SequoiaBlockchain

No content yet

SequoiaBlockchain

BTC is consolidating around 87350, after rebounding from 83700 it has entered a high-level game, with significant resistance at 87640 and multiple unsuccessful attempts to break through, leading to weakening rebound momentum. The MACD indicator shows a short-term repair signal, but the lack of volume constrains the breakout, making the overall structure bearish and prone to high fluctuations.

The operation is mainly focused on short positions, with a light position layout for shorts at 87500-87650, targeting 86500-86800 first, and if it breaks below, looking at 85800-86000; only if it stabiliz

View OriginalThe operation is mainly focused on short positions, with a light position layout for shorts at 87500-87650, targeting 86500-86800 first, and if it breaks below, looking at 85800-86000; only if it stabiliz

- Reward

- like

- Comment

- Repost

- Share

The Federal Reserve's interest rate hike and personnel changes (the probability of Powell leaving is very low, and Donald Trump may push for a "dovish" candidate) combined with a major statement at 3 AM tomorrow continue to disturb the sentiment in the crypto circle. Although Big Bro previously leveraged highly to increase his ETH long positions, he has already faced two rounds of liquidation and his assets have gone to zero, making it difficult for his operations to change the market's downward trend.

The ETH daily downtrend has not stopped, and the 50/100/200-day moving averages are

The ETH daily downtrend has not stopped, and the 50/100/200-day moving averages are

ETH1.25%

- Reward

- like

- Comment

- Repost

- Share

BTC and JPY fluctuate highly synchronously, the core is the linkage logic of JPY arbitrage trading: In the past, JPY had a zero interest rate, pros borrowed JPY to exchange for USD and held Heavy Position in BTC to earn high returns; now with Japan raising interest rates and borrowing costs soaring, it is necessary to sell BTC to exchange for USD to repay JPY debt.

The strengthening of the yen corresponds to the closing of arbitrage positions, putting pressure on BTC which has declined. This means that BTC has already integrated into global macro liquidity and has become a "barometer" for the

View OriginalThe strengthening of the yen corresponds to the closing of arbitrage positions, putting pressure on BTC which has declined. This means that BTC has already integrated into global macro liquidity and has become a "barometer" for the

- Reward

- like

- Comment

- Repost

- Share

Did you all get to enjoy the big profits from the 3214 points of the pancake this time?

12-1 Big Profits Layout, Anticipate the Sharp Decline Trend in Advance: Breaking below the lower Bollinger Band, all indicators are bearish, KDJ/RIS oversold rebound is not a reversal, but a window for trend-following replenishment layout!

Enter short positions at 86500-87000, with the target hit precisely, securing a profit of 3214 points — not betting on direction but following signals, solidifying the trend rhythm, big market movements are never about luck, but certainty after precise predictions!

#十二月行情

12-1 Big Profits Layout, Anticipate the Sharp Decline Trend in Advance: Breaking below the lower Bollinger Band, all indicators are bearish, KDJ/RIS oversold rebound is not a reversal, but a window for trend-following replenishment layout!

Enter short positions at 86500-87000, with the target hit precisely, securing a profit of 3214 points — not betting on direction but following signals, solidifying the trend rhythm, big market movements are never about luck, but certainty after precise predictions!

#十二月行情

BTC2.66%

- Reward

- like

- Comment

- Repost

- Share

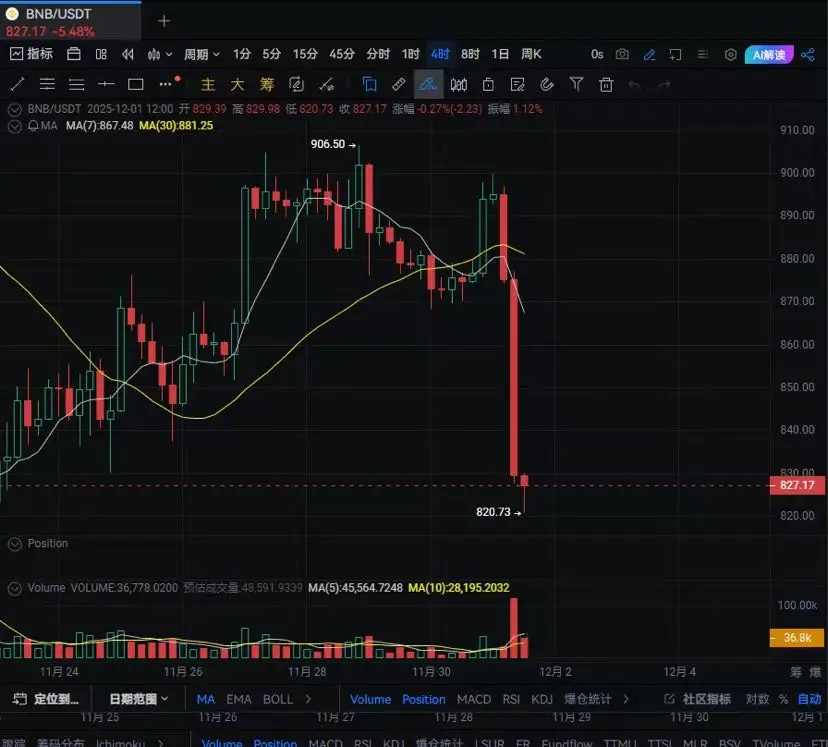

[Accurate prediction realized again! Did you catch this big dump of BNB yesterday?]

Yesterday, I placed a short position between 830-840, directly securing a profit of over 30 points. The market moved from 833 to 801, and I timed it perfectly!

The dual logic of technical analysis and macro factors has long anchored the bears; the rebound is weak, and the indicators are all bearish as expected—it's not luck, it's the precise grasp of "momentum, volume, and position!"

Remember: In our rhythm, every rebound is an opportunity to make money! For the next wave of short positions, we have alr

Yesterday, I placed a short position between 830-840, directly securing a profit of over 30 points. The market moved from 833 to 801, and I timed it perfectly!

The dual logic of technical analysis and macro factors has long anchored the bears; the rebound is weak, and the indicators are all bearish as expected—it's not luck, it's the precise grasp of "momentum, volume, and position!"

Remember: In our rhythm, every rebound is an opportunity to make money! For the next wave of short positions, we have alr

BNB3.84%

- Reward

- like

- Comment

- Repost

- Share

12-2 AM BTC/ETH layout:

BTC rebounded after hitting a low of 83786, peaking at 86817 before retreating, currently oscillating around 86500; ETH also strengthened, rising from 2718 to 2818, and is currently consolidating around 2800.

The technical analysis indicates a bearish market: the upper Bollinger Band is widening downward, the MACD is showing increasing green bars below the zero line, and bears are dominant; however, the KDJ is oversold, suggesting a possible short-term rebound. The overall bearish trend remains unchanged, and the rebound is likely to serve as a continuation of the downw

View OriginalBTC rebounded after hitting a low of 83786, peaking at 86817 before retreating, currently oscillating around 86500; ETH also strengthened, rising from 2718 to 2818, and is currently consolidating around 2800.

The technical analysis indicates a bearish market: the upper Bollinger Band is widening downward, the MACD is showing increasing green bars below the zero line, and bears are dominant; however, the KDJ is oversold, suggesting a possible short-term rebound. The overall bearish trend remains unchanged, and the rebound is likely to serve as a continuation of the downw

- Reward

- 1

- 1

- Repost

- Share

YaoQianshuA :

:

Quite powerful specific pointsYesterday, BTC opened with a flash crash, dipping from the 90,000 mark to around 83,800 before rebounding. This pullback is the result of a triple resonance of macro environment, market structure, and panic sentiment. The tightening of external liquidity has accelerated the flight to safety from mainstream assets. We accurately grasped multiple waves of market movements, and aside from one short-term long position that made a small profit, the rest of our operations were quite rewarding.

After experiencing a flash crash, BTC welcomed a technical rebound overnight, currently fluctuating around

View OriginalAfter experiencing a flash crash, BTC welcomed a technical rebound overnight, currently fluctuating around

- Reward

- 1

- Comment

- Repost

- Share

The market is experiencing higher trade volumes and a heavy drop, with BTC falling 5000 points in a single day and ETH dropping over 230 points. In the last four hours, short positions have exceeded 3.3 billion USD, and in the last 12 hours, long orders have gotten liquidated reaching 550 million USD.

The daily level rebound encounters pressure at the middle track of the Bollinger Bands, with MACD showing no bullish divergence. The double bottom resonance pattern is difficult to form, and bottom fishing should be done with caution.

#十二月行情展望

View OriginalThe daily level rebound encounters pressure at the middle track of the Bollinger Bands, with MACD showing no bullish divergence. The double bottom resonance pattern is difficult to form, and bottom fishing should be done with caution.

#十二月行情展望

- Reward

- like

- Comment

- Repost

- Share

CME data shows that the probability of the Fed cutting rates by 25 BP in December exceeds 86%. Coupled with the conclusion of QT on December 1, the dual policy shift will inject loose liquidity into the market.

As a highly sensitive risk asset, BTC has rebounded over 12% from a low point, stabilizing at $90,000. With institutional capital inflows resonating with policy dividends, it is expected to make a push towards the $100,000 mark by the end of the year. However, caution is needed regarding short-term fluctuations after expectations have been overextended.

#十二月行情展望

View OriginalAs a highly sensitive risk asset, BTC has rebounded over 12% from a low point, stabilizing at $90,000. With institutional capital inflows resonating with policy dividends, it is expected to make a push towards the $100,000 mark by the end of the year. However, caution is needed regarding short-term fluctuations after expectations have been overextended.

#十二月行情展望

- Reward

- like

- Comment

- Repost

- Share

The recent downtrend of BNB has been completely nailed down! The two consecutive falls on the 4-hour chart have left the long positions bewildered, and the 1-hour chart is even weaker to the point of being helpless—previously, there was hardly any decent support when it approached the 900 mark, and the rebound strength was comparable to "a dragonfly touching the water." The rhythm of rising slightly then falling completely exposes the predicament of the long positions' weakness.

The current technical indicators have already sent clear bearish signals, with the MACD and RSI indicators both

View OriginalThe current technical indicators have already sent clear bearish signals, with the MACD and RSI indicators both

- Reward

- like

- Comment

- Repost

- Share

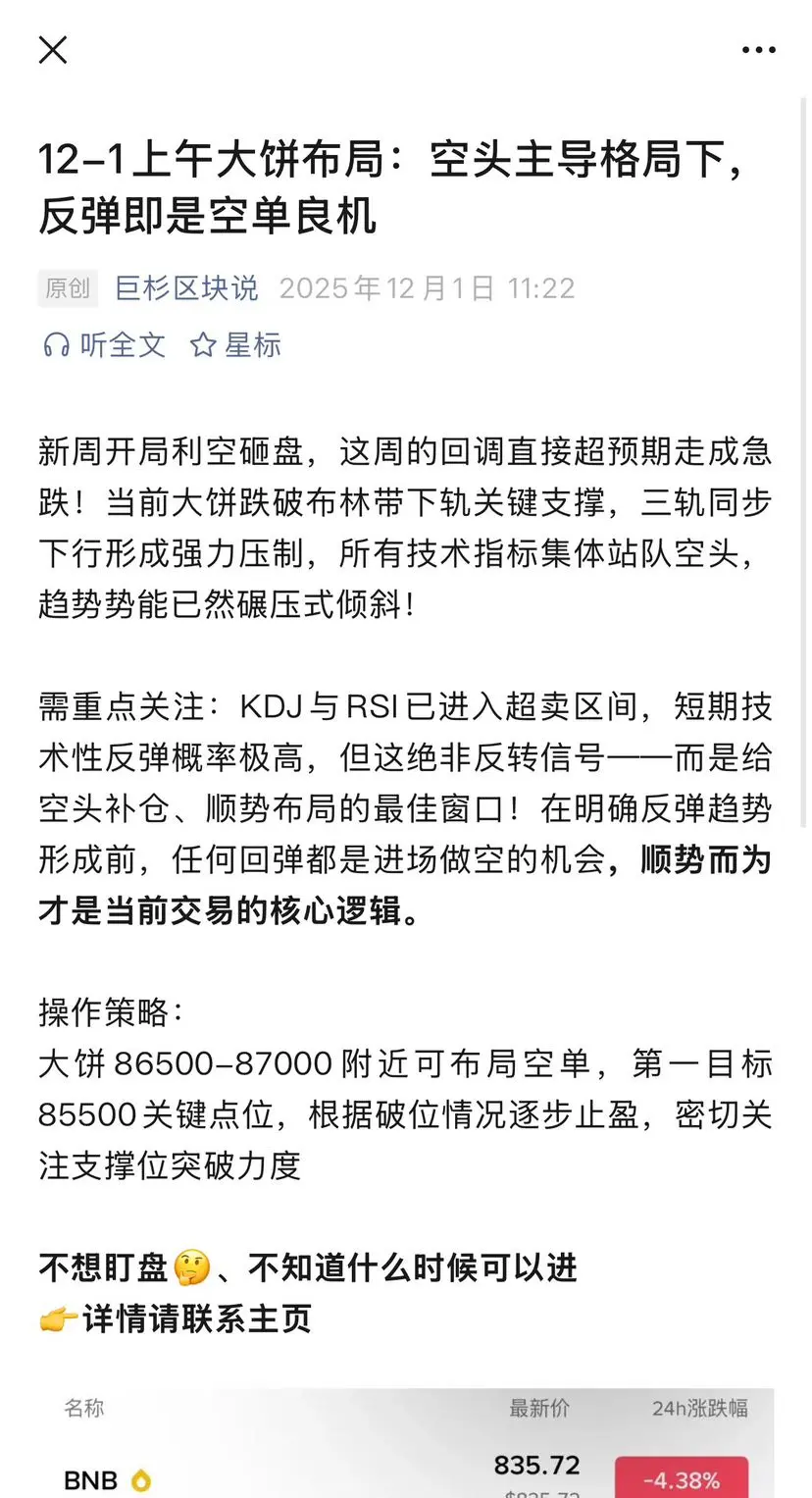

Core BTC layout on the morning of December 1st:

After the new week's bearish news triggered a sell-off, the market shifted from an expected correction to a sharp decline. BTC has broken below the lower Bollinger Band, with all three bands moving downward, and all indicators are aligned with the bearish trend, clearly indicating a shift towards bearish momentum.

Operating Strategy:

Short positions should be laid out in the 86500-87000 range, with the first target at the key level of 85500. After breaking this level, gradual profit-taking can be considered, and attention should be paid to th

View OriginalAfter the new week's bearish news triggered a sell-off, the market shifted from an expected correction to a sharp decline. BTC has broken below the lower Bollinger Band, with all three bands moving downward, and all indicators are aligned with the bearish trend, clearly indicating a shift towards bearish momentum.

Operating Strategy:

Short positions should be laid out in the 86500-87000 range, with the first target at the key level of 85500. After breaking this level, gradual profit-taking can be considered, and attention should be paid to th

- Reward

- like

- Comment

- Repost

- Share

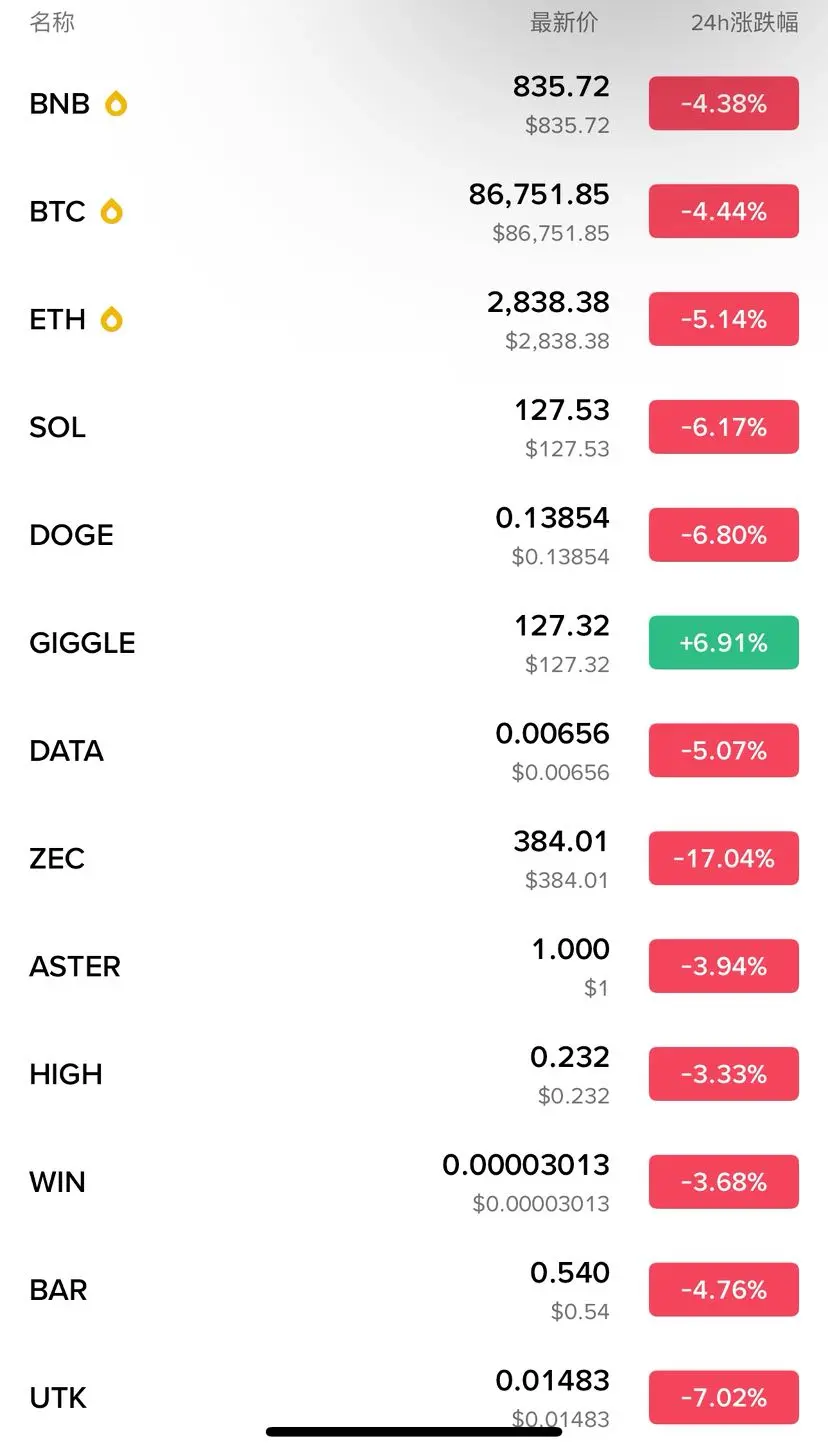

The new week starts with unfavourable information and dumping, mainstream + altcoins collectively plummet, and this week's pullback directly exceeds expectations, resulting in a sharp fall!

The trend is not right, decisively turn around—currently, a slight rebound is an opportunity to go short, short at 86800 and 88200, first look at 86000, if broken, continue to pursue the downward space.

#十二月降息预测

View OriginalThe trend is not right, decisively turn around—currently, a slight rebound is an opportunity to go short, short at 86800 and 88200, first look at 86000, if broken, continue to pursue the downward space.

#十二月降息预测

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Focus on the key level of 93000 for short-term BTC, be cautious with the rebound under mid-term pressure.

The expectation of the Federal Reserve lowering interest rates is rising, but the balance sheet reduction has not stopped. The liquidity easing is limited, coupled with the high-level correction of US stocks suppressing the risk asset sentiment. $BTC is difficult to change the mid-term pressure pattern, and the daily bearish trend is still continuing.

The short-term market is engaged in a support battle around the 90000 level, and whether the rebound can continue depends on the effectiven

View OriginalThe expectation of the Federal Reserve lowering interest rates is rising, but the balance sheet reduction has not stopped. The liquidity easing is limited, coupled with the high-level correction of US stocks suppressing the risk asset sentiment. $BTC is difficult to change the mid-term pressure pattern, and the daily bearish trend is still continuing.

The short-term market is engaged in a support battle around the 90000 level, and whether the rebound can continue depends on the effectiven

- Reward

- 2

- Comment

- Repost

- Share

Tonight's BTC market core tip: If the key level is not broken, pullback to look for new lows!

The market logic is clear tonight: if $BTC cannot effectively break through and stand firm at the 93000 level, the short-term pullback trend will continue, with targets directly aimed at the 86000 area.

The current market lacks sustained upward momentum, so do not blindly chase long positions in the short term to avoid falling into the risk of being trapped by a pullback. Patiently wait for key breakout signals or layout opportunities after the pullback is in place.

#十二月降息预测

View OriginalThe market logic is clear tonight: if $BTC cannot effectively break through and stand firm at the 93000 level, the short-term pullback trend will continue, with targets directly aimed at the 86000 area.

The current market lacks sustained upward momentum, so do not blindly chase long positions in the short term to avoid falling into the risk of being trapped by a pullback. Patiently wait for key breakout signals or layout opportunities after the pullback is in place.

#十二月降息预测

- Reward

- like

- Comment

- Repost

- Share

11.29BTC/ETH strategy: During the consolidation phase, it's the right time to set up long orders.

BTC is currently maintaining a range-bound oscillation pattern, with the 89000 level forming a strong support zone. The repeated retests without breaking through highlight the resilience of the bulls. Although market sentiment is currently in a wait-and-see phase, there are initial signs of moderate volume expansion, and the MACD indicator is about to form a golden cross. Short-term rebound momentum is accumulating.

Continue to follow the long order logic in operation, seizing the layout oppor

View OriginalBTC is currently maintaining a range-bound oscillation pattern, with the 89000 level forming a strong support zone. The repeated retests without breaking through highlight the resilience of the bulls. Although market sentiment is currently in a wait-and-see phase, there are initial signs of moderate volume expansion, and the MACD indicator is about to form a golden cross. Short-term rebound momentum is accumulating.

Continue to follow the long order logic in operation, seizing the layout oppor

- Reward

- like

- Comment

- Repost

- Share

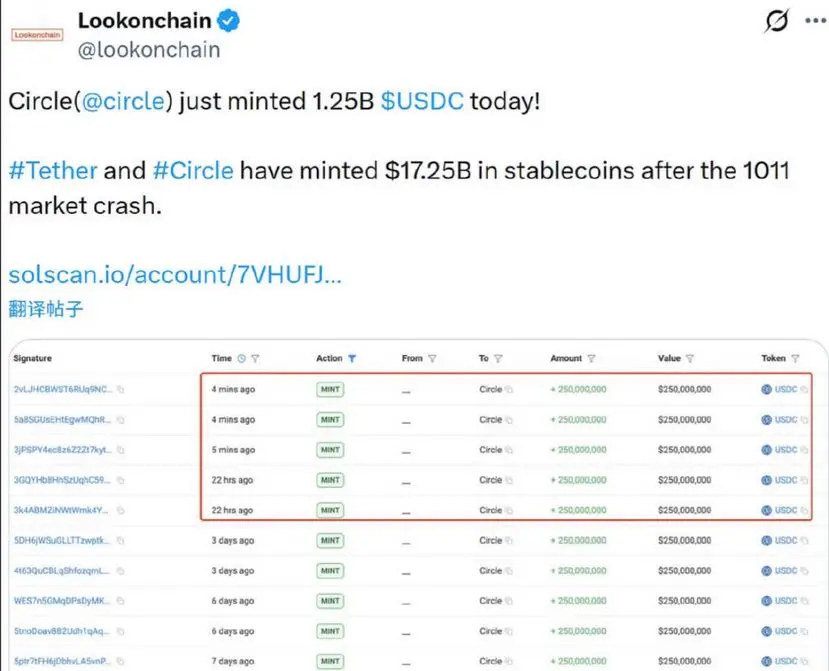

11.28 Large-scale minting of stablecoins! 17.25 billion funds poised to buy the dip?

Circle today minted 1.25 billion USDC. After the market decline on October 11, Tether and Circle have cumulatively added 17.25 billion USD stablecoins. As the market's "cash reserves", the massive minting suggests that incremental funds are entering the market, and the buy the dip signal is clear!

View OriginalCircle today minted 1.25 billion USDC. After the market decline on October 11, Tether and Circle have cumulatively added 17.25 billion USD stablecoins. As the market's "cash reserves", the massive minting suggests that incremental funds are entering the market, and the buy the dip signal is clear!

- Reward

- like

- Comment

- Repost

- Share

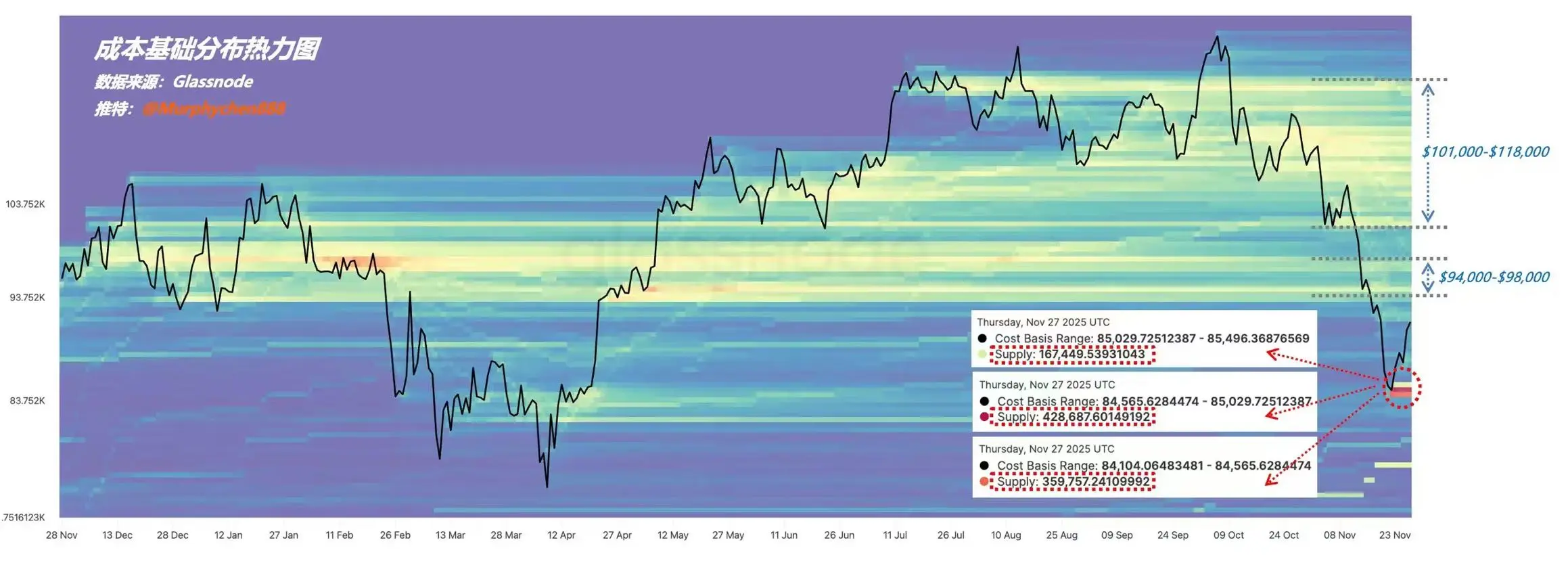

On-chain data highlights: BTC is consolidating between 84,000 and 85,000, with two resistance levels to watch out for!

On the 28th, the latest on-chain analysis by analysts shows that the CBD cost distribution heatmap indicates there are two key resistance zones for BTC—94,000 to 98,000 and 101,000 to 118,000. Notably, 98,000 is the historical fair price, and 104,000 is the average cost for short-term holders. A rebound to these two ranges is likely to encounter resistance.

Recently, around 950,000 BTC has accumulated in the $84,000 to $85,000 range (after excluding the 550,000 BTC from the Co

View OriginalOn the 28th, the latest on-chain analysis by analysts shows that the CBD cost distribution heatmap indicates there are two key resistance zones for BTC—94,000 to 98,000 and 101,000 to 118,000. Notably, 98,000 is the historical fair price, and 104,000 is the average cost for short-term holders. A rebound to these two ranges is likely to encounter resistance.

Recently, around 950,000 BTC has accumulated in the $84,000 to $85,000 range (after excluding the 550,000 BTC from the Co

- Reward

- like

- Comment

- Repost

- Share