growth potential in the cryptocurrency sector.

How much will 1 pi be worth in 2025?

Based on market analysis, 1 PI is expected to range between $0.28 and $0.65 in 2025. The exact value depends on network adoption, market conditions, and overall cryptocurrency trends throughout the year.

Will pi reach 100 dollars?

Pi reaching $100 would require a market cap of approximately $670.8 billion, comparable to Bitcoin's current valuation. While theoretically possible with massive adoption and network growth, current fundamentals suggest this is unlikely in the near term.

What factors influence PIN price predictions?

PIN price predictions are influenced by market supply and demand dynamics, trading volume, overall market trends, investor sentiment, regulatory developments, and macroeconomic conditions. Technical indicators and on-chain metrics also significantly impact price movements.

2025 PIN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 PINGO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

How Does Competitor Analysis Drive Crypto Market Share Growth in 2030?

VELAAI vs BAT: The Battle for AI Dominance in the Tech Industry

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability