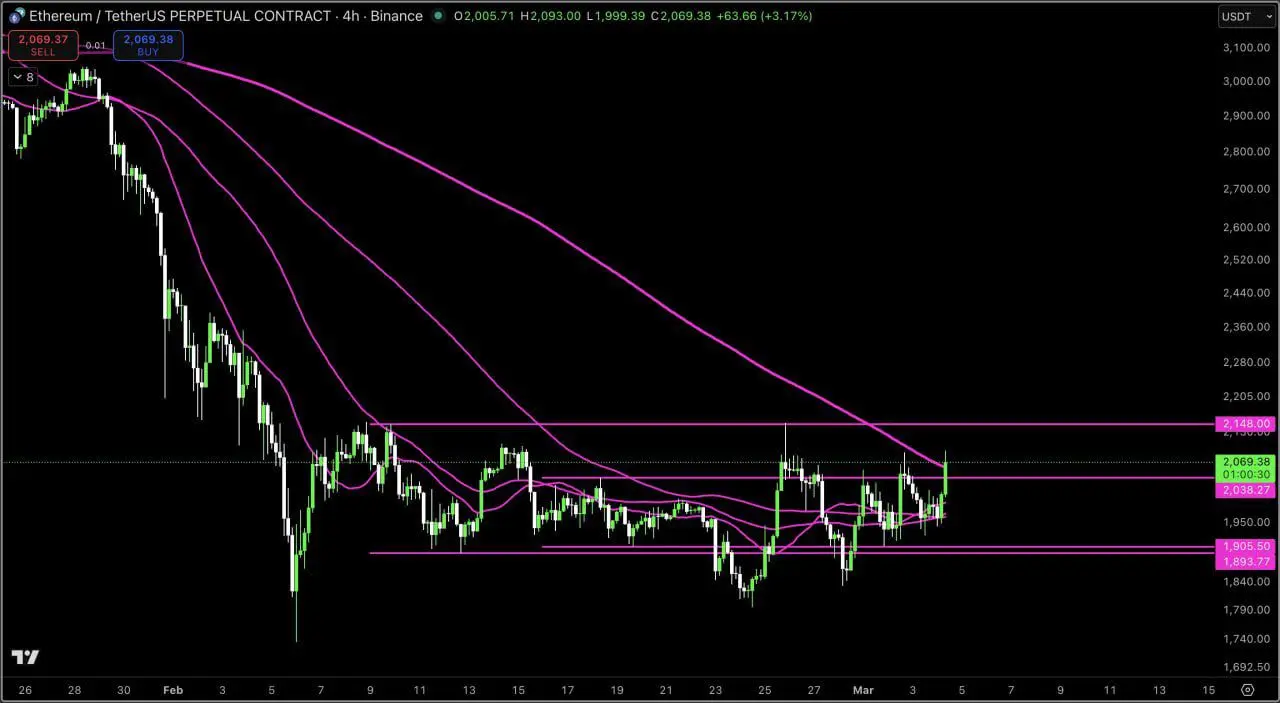

Futures

Des centaines de contrats réglés en USDT ou en BTC

TradFi

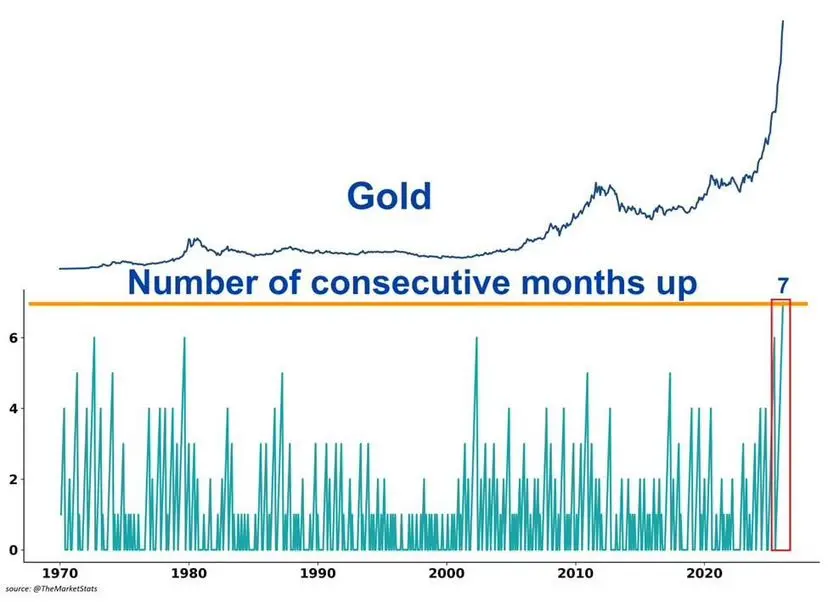

Or

Une plateforme pour les actifs mondiaux

Options

Hot

Tradez des options classiques de style européen

Compte unifié

Maximiser l'efficacité de votre capital

Trading démo

Lancement Futures

Préparez-vous à trader des contrats futurs

Événements futures

Participez aux événements et gagnez

Trading démo

Utiliser des fonds virtuels pour faire l'expérience du trading sans risque

Lancer

CandyDrop

Collecte des candies pour obtenir des airdrops

Launchpool

Staking rapide, Gagnez de potentiels nouveaux jetons

HODLer Airdrop

Conservez des GT et recevez d'énormes airdrops gratuitement

Launchpad

Soyez les premiers à participer au prochain grand projet de jetons

Points Alpha

Tradez des actifs on-chain et profitez des récompenses en airdrop !

Points Futures

Gagnez des points Futures et réclamez vos récompenses d’airdrop.

Investissement

Simple Earn

Gagner des intérêts avec des jetons inutilisés

Investissement automatique

Auto-invest régulier

Double investissement

Acheter à bas prix et vendre à prix élevé pour tirer profit des fluctuations de prix

Staking souple

Gagnez des récompenses grâce au staking flexible

Prêt Crypto

0 Fees

Mettre en gage un crypto pour en emprunter une autre

Centre de prêts

Centre de prêts intégré

Gestion de patrimoine VIP

La gestion qui fait grandir votre richesse

Gestion privée de patrimoine

Gestion personnalisée des actifs pour accroître vos actifs numériques

Fonds Quant

Une équipe de gestion d'actifs de premier plan vous aide à réaliser des bénéfices en toute simplicité

Staking

Stakez des cryptos pour gagner avec les produits PoS.

Levier Smart

New

Pas de liquidation forcée avant l'échéance, des gains à effet de levier en toute sérénité

Mint de GUSD

Utilisez des USDT/USDC pour minter des GUSD et obtenir des rendements de niveau trésorerie