Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

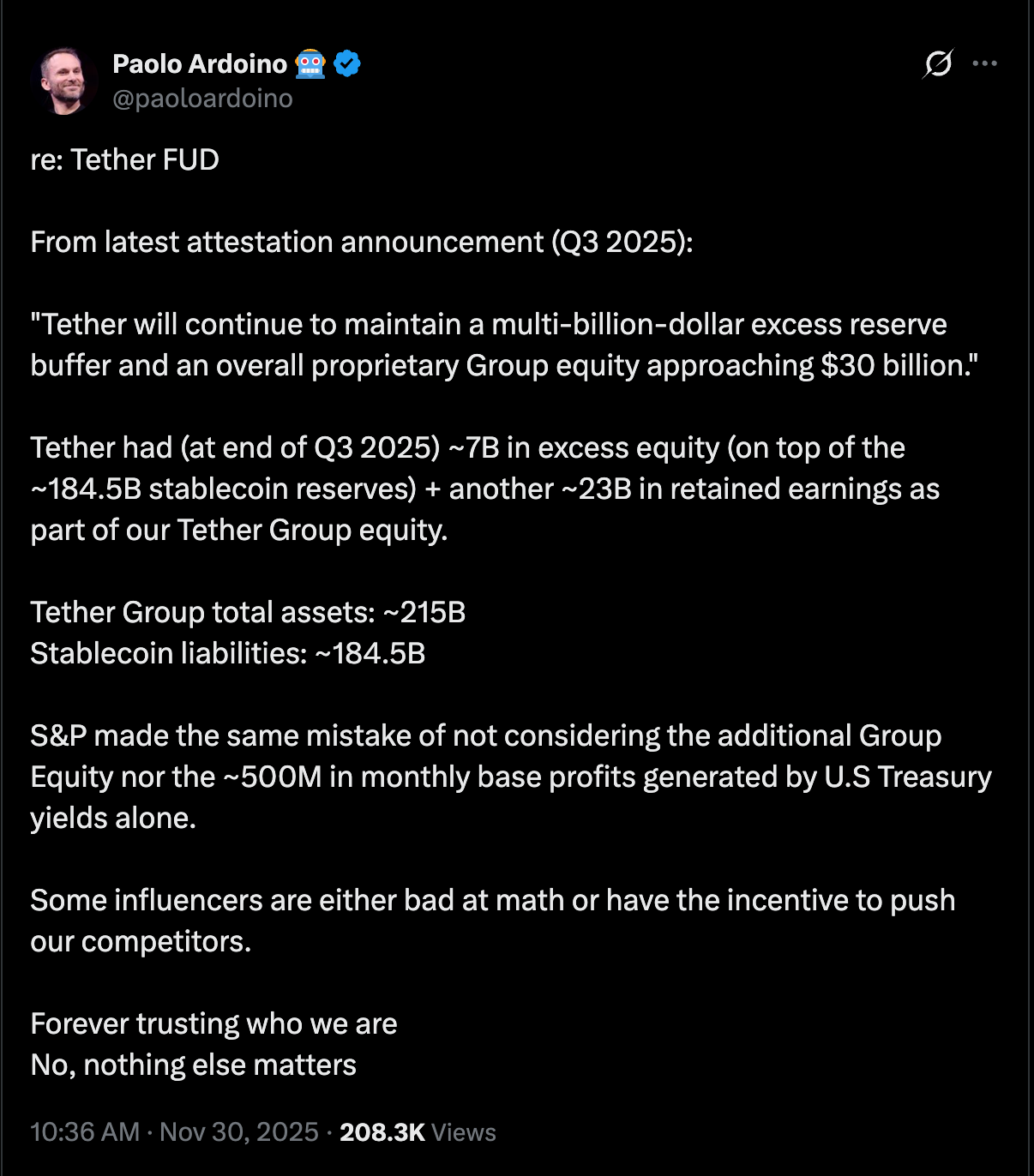

Tether CEO Counters Hayes’ Warning With Q3 Data Showing a Major Equity Cushion

Tether CEO Paolo Ardoino refuted claims of USDT stress due to potential drops in Bitcoin or gold, presenting Q3 2025 data showing $215 billion in assets and $30 billion in equity. S&P downgraded USDT citing high asset exposure, but Ardoino emphasized Tether's strong financial position.

BTC0.86%

CryptoFrontNews·6h ago

Tether Equity Debate Grows as Analysts Split on Risks

The debate over Tether's equity strength has intensified, with analysts questioning its reserve strategy and risk exposure amid concerns about Bitcoin and gold holdings potentially impacting equity.

BTC0.86%

CryptoFrontNews·13h ago

Former Citi Analyst Refutes Arthur Hayes’ Tether Insolvency Claims

A former Citi crypto research head contests Arthur Hayes' solvency concerns regarding Tether, highlighting undisclosed corporate assets and significant profits that suggest USDT's strength and profitability surpass criticisms.

BitcoincomNews·19h ago

Tether Theory: The Architecture of Monetary Sovereignty and Private Dollarization

I. Core Argument

The international monetary order is undergoing a fundamental reorganization, which is not the result of deliberate actions by central banks or multilateral institutions, but rather stems from the emergence of an offshore entity that most policymakers still find difficult to categorize. Tether Holdings Limited (the issuer of the USDT stablecoin) has constructed a financial architecture that extends the United States' monetary hegemony to the deepest parts of the global informal economy, while simultaneously laying the groundwork for ultimately circumventing this hegemony.

This is not a story about cryptocurrency, but rather a story about the privatization of US dollar issuance, the fragmentation of monetary sovereignty, and the emergence of a new type of systemic actor that exists in the gray area between regulated finance and borderless capital. The passage of the GENIUS Act in July 2025 will solidify this shift into a binary choice faced by global dollar users: either accept the United States.

BTC0.86%

金色财经_·19h ago

Former Head of Encryption Research at Citigroup: Tether has a "money printer" with no external bankruptcy risk concerns.

According to a TechFlow report, on December 1st, Joseph, the former head of encryption research at Citigroup, stated on social media that Tether operates a "printing press," far from the bankruptcy risks that the outside world is worried about.

Joseph pointed out that Tether's public disclosure of assets does not represent all of the company's assets. The company has a separate equity asset balance sheet, which includes equity investments, mining operations, corporate reserves, and possibly more Bitcoin, with the rest distributed as dividends to shareholders.

Secondly, Tether holds approximately 120 billion USD in interest-bearing government bonds, with a yield of about 4% since 2023, generating an annual income of around 10 billion USD. With a low-cost operation of only 150 employees, it has become one of the most efficient cash-generating businesses in the world.

Third, Joseph estimates the equity value of Tether to be between 500 and 1.

BTC0.86%

DeepFlowTech·20h ago

Former Citibank encryption research head: Arthur Hayes missed 3 key points on Tether's FUD.

According to Mars Finance news, in response to Arthur Hayes' doubts about the operation of USDT, former head of crypto research at Citibank, Joseph, stated on the X platform that @CryptoHayes' analysis missed several key points: 1. Disclosure of assets ≠ total corporate assets USDT discloses reserves according to the "matching principle", but its undisclosed balance sheet includes equity investment income, mining business, corporate reserves, and potential Bitcoin holdings, with remaining profits distributed to shareholders in the form of dividends. 2. Ultra-high profit margins and equity value Tether holds $120 billion in US Treasury bonds (annualized 4% yield), with an annual net profit of about $10 billion starting from 2023 (with only 150 employees), making it the world's most efficient money printer; equity valuation could reach $50-100 billion (close to...

BTC0.86%

MarsBitNews·20h ago

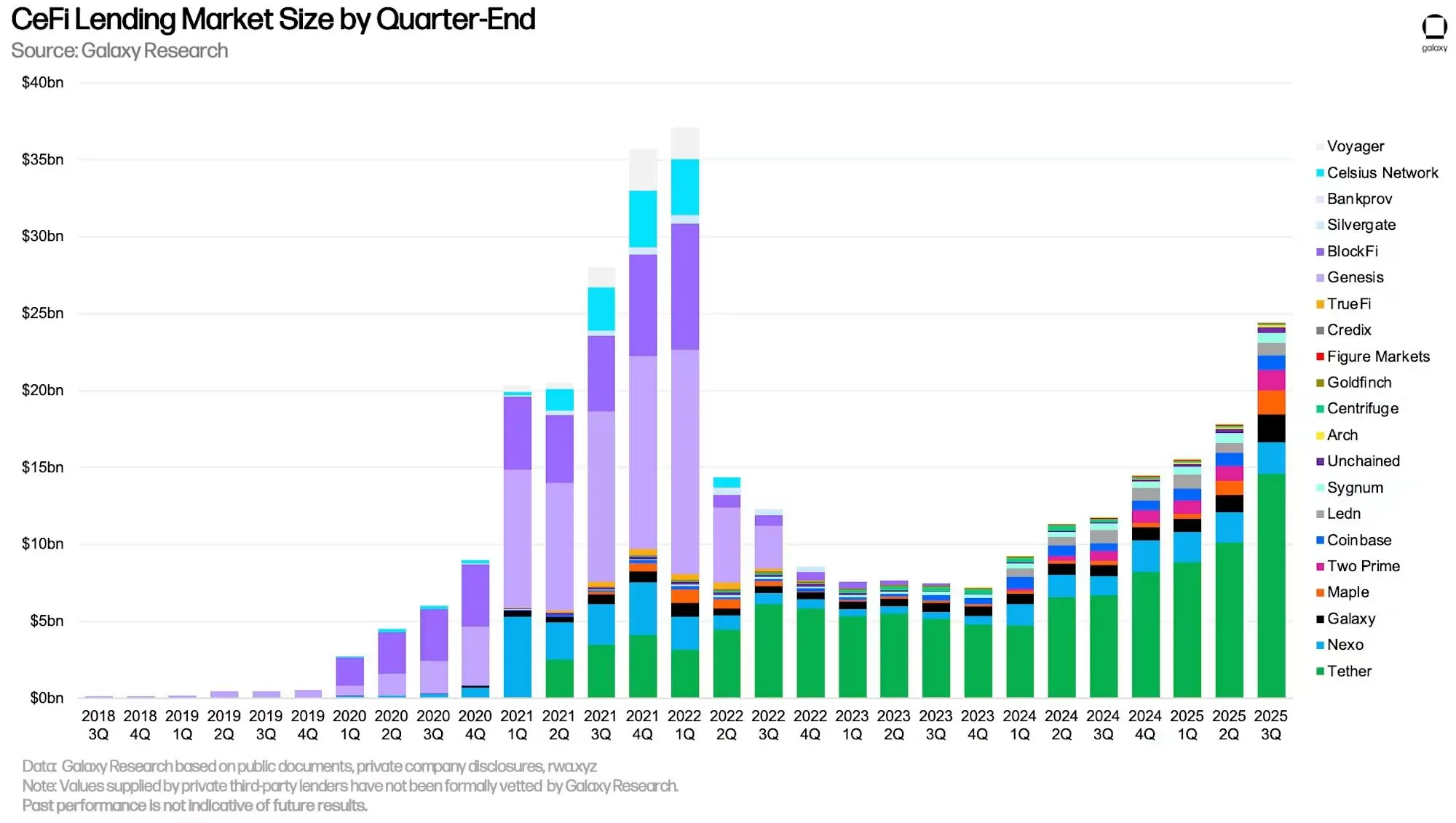

The lending market has exploded! CeFi recovers losses of 25 billion, with Tether issuers monopolizing 60%.

The total amount of outstanding loans in the cryptocurrency lending market in the third quarter has approached $25 billion, according to data from Galaxy Research. Since the beginning of 2024, the CeFi lending market has grown by over 200%, reaching its highest level since the peak in the first quarter of 2022. As of September 30, the outstanding loans of stablecoin issuer Tether amount to $14.6 billion, with a market share of 60%.

MarketWhisper·23h ago

Tether CEO Fires Back at S&P Downgrade: “They Didn’t Do Their Homework”

Tether CEO Paolo Ardoino has strongly rejected S&P Global Ratings’ recent downgrade of USDt’s peg stability to the lowest possible score, calling the assessment “incomplete and misleading.”

BTC0.86%

CryptoPulseElite·23h ago

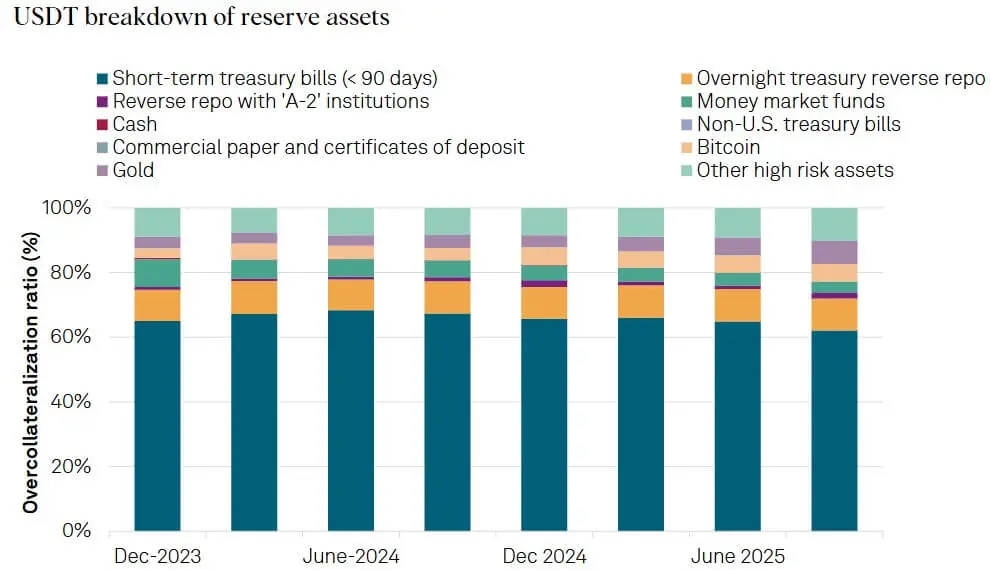

Willy Woo: Tether performed better than several banks during the bank run, still having 95% asset backing in extreme cases.

According to Mars Finance, crypto analyst Willy Woo released a comparison chart of bank runs, showing that Tether (USDT) fully honored redemptions even during a redemption wave of about 20–25%, outperforming traditional banks such as Silicon Valley Bank (25%) and First Republic Bank (57%). Woo pointed out that Tether currently has 77% of its assets in cash equivalents, with the remainder in gold and Bitcoin, leading to an overall over-collateralization of 3%. Even if volatile assets experience a big dump of 30% in extreme market conditions, USDT still has 95% asset backing.

BTC0.86%

MarsBitNews·12-01 06:14

Tether's reserve transformation sparks controversy: Arthur Hayes warns of significant downside risks in Bitcoin's gold allocation, Paolo Ardoino responds strongly.

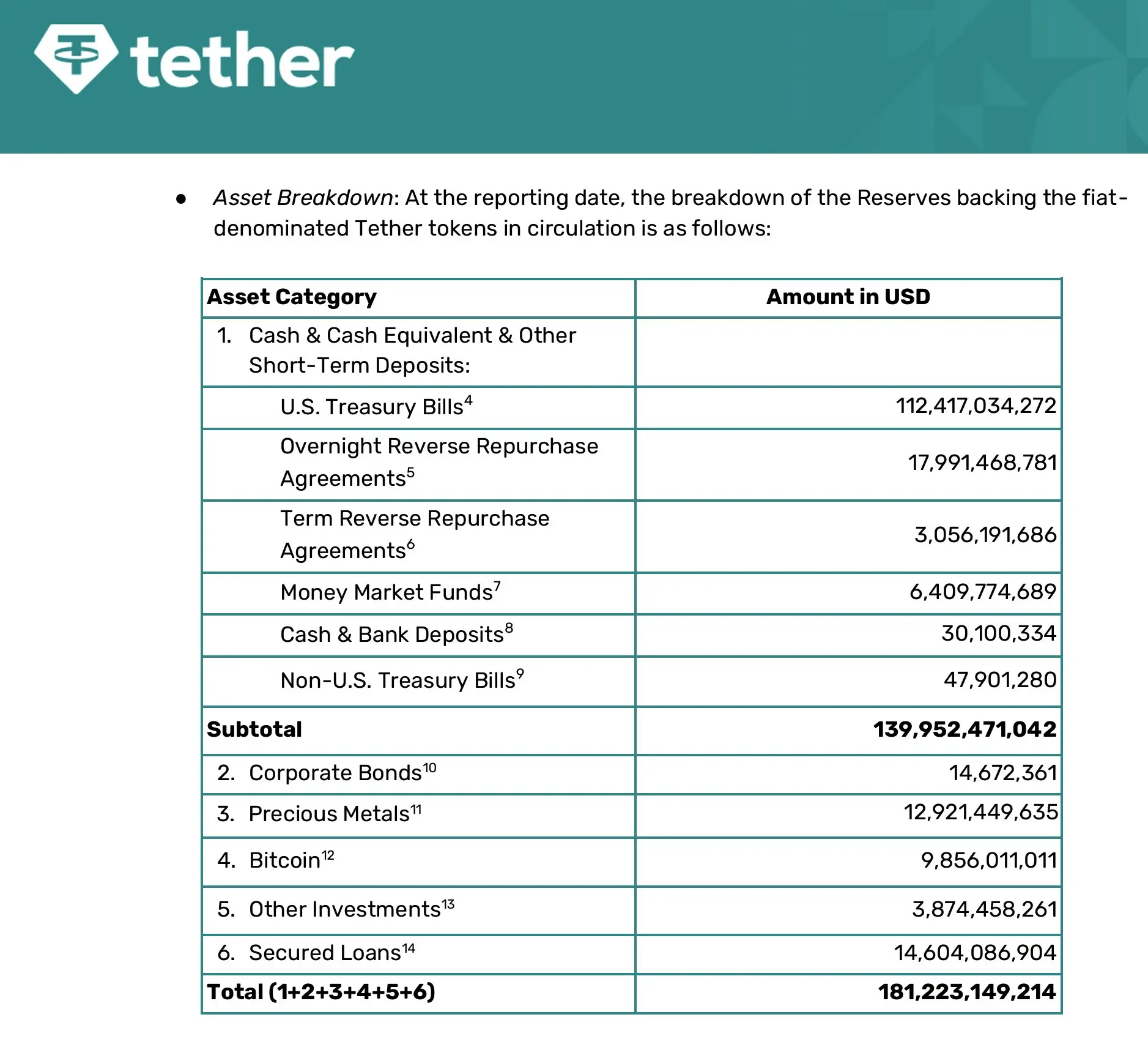

Notable industry figure Arthur Hayes pointed out that Tether is shifting its reserve assets towards Bitcoin and gold to respond to the Fed's interest rate cut cycle, but warned that if the prices of these two assets fall by 30%, it could deplete the company's equity capital. S&P Global Ratings downgraded the stability rating of USDT to "weak," reflecting an increase in high-risk asset exposure to nearly 23 billion USD. Tether CEO Paolo Ardoino strongly responded, revealing that the group's total assets reached 215 billion USD, with monthly profits exceeding 500 million USD, emphasizing that the company's financial strength far exceeds market perception. This debate highlights the value judgment discrepancies between traditional rating agencies and crypto-native enterprises.

MarketWhisper·12-01 02:33

Paolo Ardoino Fires Shots At S&P For Tether’s ‘Weak’ Rating

Tether CEO Paolo Ardoino fired back at S&P’s latest downgrade of his company.

The ratings firm gave the stablecoin company a “weak” rating of 5 due to its reserve’s exposure to high-risk assets, which could risk the USDT’s 1:1 peg to the US dollar.

S&P recently downgraded Tether’s ratings.

BTC0.86%

Blockzeit·12-01 01:08

Tether strikes back at S&P ratings! USDT earns 500 million a month, is the bankruptcy theory panic or truth?

S&P Global has downgraded the USD peg rating of USDT to "weak," the lowest score in its rating system, triggering panic in the crypto market. Tether CEO Paolo Ardoino countered that as of the end of Q3 2025, Tether's total assets amount to approximately 215 billion USD. Ardoino emphasized that the monthly yield from U.S. Treasury bonds alone generates $500 million in basic profit, but the S&P rating overlooked this crucial data.

MarketWhisper·12-01 00:35

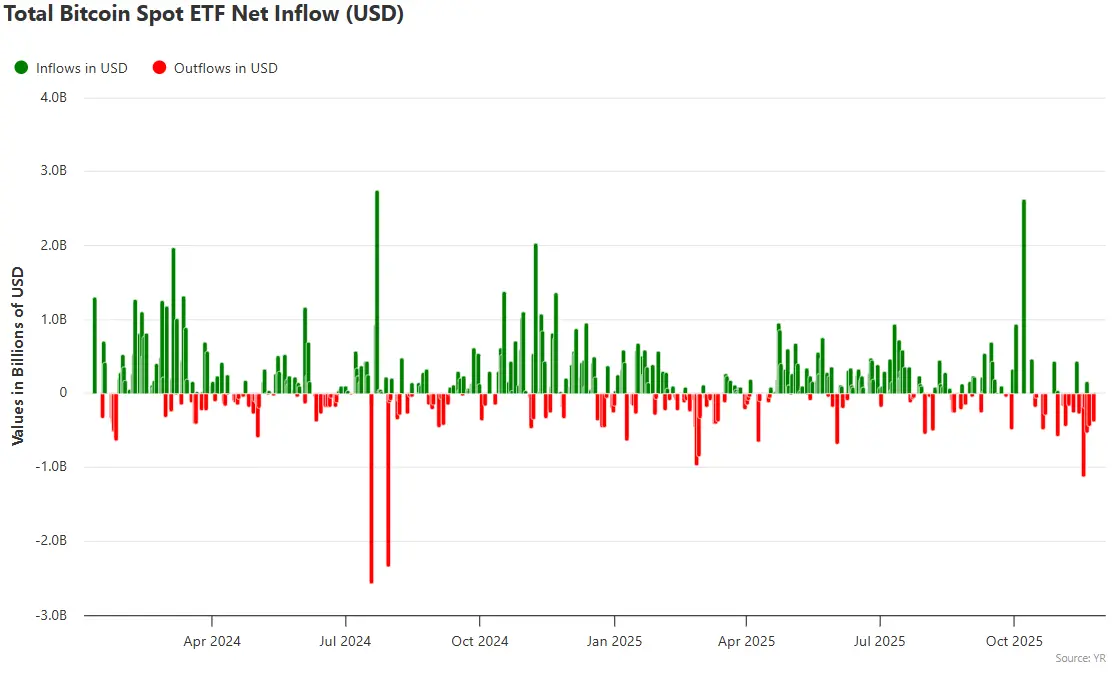

Panic sentiment eases, Bitcoin holds at 90,000, can the Christmas market make a rebound?

The US stock market has slightly rebounded after experiencing a pullback, and the sentiment in the crypto market is gradually improving. Bitcoin remains above 90,000, but the cumulative decline still reaches 17%. Key data this week will affect interest rate decisions, and the market is looking forward to the appointment of the new chairman of The Federal Reserve (FED). The crypto market is cautiously optimistic, and it remains to be seen whether the Christmas rally can help Bitcoin recover.

ChainNewsAbmedia·12-01 00:14

Paolo Ardoino responds to reserve doubts, stating that S&P overlooks Tether group's equity and U.S. treasury yields.

Tether CEO Paolo Ardoino emphasized that the company's audit in Q3 2025 shows it has billions of dollars in excess reserves and close to 30 billion in group equity, pointing out the misunderstanding from the outside about its financial condition.

WuSaidBlockchainW·11-30 18:26

Tether CEO refutes doubts: the group has nearly $30 billion in equity and excess reserves of $7 billion.

Tether CEO Paolo Ardoino responded to negative rumors about Tether, stating that by the third quarter of 2025, Tether will maintain billions of dollars in excess reserves, with total assets of approximately $215 billion, of which excess equity is around $7 billion, and about $23 billion in retained earnings.

DeepFlowTech·11-30 15:59

Latam Insights: Bolivia Embraces Stablecoins, Tether Leaves Uruguay

Welcome to Latam Insights, a compilation of the most relevant crypto news from Latin America over the past week. In this week’s edition, Bolivia announces the integration of stablecoins into its banking system, Tether abandons mining operations in Uruguay, and the Libra Trust emerges out of the

Coinpedia·11-30 11:36

Arthur Hayes Warns: Tether’s Bitcoin and Gold Bet Could Trigger a Solvency Crisis

Arthur Hayes has raised a sharp warning about Tether’s reserve strategy after reviewing the company’s latest attestation report. In a post on X, Hayes suggested that Tether is no longer just passively backing USDT with cash-like instruments, but is now taking a far more aggressive position; one that

CaptainAltcoin·11-30 08:44

Tether Ceases Bitcoin Mining Operations in Uruguay Over High Energy Cost

Tether is closing its Bitcoin mining operations in Uruguay due to high energy costs and regulatory disputes, affecting 30 employees. Despite this setback, Tether remains committed to mining and exploring opportunities elsewhere.

BTC0.86%

CryptoNewsLand·11-30 04:14

Tether CEO Paolo Ardoino responded to S&P classifying USDT as "junk grade": Smear campaigns are our proudest badge of honor.

S&P has downgraded USDT to "lowest grade", with Tether officials emphasizing that existing cash flows can easily fill the risk gap, while CEO Paolo Ardoino responded, "Your disdain is our badge of honor." (Background: Tether announced an investment in the digital asset infrastructure platform Parfin: Accelerating the adoption of USDT in Latin America) (Supplementary background: Tether's Golden Empire: Tether's ambition and fractures of a "borderless Central Bank") On November 26, S&P Global Ratings suddenly downgraded the stability score of the stablecoin Tether, which has a market capitalization of approximately 184 billion USD, to the lowest level 5. The report pointed out that the proportion of Bitcoin, gold, and corporate bonds in USDT reserves is too high, impacting the adequacy of the buffer capital. A few hours later, Tether issued a statement and

動區BlockTempo·11-29 11:37

Tether Exits Uruguay: $500M Bitcoin Mining Bet Crumbles Over Electricity Prices

Tether Holdings has officially suspended all its Bitcoin mining activities in Uruguay. The company cited electricity tariffs that proved unsustainable despite the country’s near-100% renewable energy grid. The decision ends a two-year push into what was once seen as one of Latin America’s most

BTC0.86%

CryptoBreaking·11-29 08:24

Stablecoin Giant Tether to Shutter Uruguay Bitcoin Mining Operation

Tether is ending its Bitcoin mining operations in Uruguay due to high energy costs, leaving 30 out of 38 employees unemployed. Despite this setback, Tether aims to become the world's largest Bitcoin miner and continues to expand in Latin America.

BTC0.86%

Decrypt·11-28 19:09

Tether Freezes $5M, Exposing Stablecoin Centralization Risks

Tether froze $5M in three wallets, highlighting centralization risks in stablecoins like USDT, USDC, and BUSD.

T3 FCU has frozen over $300M in criminal crypto assets, supporting 23 jurisdictions and strengthening global law enforcement.

S&P downgraded USDT to “weak” despite Tether

CryptoFrontNews·11-28 17:31

Tether CEO Paolo Ardoino Responds to S&P’s USDT Downgrade, Says Stablecoin Giant Takes It With Pride

Tether CEO Paolo Ardoino defends the company's stablecoin USDT following a lowered stability rating by S&P Global Ratings, emphasizing Tether's resilience and profitability despite traditional finance criticisms. He claims outdated rating models led to significant investment failures.

BTC0.86%

TheBitTimesCom·11-28 12:56

Tether Finally Winds Down Mining Operations in Uruguay

Tether, one of the largest cryptocurrency companies, has finally confirmed its exit from Uruguay after a breakdown in its negotiations with UTE, the national power company. The local press reported that the company fired 30 workers and notified the national labor ministry (MTSS) of these

BTC0.86%

Coinpedia·11-28 09:35

Why did S&P downgrade Tether after the company bought more gold than any country?

In the past year, Tether – the issuer of the USDT stablecoin – has accumulated Bitcoin and gold at a rate that places them alongside many national treasuries. In just the recent quarter, Tether purchased more gold than the total amount bought by all central banks combined, bringing the total amount of physical gold held to

BTC0.86%

TapChiBitcoin·11-28 08:05

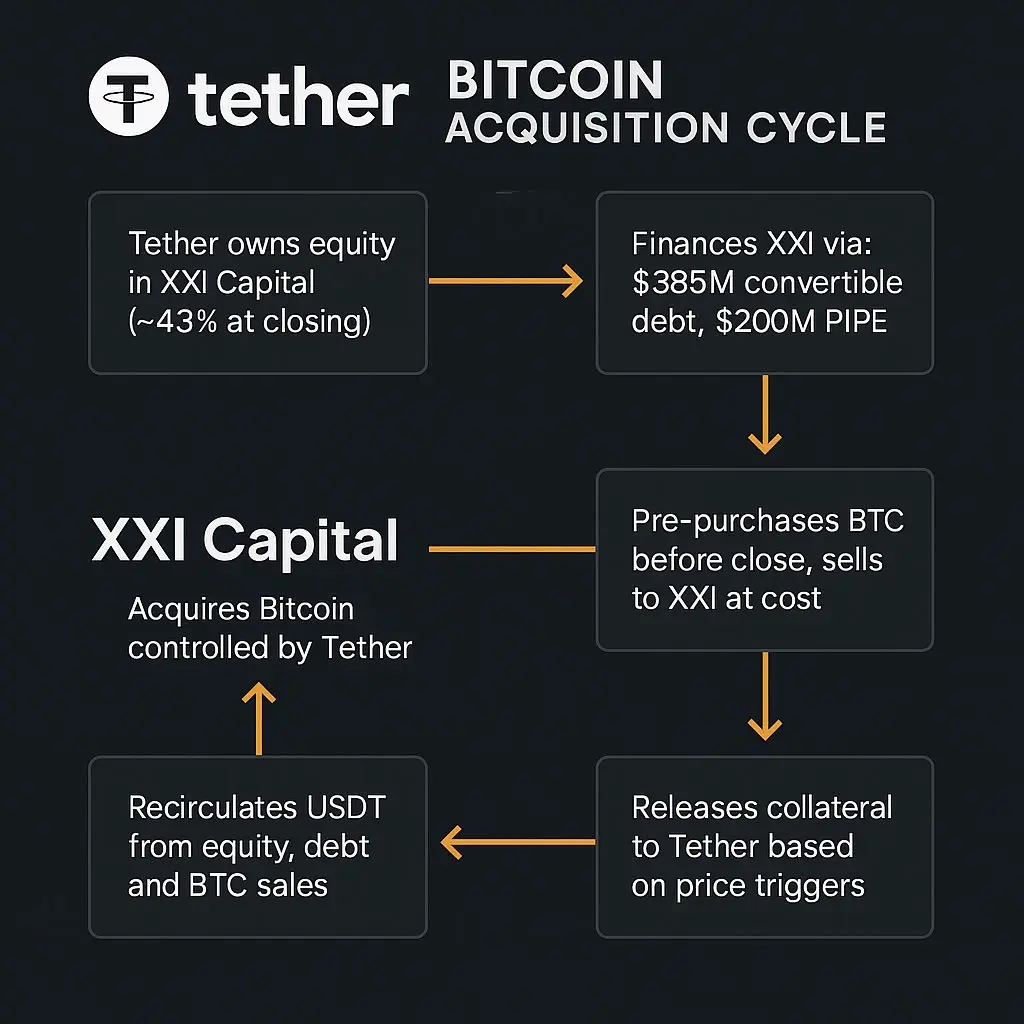

SPAC 93% Redemption Rate Alert! Tether and SoftBank bet on Twenty One as a focus of attention.

As Bitcoin has fallen 30% from its peak in October, special purpose acquisition companies (SPACs) are facing challenges in replicating MicroStrategy's success story. The performance of Bitcoin company Twenty One Capital Inc., supported by SoftBank Group and Tether, after its merger with Cantor Equity Partners Inc. will be closely followed after the investor vote on December 3.

MarketWhisper·11-28 02:38

Gold pumps 50% depeg Bitcoin! Tether massively buys 14 billion pushing gold price above 5000 dollars.

Under the global market's risk aversion sentiment, the trends of gold and Bitcoin have significantly diverged. Gold reached a record high in 2025, with prices rising by more than 50%. An important factor driving the surge in gold prices in 2025 is Tether, which purchased more gold in Q2 and Q3 than any single Central Bank, totaling 116 tons of gold worth approximately 14 billion USD. The gold/Bitcoin ratio has broken through a long-term downward channel, and the technical target for gold prices points to 5,000 USD.

MarketWhisper·11-28 01:46

Is the SPAC craze cooling down after the big dump of Bitcoin? Tether and SoftBank's bet on Twenty One becomes the focus.

As Bitcoin falls by 30% from its peak in October, the blank check company (SPAC)'s aspiration to replicate the success of MicroStrategy's digital asset financial company (DAT) is facing a test. The performance after the merger of the Bitcoin company Twenty One Capital Inc., supported by SoftBank Group and the largest stablecoin issuer Tether, with Cantor Equity Partners Inc., a special purpose acquisition company led by Cantor Fitzgerald Chairman Brandon Lutnick, will be closely watched after the investor vote on December 3.

Multiple SPACs are waiting to merge with digital asset management companies.

According to a report by Bloomberg, there are currently nine SPAC companies waiting to merge with digital asset management companies.

BTC0.86%

ChainNewsAbmedia·11-28 00:34

Tether Strengthens USDT Backing With Record Gold Reserves

Tether has emerged as the largest holder of gold, acquiring 116 metric tons to bolster its USDT reserves amid market instability. This strategy may reshape stablecoin investment dynamics and emphasizes gold's role as a secure asset.

XAUT-0.07%

BitcoinInsider·11-27 19:43

Tether Ends EURT Redemptions Today as MiCA Rules Force Full Euro Exit

Tether has officially severed its ties with the Euro.

After years of friction with European regulators, the company

BitcoinInsider·11-27 14:54

Tether Shocks the World: Becomes Largest Private Gold Holder Globally

Tether has become the largest non-central bank holder of gold, holding 116 metric tons. Analysts suggest its gold investments may be influencing rising gold prices, while plans to acquire an additional 100 tons by 2025 could further solidify Tether's market dominance despite regulatory challenges.

Moon5labs·11-27 13:01

Tether CEO hits back at S&P over weak stablecoin rating

Tether CEO Paolo Ardoino slammed S\&P Global Ratings after it gave the company's stablecoin its lowest stability score, citing disclosure gaps and high-risk reserves.

Summary

S\&P rated tether's stablecoin "5 (weak)", pointing to limited transparency and growing exposure to bitcoin, gold,

BTC0.86%

Cryptonews·11-27 12:06

Tether to shut down Bitcoin mining operations in Uruguay over high energy costs

Tether has reportedly confirmed its intention to cease its operations based in Uruguay.

According to local media, Tether has informed Uruguay's Ministry of Labor and Social Security during a meeting held at the headquarters of the National Directorate of Labor. Simultaneously, the USDT issuer has r

BTC0.86%

Cryptonews·11-27 10:06

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27