Crypto_Buzz_with_Alex

Crypto enthusiast | Spot, Limit and Stop Loss trading made simple | Easy crypto lessons | Live streams to learn, grow, and trade smarter together

Crypto_Buzz_with_Alex

Please join and watch the BTC show 😎 🧧

https://gate.com/live/video?stream_id=03115d923b6346cea9498c2dfa231a9e&session_id=03115d923b6346cea9498c2dfa231a9e-1769272288&ref=VVNHBAXDBQ&ref_type=104

https://gate.com/live/video?stream_id=03115d923b6346cea9498c2dfa231a9e&session_id=03115d923b6346cea9498c2dfa231a9e-1769272288&ref=VVNHBAXDBQ&ref_type=104

BTC-0.21%

- Reward

- 5

- 4

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

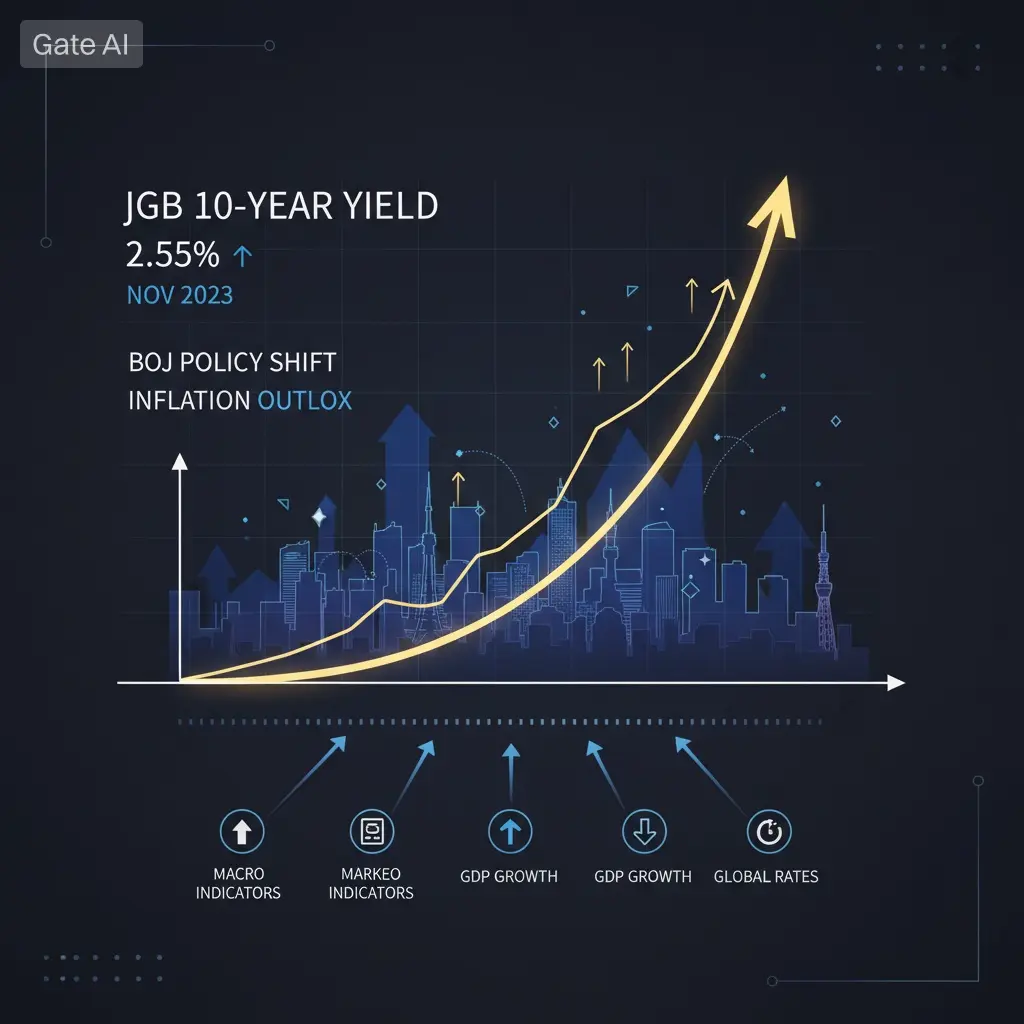

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro signal that many traders may be underestimating.

A jump of 25+ bps in 30Y and 40Y Japanese bond yields after plans to ease fiscal tightening is a notable shift.

Japan has long been associated with ultra-low yields, so movements like this can influence global rate expectations and capital flows.

If higher yields persist, risk assets around the world — including crypto — could start to feel indirect pressure.

Sometimes bond markets move first, and other markets react later.

This is why I’m watching this development closely rather tha

#JapanBondMarketSell-Off is a macro signal that many traders may be underestimating.

A jump of 25+ bps in 30Y and 40Y Japanese bond yields after plans to ease fiscal tightening is a notable shift.

Japan has long been associated with ultra-low yields, so movements like this can influence global rate expectations and capital flows.

If higher yields persist, risk assets around the world — including crypto — could start to feel indirect pressure.

Sometimes bond markets move first, and other markets react later.

This is why I’m watching this development closely rather tha

- Reward

- 16

- 23

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#ETHTrendWatch #

ETH/BTC pair is testing a resistance trendline that has held strong for the past 8 years.

Price is once again touching this major level.

A decisive breakout from here could signal a big shift in trend for 2026.

#ETHTrendWatch #CryptoMarketWatch

ETH/BTC pair is testing a resistance trendline that has held strong for the past 8 years.

Price is once again touching this major level.

A decisive breakout from here could signal a big shift in trend for 2026.

#ETHTrendWatch #CryptoMarketWatch

- Reward

- 15

- 19

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#GateTradFi1gGoldGiveaway

#GateTradFi1gGoldGiveaway is one of the most fun TradFi campaigns currently running on Gate.

Making a single ≥100 USDT trade unlocks 5 consecutive gold draw chances, which makes normal trading much more exciting.

What stands out is the frequency — 1g of real gold every 10 minutes means there are opportunities throughout the day.

I’ve been actively trading and checking the Gold Lucky Bag draws, and the process is smooth and straightforward.

Sharing trading or lottery screenshots here also gives a chance to join the $10,000 prize pool on Gate Square.

It’s a nice mix o

#GateTradFi1gGoldGiveaway is one of the most fun TradFi campaigns currently running on Gate.

Making a single ≥100 USDT trade unlocks 5 consecutive gold draw chances, which makes normal trading much more exciting.

What stands out is the frequency — 1g of real gold every 10 minutes means there are opportunities throughout the day.

I’ve been actively trading and checking the Gold Lucky Bag draws, and the process is smooth and straightforward.

Sharing trading or lottery screenshots here also gives a chance to join the $10,000 prize pool on Gate Square.

It’s a nice mix o

- Reward

- 16

- 18

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

#IranTradeSanctions introduces another layer of uncertainty into already sensitive global markets.

A proposed 25% tariff on countries trading with Iran could increase geopolitical tension and affect global trade flows.

Markets usually react quickly to sanction and tariff headlines, especially when they involve energy routes and international partners.

This can influence inflation expectations, risk sentiment, and indirectly pressure both financial and crypto markets.

The real question is whether this becomes strict policy enforcement or remains political pressure.

Either

#IranTradeSanctions introduces another layer of uncertainty into already sensitive global markets.

A proposed 25% tariff on countries trading with Iran could increase geopolitical tension and affect global trade flows.

Markets usually react quickly to sanction and tariff headlines, especially when they involve energy routes and international partners.

This can influence inflation expectations, risk sentiment, and indirectly pressure both financial and crypto markets.

The real question is whether this becomes strict policy enforcement or remains political pressure.

Either

- Reward

- 14

- 15

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#DOGEETFListsonNasdaq

#DOGEETFListsonNasdaq is a headline few would have imagined a couple of years ago.

A meme-born cryptocurrency now getting ETF exposure on a major traditional exchange shows how far crypto narratives have evolved.

This kind of development can attract a different class of investors who prefer regulated market access instead of holding tokens directly.

At the same time, it raises questions about valuation, hype cycles, and long-term sustainability.

Is this a sign that meme coins are entering mainstream finance, or just another short-term excitement wave?

I’m watching how p

#DOGEETFListsonNasdaq is a headline few would have imagined a couple of years ago.

A meme-born cryptocurrency now getting ETF exposure on a major traditional exchange shows how far crypto narratives have evolved.

This kind of development can attract a different class of investors who prefer regulated market access instead of holding tokens directly.

At the same time, it raises questions about valuation, hype cycles, and long-term sustainability.

Is this a sign that meme coins are entering mainstream finance, or just another short-term excitement wave?

I’m watching how p

DOGE-0.17%

- Reward

- 11

- 12

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#RIVERUp50xinOneMonth

#RIVERUp50xinOneMonth is one of those moves that instantly grabs market attention.

From around $4 to nearly $70 and a market cap crossing $3B, the momentum behind this DeFi infrastructure token has been extraordinary.

Such explosive rallies always create a dilemma for traders.

Is this the continuation of a strong narrative around chain-abstracted DeFi, or has price moved too far too fast?

I’m watching how price and volume behave after this surge to judge whether momentum can sustain.

Big moves often bring both opportunity and risk at the same time.

Did you catch this ra

#RIVERUp50xinOneMonth is one of those moves that instantly grabs market attention.

From around $4 to nearly $70 and a market cap crossing $3B, the momentum behind this DeFi infrastructure token has been extraordinary.

Such explosive rallies always create a dilemma for traders.

Is this the continuation of a strong narrative around chain-abstracted DeFi, or has price moved too far too fast?

I’m watching how price and volume behave after this surge to judge whether momentum can sustain.

Big moves often bring both opportunity and risk at the same time.

Did you catch this ra

- Reward

- 10

- 10

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#GateWeb3UpgradestoGateDEX

#GateWeb3UpgradestoGateDEX marks an important step in making decentralized trading easier for everyday users.

The shift from Gate Web3 to Gate DEX shows a clear focus on simplifying the Web3 experience without losing functionality.

One-click login with a Gate account, Google, or wallet removes a big barrier many users face when entering DeFi.

At the same time, smooth access to spot, derivatives, and swaps creates an experience that feels close to centralized exchanges.

What stands out is how this upgrade connects CeFi convenience with DeFi freedom in one interface.

#GateWeb3UpgradestoGateDEX marks an important step in making decentralized trading easier for everyday users.

The shift from Gate Web3 to Gate DEX shows a clear focus on simplifying the Web3 experience without losing functionality.

One-click login with a Gate account, Google, or wallet removes a big barrier many users face when entering DeFi.

At the same time, smooth access to spot, derivatives, and swaps creates an experience that feels close to centralized exchanges.

What stands out is how this upgrade connects CeFi convenience with DeFi freedom in one interface.

- Reward

- 9

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

#TrumpWithdrawsEUTariffThreats adds a sudden tone of relief to markets that were leaning risk-off.

Cancelling planned tariffs on several European countries removes a near-term pressure point ahead of Feb 1.

Trade headlines have been a key driver of volatility recently, so this easing signal could calm sentiment across equities and crypto.

But the bigger question is whether this is a lasting shift or just a temporary pause in a broader trade narrative.

Markets often react quickly to relief, but sustainability depends on follow-through.

I’m watching how BTC and m

#TrumpWithdrawsEUTariffThreats adds a sudden tone of relief to markets that were leaning risk-off.

Cancelling planned tariffs on several European countries removes a near-term pressure point ahead of Feb 1.

Trade headlines have been a key driver of volatility recently, so this easing signal could calm sentiment across equities and crypto.

But the bigger question is whether this is a lasting shift or just a temporary pause in a broader trade narrative.

Markets often react quickly to relief, but sustainability depends on follow-through.

I’m watching how BTC and m

BTC-0.21%

- Reward

- 9

- 9

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs shows how strong the shift toward safe-haven assets has become.

Spot gold breaking $4,950/oz and silver moving above $97/oz reflects rising risk aversion across global markets.

I recently increased exposure to gold during the breakout, and the move has been rewarding as momentum stayed strong above resistance.

What’s interesting is that metals are attracting attention again not just for hedging, but for momentum trades as well.

This kind of rally often brings new opportunities across other precious and non-ferrous metals too.

Did you catch

#GoldandSilverHitNewHighs shows how strong the shift toward safe-haven assets has become.

Spot gold breaking $4,950/oz and silver moving above $97/oz reflects rising risk aversion across global markets.

I recently increased exposure to gold during the breakout, and the move has been rewarding as momentum stayed strong above resistance.

What’s interesting is that metals are attracting attention again not just for hedging, but for momentum trades as well.

This kind of rally often brings new opportunities across other precious and non-ferrous metals too.

Did you catch

- Reward

- 10

- 10

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#DOGEETFListsonNasdaq

#DOGEETFListsonNasdaq is something many didn’t expect to see this soon.

A meme-origin coin now getting ETF exposure on a major traditional exchange shows how far crypto narratives have evolved.

This could open the door for more mainstream attention and new types of investors looking at DOGE differently.

At the same time, it raises questions about valuation and long-term sustainability.

Is this a turning point where meme coins gain institutional interest, or just a short-term hype cycle?

I’m watching how price and volume react after this listing news.

Do you think this s

#DOGEETFListsonNasdaq is something many didn’t expect to see this soon.

A meme-origin coin now getting ETF exposure on a major traditional exchange shows how far crypto narratives have evolved.

This could open the door for more mainstream attention and new types of investors looking at DOGE differently.

At the same time, it raises questions about valuation and long-term sustainability.

Is this a turning point where meme coins gain institutional interest, or just a short-term hype cycle?

I’m watching how price and volume react after this listing news.

Do you think this s

DOGE-0.17%

- Reward

- 17

- 23

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#RIVERUp50xinOneMonth

#RIVERUp50xinOneMonth is the kind of move that grabs everyone’s attention.

A 50× rise in such a short time shows how quickly momentum and liquidity can flow into the right narrative.

Moves like this always create two sides in the market:

Some see opportunity and momentum, while others see risk after such a strong rally.

The key question is sustainability —

Is this the start of a bigger trend, or the result of short-term hype and speculation?

I’m watching how price behaves after this explosive move and whether volume supports continuation.

Are you chasing this momentum o

#RIVERUp50xinOneMonth is the kind of move that grabs everyone’s attention.

A 50× rise in such a short time shows how quickly momentum and liquidity can flow into the right narrative.

Moves like this always create two sides in the market:

Some see opportunity and momentum, while others see risk after such a strong rally.

The key question is sustainability —

Is this the start of a bigger trend, or the result of short-term hype and speculation?

I’m watching how price behaves after this explosive move and whether volume supports continuation.

Are you chasing this momentum o

- Reward

- 16

- 22

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GrowthPointsDrawRound16

#GrowthPointsDrawRound16 makes everyday activity on Gate Square more exciting during the New Year period.

Posting, liking, and commenting are no longer just interactions — they now help you collect growth points toward a lucky draw.

Once you reach 300 points, you unlock a chance to win prizes like iPhone 17, tokens, and exclusive merch.

It’s a simple idea that rewards consistency and participation.

This means staying active here has double benefits:

You engage with the community and build toward real rewards at the same time.

I’ve started tracking my points more clos

#GrowthPointsDrawRound16 makes everyday activity on Gate Square more exciting during the New Year period.

Posting, liking, and commenting are no longer just interactions — they now help you collect growth points toward a lucky draw.

Once you reach 300 points, you unlock a chance to win prizes like iPhone 17, tokens, and exclusive merch.

It’s a simple idea that rewards consistency and participation.

This means staying active here has double benefits:

You engage with the community and build toward real rewards at the same time.

I’ve started tracking my points more clos

- Reward

- 16

- 24

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TrumpWithdrawsEUTariffThreats

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

BTC-0.21%

- Reward

- 16

- 23

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs is a clear sign that markets are leaning toward safe-haven assets again.

Both metals pushing to new highs reflects rising caution around global growth, inflation concerns, and geopolitical pressure.

When gold and silver move together like this, it often signals deeper shifts in investor sentiment.

Capital is looking for stability while risk appetite weakens across other markets.

The interesting part is timing — are we witnessing the start of a longer metals cycle, or a temporary reaction to current uncertainty?

I’m watching how long this st

#GoldandSilverHitNewHighs is a clear sign that markets are leaning toward safe-haven assets again.

Both metals pushing to new highs reflects rising caution around global growth, inflation concerns, and geopolitical pressure.

When gold and silver move together like this, it often signals deeper shifts in investor sentiment.

Capital is looking for stability while risk appetite weakens across other markets.

The interesting part is timing — are we witnessing the start of a longer metals cycle, or a temporary reaction to current uncertainty?

I’m watching how long this st

- Reward

- 14

- 22

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

- Reward

- 13

- 18

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#JapanBondMarketSell-Off

#JapanBondMarketSell-Off is a macro development that could quietly influence global markets.

A sharp rise of over 25 bps in 30Y and 40Y Japanese bond yields signals a shift after plans to ease fiscal tightening and boost spending.

Japan has long been associated with ultra-low yields, so moves like this can affect global capital flows and rate expectations.

If higher yields persist, risk assets worldwide — including crypto — may start feeling the pressure.

The question is whether this is a temporary reaction or the start of broader repricing in global bond markets.

Ma

#JapanBondMarketSell-Off is a macro development that could quietly influence global markets.

A sharp rise of over 25 bps in 30Y and 40Y Japanese bond yields signals a shift after plans to ease fiscal tightening and boost spending.

Japan has long been associated with ultra-low yields, so moves like this can affect global capital flows and rate expectations.

If higher yields persist, risk assets worldwide — including crypto — may start feeling the pressure.

The question is whether this is a temporary reaction or the start of broader repricing in global bond markets.

Ma

- Reward

- 15

- 26

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CryptoMarketPullback

#CryptoMarketPullback highlights how sensitive the market still is to global trade concerns and shifting risk appetite.

BTC and major altcoins moving lower shows that traders are turning cautious in the short term.

But pullbacks like this often have two sides:

Some see it as a defensive phase where capital waits for clarity, while others see it as the groundwork for the next rebound.

I’m watching how price behaves around key support levels and whether buyers show strength on dips.

Market structure during corrections usually tells more than the headlines.

Do you think th

#CryptoMarketPullback highlights how sensitive the market still is to global trade concerns and shifting risk appetite.

BTC and major altcoins moving lower shows that traders are turning cautious in the short term.

But pullbacks like this often have two sides:

Some see it as a defensive phase where capital waits for clarity, while others see it as the groundwork for the next rebound.

I’m watching how price behaves around key support levels and whether buyers show strength on dips.

Market structure during corrections usually tells more than the headlines.

Do you think th

BTC-0.21%

- Reward

- 11

- 14

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Trending Topics

View More56.57K Popularity

33.09K Popularity

26.96K Popularity

9.35K Popularity

20.79K Popularity

Hot Gate Fun

View More- MC:$3.53KHolders:20.51%

- MC:$3.41KHolders:10.00%

- MC:$3.41KHolders:10.00%

- MC:$3.41KHolders:10.00%

- MC:$3.41KHolders:10.00%

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889