WaterExpoChaos

No content yet

WaterExpoChaos

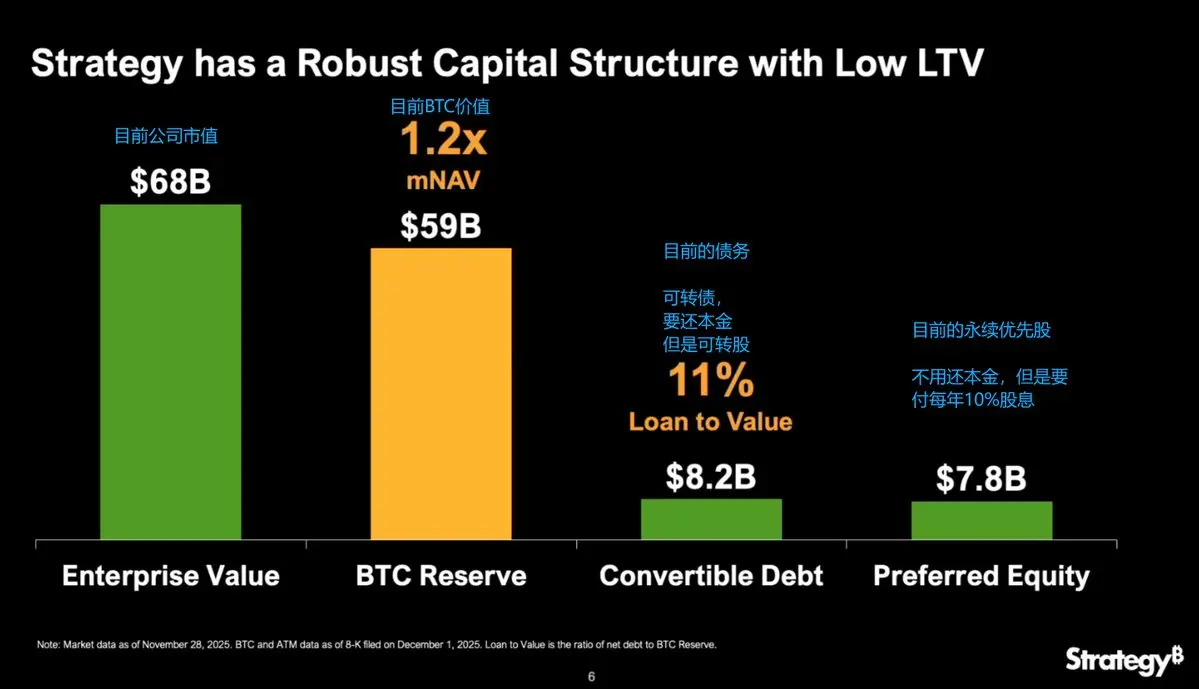

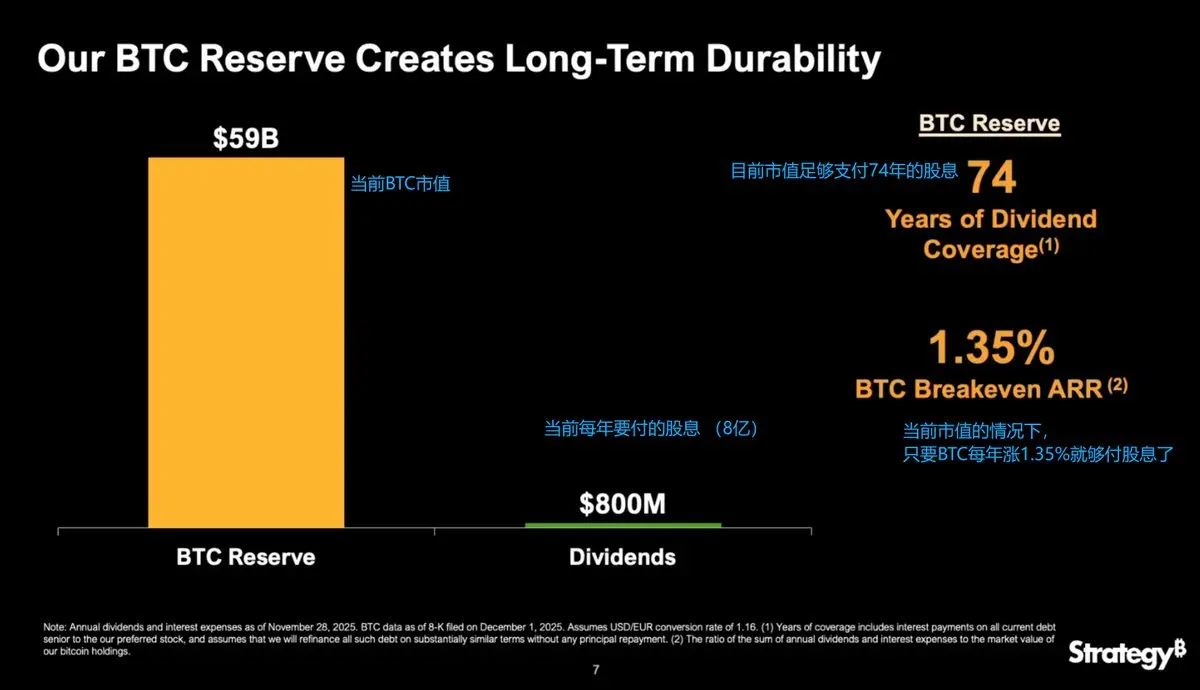

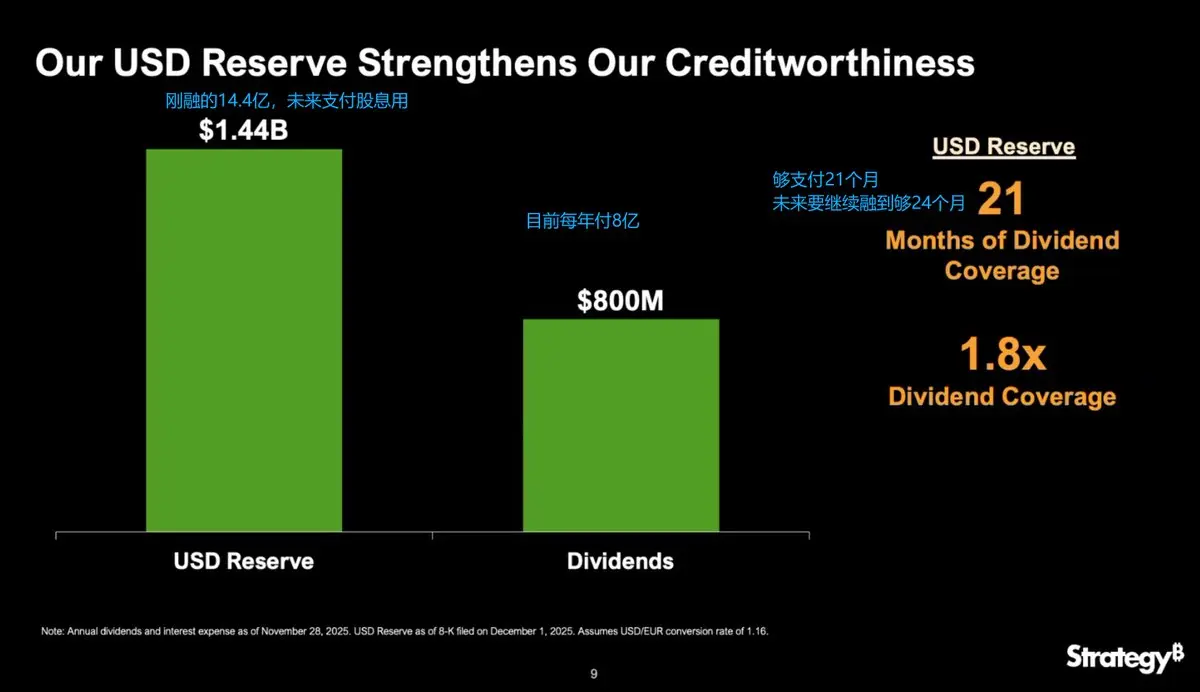

The reason for MicroStrategy's stock price big dump last week has been found: was it caused by the boss himself?

How much will BTC fall before MicroStrategy truly collapses? Not 70,000, but 10,000? What is the likelihood of them selling coins in the near future? How will they maintain their cash flow in the future?

Deep dive into where the death spiral trigger line of MSTR really is!

In the past two days, discussions have increased regarding whether MicroStrategy @Strategy will experience a big dump in the future and whether it will trigger a spiral risk.

Yesterday, MicroStrategy announced

How much will BTC fall before MicroStrategy truly collapses? Not 70,000, but 10,000? What is the likelihood of them selling coins in the near future? How will they maintain their cash flow in the future?

Deep dive into where the death spiral trigger line of MSTR really is!

In the past two days, discussions have increased regarding whether MicroStrategy @Strategy will experience a big dump in the future and whether it will trigger a spiral risk.

Yesterday, MicroStrategy announced

BTC0.41%

- Reward

- 2

- Comment

- Repost

- Share

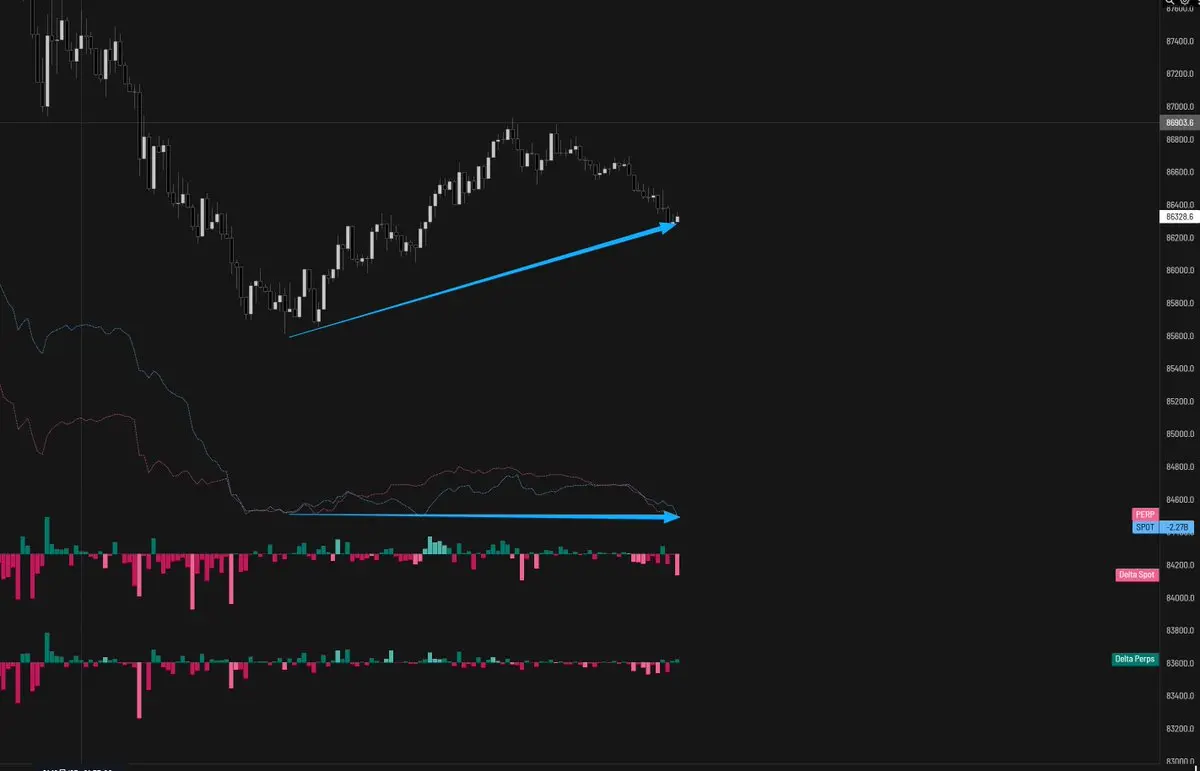

#BTC long positions 1.5b's delta has been completed..... The rebound strength is very limited.

(There should be significant passive selling pressure, so the price has not rebounded much)

According to Delta, this rebound is just like this..

After all, since 10.11, long positions have hardly made a single wave exceeding 1.5b...

(There should be significant passive selling pressure, so the price has not rebounded much)

According to Delta, this rebound is just like this..

After all, since 10.11, long positions have hardly made a single wave exceeding 1.5b...

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

Today, the key focus for #BTC is still the 1-2 hours after the opening of the US stock market...

See if there is a chance to break 85k and accelerate into the 82~83k demand zone to hit the previous low sfp...

Look up to 87~88k (a small amount of long positions trapped) whether it can go through.. (Figure two)

See if there is a chance to break 85k and accelerate into the 82~83k demand zone to hit the previous low sfp...

Look up to 87~88k (a small amount of long positions trapped) whether it can go through.. (Figure two)

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

UserHasSeverelyViolatedThe :

:

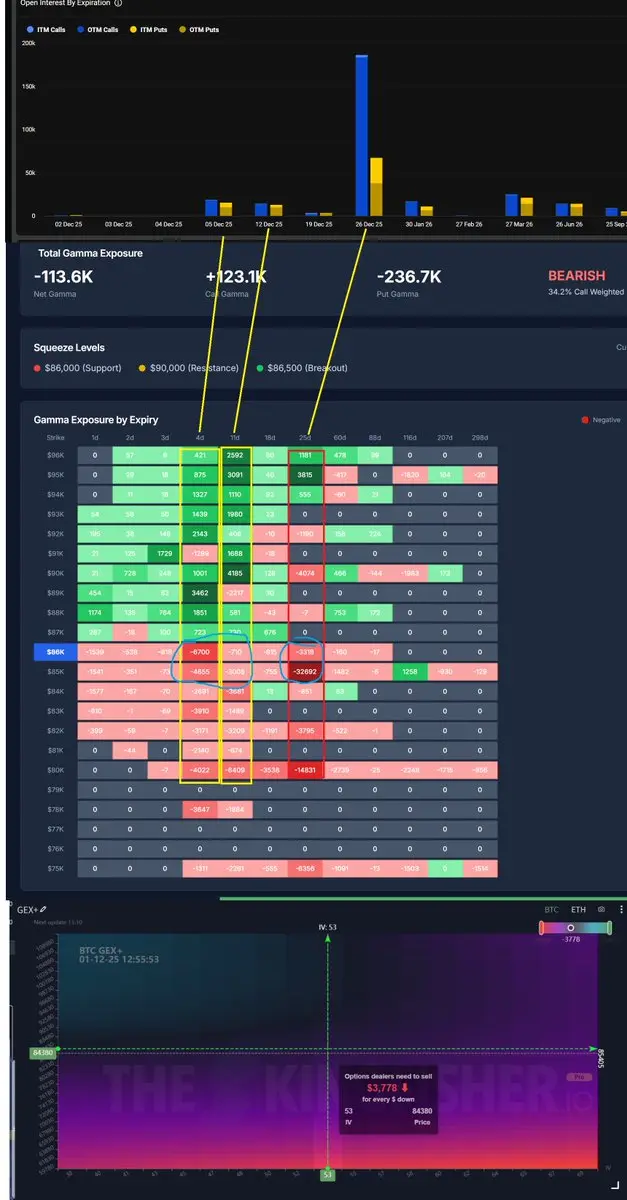

Can't do it, can't do it.Currently, the #BTC below 85k is still a very heavy negative gamma zone... We are only looking at three options with relatively large holdings (the giants on the 5th, 12th, and 26th)

This means that if the price falls below here and does not recover quickly, the options party will need to hedge, increasing volatility (accelerated decline).. The integration GEX of kingfisher has the same conclusion, with negative gamma below ( accelerating volatility) and positive gamma above (suppressing volatility, which means that when it rebounds, there will be damping, making it not so easy to bounce back)

This means that if the price falls below here and does not recover quickly, the options party will need to hedge, increasing volatility (accelerated decline).. The integration GEX of kingfisher has the same conclusion, with negative gamma below ( accelerating volatility) and positive gamma above (suppressing volatility, which means that when it rebounds, there will be damping, making it not so easy to bounce back)

BTC0.41%

- Reward

- 1

- Comment

- Repost

- Share

#BTC Spot and contract currently have a bull divergence.. There is passive buying pressure to absorb the selling pressure..

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

If there is no quick rebound here and it moves sideways instead... Is this the worst-case scenario?

View Original

- Reward

- like

- Comment

- Repost

- Share

Total delta is -2b

View Original

- Reward

- like

- Comment

- Repost

- Share

The VWAP that came up on Wednesday and the VWAP that came down from Friday's high temporarily defined the range for the weekend... Do we have to wait until midnight on Sunday?

#BTC

#BTC

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

#ETH 50,000 ETH at around 3000

The contract sell orders suppressed the price all night... The bulls tried to take a bite but only consumed 5000, realizing it wasn’t spoofing..

Then continue to be suppressed...

The contract sell orders suppressed the price all night... The bulls tried to take a bite but only consumed 5000, realizing it wasn’t spoofing..

Then continue to be suppressed...

ETH-1.35%

- Reward

- 1

- 1

- Repost

- Share

GateUser-cee5dbab :

:

Tap on the clip to paste it into the text box.#BTC The weekend has been a bit boring.. You can still follow down to 90K and 89K here.. Two potential SFPs at the previous lows...

There isn't much to do upwards... Only near the previous high of 9W3... After the sell orders around 9W3 were absorbed, they were placed again.

So the 9W3 pressure still exists..

This sideways trend, check URPD at midnight to see if there are any movements on the chain.. Yesterday's market fluctuated so much but URPD surprisingly had a turnover of less than 100,000.. It's quite strange.. So let's continue to keep an eye on URPD this weekend..

There isn't much to do upwards... Only near the previous high of 9W3... After the sell orders around 9W3 were absorbed, they were placed again.

So the 9W3 pressure still exists..

This sideways trend, check URPD at midnight to see if there are any movements on the chain.. Yesterday's market fluctuated so much but URPD surprisingly had a turnover of less than 100,000.. It's quite strange.. So let's continue to keep an eye on URPD this weekend..

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

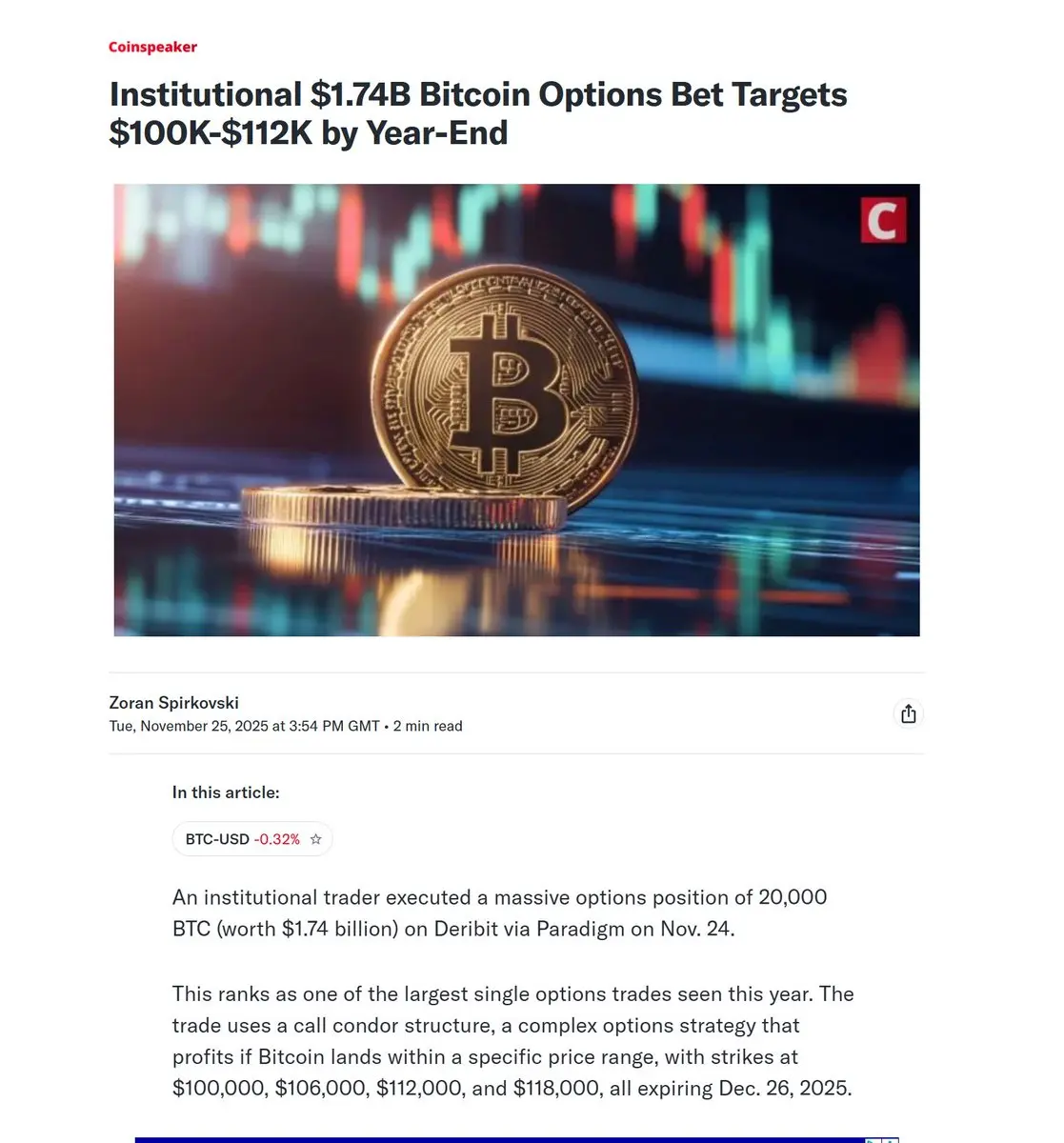

Next month, 23 billion in Options Delivery! A single institution has already bet 1.7 billion USD that BTC must close within this range by the end of the year!

10W stalemate battlefield, below 8W5 must slide and kneel? Currently all written in this December 26th Options data...

⬇️⬇️⬇️⬇️

Today, the 13 billion Options have just been delivered, and on December 26 next month, the crypto world will witness the largest Options delivery in history -- with a nominal amount of 23 billion USD.

This is not just a quarterly Delivery, but rather an annual Delivery.

With so much money on the table, how do y

10W stalemate battlefield, below 8W5 must slide and kneel? Currently all written in this December 26th Options data...

⬇️⬇️⬇️⬇️

Today, the 13 billion Options have just been delivered, and on December 26 next month, the crypto world will witness the largest Options delivery in history -- with a nominal amount of 23 billion USD.

This is not just a quarterly Delivery, but rather an annual Delivery.

With so much money on the table, how do y

BTC0.41%

- Reward

- 1

- Comment

- Repost

- Share

Woke up today and saw it still Sideways, there's nothing much to update on the market data, so I went to study next month's giant Options worth 23 billion.

There are many conclusions that will be released later..

I didn't expect the funds in the US stock market to be so strong, breaking out in a wave... very strong.

While writing, the orders over here started calling out in various ways.

Did not catch it, but verified a new entry model...

After that, a summary can be made.

View OriginalThere are many conclusions that will be released later..

I didn't expect the funds in the US stock market to be so strong, breaking out in a wave... very strong.

While writing, the orders over here started calling out in various ways.

Did not catch it, but verified a new entry model...

After that, a summary can be made.

- Reward

- like

- Comment

- Repost

- Share

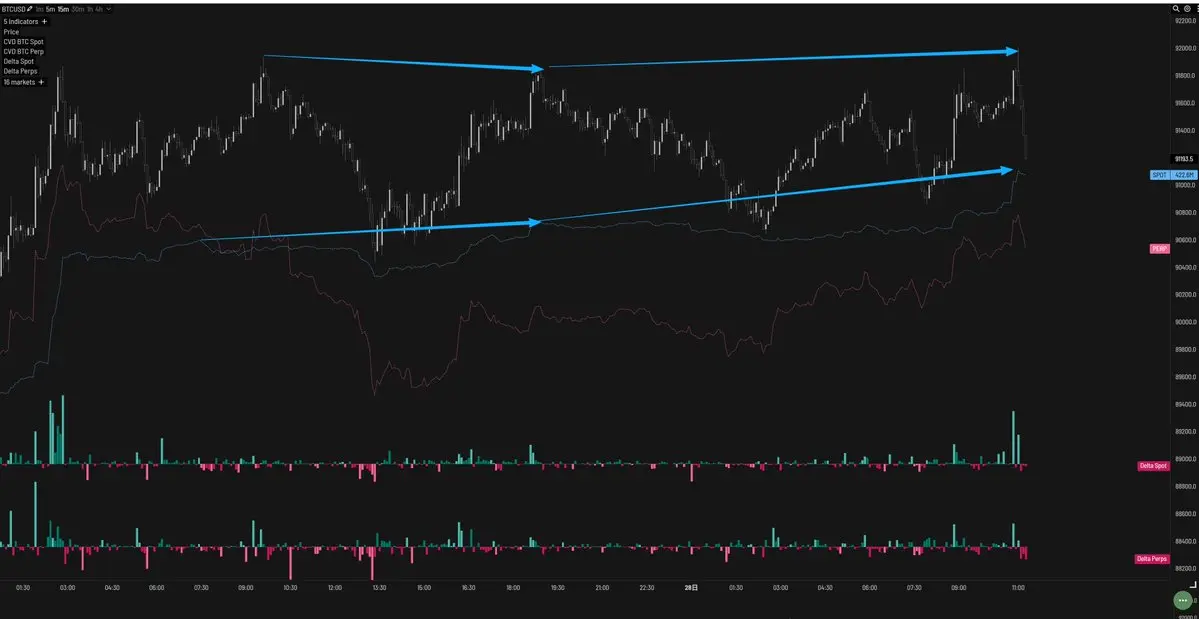

#btc has been showing a bearish divergence around 92k for the past few days... Higher CVD has not led to higher prices.. A lot of buy orders have been absorbed around 92k...

Let's see if there is any capital in today's US stock market that can break through in those 3 hours.

Let's see if there is any capital in today's US stock market that can break through in those 3 hours.

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share

#BTC Just finished talking about the 90K put wall during the day and then it quickly reached 90K..

anway. The 9W area has once again reached a total delta of 1b ( bullish 10.11 within 5 hours after the exhaustion zone) + the position of order flow pressure.

This is also the range where every intraday rebound has exhausted since 10.11...

See the image...

When will the pattern of a total of 1b + order flow pressure be broken (for example, a total Delta of over 1.5b in 5 hours or a rise against the pressure of reverse order fill orders), which would be one of the signals for a trend reversal un

anway. The 9W area has once again reached a total delta of 1b ( bullish 10.11 within 5 hours after the exhaustion zone) + the position of order flow pressure.

This is also the range where every intraday rebound has exhausted since 10.11...

See the image...

When will the pattern of a total of 1b + order flow pressure be broken (for example, a total Delta of over 1.5b in 5 hours or a rise against the pressure of reverse order fill orders), which would be one of the signals for a trend reversal un

BTC0.41%

- Reward

- like

- Comment

- Repost

- Share