Uniswap (UNI) News Today

Latest crypto news and price forecasts for UNI: Gate News brings together the latest updates, market analysis, and in-depth insights.

The Uniswap "UNIfication" proposal has passed the preliminary vote with an overwhelming majority, launching a $15.5 million bug bounty program.

The "UNIfication" governance proposal of Uniswap received support of over 63 million UNI tokens in the preliminary vote, with almost no opposition. The proposal aims to unify Uniswap Labs and Uniswap Foundation, activate the fee mechanism, and simultaneously launch a bug bounty program worth $15.5 million.

UNI-0.01%

MarsBitNews·11-27 15:55

Token buyback, making a comeback

Written by: Ekko an and Ryan Yoon

The repurchase, which was stalled in 2022 due to pressure from the U.S. Securities and Exchange Commission, has once again become a focal point. This report, written by Tiger Research, analyzes how this mechanism, once deemed unfeasible, has re-entered the market.

Key Points Summary

Hyperliquid's 99% buyback and the discussion of Uniswap's buyback restart have brought buybacks back into focus.

What was once considered unfeasible, buybacks have now become possible due to the U.S. Securities and Exchange Commission's "crypto projects" and the introduction of the Clarity Act.

However, not all repurchase structures are feasible, which confirms that the core requirement of decentralization remains crucial.

1. The buyback returns three years later.

The repurchase that disappeared from the crypto market after 2022 will return in 2025.

DeepFlowTech·11-27 01:55

100x Crypto News: LivLive Surges With BLACK300 Bonus While DOT Falls Toward $2.05 and UNI Sees Ma...

The 100x crypto narrative has returned stronger than ever in Q4 2025 as new real utility projects begin outshining older narrative coins. The market is transforming quickly, and attention is shifting toward tokens that connect physical activity with digital rewards.

This shift has directed

CaptainAltcoin·11-26 12:36

Token buyback makes a comeback

Author: Ekko an and Ryan Yoon

The repurchase that stalled in 2022 due to pressure from the U.S. Securities and Exchange Commission has once again become a focal point. This report, authored by Tiger Research, analyzes how this mechanism, once deemed impractical, has re-entered the market.

Summary of Key Points

Hyperliquid's 99% buyback and the discussion of Uniswap's buyback restart have brought buybacks back into the spotlight.

The repurchase, once considered unfeasible, has now become possible due to the introduction of the SEC's "crypto projects" and the "Clarity Act."

However, not all buyback structures are feasible, which confirms that the core requirement of decentralization remains crucial.

1. The repurchase comes back three years later.

The repurchase that disappeared from the cryptocurrency market after 2022 reappeared in 2025.

PANews·11-26 10:22

Uniswap Launches $15.5M Bug Bounty Program On Cantina To Strengthen Security

In Brief

Uniswap has launched a bug bounty program with rewards up to $15.5 million to incentivize researchers to identify security vulnerabilities across its protocol, contracts, and related infrastructure.

Decentralized exchange (DEX) Uniswap announced that it has introduced a new bug bounty

UNI-0.01%

MpostMediaGroup·11-26 07:22

How high can the Uniswap price rise before the sellers counterattack?

Uniswap (UNI) experienced a strong surge to $10.3, but has since faced potential corrections, currently hovering above $5.92. Technical indicators show mixed signals, with prevailing bearish trends. Future movements depend on breaking key price levels.

UNI-0.01%

TapChiBitcoin·11-26 04:09

UNI Steadies At $6.24 As Falling Wedge Tightens Above Key $5.88 Support

UNI trades at $6.24, up 3.6% in 24 hours, while remaining below both the 9 EMA and 50 SMA on the four-hour chart.

The token continues to move inside a falling wedge, with support at $5.88 and resistance at $6.33 shaping the short-term range.

Declining sell volume accompanies UNI’s movement along t

UNI-0.01%

CryptoNewsLand·11-25 19:35

The new proposal reshapes the value of UNI: Is the forgotten Uniswap still worth investing in?

Written by: Michael Nadeau, The Decentralized Finance Report; Translated by: Glendon, Techub News

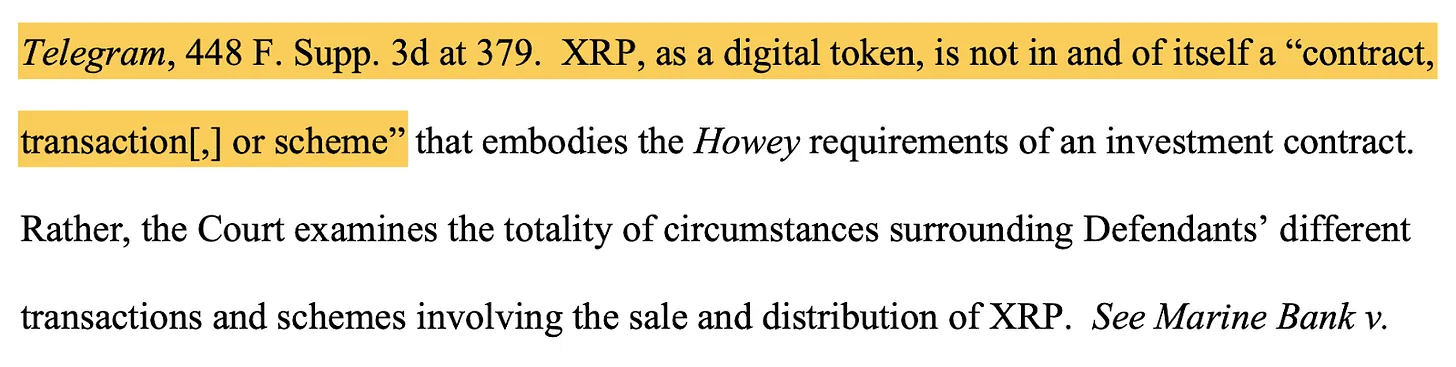

Uniswap was launched in 2018 and is a groundbreaking innovation that enables the organic formation of a bilateral market for trading financial assets. Since its inception, the protocol has generated over $3.3 trillion in trading volume and $4.7 billion in trading fees.

However, all along, we have always regarded Uniswap as a project not worth investing in.

Why is this?

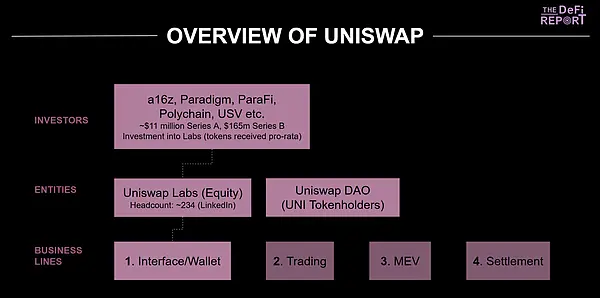

Uniswap has multiple capital tables, one for equity investors and one for token holders. This structure is not unique to Uniswap, but what makes it unique is that Uniswap often distributes income to equity holders rather than token holders.

This is a serious conflict of interest.

金色财经_·11-24 06:33

Uniswap Trading Soars While UNI Valuation Declines

Uniswap's trading surged to $116B monthly, yet UNI's market cap fell to $6.8B, highlighting token value and protocol growth's disconnect. New releases improve accessibility, and the UNIfication proposal could enhance token value through buybacks, potentially influencing DeFi trends.

UNI-0.01%

CryptoFrontNews·11-23 21:33

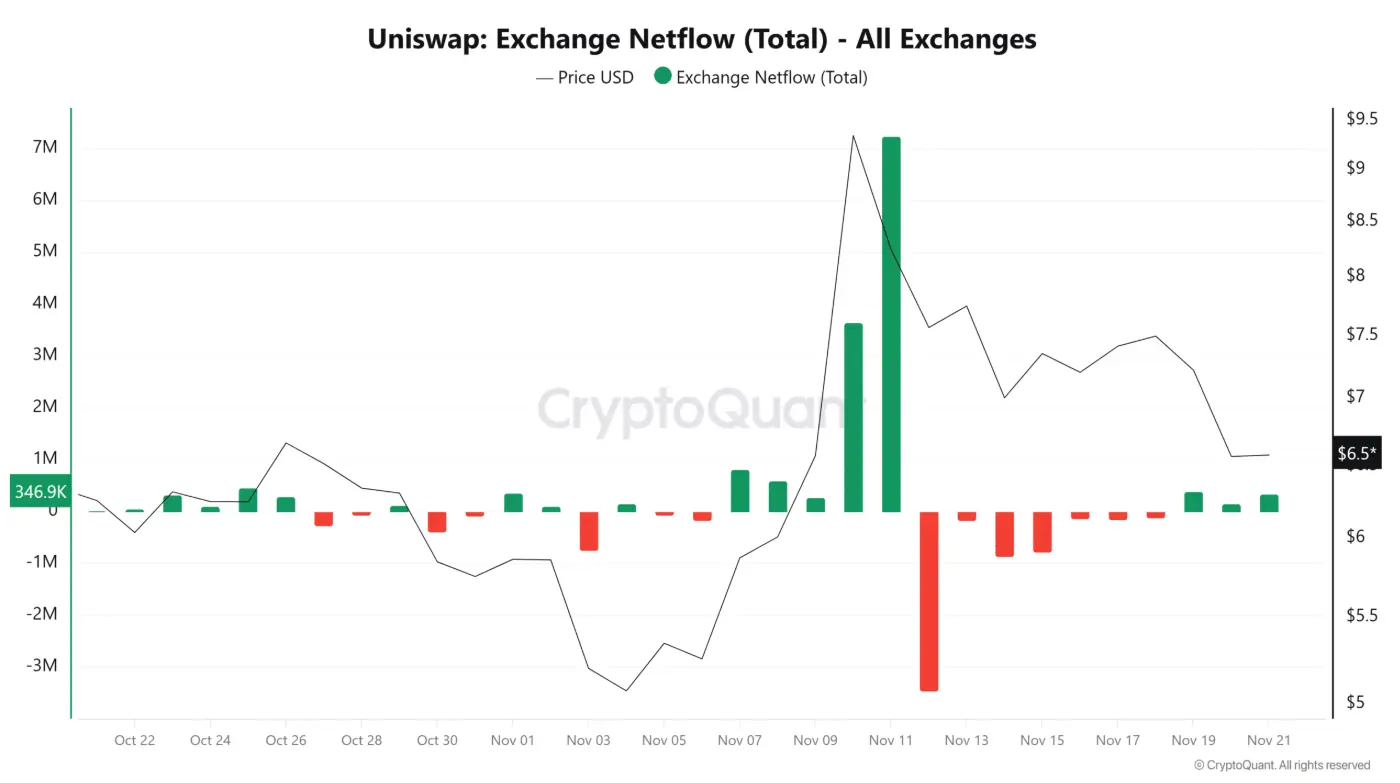

UNI Breakout Under Threat: Heavy Selling Pressure Hits Uniswap

UNI faces strong resistance at $8-$8.6, limiting further bullish momentum.

Heavy selling pressure from dormant tokens and whales weighs on price recovery.

On-chain metrics show cautious optimism, but organic demand must increase for sustained gains.

Uniswap’s UNI recently caught attention with a

UNI-0.01%

CryptoNewsLand·11-23 16:24

The Uniswap community will activate protocol fees and unify the ecological incentive mechanism through the "UNIfication" proposal.

The Uniswap community passed the "UNIfication" governance proposal on November 23 with 100% support. The proposal includes activating protocol fees, burning 100 million UNI tokens, establishing fee discount auctions, upgrading to an on-chain aggregator, and adjusting the relationship between Uniswap Labs and the foundation for joint development of the protocol.

UNI-0.01%

DeepFlowTech·11-23 11:38

Crypto News: UNI, ETH, and XRP Are About to Unlock Real Value Capture, Says Bitwise Executive

Bitwise CIO says UNI, ETH, and XRP are improving value capture through fee burns, staking, and Fusaka upgrade, with effects clear by 2026.

Major crypto tokens are undergoing changes that could improve value capture for holders. UNI, ETH, and XRP are implementing updates that affect revenue and s

LiveBTCNews·11-23 11:23

Data: 3,819,600 EIGEN transferred from an anonymous Address and flowed into Uniswap after a relay.

According to Mars Finance, data from Arkham shows that at 11:25, 3.8196 million EIGEN (worth about 2.1111 million USD) were transferred from an anonymous Address (starting with 0x4817...) to Uniswap. Subsequently, the Address transferred part of the EIGEN to Uniswap.

EIGEN-2.54%

MarsBitNews·11-23 04:44

Why did the "hibernating" Uniswap whale suddenly dump 512,000 UNI, accepting a loss of up to 76%?

After Uniswap announced the “Unification” proposal 10 days ago, UNI quickly broke out, climbing to $10.2 as capital from investors poured in. However, the excitement didn’t last long. Just a few days later, both “whales” and retail investors simultaneously took profits, causing UNI to enter a correction trajectory.

UNI-0.01%

TapChiBitcoin·11-22 10:08

DeFi Giant Uniswap Labs Snaps up Guidestar to Supercharge AMM Research

Uniswap Labs has acquired Guidestar, a team specializing in automated market maker technology, to enhance decentralized trading efficiency and market design. This collaboration aims to improve trade execution and liquidity access across various asset types.

UNI-0.01%

Coinpedia·11-21 02:48

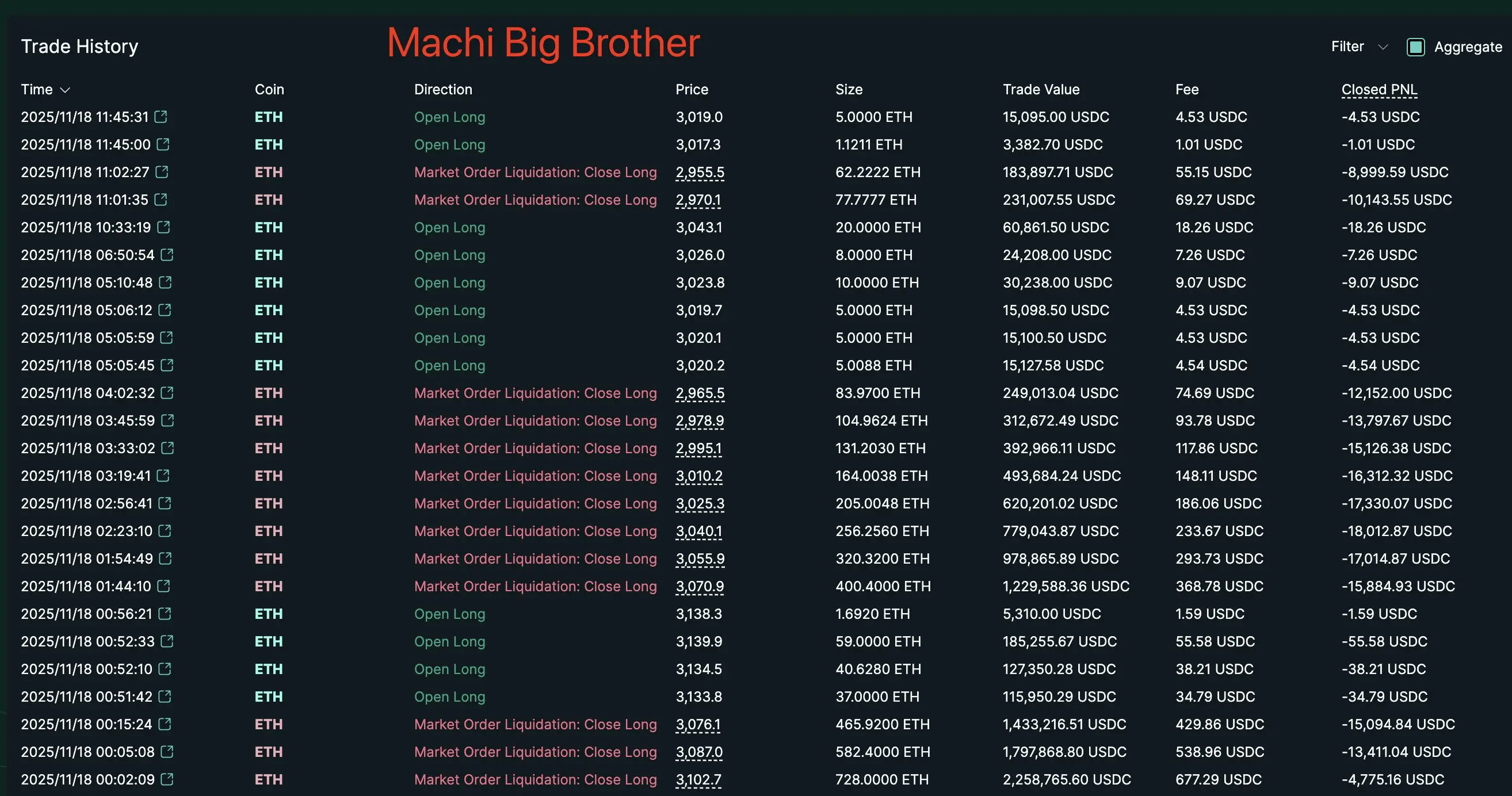

Huang Licheng got liquidated 71 times to top the list! Aster pays tribute to the brother with a dedicated mode.

The decentralized exchange Aster is delving into the Degen culture of crypto assets, launching the "Machi Mode," a new feature that rewards traders with points for getting liquidated. The update is scheduled to go live next week, paying direct homage to "Machi Big Brother" (real name Huang Licheng). Since November 1, Machi Big Brother has recorded 71 liquidations, far exceeding James Wynn.

MarketWhisper·11-20 05:07

Uniswap Founder: Welcomes challengers but is skeptical about being "replaced"

According to Mars Finance, Uniswap founder Hayden Adams posted on X that there are often new competitors boldly claiming to "replace Uniswap". The team welcomes this kind of competition, believing that a lack of competition would make the arena boring. He stated that while certain projects may bring about different changes, he remains skeptical about them.

UNI-0.01%

MarsBitNews·11-19 02:38

FIL & UNI Whales Keep Dumping, While Zero Knowledge Proof (ZKP)’s ICA Offers the First Fair Entry...

Current attention across the market revolves around the intense Uniswap (UNI) price climb and the sharp changes influencing each Filecoin (FIL) price prediction. These movements, although exciting, also expose how many top crypto assets still rely on structures shaped by early allocations and

CryptoNewsLand·11-19 01:03

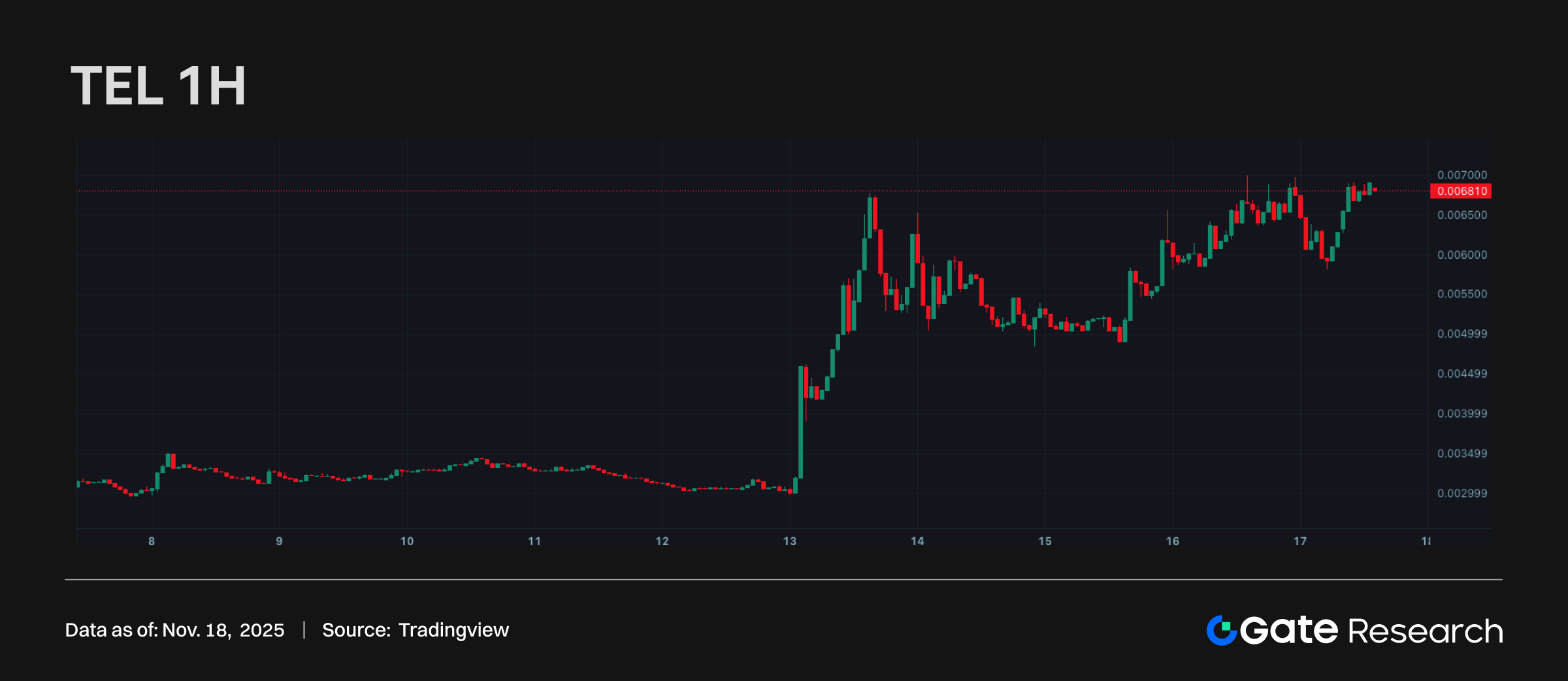

Gate Research Institute: TEL weekly rise exceeds 100%, UNI governance proposal stimulates price with a single-day big pump of 50%|Gate VIP Weekly Report

Last week's market data showed that BTC and ETH experienced a technical Rebound, with TEL seeing a big pump of over 100%. The Sei ecosystem and capital inflow are rising rapidly, and Uniswap has proposed a governance reform plan that could reshape its economic model. The complete report provides in-depth analysis and data support.

GateResearch·11-18 10:03

Uniswap has launched the "UNIfication" proposal, which aims to initiate protocol fees and buy back and burn UNI.

According to Mars Finance, Uniswap founder Hayden Adams tweeted that he has submitted the "UNIfication" proposal to the Snapshot platform for a temperature check vote. The proposal was jointly put forward by Uniswap Labs and the foundation, aiming to open protocol fees and use them for repurchasing and burning UNI, while also burning 100 million treasury UNI. The content also includes building an LP yield enhancement mechanism, integrating external liquidity, and optimizing Uniswap.

UNI-0.01%

MarsBitNews·11-18 03:16

The value of the Uniswap unification proposal and the CCA protocol

Foreword

Recently, the industry's enthusiasm has been shifted by the rise of the X402 payment track, as well as the panic of Black Monday, Tuesday, Wednesday, Thursday, and Friday, along with the rotation of the privacy sector in the cow-end legend.

This world is truly amazing, and also very noisy.

Now whether it's a bear market or not, after all, a common mistake made by smart people is to strive to optimize something that shouldn't exist~ (from Musk). Now, calm down and review the brilliance of past successful products, observe which players in the competition are engaging in ineffective operations, and identify which are the pigs on the windfall. When the wind stops, we can truly see the long-term value of the future.

If asked, what are the representative track trends this year?

My first choice is Dex. It has been 4 years since the summer of DeFi, and by 2025, there have been several typical products that have firmly established a significant presence in the market, both in terms of concept and volume. The most amazing aspect of this track is that just when you think you have done everything possible and the landscape is set...

金色财经_·11-18 02:15

Alt season expectations falter: Why are Uniswap, Ethena, and Immutable rising against the trend?

In November 2025, the crypto market fear and greed index fell to an extreme fear range of 17, with Bitcoin hovering around $94,000, and the altcoin season expectations completely stalled. However, Uniswap (UNI), Ethena (ENA), and Immutable (IMX) showed an upward trend against the tide, with 24-hour rises of 5%, 3%, and 2.5%, respectively.

Analysts point out that in a liquidity tightening environment, funds are flowing towards projects with clear use cases, stable cash flows, and active development entries. This selective gathering reflects the market's transition from concept speculation to fundamental verification.

MarketWhisper·11-18 01:42

Analyzing the value of the Uniswap unification proposal and the CCA auction protocol

Author | Shisi Jun

Preface

Recently, the industry's excitement has shifted due to the emergence of the X402 payment track, as well as the panic caused by Black Monday, Tuesday, Wednesday, Thursday, and Friday, along with the rotation of the privacy sector related to the bull market myth.

This world is truly wonderful, and also too noisy.

Right now, the bear market is fine, after all, a common mistake made by smart people is to strive to optimize something that shouldn't exist (from Musk). Now, calm down and review the brilliance of past successful products, observe which players in the competition are engaging in ineffective operations, and identify which are the pigs on the windfall. When the wind stops, we can truly see the long-term value of the future.

If asked, what are the representative track trends this year?

My first choice is Dex. It has been 4 years since the summer of DeFi, and there have been several typical products over the course of 25 years, which have gained significant attention from concept to market. The most fascinating aspect of this track is that,

WuSaidBlockchainW·11-17 23:32

Today's Crypto Assets market capitalization top 100 Tokens rise and fall: UNI rise 6.21%, DASH fall 10.98%

According to Deep Tide TechFlow news on November 18, based on Coinmarketcap data, the performance of the top 100 Crypto Assets today is as follows,

Top five gains:

Uniswap (UNI) rose 6.21%, current price is 7.83 dollars;

Monero (XMR) rose by 5.39%, currently priced at 418.20 USD;

Bitcoin Cash (BCH) rose 3.80%, currently priced at 503.47 USD;

MemeCore (M) rose 3.51%, current price is 2.16 USD;

Cosmos (ATOM) rose 2.70%, currently priced at 2.85 dollars.

Top five declines:

Dash (DASH) fell by 10.98%, current price is 83.44

DeepFlowTech·11-17 16:06

Uniswap Price Shoots 18% in a week, Can Bulls Flip $8 and Claim $9.46?

The UNI price has surged past key averages, with a focus on the $8 psychological level. Daily trading activity has increased by 48% as traders pursue breakout opportunities, facing the $9.46 Fibonacci resistance as the next challenge for bullish momentum.

UNI-0.01%

BitcoincomNews·11-17 09:00

Eugene: Bullish on UNI or leading the market rebound.

According to Mars Finance news, trader Eugene stated that since October 10, most alts have experienced a significant pullback. He believes that the phase of selling pressure has basically been released, and most investors who opted for stop loss have exited during the continuous five-week decline. He pointed out that if the market rebounds, high-quality tokens driven by fundamentals may perform stronger, with Uniswap receiving more attention due to recent progress on fee switches. Eugene stated that UNI has no historical Heavy Position, a reinforced income narrative, and the current price is close to the level before the fee adjustment proposal was announced, which may have potential for rise in the coming weeks, with an invalid range for his view being below $6.50.

UNI-0.01%

MarsBitNews·11-17 08:44

UNI Traders Eye This Crucial Price Zone for the Next Buying Opportunity

The essay discusses Uniswap's recent bullish momentum, highlighting potential buying zones at $6.86 and $5.92. It notes short-term resistance near $8.6 and signals of a retracement due to declining Open Interest and long liquidations, indicating caution despite recent gains.

UNI-0.01%

CryptoNewsLand·11-17 05:54

a16z: Arcade Tokens Surpass Stablecoins! Airline Mileage Model Reshapes the Encryption Economy

Venture capital firm a16z believes that ecosystem-locked tokens, similar to airline miles, could be key for developers in creating a stable digital economy. a16z points out that one of the most undervalued types of tokens in crypto assets is "Arcade Tokens." These tokens maintain a relatively stable value within specific software or product ecosystems, akin to airline mileage rewards, allowing users to perform specific functions within the ecosystem rather than speculate.

USDC-0.02%

MarketWhisper·11-17 05:38

Data: 544,500 UNI transferred to Coinbase Prime, worth approximately $4.0671 million.

According to Mars Finance, data from Arkham shows that at 23:02, 544,500 UNI (worth approximately $4.0671 million) was transferred from an anonymous Address (starting with 0xAFA7...) to Coinbase Prime.

MarsBitNews·11-16 15:54

Uniswap controversy reveals old conflict between DeFi and Washington

Four days after Uniswap Labs and the Uniswap Foundation proposed to merge operations and activate the long-awaited "fee switch", a controversy on X between the protocol's founder and Gary Gensler's former chief of staff has reopened wounds in the crypto industry that seemed to have healed.

UNI-0.01%

TapChiBitcoin·11-16 11:20

Weekly Popular Project Updates: Uniswap proposal to launch protocol fees, Magic Eden initiates buyback, Aave may delist high fluctuation collateral, etc. (1109–1115)

1. The Uniswap proposal launches the protocol fees and UNI Burn Mechanism, and the foundation's functions will be merged into Labs link.

The Uniswap Foundation and Uniswap Labs jointly proposed a governance proposal to initiate a protocol fee mechanism, reduce the total supply of UNI, and trigger UNI burns through protocol usage to restructure the ecological incentive model. The proposal also includes the establishment of a Uniswap Growth Budget to fund protocol and ecological development under the service provision protocol framework, while merging most functions and teams of the Foundation into Uniswap Labs. The Foundation will continue to execute existing grant commitments and will terminate operations after completing the remaining grant budget of approximately $100 million.

2.

WuSaidBlockchainW·11-16 10:44

Uniswap Whale Sells $75M UNI While ‘UNIfication’ Rockets 44% – a Sign of Trouble?

Uniswap whale sold $75M UNI during hype, raising insider timing concerns.

UNIfication proposal activates fees, burns tokens, and merges Labs with Foundation.

Retail buying surged, but whale exits suggest distribution disguised as growth.

Recently, the crypto community cheered when Uniswap’s UNI t

CryptoNewsLand·11-16 10:25

Crypto Weekly Roundup: Circle Reports Gains, Uniswap Launches New Features, & More

This week, Circle reported a substantial 66% revenue growth, beating third-quarter expectations due to higher reserve income and rising USDC circulation. Uniswap announced the launch of the game-changing Continuous Clearing Auction Protocol.

The new protocol is designed for price discovery and

CryptoDaily·11-16 09:03

Crypto News Today: AB Drops 19%, UNI Price News Shows Strength At $7.08, and LivLive Emerges As t...

Best crypto presale to buy now is the top topic in Q4 2025 as new technology projects push past older limits. Fresh utility, stronger models, and new reward layers are creating market interest across multiple sectors. LivLive ($LIVE) joins this lineup by turning real actions into digital value,

CaptainAltcoin·11-15 16:34

UNI Retests Its Falling Wedge Breakout as Analysts Point to $8.25 as the Key Price Level

Uniswap (UNI) is undergoing a retest of a falling wedge pattern, with analysts watching for a breakout above $8.25 to confirm upward momentum. Current indicators show stability and potential for further gains towards $9 and $10.

UNI-0.01%

CryptoFrontNews·11-15 03:47

Uniswap Launches Continuous Clearing Auction Protocol

Uniswap has unveiled Continuous Clearing Auctions, a potential game-changer in decentralized finance (DeFi). The protocol is designed for price discovery and liquidity bootstrapping of pools on Uniswap v4

The new protocol will offer a seamless experience for traders and projects, and tackle

CryptoDaily·11-14 17:33

Uniswap Introduces New Auction Protocol to Transform Early Token Markets

Uniswap has launched a new mechanism intended to reshape how early-stage token markets form onchain and how value is captured across decentralized finance. On Thursday, the decentralized exchange revealed its Continuous Clearing Auctions (CCA) model, a permissionless system that enables

ICOHOIDER·11-14 10:28

Data: A certain Whale continues to inject various assets such as UNI and LINK into Binance while incurring significant unrealized losses.

According to Mars Finance, a Whale deposited 1.19 million UNI (approximately 10.54 million USD) to Binance, and then continued to deposit multiple assets while being in a significant loss state: 74,281 LINK is currently worth about 1.07 million USD, with a loss of 752,000 USD compared to the purchase price; 764,376 PENDLE is currently worth about 1.85 million USD, with a loss of 1.77 million USD; 8,936 AAVE is currently worth about 1.66 million USD, with a loss of 570,000 USD. The Address also sold 220,351 AERO for 186,000 USDC and still holds 150,000 AERO.

UNI-0.01%

MarsBitNews·11-14 10:21

Uniswap Labs Launches Continuous Clearing Auction (CCA): Revolutionizing Fair Token Launches on v4

Uniswap Labs has unveiled the Continuous Clearing Auction (CCA) protocol, a groundbreaking mechanism for transparent on-chain price discovery and liquidity bootstrapping for new tokens on Uniswap v4.

CryptoPulseElite·11-14 09:26

Explore the unique features of Uniswap's new auction protocol CCP.

Uniswap Labs has launched the Continuous Clearing Auction protocol (CCA), aimed at helping new tokens establish fair market prices. The protocol is jointly designed by Uniswap and Aztec Network, supporting transparent auctions and fair price discovery to prevent market manipulation. Aztec becomes the first project to use this protocol, with a public sale scheduled for December, and CCA may set a new benchmark for Decentralized Finance issuance.

PANews·11-14 08:53

A brief analysis of the new protocol CCA jointly released by Uniswap and Aztec

Uniswap and Aztec's "Continuous Clearing Auction" (CCA) aims to address the pricing and liquidity initiation issues of new assets. CCA provides a flexible auction framework that allows initiators to set rules, with participants able to bid in real-time and the system automatically clearing. This mechanism combines the liquidity onboarding features of Uniswap v4 with Aztec's compliance tool ZKPassport, ensuring participant privacy. At the same time, CCA focuses not only on price discovery but also on smoothly initiating liquidity.

UNI-0.01%

PANews·11-14 06:05

Uniswap (UNI) adjusts after a 40% increase: Will the uptrend continue?

Uniswap (UNI) is currently trading around 7.66 USD on Friday morning, showing a return to stability after a breakout of over 40% earlier in the week. The governance proposal "UNIfication" announced by Uniswap Labs and the Uniswap Foundation on Monday has injected new life into the ecosystem, sparking a wave of optimism as it continues.

UNI-0.01%

TapChiBitcoin·11-14 04:35

Data: 511,100 UNI transferred to Coinbase Prime, valued at approximately 3.87 million USD

According to Mars Finance, data from Arkham shows that at 10:15, 511,100 UNI (worth about $3.87 million) was transferred from an anonymous Address (starting with 0xAd1e...) to Coinbase Prime.

MarsBitNews·11-14 02:44

Uniswap partners with Aztec to launch a continuous liquidation auction protocol, redefining Token pricing and Liquidity mechanisms.

Uniswap Labs has partnered with the privacy protocol Aztec Network to launch a new protocol called "Continuous Clearing Auction (CCA)" aimed at enhancing the efficiency of token price discovery while improving liquidity guidance. This protocol is specifically designed for Uniswap v4 and is expected to become a new standard for token issuance and liquidity activation.

Transparent and decentralized price discovery mechanisms replace traditional methods.

The CCA protocol adopts a more refined mechanism compared to existing airdrops, Dutch auctions, or fixed-price sales. The auction will be divided into multiple rounds, with token issuance distributed in phases, effectively reducing common issues such as drastic price fluctuations and front-running, while enhancing overall fairness and market transparency.

Uniswap Official Blog

UNI-0.01%

ChainNewsAbmedia·11-14 02:24

4 Most Promising Cryptos Right Now Ready to Explode: Zero Knowledge Proof, Uniswap, Sui & Tron!

The crypto scene is showing mixed movements this week, as some assets struggle near support zones while others show renewed power through tested technology and transparency. For those following the most

CaptainAltcoin·11-14 00:03

Uniswap Price Prediction 2025: Will UNI/USD Break $11 and Start Its Next Big Rally?

Story Highlights Uniswap price prediction 2025 signals strong bullish potential as whale accumulation resumes and a breakout pattern forms.

Technicals show a falling wedge nearing breakout above $11, with possible targets of $14 based on Fibonacci levels.

The proposed “fee switch” could bring

UNI-0.01%

BitcoincomNews·11-13 13:34

Data: The value of "Ma Ji Da Ge" ETH and UNI long order positions has exceeded 10 million USD.

According to Mars Finance, Hyperbot data shows that "Brother Maji" has long order positions in ETH and UNI worth over 10 million USD, of which: the ETH long order is 9.653 million USD; the UNI long order is 471 thousand USD.

MarsBitNews·11-13 09:49

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27